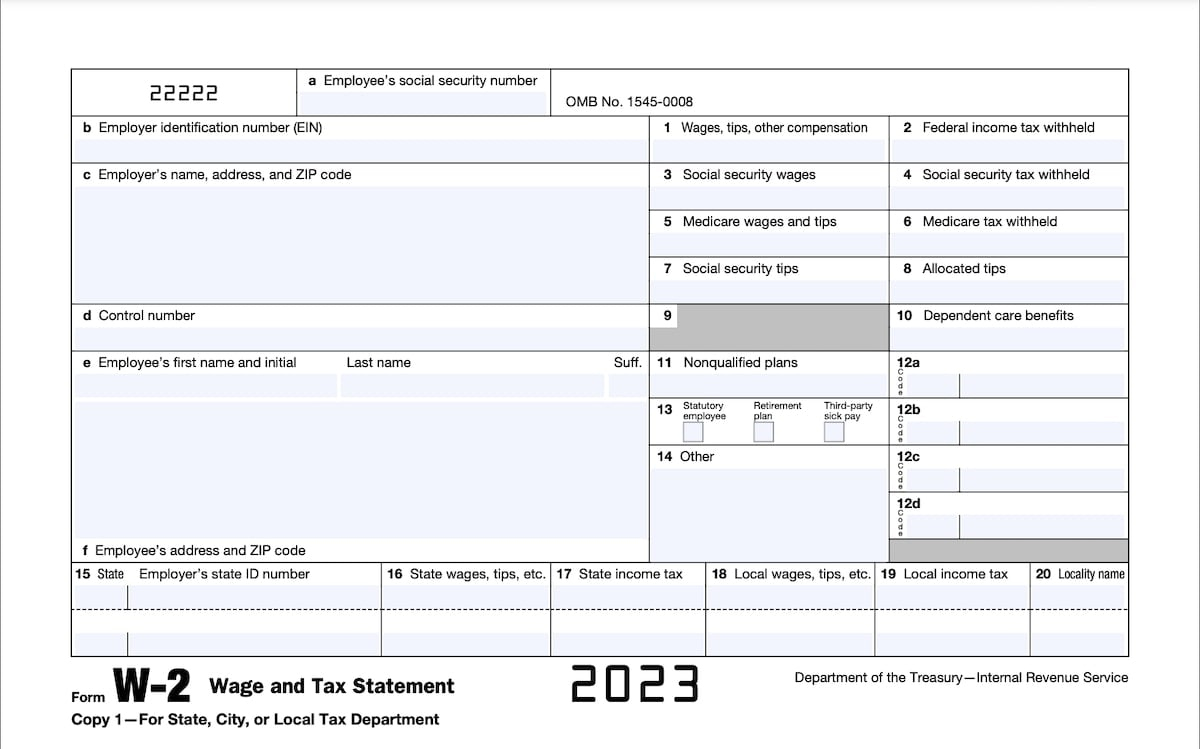

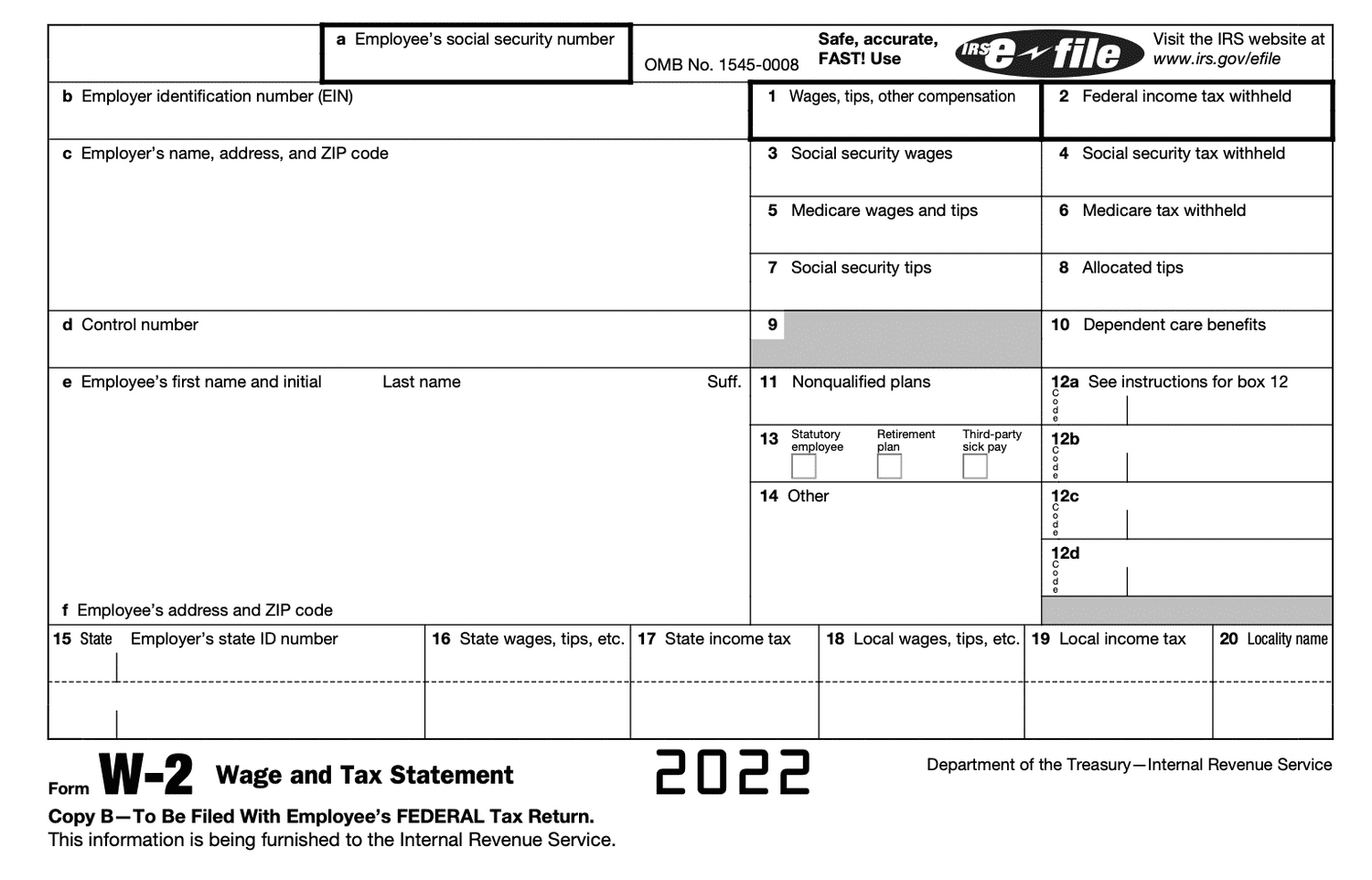

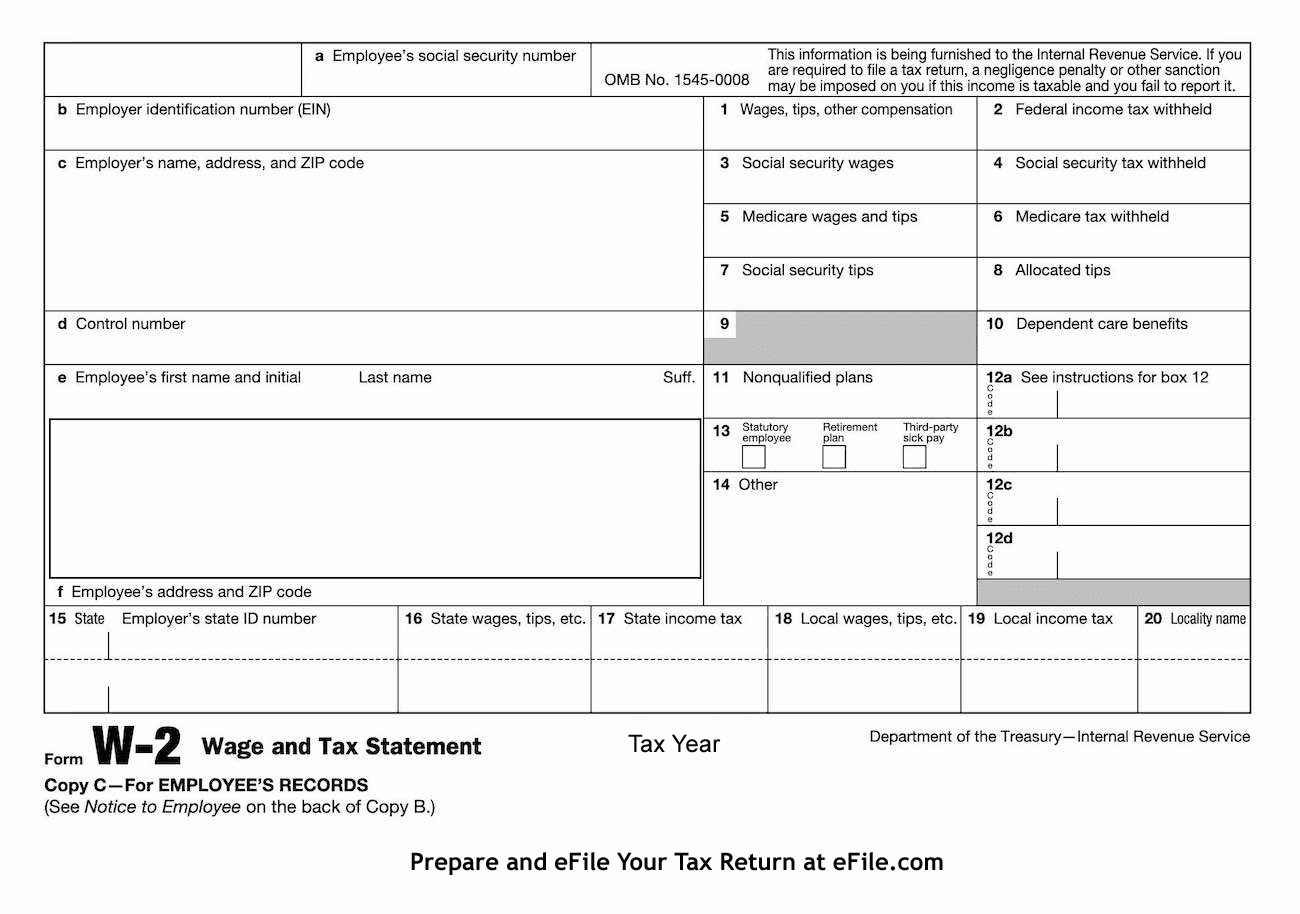

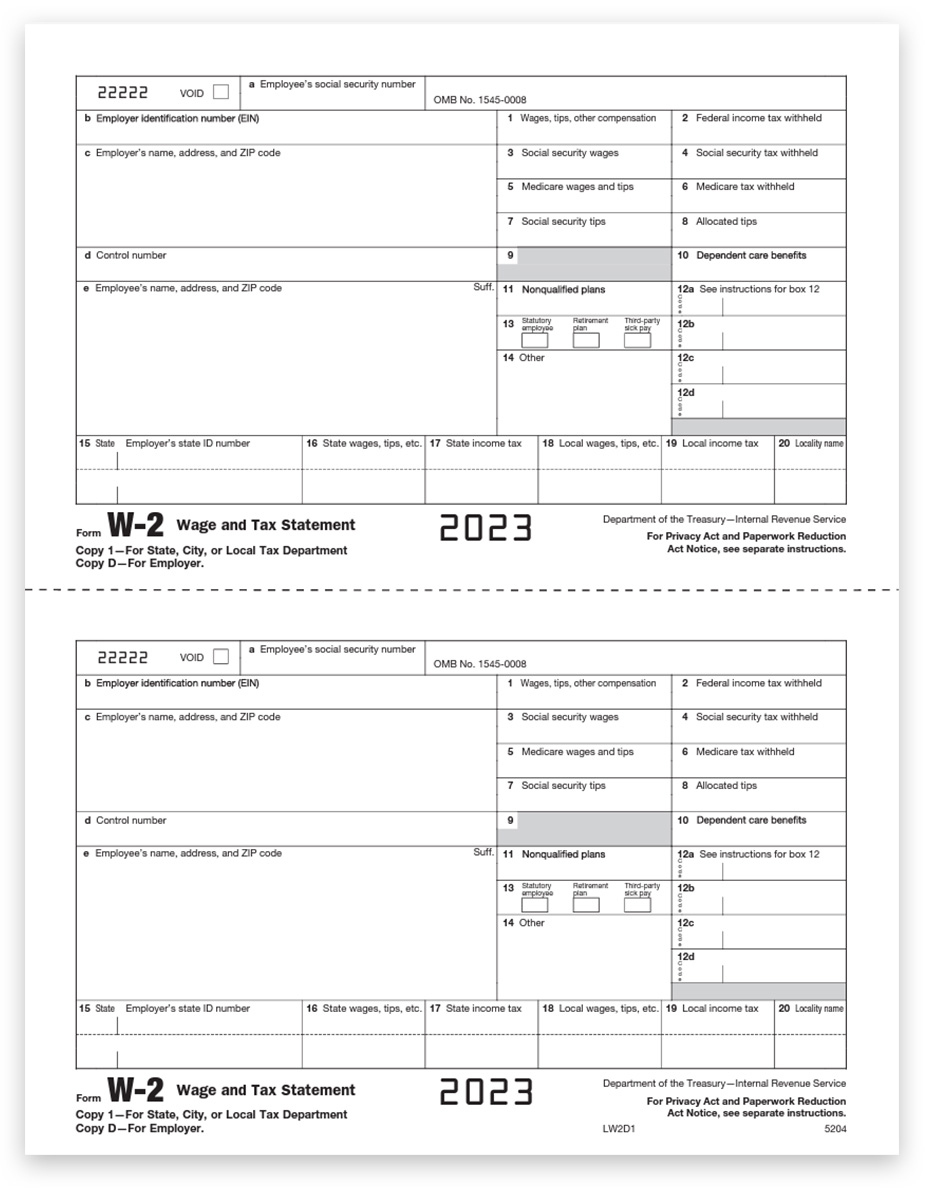

W2 Forma – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Forms: Your Ticket to Tax Time Success!

Tax season can be a daunting time for many individuals, but fear not! W2 forms are here to save the day and make the process smoother than ever. These seemingly mysterious documents hold the key to unlocking the magic of tax time success. So let’s dive in and discover the power of W2 forms together!

Unveiling the Mystery: The Power of W2 Forms

