Is 1099 Form Same As W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Myth Buster: Are 1099s and W2s Twins?

Ah, tax season – a time of year that can bring both dread and confusion for many. Among the various forms and documents that come into play, two of the most commonly mixed up are the 1099 and W2. Are they really twins, as some believe, or are they more like distant cousins? Let’s dive in and unravel the mystery of these tax forms!

Unraveling the Mystery of 1099s and W2s

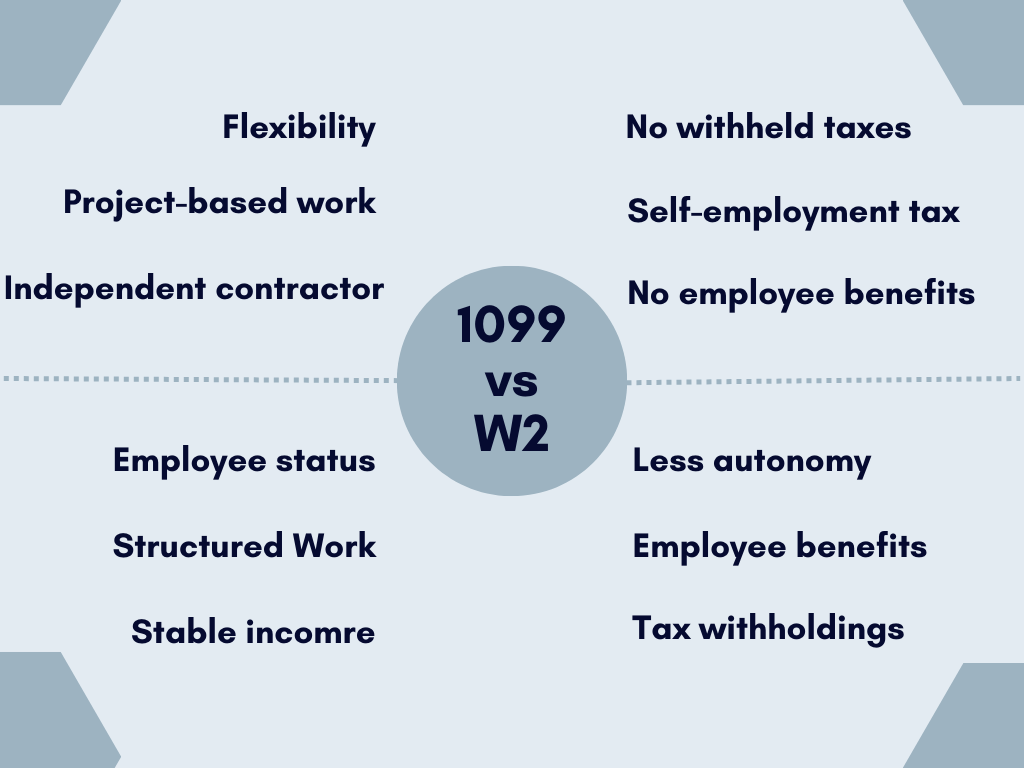

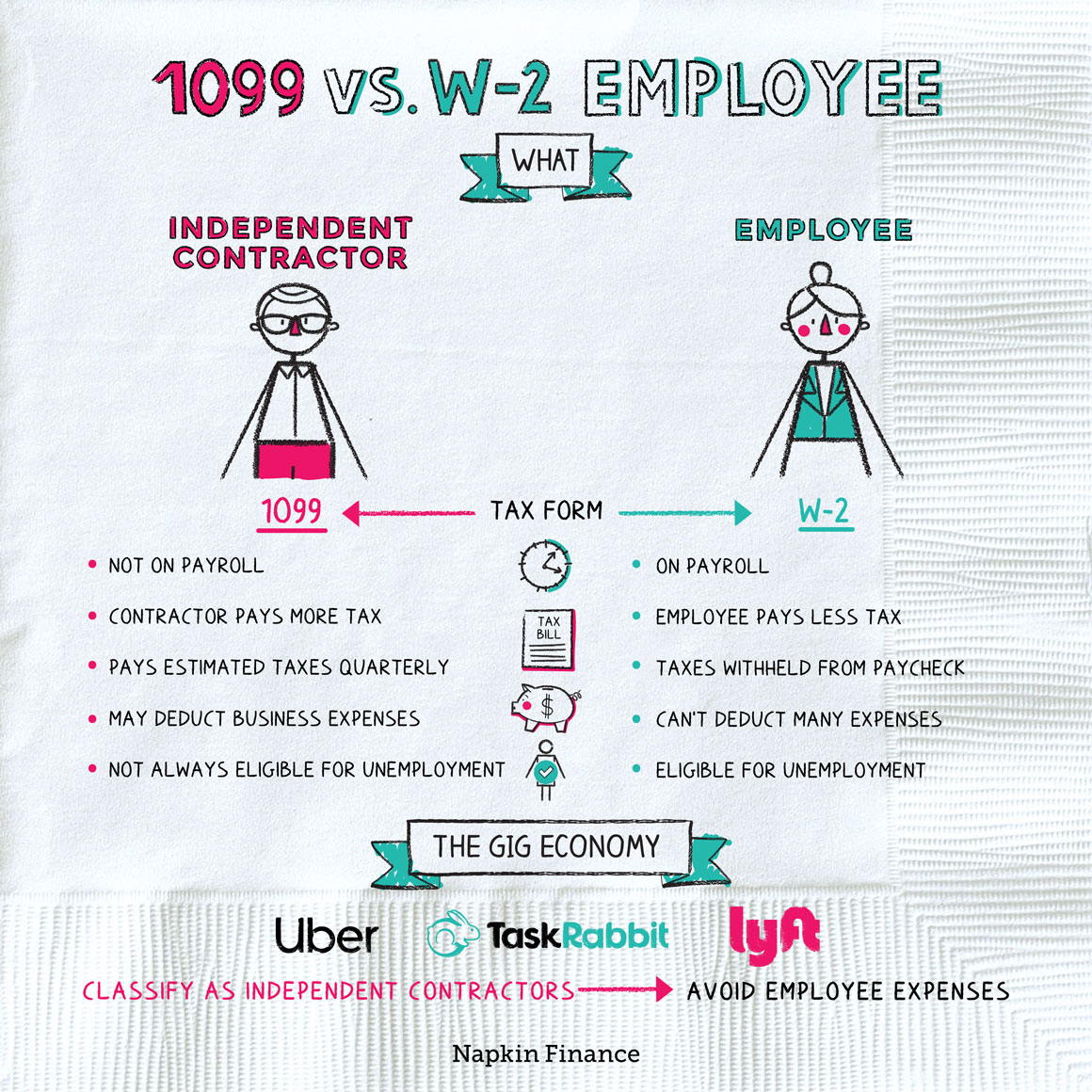

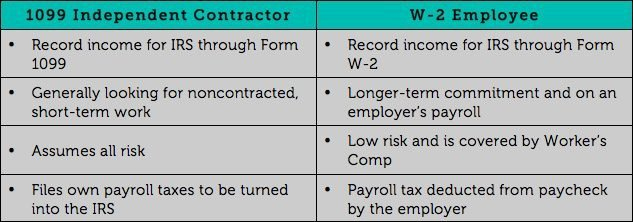

First off, let’s clarify what exactly each form is. A W2 is a form that an employer sends to their employees, detailing their wages earned and taxes withheld throughout the year. On the other hand, a 1099 is typically sent to independent contractors or freelancers, showing how much income they received from a particular client or company. So, while they both have to do with income and taxes, they serve different purposes depending on your employment status.

Now, here’s where the confusion often sets in – can you receive both a W2 and a 1099? The answer is yes! It’s not uncommon for individuals to have multiple streams of income, whether that be through traditional employment or side gigs. So, don’t be surprised if you find yourself with both forms come tax time. Just remember, they may look similar at first glance, but they each play a unique role in your tax filing process.

Let’s Set the Record Straight! Fact vs Fiction!

