W2 Form 12a – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Form 12a: Your Key to Tax Success!

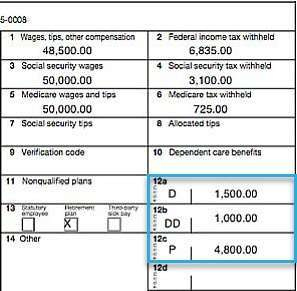

In the world of taxes, there is a hidden gem that many overlook – W2 Form 12a. This seemingly innocuous section of your W2 form holds the key to unlocking potential tax savings and maximizing your refund. By understanding the secrets of W2 Form 12a, you can take control of your tax situation and ensure you are getting every penny you deserve.

Discover the Hidden Secrets of W2 Form 12a!

W2 Form 12a may seem like just a random string of numbers and letters, but it actually holds valuable information about pre-tax deductions from your paycheck. This section of your W2 form includes details about contributions to retirement accounts, health savings accounts, and other pre-tax benefits. By reviewing W2 Form 12a, you can ensure that these deductions are accurately reflected in your tax return, potentially lowering your taxable income and increasing your refund.

Additionally, W2 Form 12a can also provide insight into other pre-tax deductions, such as commuter benefits or flexible spending accounts. By understanding these deductions and how they impact your tax situation, you can make informed decisions about your finances and potentially save money on your taxes. Don’t overlook the power of W2 Form 12a – it’s a small section with big implications for your tax refund.

Maximize Your Tax Refund with This Key Information!

When it comes to taxes, every deduction counts. By unlocking the magic of W2 Form 12a, you can potentially uncover additional deductions that you may have overlooked. Whether it’s contributions to a retirement account or pre-tax healthcare benefits, the information in W2 Form 12a can help you maximize your refund and keep more money in your pocket. Take the time to review this section of your W2 form and ensure that you are taking full advantage of all available deductions.

In conclusion, don’t underestimate the power of W2 Form 12a. This small section of your W2 form holds valuable information that can help you maximize your tax refund and ensure you are getting every penny you deserve. By understanding the hidden secrets of W2 Form 12a, you can take control of your tax situation and unlock potential tax savings. So dive into your W2 form, uncover the magic of W2 Form 12a, and set yourself up for tax success!

Below are some images related to W2 Form 12a

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] inside W2 Form 12A](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-inside-w2-form-12a.jpg)

w2 form 12a, w2 form 12a code c, w2 form 12a code d, w2 form 12a code w, w2 form 12a codes, , W2 Form 12a.

w2 form 12a, w2 form 12a code c, w2 form 12a code d, w2 form 12a code w, w2 form 12a codes, , W2 Form 12a.