Irs.Gov W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Enchantment of IRS.Gov W2 Forms!

Are you ready to embark on a mystical journey into the world of taxes? Look no further than IRS.Gov W2 forms! These seemingly ordinary documents hold the key to unlocking the magic of tax season. From deciphering your earnings to understanding your withholdings, the information contained in your W2 form is crucial for filing your taxes accurately. Let’s dive into the enchanting world of IRS.Gov W2 forms and uncover the secrets they hold!

Unleash the Secrets to Mastering Your Taxes!

Navigating the world of taxes can feel like a daunting task, but fear not – with the help of IRS.Gov W2 forms, you can unleash the secrets to mastering your taxes! By carefully reviewing your W2 form, you can ensure that all your income and taxes withheld are accurately reported on your tax return. Understanding the information on your W2 form is the first step towards taking control of your tax obligations and maximizing your potential refund. So, grab your wand (or pen) and let’s dive into the magical realm of IRS.Gov W2 forms!

Conclusion

In conclusion, don’t let tax season cast a spell of confusion over you – empower yourself with the knowledge and information contained in your IRS.Gov W2 form! By embracing the magic of W2 forms and taking the time to understand your earnings and withholdings, you can navigate the world of taxes with confidence and ease. So, grab your broomstick (or calculator) and embark on a journey towards mastering your taxes with the enchanting power of IRS.Gov W2 forms!

