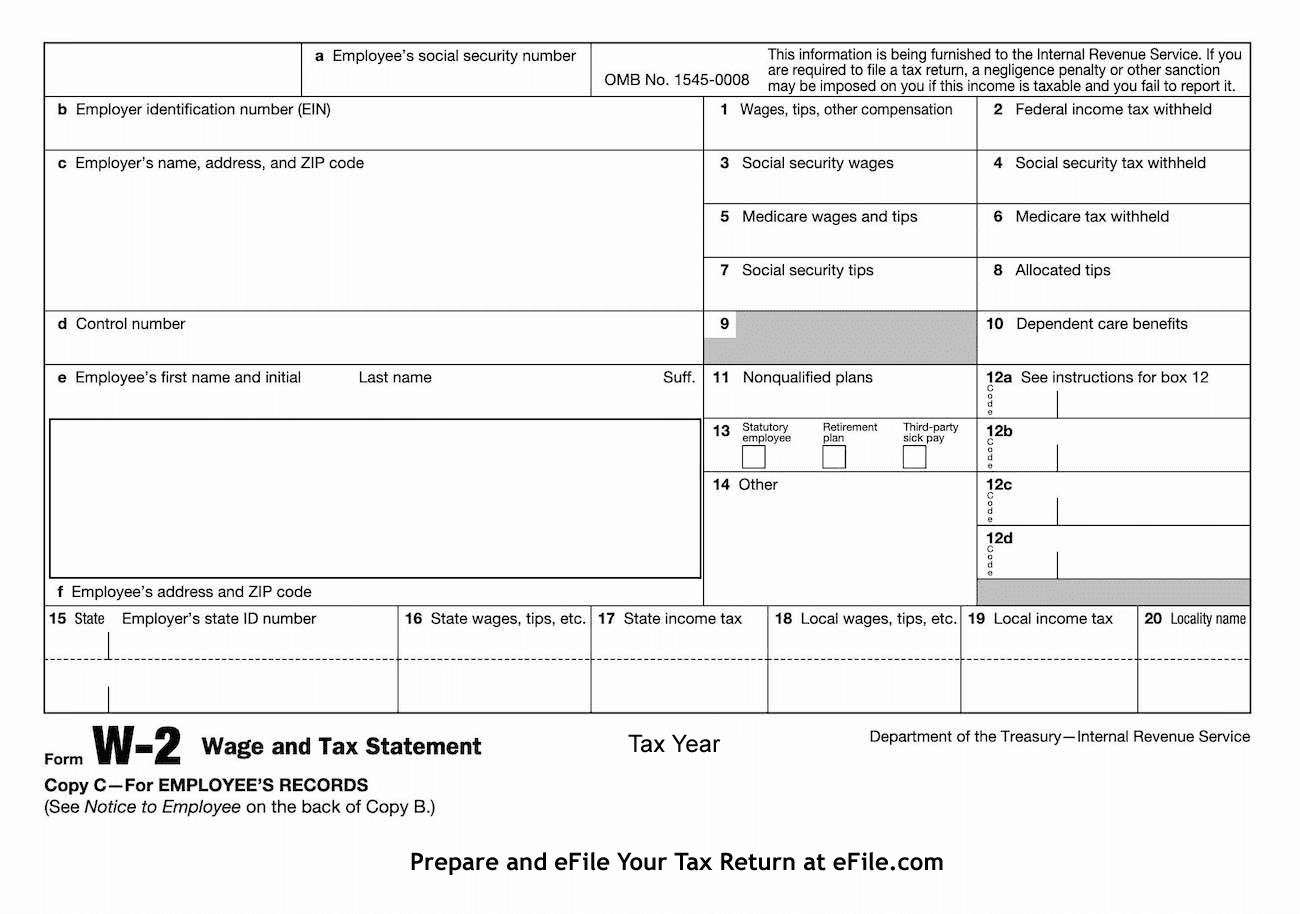

How To Get W2 Forms From Previous Years – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Time to Unlock Your Past Payday!

Are you missing out on potential tax refunds because you can’t find your old W2 forms? Don’t worry, there are easy ways to retrieve them and unlock your past payday! With just a little bit of effort and some helpful tips, you can access the information you need to file your taxes correctly and get the money you deserve. Say goodbye to lost documents and hello to financial freedom!

