W2 Form Copy – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of the W2 Form Copy!

Ah, tax season – a time of confusion and dread for many. But fear not, for the W2 form copy is here to save the day! This little document may seem like a daunting piece of paper full of numbers and codes, but don’t worry, we’re here to help you unravel its mysteries. The W2 form copy is essential for reporting your annual earnings to the IRS, so it’s important to understand what it all means.

When you receive your W2 form copy from your employer, you’ll notice that it contains a wealth of information about your earnings and taxes withheld throughout the year. This includes your total wages, tips, bonuses, and any other compensation you received, as well as the amount of federal and state taxes that were taken out of your paychecks. Understanding these numbers will help you accurately report your income and ensure that you’re not paying more (or less) in taxes than you owe.

One important thing to keep in mind when reviewing your W2 form copy is to double-check all the information for accuracy. Make sure your name, social security number, and other personal details are correct, as any errors could lead to delays in processing your tax return. If you notice any discrepancies, be sure to reach out to your employer to get them corrected as soon as possible. It’s always better to be safe than sorry when it comes to tax time!

Double the Excitement: Your Complete Guide to the W2 Form Copy!

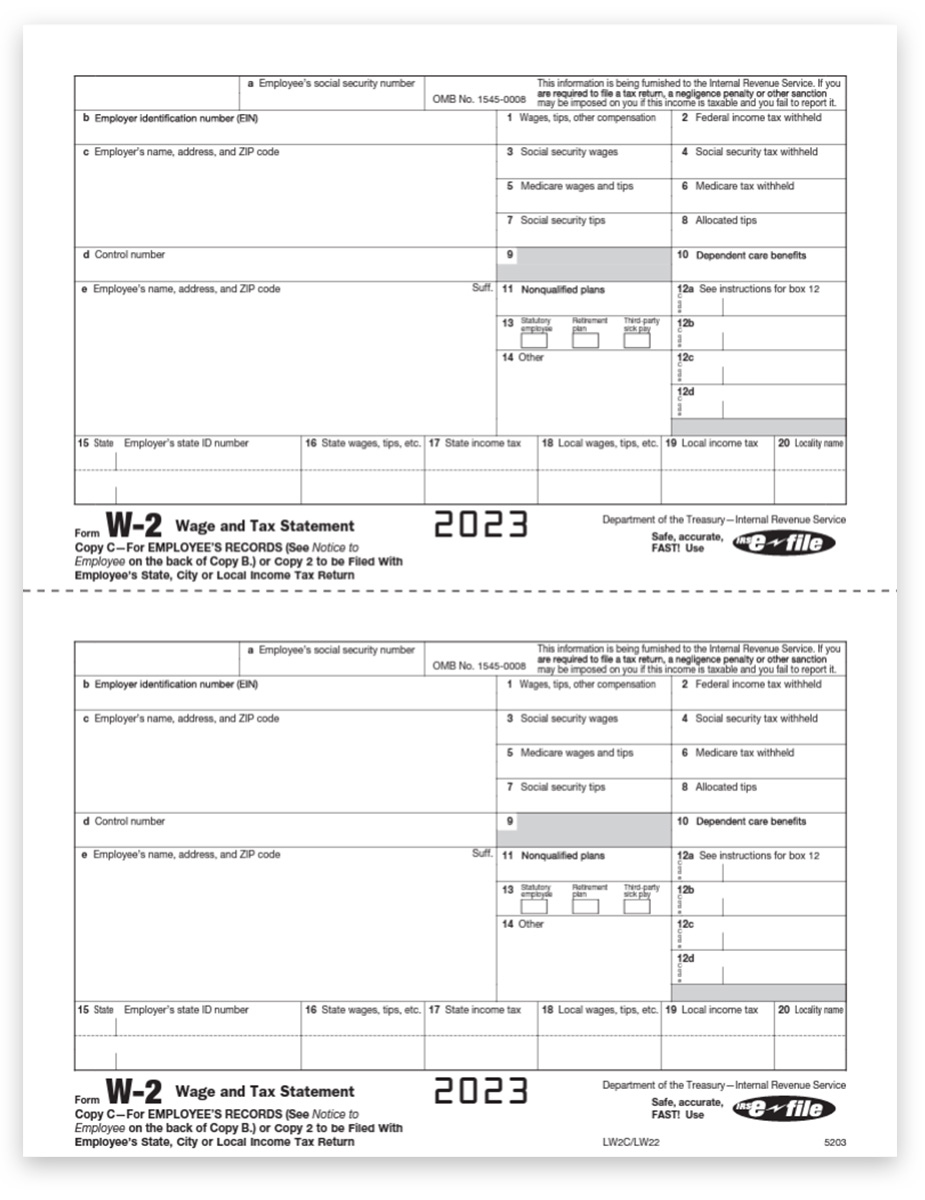

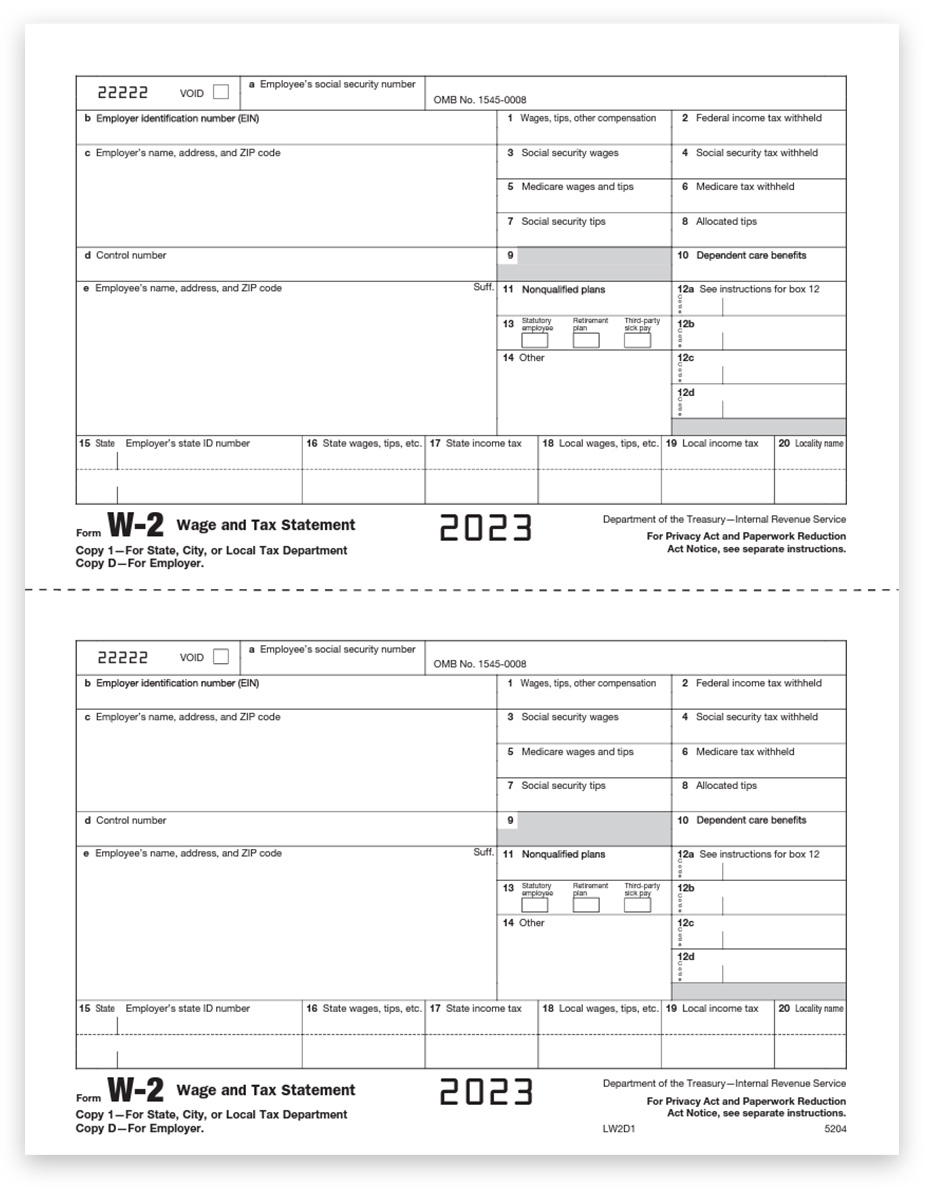

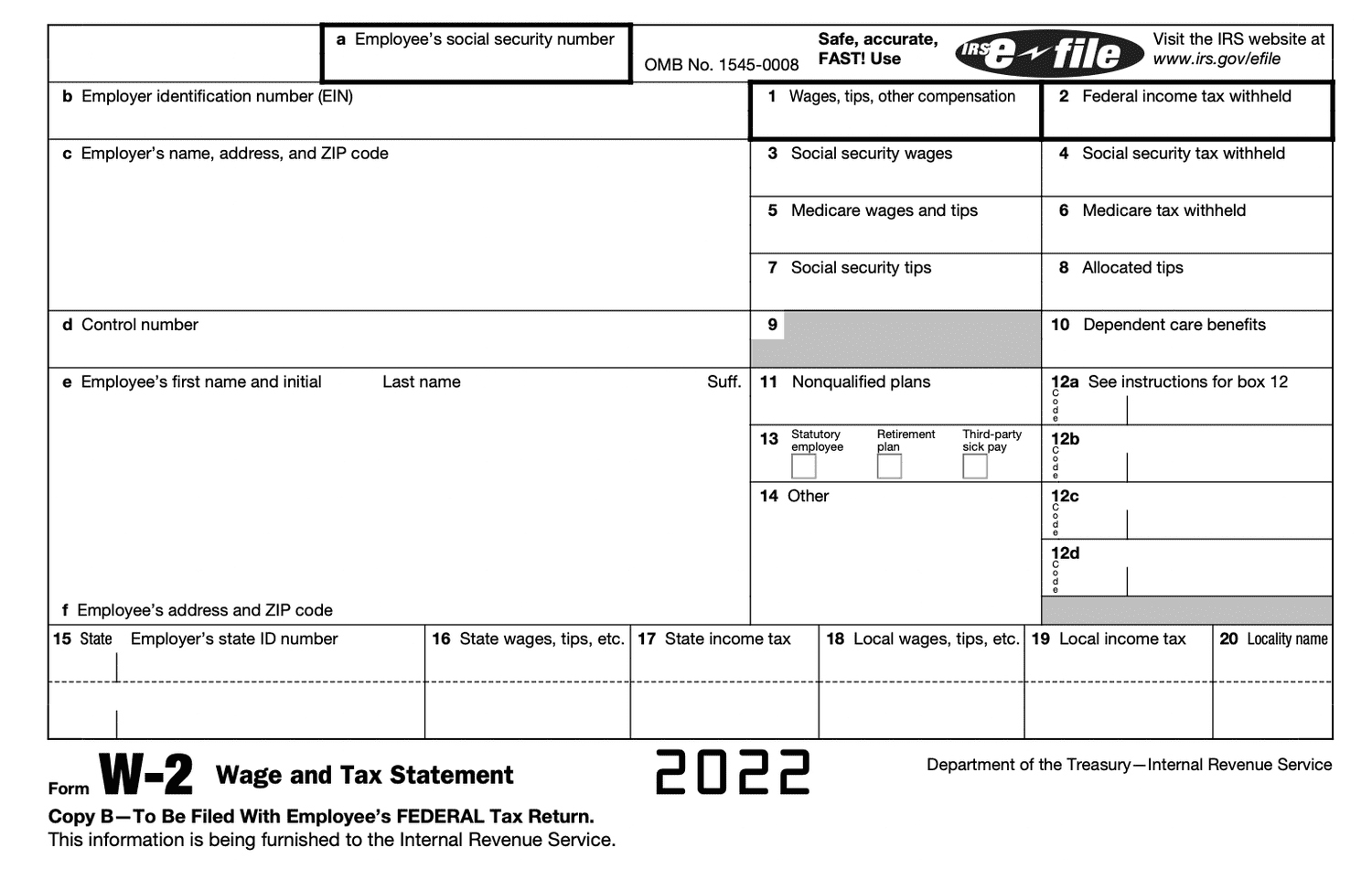

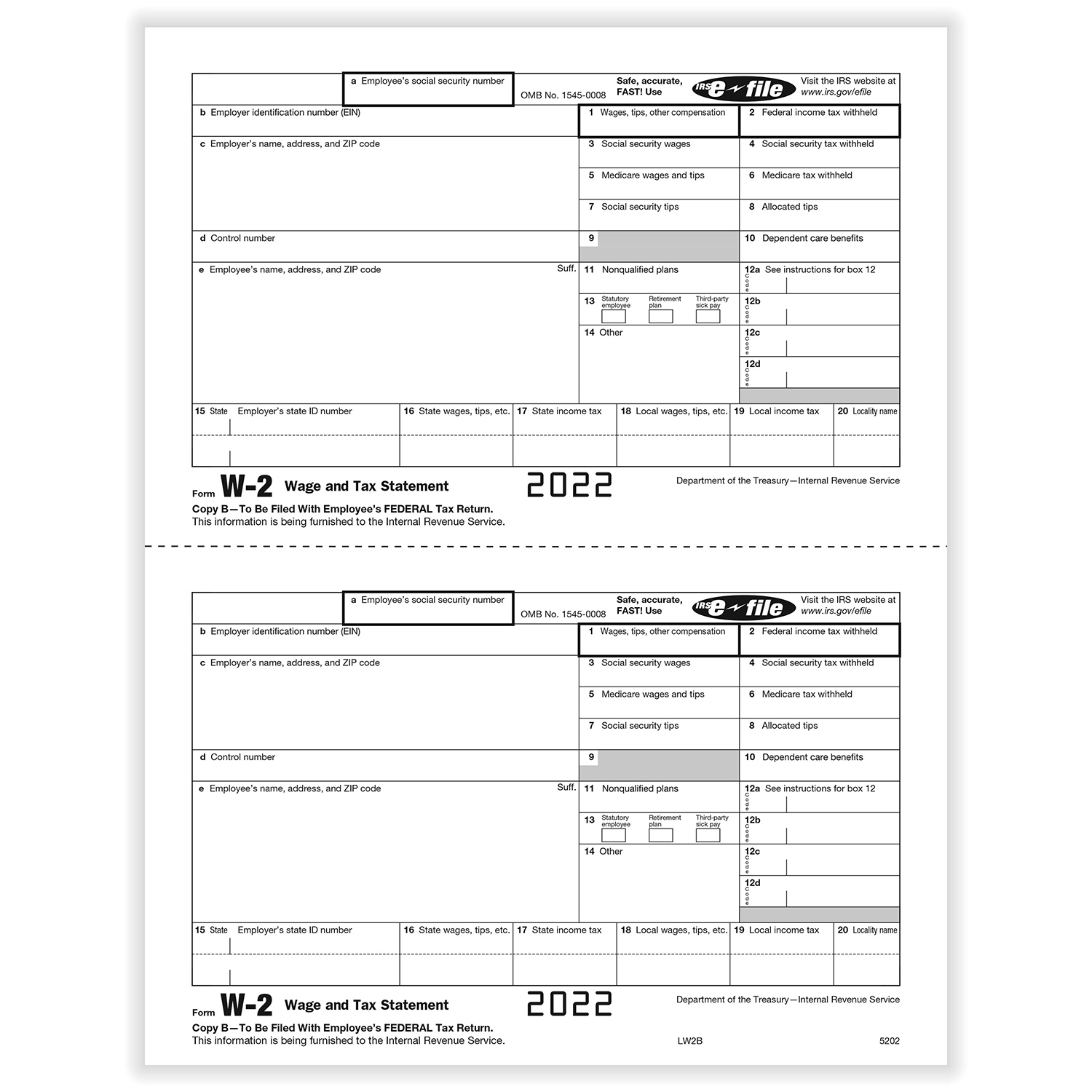

