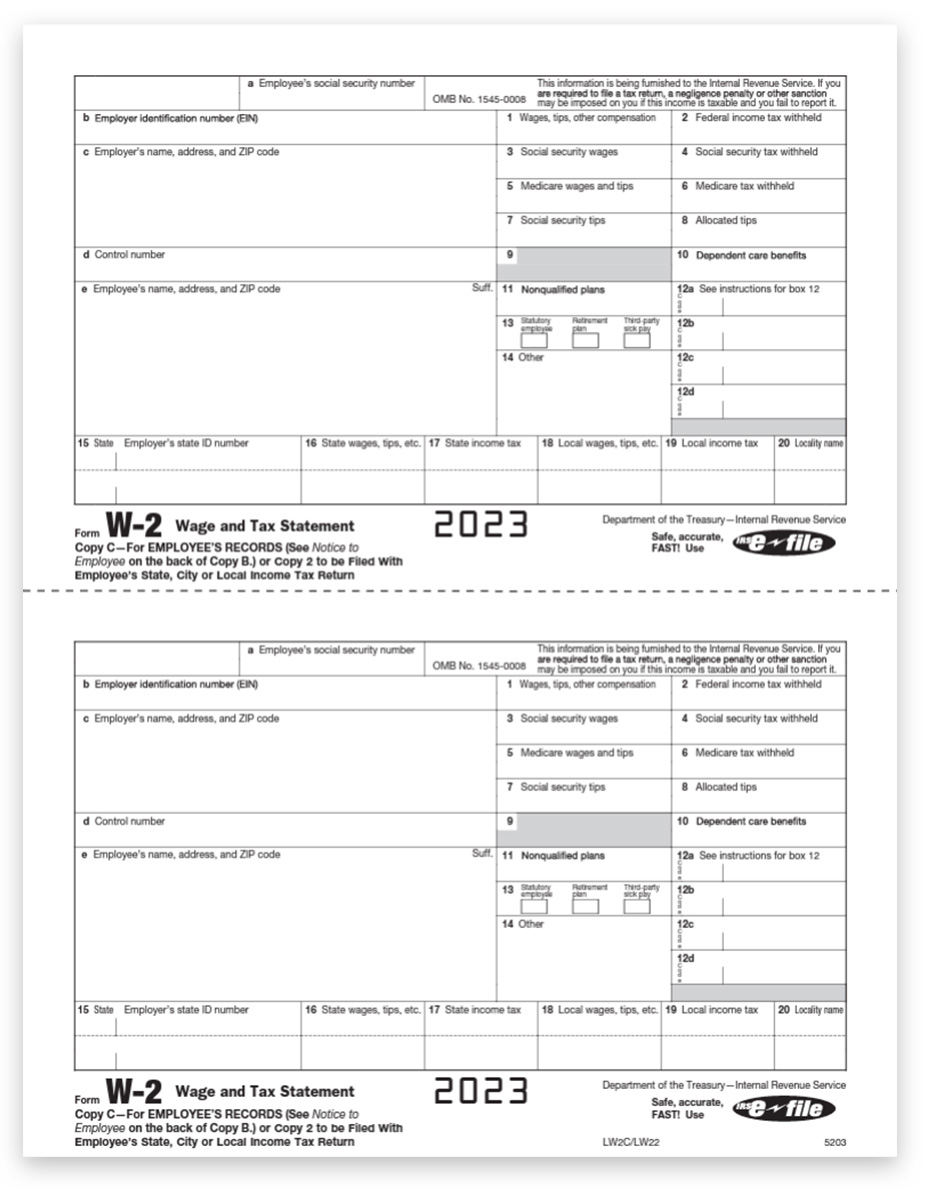

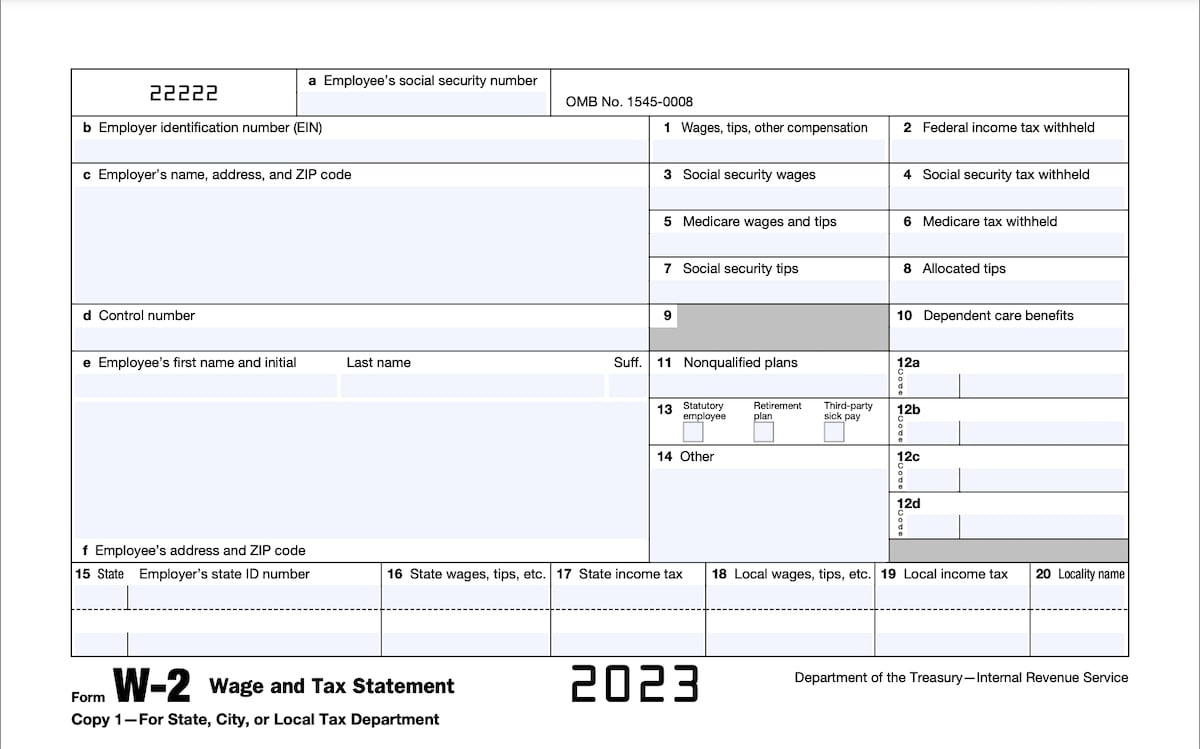

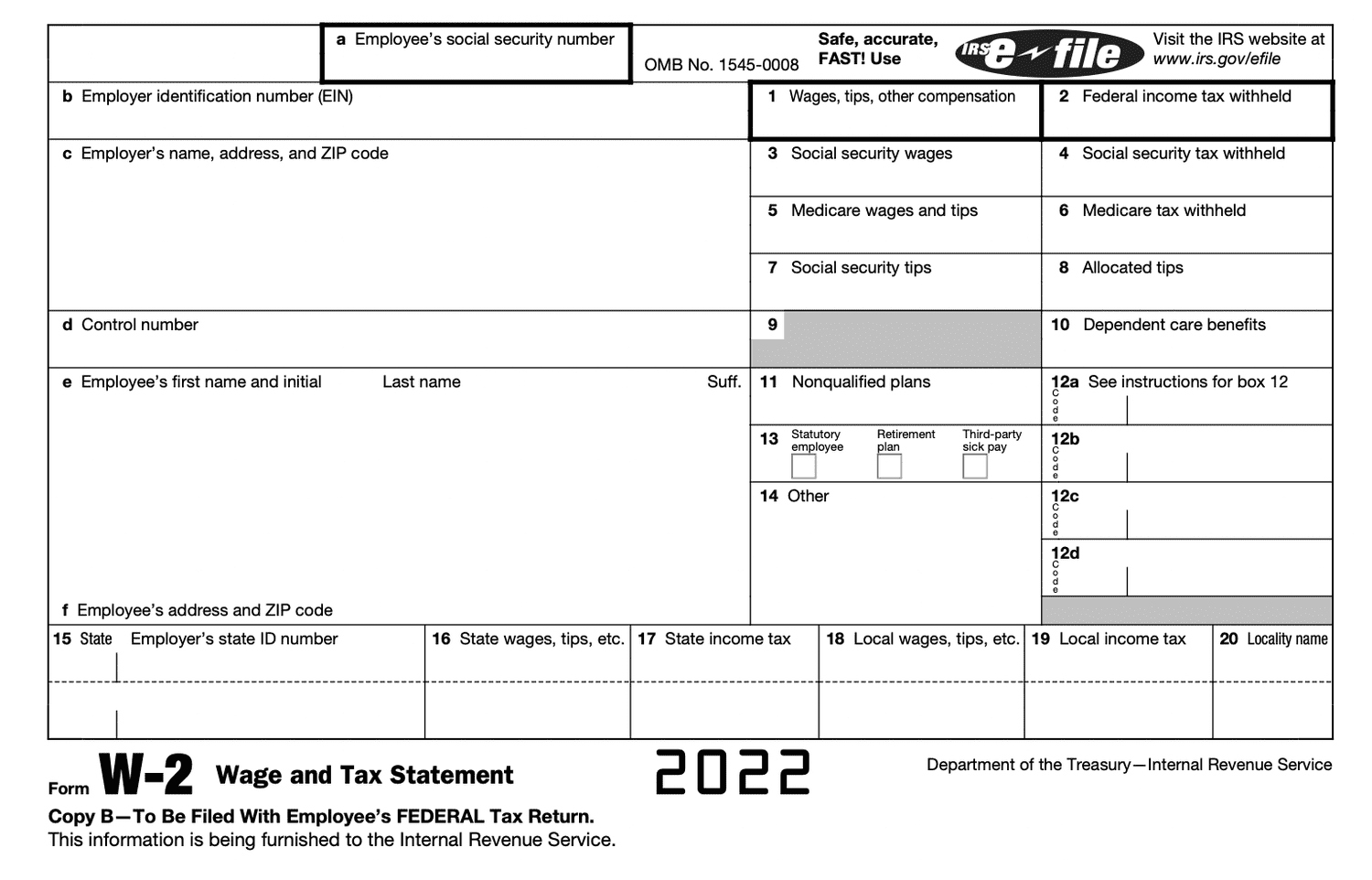

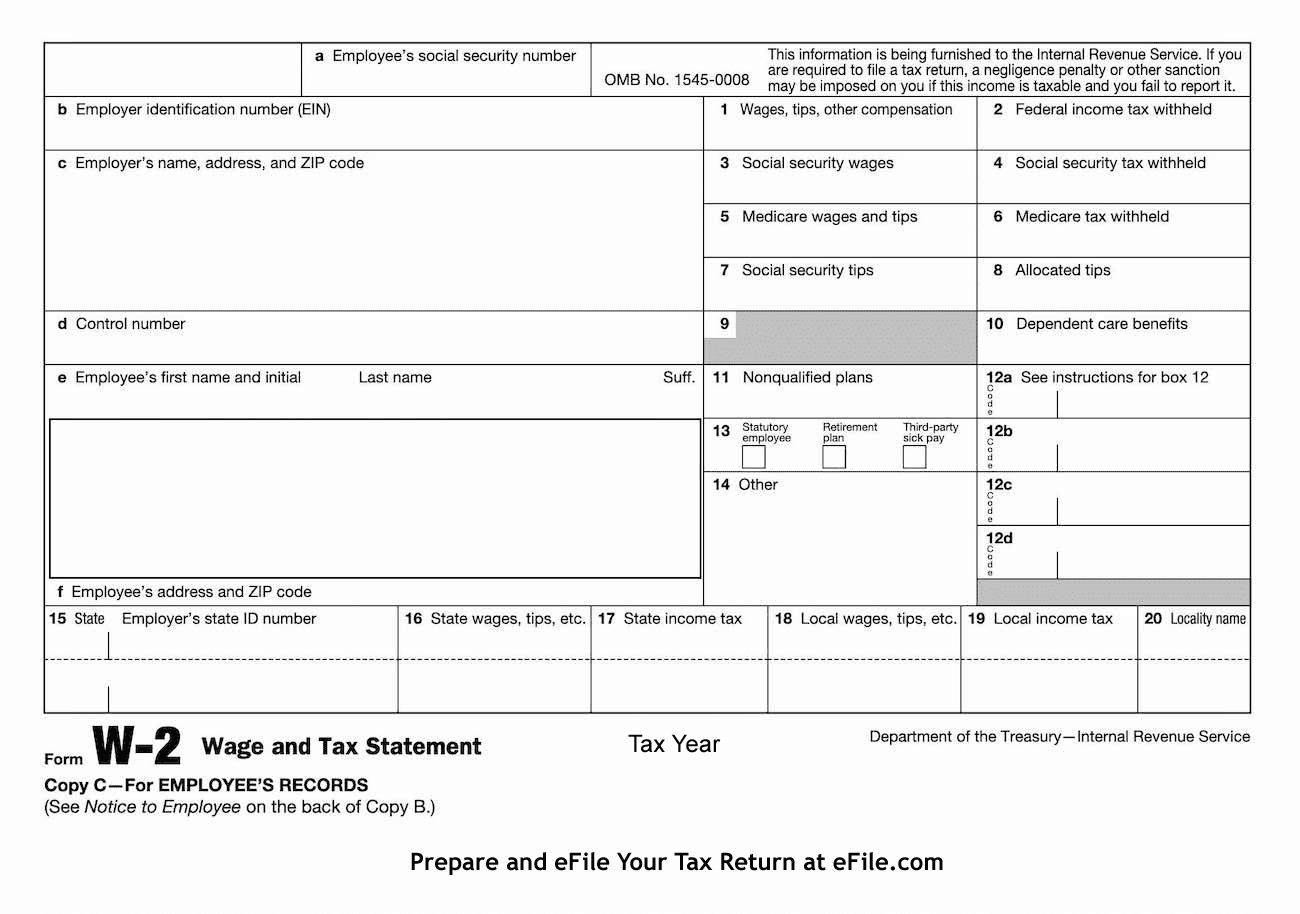

Forms For W2 Employees – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Basics of W2 Employees!

Are you ready to dive into the exciting world of W2 employees? Let’s start with the basics! W2 employees are individuals who are hired by a company and classified as employees. This means that the company withholds taxes from their paychecks, provides benefits, and follows labor laws. W2 employees are an integral part of any organization, bringing their unique skills and talents to the table.

When you see the term W2 on your pay stub, it means that you are a W2 employee. This form is used to report your annual wages and the amount of taxes withheld from your paycheck. As a W2 employee, you are entitled