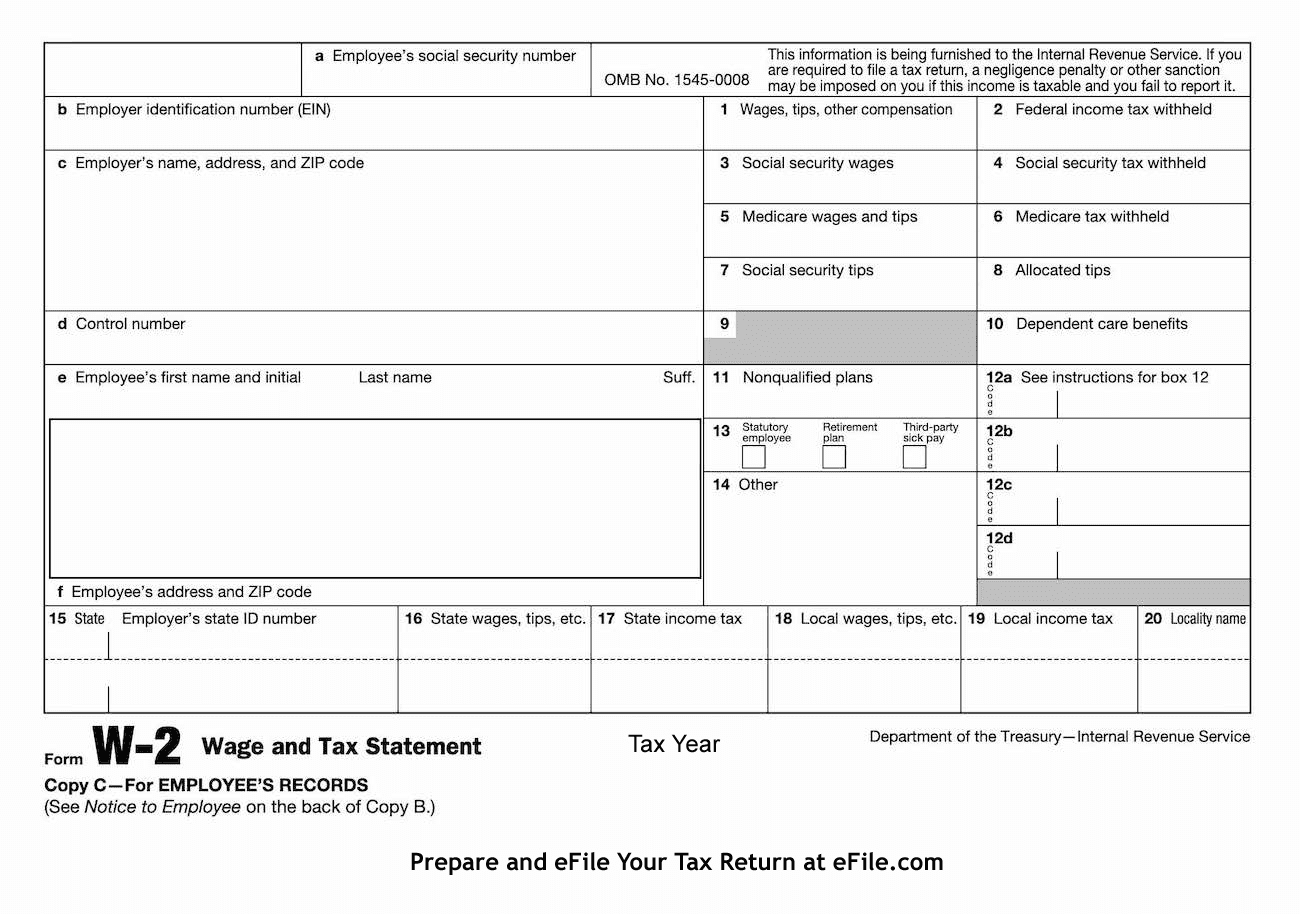

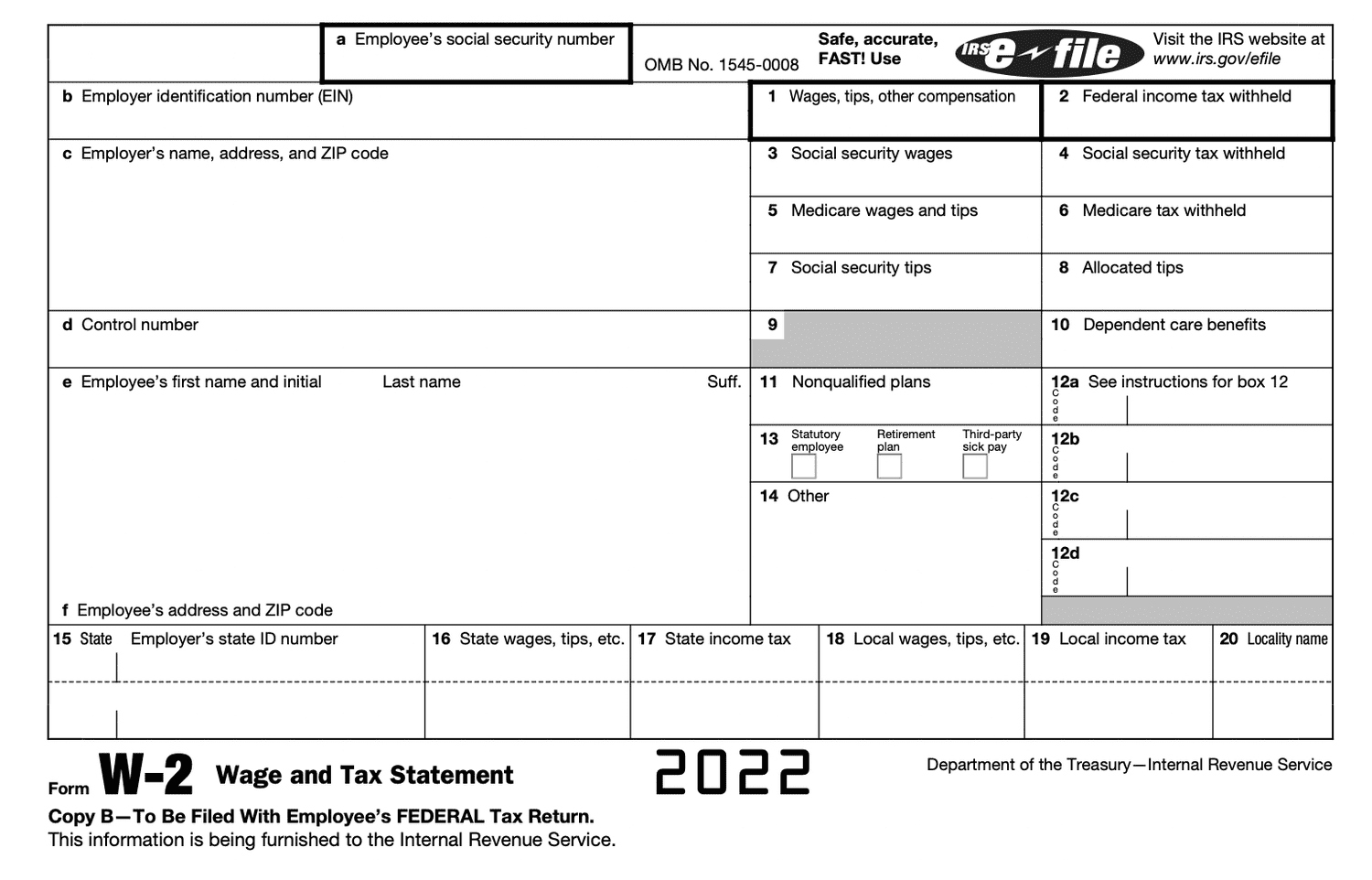

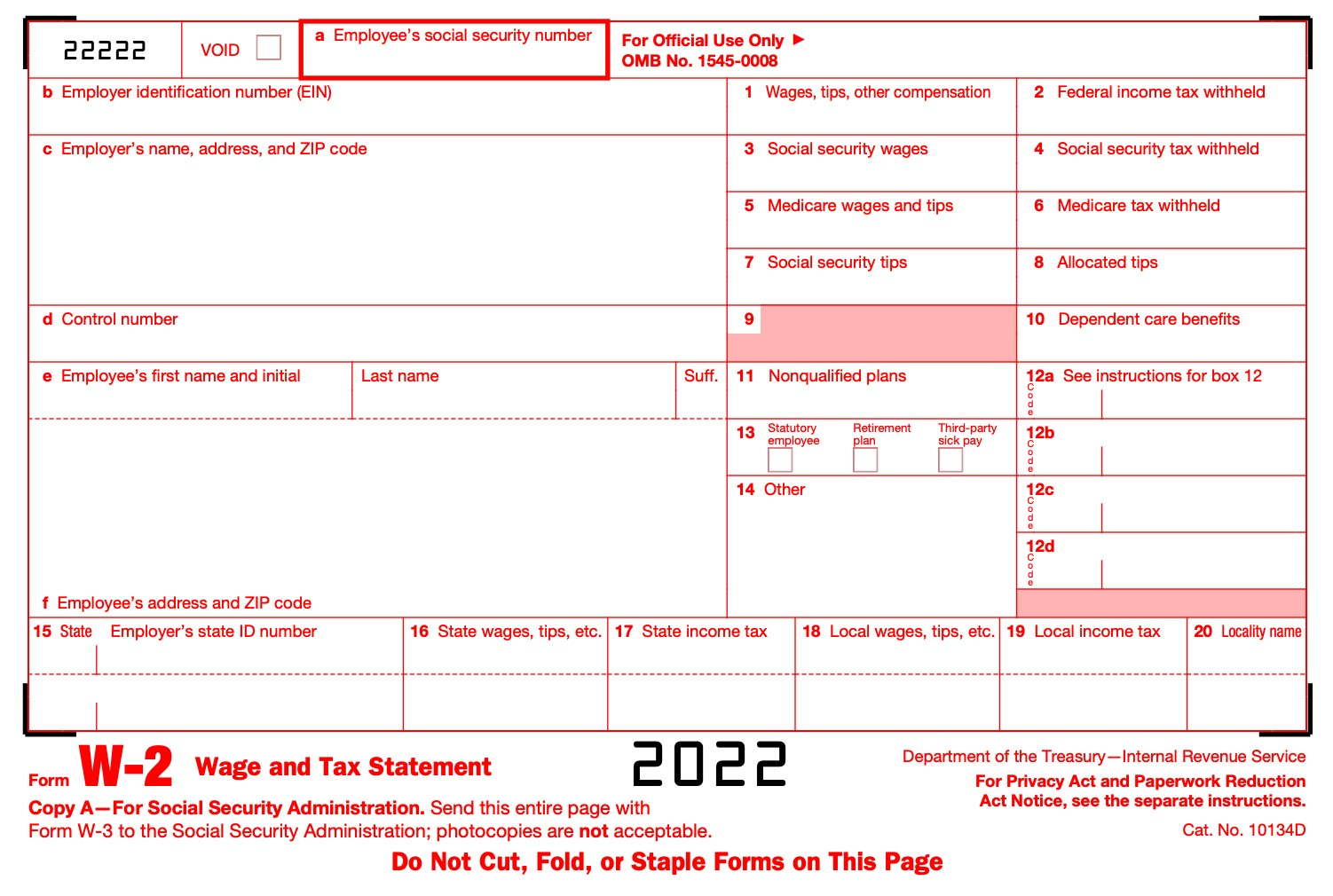

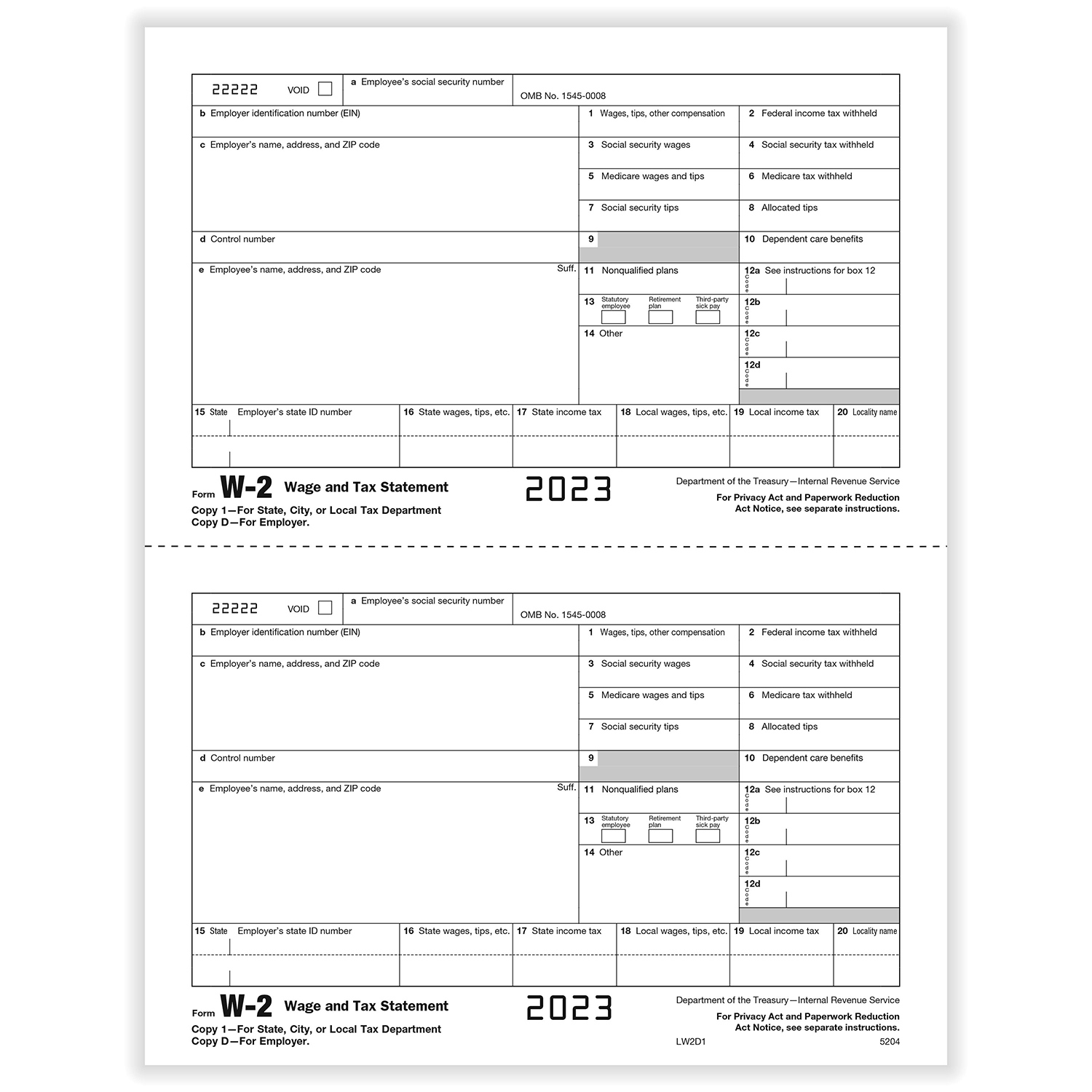

2 W2 Forms Different Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Fun: Juggling 2 W2 Forms from Different Employers!

Are you juggling two W2 forms from different employers this tax season? While it may seem overwhelming at first, handling multiple W2s can actually be quite exciting! Not only does it mean you were able to diversify your income streams, but it also shows your versatility in the job market. So, let’s dive into how you can master the art of managing multiple W2 forms with ease and ensure you get the most out of your tax return!