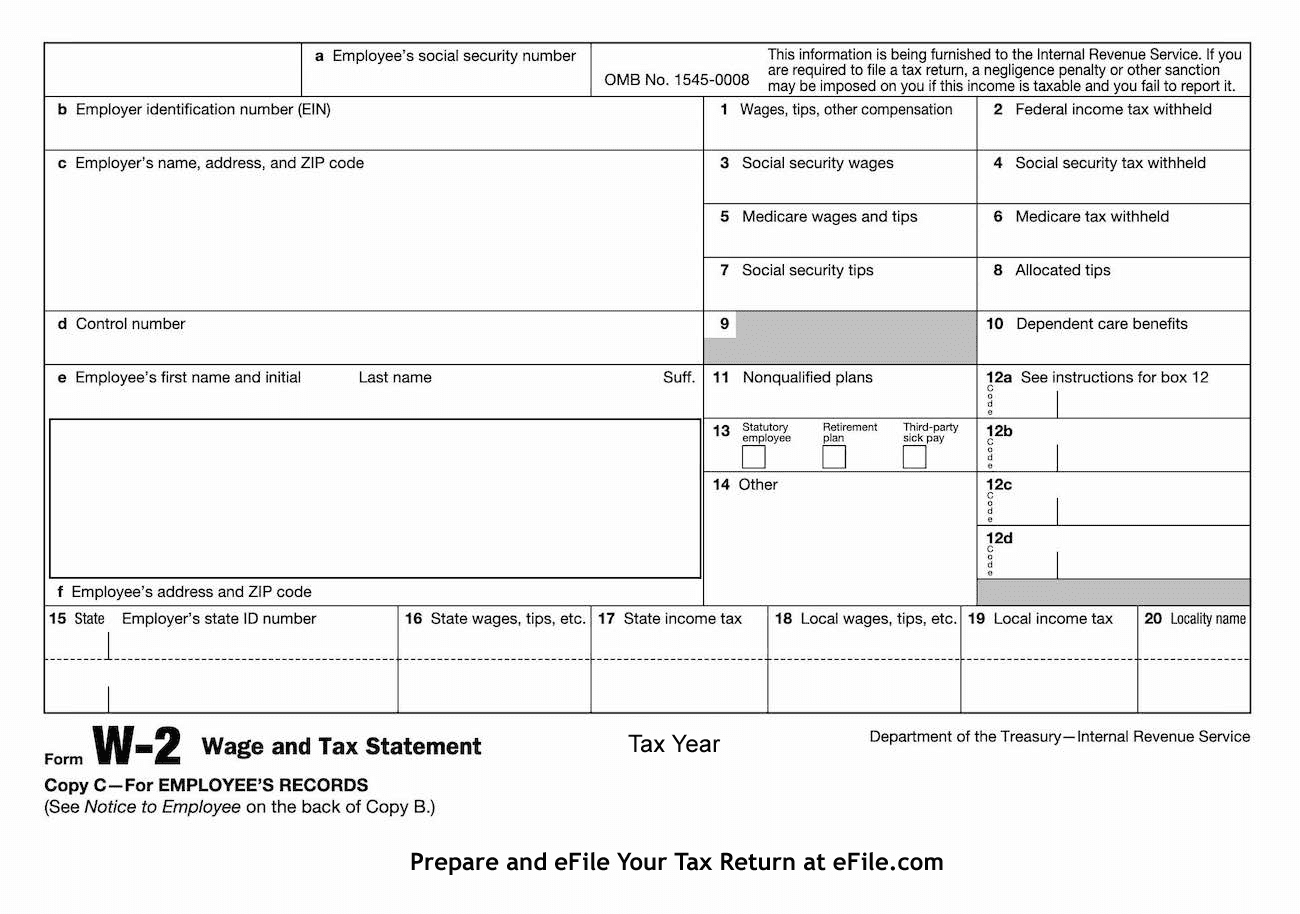

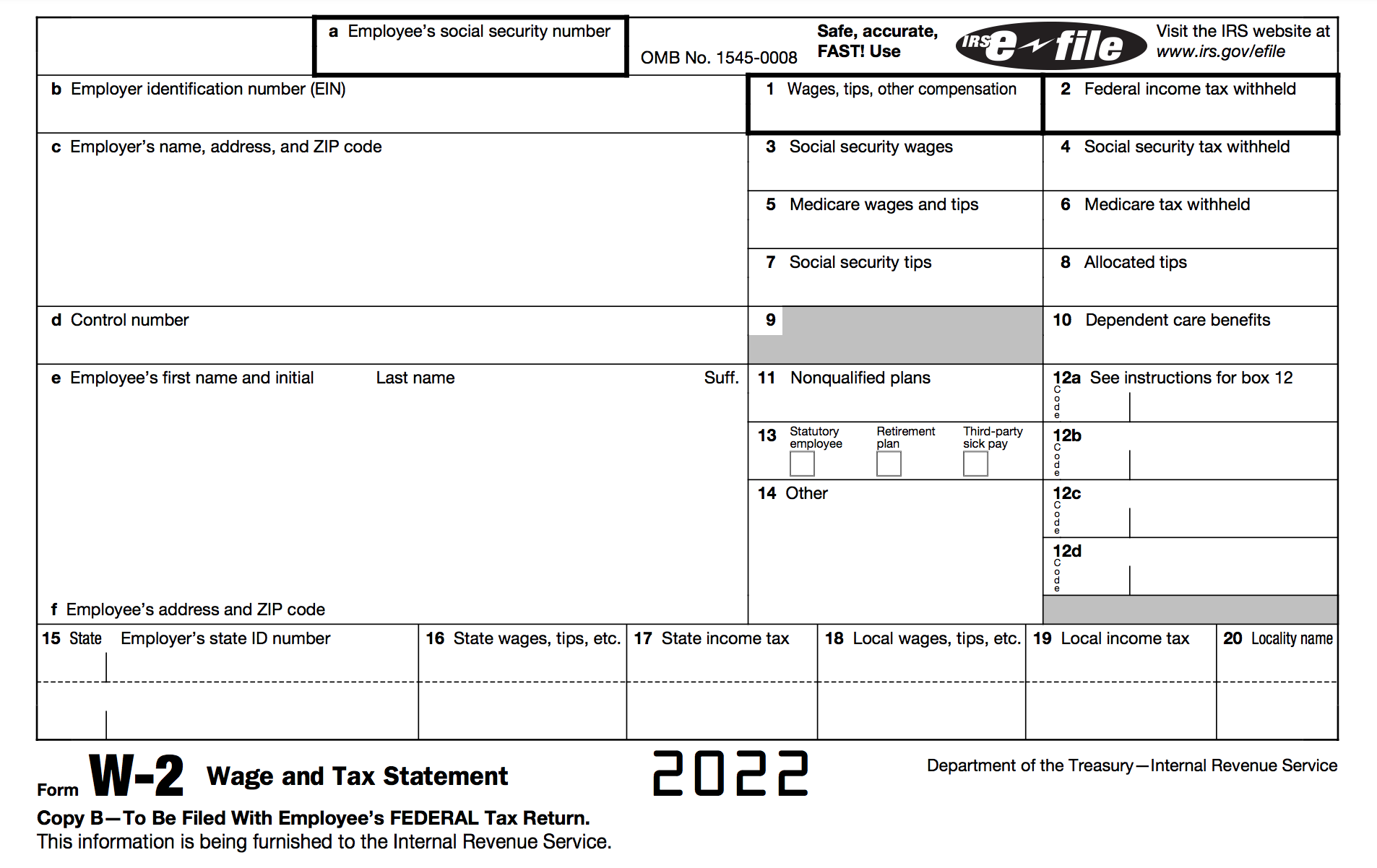

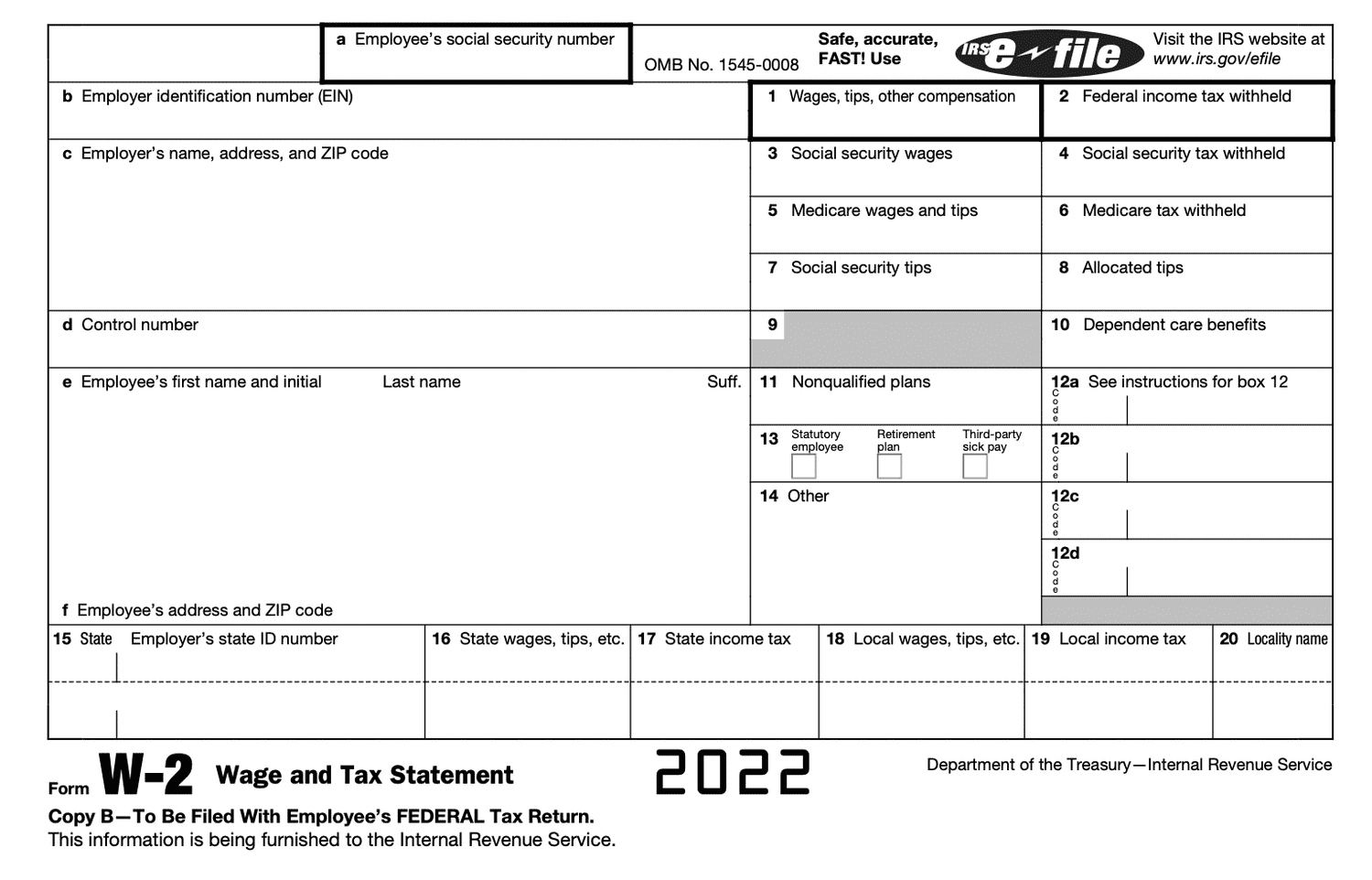

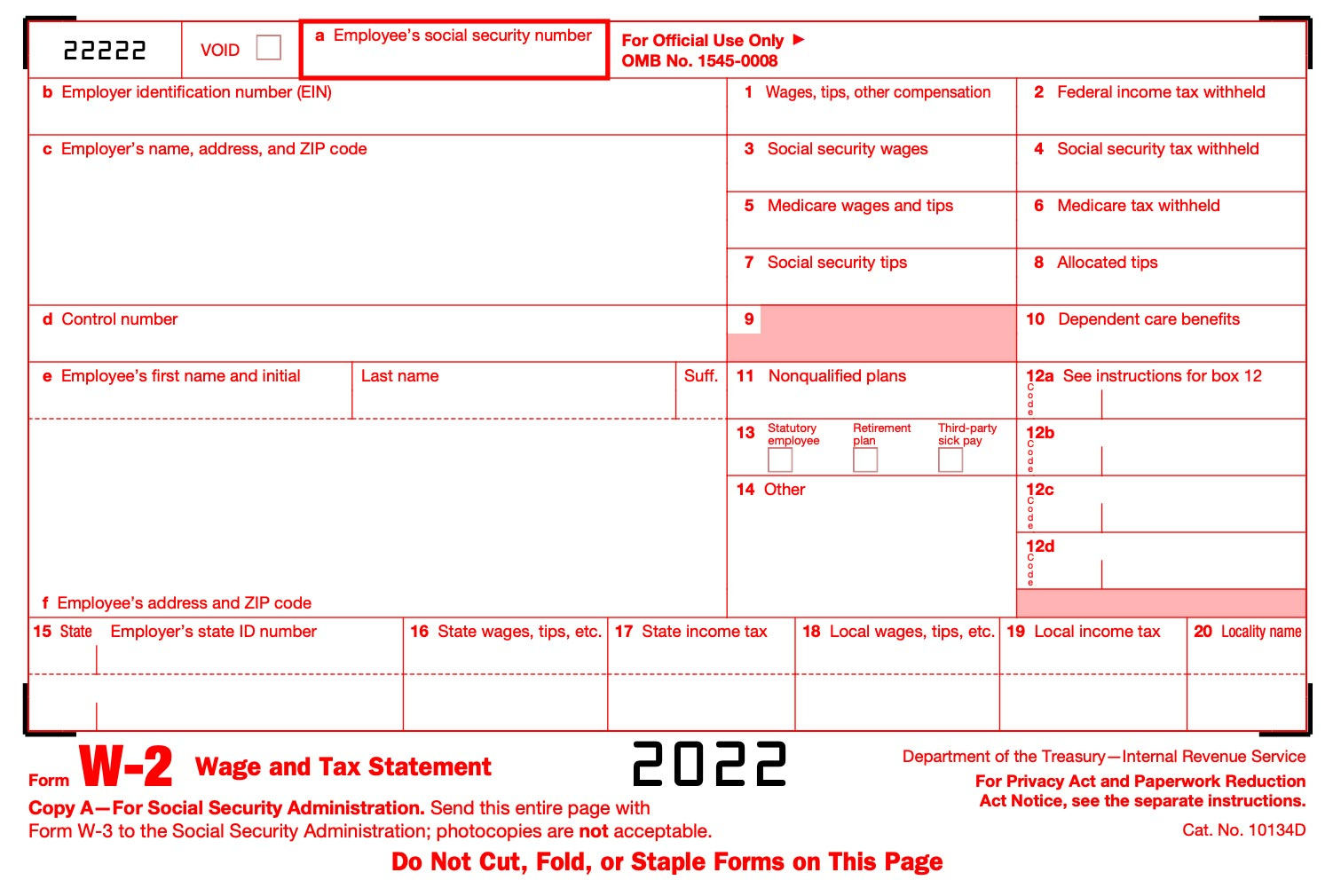

Below are some images related to Irs.Gov W2 Forms

irs gov w2 form online, irs gov w2 form pdf, irs.gov forms w2 w3, irs.gov order w-2 forms, irs.gov w2 2023 form, , Irs.Gov W2 Forms.

irs gov w2 form online, irs gov w2 form pdf, irs.gov forms w2 w3, irs.gov order w-2 forms, irs.gov w2 2023 form, , Irs.Gov W2 Forms.