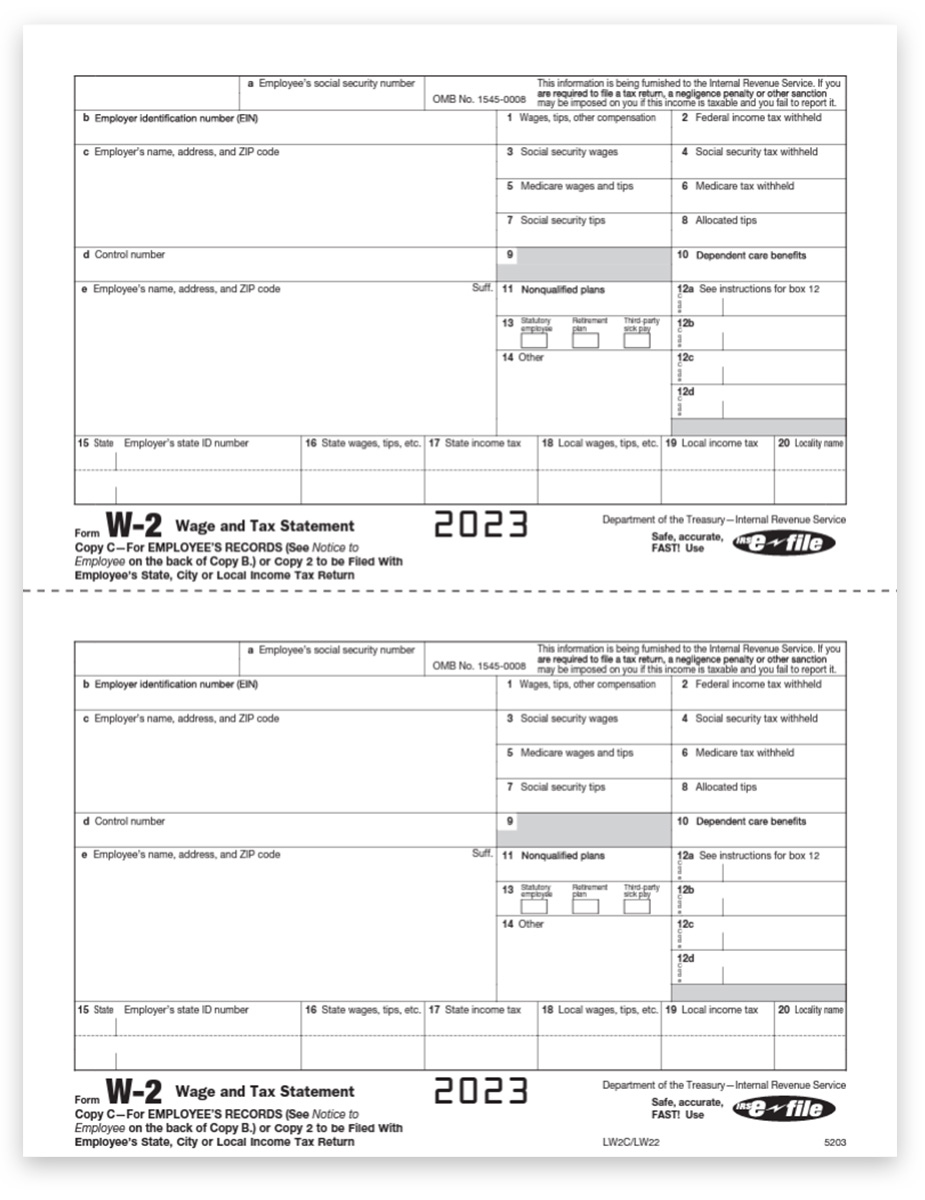

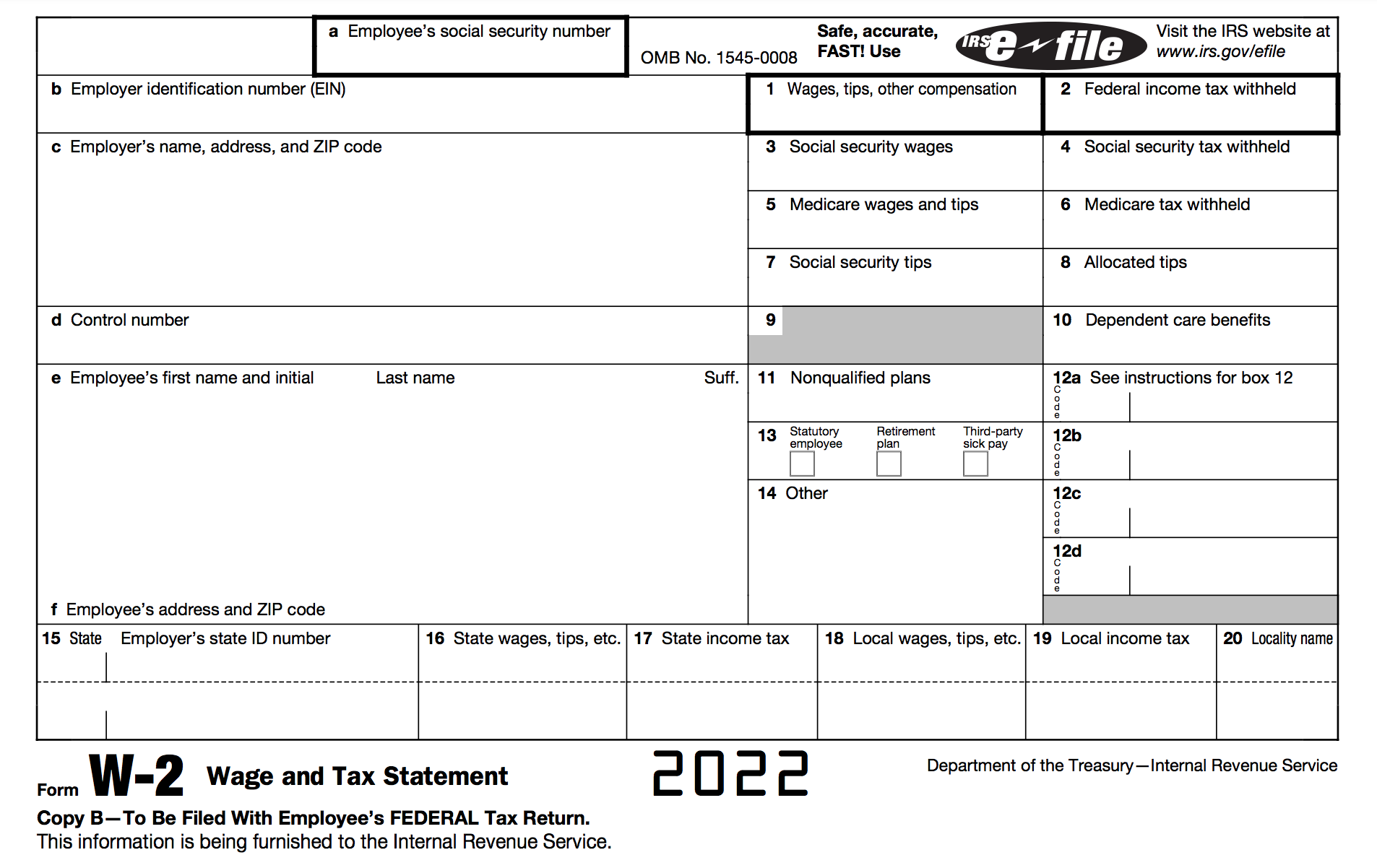

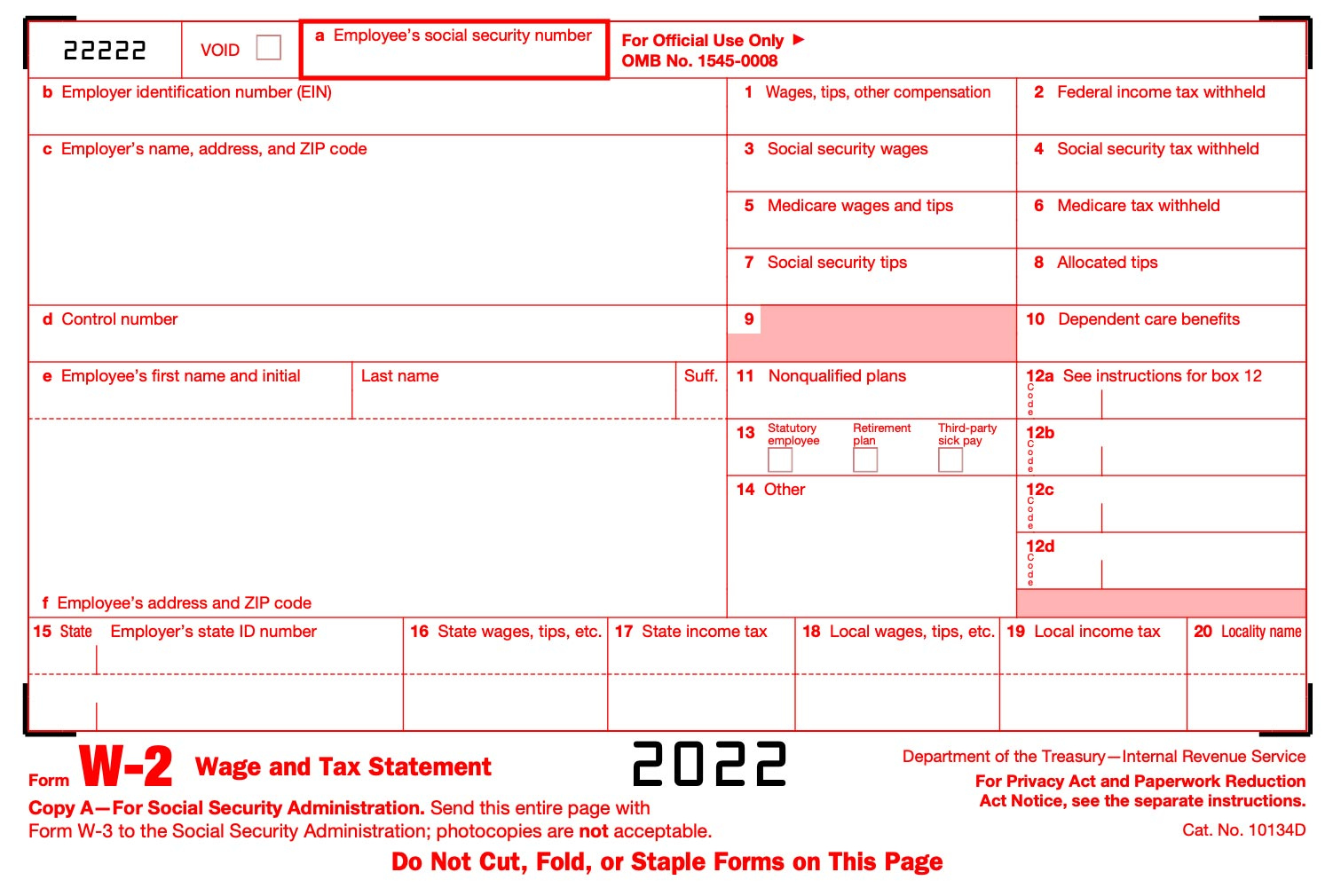

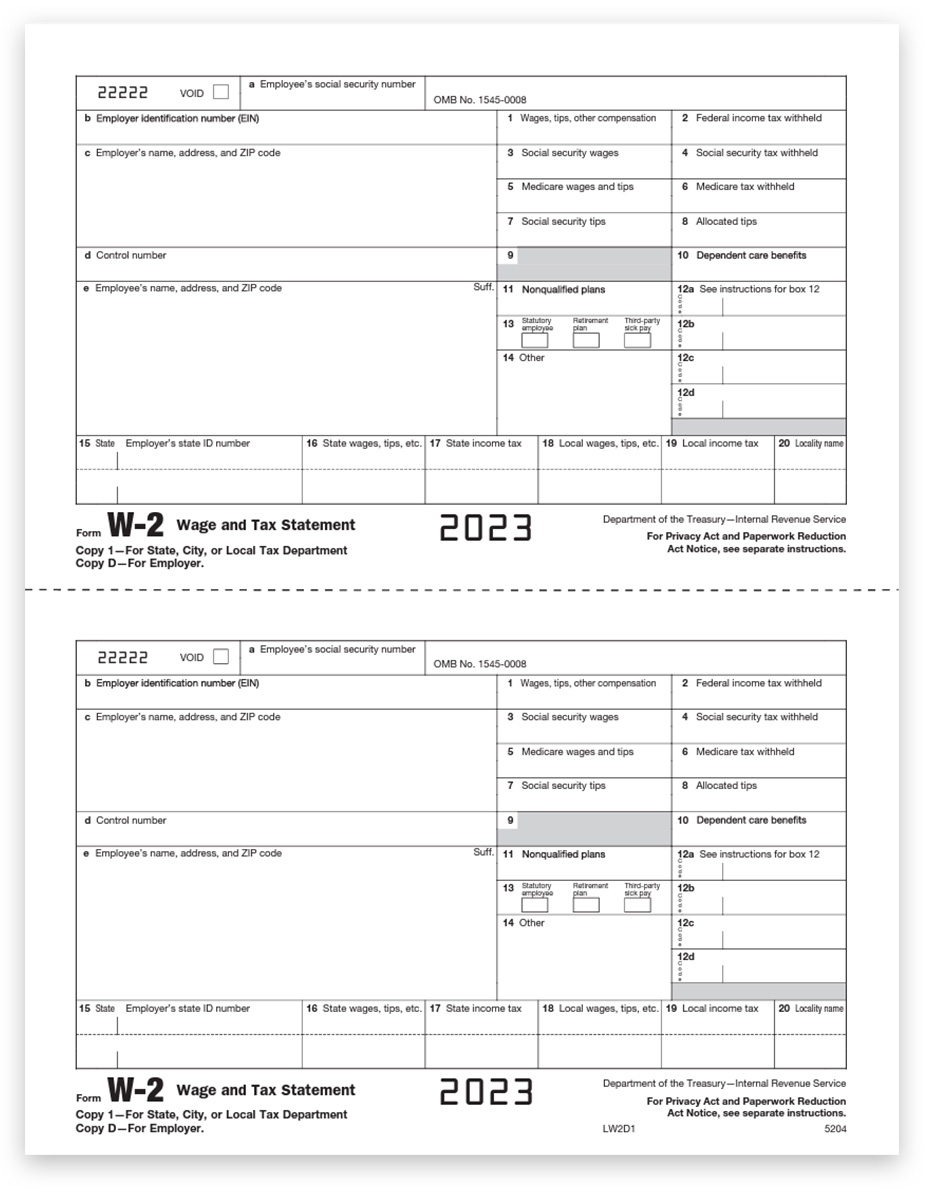

How To File Two W2 Forms From Different Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Fun: Filing Two W2s Like a Pro!

Are you feeling overwhelmed by the thought of handling not one, but two W2 forms this tax season? Fear not! With the right tips and tricks, you can conquer this task with ease and maybe even double the fun in the process. Filing multiple W2s doesn’t have to be a headache – it can be an opportunity to showcase your organizational skills and efficiency. So, let’s dive in and master the art of handling multiple W2s like a pro!

Mastering the Art of Handling Multiple W2s