One common myth that often circulates is that you don’t have to report income received on a 1099 if it’s below a certain threshold. This is false! Regardless of the amount, all income earned must be reported on your tax return, whether it’s from a W2, 1099, or any other source. Failing to do so can result in penalties from the IRS, so it’s always best to be upfront and honest about your earnings.

Another misconception is that individuals who receive a 1099 are automatically considered self-employed. While it’s true that many independent contractors fall into this category, it’s not a blanket rule. Your employment status is determined by a variety of factors, such as control over your work and how you are paid. So, receiving a 1099 doesn’t necessarily mean you’re self-employed, but it does mean you’ll need to report that income on your taxes.

In conclusion, while 1099s and W2s may seem like twins in the tax world, they are actually more like distant relatives with their own unique roles to play. Understanding the differences between these forms and how they impact your tax return is key to navigating the sometimes murky waters of tax season. So, the next time you’re sorting through your documents, remember that knowledge is power – and the more you know, the better equipped you’ll be to tackle your taxes like a pro!

Below are some images related to Is 1099 Form Same As W2

does a 1099 replace a w2, is 1099 different from w2, is 1099 form same as w2, is 1099 form the same as w-2, is 1099 same as w2, , Is 1099 Form Same As W2.

does a 1099 replace a w2, is 1099 different from w2, is 1099 form same as w2, is 1099 form the same as w-2, is 1099 same as w2, , Is 1099 Form Same As W2.