Discover Easy Ways to Retrieve Old W2 Forms

One of the simplest ways to retrieve old W2 forms is to reach out to your previous employers. Many companies keep records of past employees’ tax documents for several years, so they should be able to provide you with a copy of your W2 form upon request. Another option is to access your online payroll account if your employer offers this service. By logging in with your credentials, you can easily download and print your old W2 forms without having to wait for them to be mailed to you.

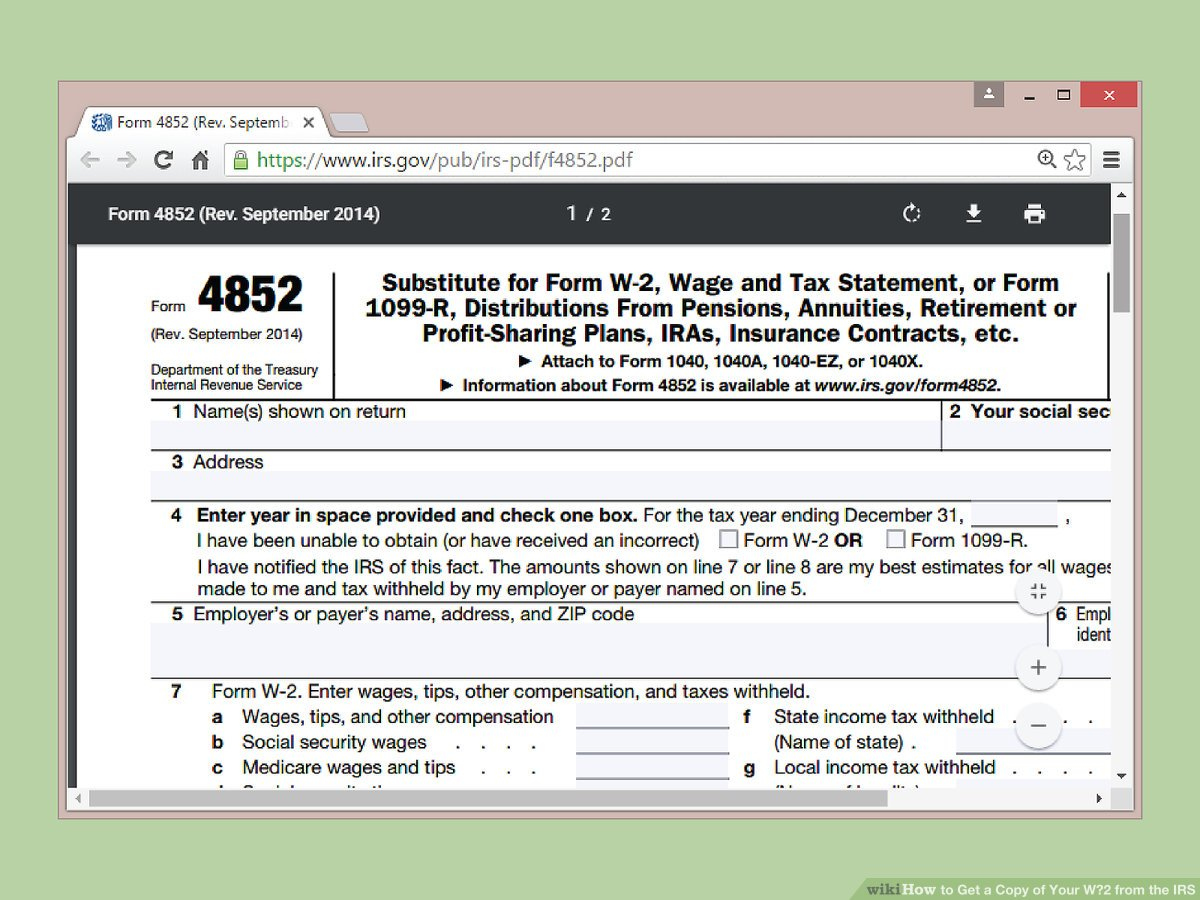

If you’re still having trouble retrieving your old W2 forms, you can contact the IRS for assistance. The IRS can provide you with a transcript of your past tax returns, which includes information from your W2 forms. By requesting a transcript online, by mail, or over the phone, you can access the data you need to complete your tax filings accurately. Don’t let missing W2 forms hold you back from claiming your hard-earned money – take advantage of these simple solutions and unlock your past payday today!