W2 forms are like a treasure map leading you to potential tax refunds and credits. They provide a detailed summary of your earnings and withholdings throughout the year, giving you a clear picture of your financial status. Understanding your W2 form is the first step towards mastering your taxes and maximizing your returns. It’s like having a cheat code for tax season!

One of the most valuable sections of your W2 form is Box 1, which shows your total taxable wages. This number is crucial for calculating your tax liability and determining if you are eligible for any deductions or credits. Additionally, Boxes 2 and 4 display the total federal income tax withheld and Social Security tax withheld respectively, which are important for accurately reporting your payments to the IRS. With this information at your fingertips, you can confidently navigate the tax filing process with ease.

Let’s Dive In: Your Guide to Mastering Taxes with W2 Forms

Now that you’ve unlocked the magic of W2 forms, it’s time to put that knowledge to use and conquer tax time like a pro. Start by carefully reviewing your W2 form for any errors or discrepancies, as these can lead to delays in processing your tax return. Next, gather any additional documents or receipts that may be needed to claim deductions or credits, such as charitable donations or business expenses. With all your financial information in hand, you’ll be well-equipped to tackle your taxes head-on.

Remember, tax season doesn’t have to be a stressful experience. By utilizing the power of W2 forms and staying organized throughout the process, you can turn tax time into a breeze. So grab your W2 form, put on your tax-time cape, and get ready to conquer your taxes with confidence and ease. With a little bit of magic and a whole lot of know-how, you’ll be well on your way to tax time success!

Below are some images related to W2 Forma

2023 w2 forms, forma w2 en español, forma w2 para imprimir, forma w2 para que es, format w2 surveilans, , W2 Forma.

2023 w2 forms, forma w2 en español, forma w2 para imprimir, forma w2 para que es, format w2 surveilans, , W2 Forma.