Now that you’ve got a better understanding of the W2 form copy, it’s time to dive deeper into the exciting world of taxes! One key thing to keep in mind is that you’ll receive multiple copies of your W2 form – one for your federal tax return, one for your state tax return (if applicable), and one for your records. Each copy serves a specific purpose, so be sure to keep them organized and handy when it’s time to file your taxes.

When it comes to filing your taxes, having your W2 form copy at the ready will make the process much smoother and more efficient. Whether you’re using tax software or working with a professional accountant, having all the necessary information at your fingertips will help ensure that you’re completing your tax return accurately and on time. So, embrace the excitement of tax season and get ready to conquer those forms with confidence!

In conclusion, the W2 form copy may seem intimidating at first, but with a little guidance and a positive attitude, you’ll be well on your way to becoming a tax-filing pro. Remember to review your W2 form copy carefully, keep all copies organized, and reach out to your employer if you spot any errors. With these tips in mind, tax season will be a breeze, and you’ll be well on your way to a stress-free filing experience. So, double the fun and dive into the world of taxes with confidence – you’ve got this!

Below are some images related to W2 Form Copy

form w-2 copy c, form w-2 copy d, w2 form 2019 copy, w2 form 2021 copy, w2 form 2023 copy, , W2 Form Copy.

form w-2 copy c, form w-2 copy d, w2 form 2019 copy, w2 form 2021 copy, w2 form 2023 copy, , W2 Form Copy.