In conclusion

Don’t let missing W2 forms keep you from accessing your past payday. By following these easy tips and reaching out to the right resources, you can retrieve your old tax documents and ensure that you receive any refunds owed to you. Take control of your finances and unlock your past payday with confidence and ease. Get ready to file your taxes accurately and maximize your returns – the money you’ve been missing out on could be just a few clicks away!

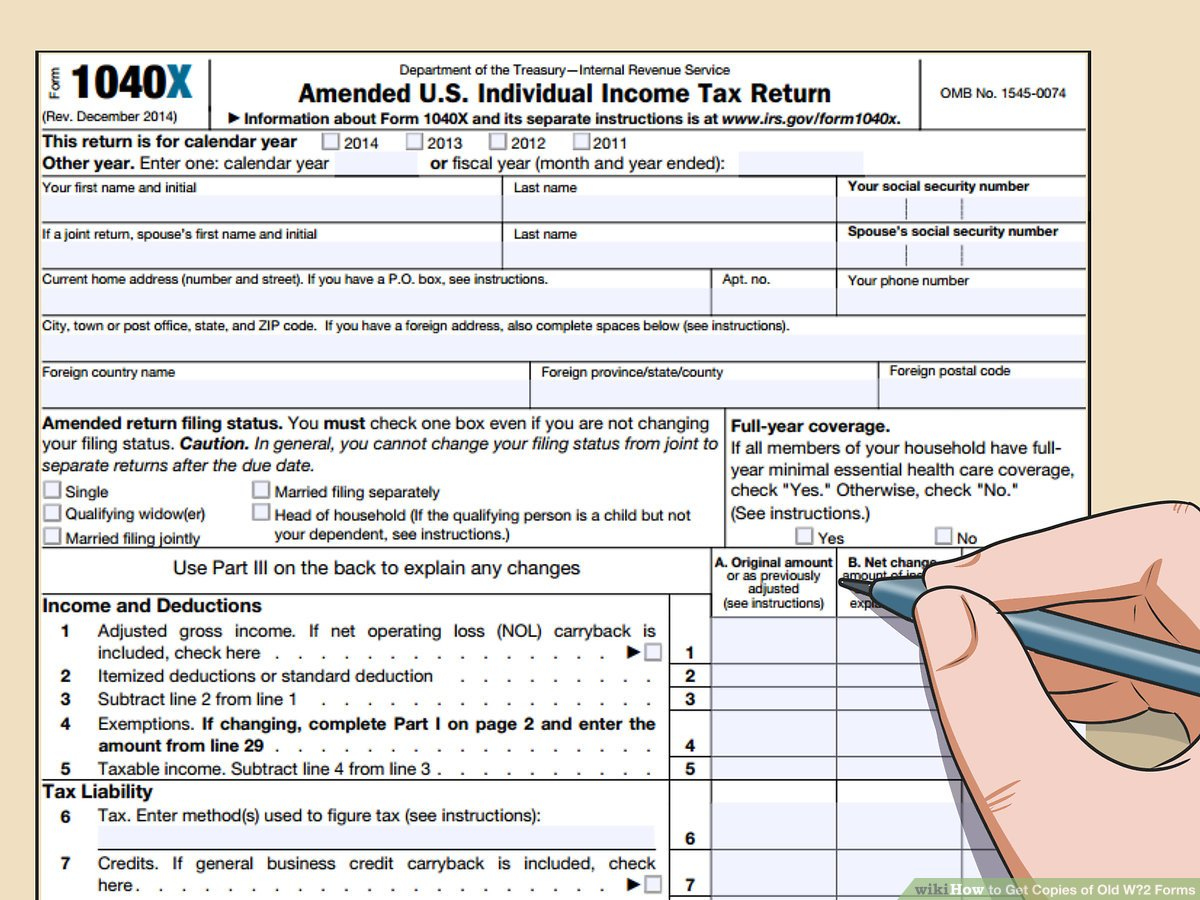

Below are some images related to How To Get W2 Forms From Previous Years

get w2 from previous years, how can i get a copy of my w2 from previous years, how can i get all my w2 forms from previous years, how can i get my w2 for past years, how to get w2 forms from last year, , How To Get W2 Forms From Previous Years.

get w2 from previous years, how can i get a copy of my w2 from previous years, how can i get all my w2 forms from previous years, how can i get my w2 for past years, how to get w2 forms from last year, , How To Get W2 Forms From Previous Years.