Master the Art of Handling Multiple Employers’ W2s

The key to successfully managing multiple W2 forms is organization. Start by creating a folder or digital file for each employer’s tax documents to keep them separate and easily accessible. Make sure to review each W2 carefully to ensure all the information is correct, including your name, Social Security number, wages, and taxes withheld. If there are any discrepancies, reach out to your employer for clarification before filing your taxes.

Next, consider using tax software or hiring a professional tax preparer to help you navigate the complexities of filing multiple W2 forms. They can provide valuable guidance on how to maximize your deductions and credits to minimize your tax liability. Additionally, be sure to keep track of any additional income sources, such as freelance work or investments, to accurately report your total earnings for the year. By staying organized and seeking expert advice, you can confidently juggle multiple W2 forms and make the most of tax season!

In conclusion, juggling two W2 forms from different employers may seem daunting at first, but with the right approach, it can be a rewarding experience. By staying organized, reviewing your W2s carefully, and seeking professional guidance, you can navigate the tax filing process with ease and confidence. So, embrace the challenge of managing multiple income streams and make the most of your tax return this year! Double the fun, double the excitement – you’ve got this!

Below are some images related to 2 W2 Forms Different Employer

2 w2 forms different employer, can you get two w2 from same employer, can you have two w2s from the same employer, two w2 forms from different employers, why do i have 2 w2 forms from the same employer, , 2 W2 Forms Different Employer.

2 w2 forms different employer, can you get two w2 from same employer, can you have two w2s from the same employer, two w2 forms from different employers, why do i have 2 w2 forms from the same employer, , 2 W2 Forms Different Employer.