to benefits such as health insurance, retirement plans, and paid time off. Being a W2 employee offers stability and security, as you are part of a structured organization with clear guidelines and expectations.

Being a W2 employee also means that you have taxes withheld from your paycheck, including federal income tax, Social Security, and Medicare. These taxes are automatically deducted by your employer and sent to the appropriate government agencies. While it may seem like a hassle to have taxes taken out of your paycheck, it ensures that you are compliant with tax laws and helps fund important programs and services.

Dive Deeper Into the World of W2 Employees!

Now that you understand the basics of W2 employees, let’s dive deeper into what it means to be part of this workforce. W2 employees have the benefit of being covered by workers’ compensation insurance, which provides financial protection in case of a work-related injury or illness. This coverage gives W2 employees peace of mind knowing that they are protected while on the job.

As a W2 employee, you may also have access to employer-sponsored training programs and professional development opportunities. Many companies invest in their employees’ growth and development, offering workshops, seminars, and tuition reimbursement programs. This can help you advance your career and acquire new skills that benefit both you and your employer.

In addition to benefits and training opportunities, being a W2 employee means that you are part of a community of like-minded individuals working towards a common goal. You have the opportunity to collaborate with your colleagues, build relationships, and contribute to the success of the organization. This sense of camaraderie and teamwork can be incredibly rewarding and fulfilling.

In conclusion, being a W2 employee comes with a host of benefits and opportunities for growth. From receiving benefits and training to being part of a supportive community, W2 employees play a vital role in the success of any organization. So, embrace your W2 status with pride and enthusiasm, knowing that you are valued for your contributions and dedication. Let’s get formed and make a positive impact together!

Below are some images related to Forms For W2 Employees

blank w2 forms for employees, forms for w2 employees, forms needed for w2 employees, how do i file w2 for my employees, staples w2 forms for former employees, , Forms For W2 Employees.

blank w2 forms for employees, forms for w2 employees, forms needed for w2 employees, how do i file w2 for my employees, staples w2 forms for former employees, , Forms For W2 Employees.