Section 125 On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

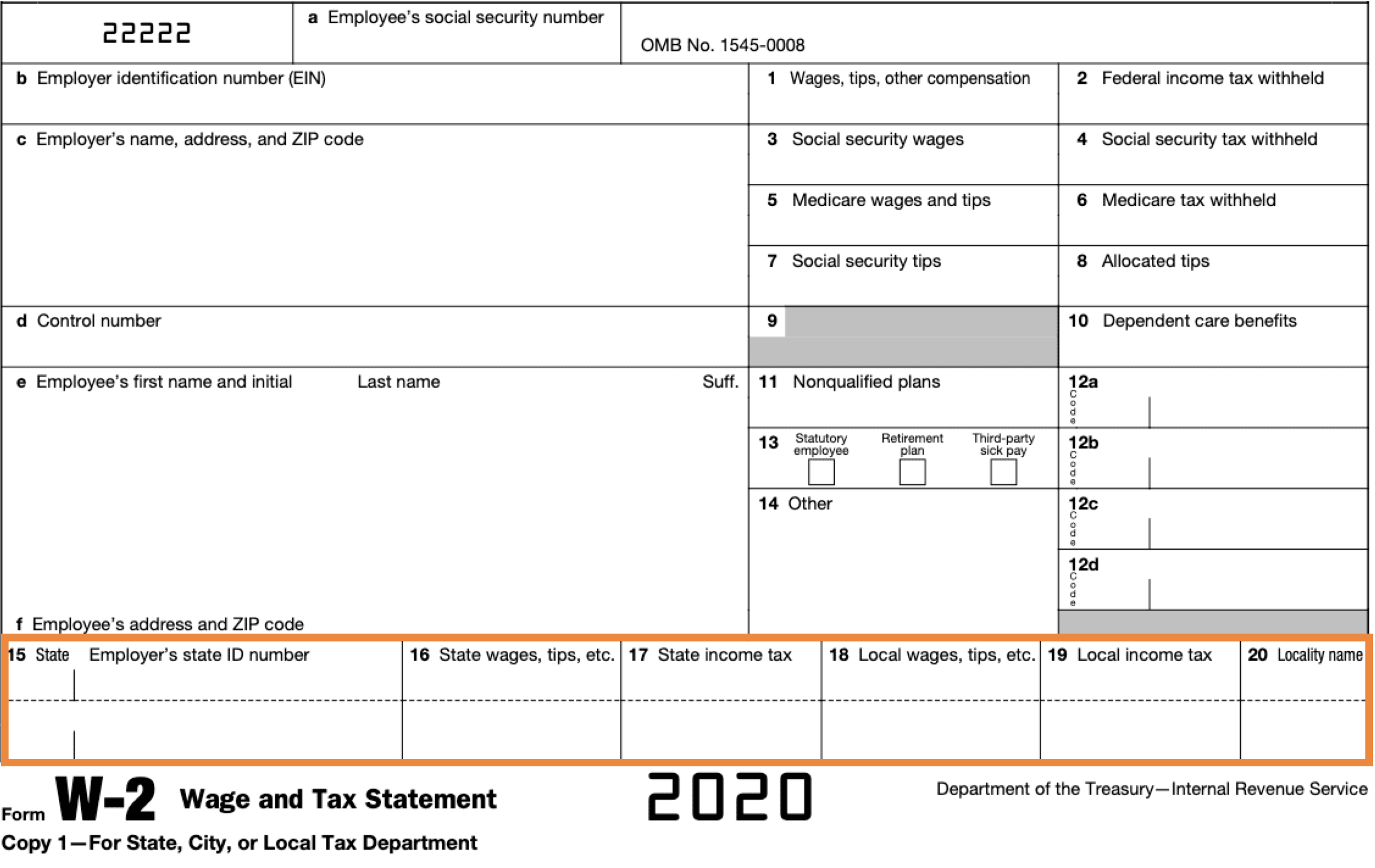

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of Section 125 on Your W2 Form

Are you ready to dive into the world of Section 125 on your W2 form? This often overlooked section holds the key to unlocking a treasure trove of benefits that can save you money and maximize your earnings. By understanding how to leverage Section 125, you can unleash its magic and take full advantage of all it has to offer.