When it comes to managing multiple W2 forms, organization is key. Start by creating separate folders or digital files for each employer to keep their information organized and easily accessible. Make sure to double-check all the information on each W2 form, including your name, Social Security number, and earnings. It’s crucial to ensure the accuracy of this information to avoid any delays or issues with your tax return.

Another important aspect of handling multiple W2s is understanding how they impact your tax liability. Each W2 form represents income you earned from a specific employer, and the total of all your W2 forms will determine your overall income for the year. Be sure to calculate your total income accurately and take advantage of any deductions or credits you may qualify for. If you’re unsure about any aspect of your tax situation, don’t hesitate to seek guidance from a tax professional.

As you prepare to file your taxes with multiple W2 forms, consider using tax software or enlisting the help of a professional tax preparer. These resources can help streamline the process and ensure that you’re taking full advantage of all available deductions and credits. By staying organized, understanding your tax liability, and seeking assistance when needed, you can navigate the challenge of filing two W2s like a pro and maybe even enjoy the process along the way.

In conclusion, filing two W2s doesn’t have to be a daunting task. With the right approach and a positive attitude, you can tackle this challenge with confidence and efficiency. By mastering the art of handling multiple W2s and following the tips outlined above, you’ll be well on your way to a smooth and successful tax season. So, embrace the opportunity to showcase your skills and double the fun of filing two W2s like a pro!

Below are some images related to How To File Two W2 Forms From Different Employer

can you get two w2 from same employer, how to file two w2 forms from different employer, how to file two w2 forms from same employer, what if i have two w2 forms from different employers, why did i get 3 w2 forms from the same employer, , How To File Two W2 Forms From Different Employer.

can you get two w2 from same employer, how to file two w2 forms from different employer, how to file two w2 forms from same employer, what if i have two w2 forms from different employers, why did i get 3 w2 forms from the same employer, , How To File Two W2 Forms From Different Employer.