Discover the Hidden Treasure: Section 125 on Your W2 Form

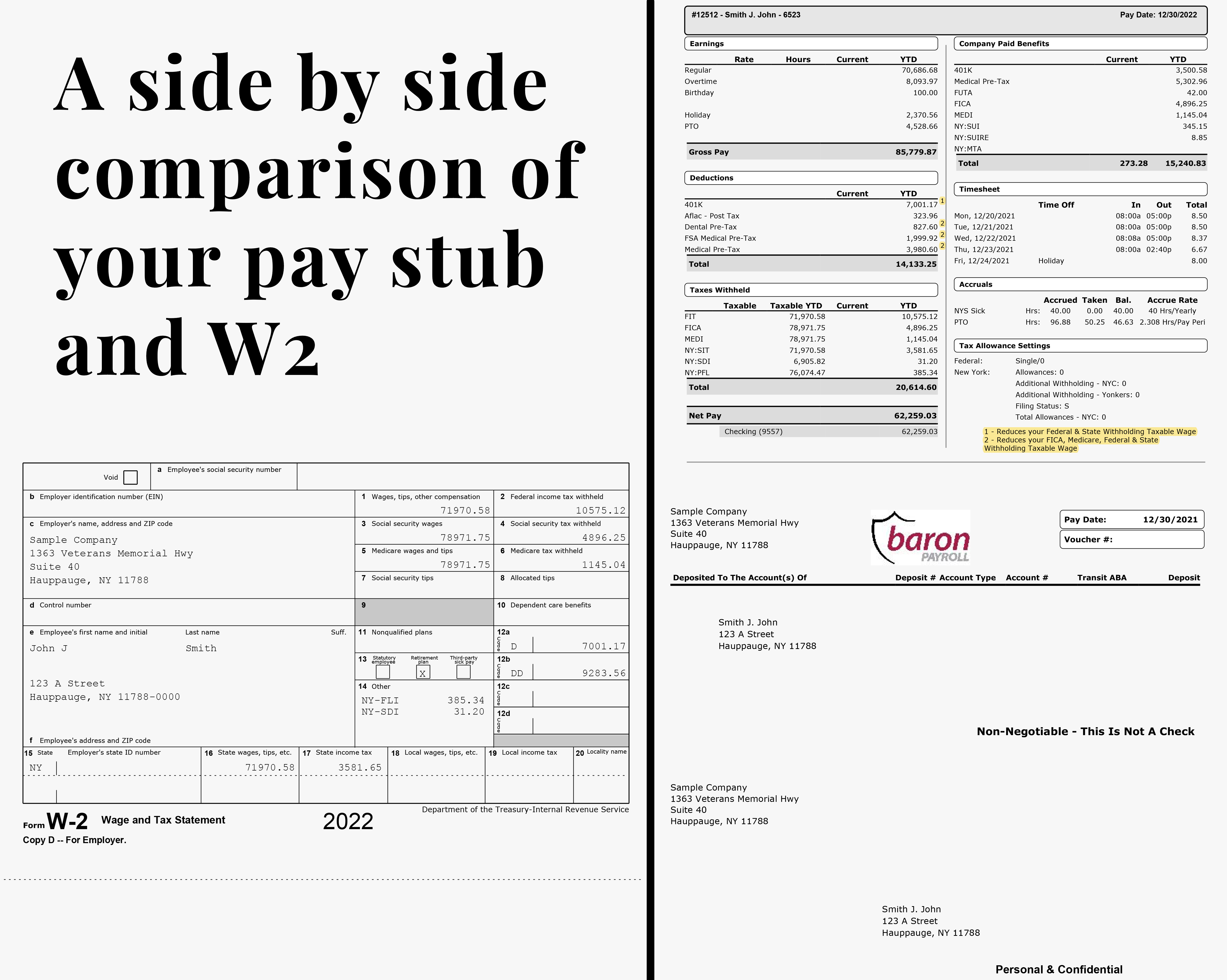

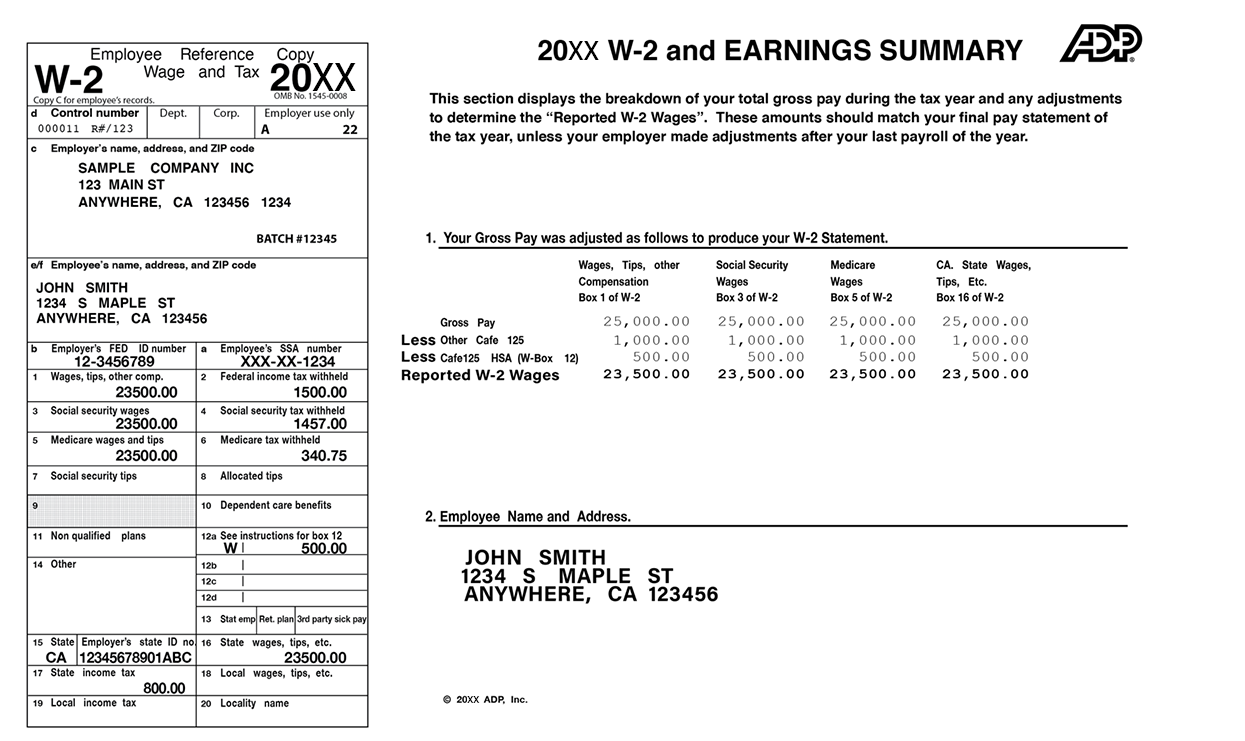

Section 125 on your W2 form may seem like just another line item, but it is so much more than that. This section refers to the cafeteria plan, also known as a flexible spending account (FSA) or a health savings account (HSA). By contributing to these accounts pre-tax, you can lower your taxable income and potentially save hundreds or even thousands of dollars each year. This hidden treasure allows you to pay for eligible medical expenses, dependent care, and other qualifying expenses with pre-tax dollars, giving you more bang for your buck.

But the benefits of Section 125 don’t stop there. In addition to saving money on taxes, participating in a cafeteria plan can also provide you with valuable insurance benefits. Many employers offer the option to use pre-tax dollars to pay for health, dental, vision, and other insurance premiums through Section 125. This means you can protect yourself and your family without having to pay with after-tax dollars, giving you peace of mind and financial security. Don’t let the magic of Section 125 go to waste – take advantage of all it has to offer.

Unleash the Magic: Maximizing Your Benefits with Section 125

To fully unleash the magic of Section 125, it’s important to understand how to maximize your benefits. Start by carefully reviewing your employer’s cafeteria plan options and choosing the ones that best fit your needs. Consider your anticipated medical expenses, insurance needs, and dependent care costs to determine how much to contribute to each account. By planning ahead and making strategic decisions, you can make the most of Section 125 and stretch your dollars further than you ever thought possible.

In conclusion, Section 125 on your W2 form is not just a mundane detail – it is a powerful tool that can help you save money, lower your taxes, and protect your family. By discovering the hidden treasure of Section 125 and unleashing its magic through strategic planning and smart decision-making, you can reap the benefits and enjoy a brighter financial future. So don’t overlook this valuable section on your W2 form – embrace it, leverage it, and watch the magic unfold before your eyes.

Below are some images related to Section 125 On W2 Form

how to report section 125 on w2, section 125 contributions on w2, section 125 deductions on w2, section 125 on w2 form, what is section 125 on w-2 form, , Section 125 On W2 Form.

how to report section 125 on w2, section 125 contributions on w2, section 125 deductions on w2, section 125 on w2 form, what is section 125 on w-2 form, , Section 125 On W2 Form.