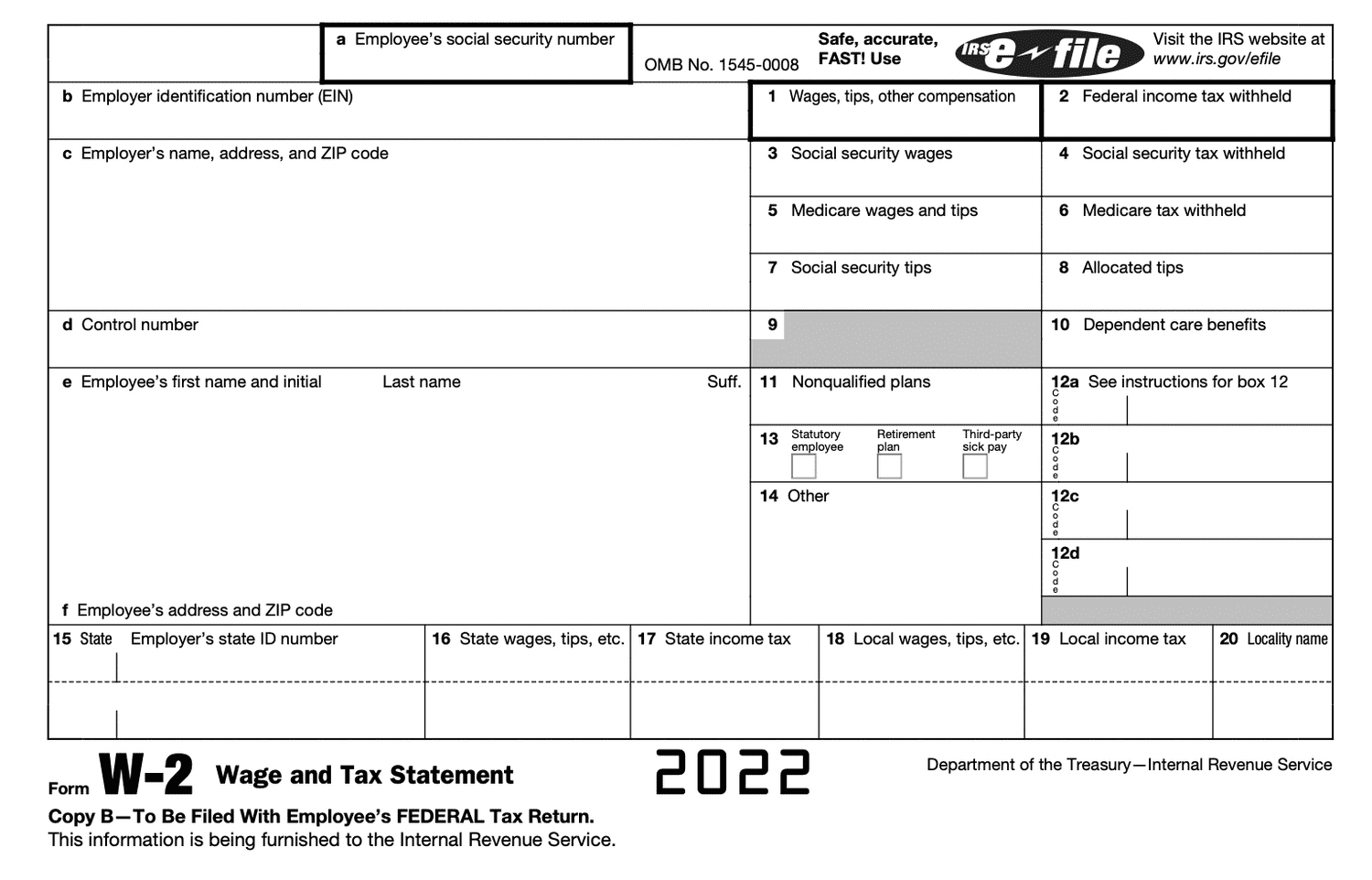

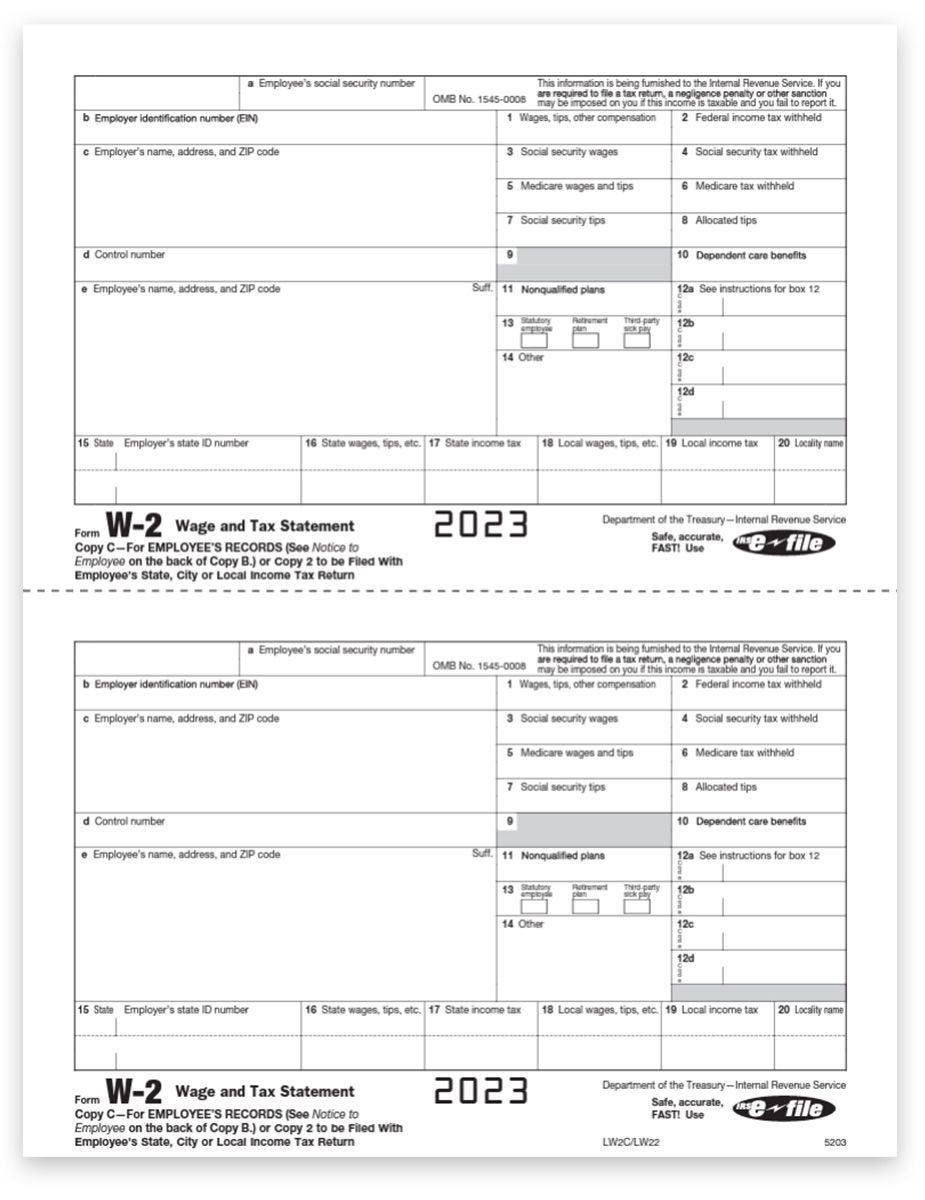

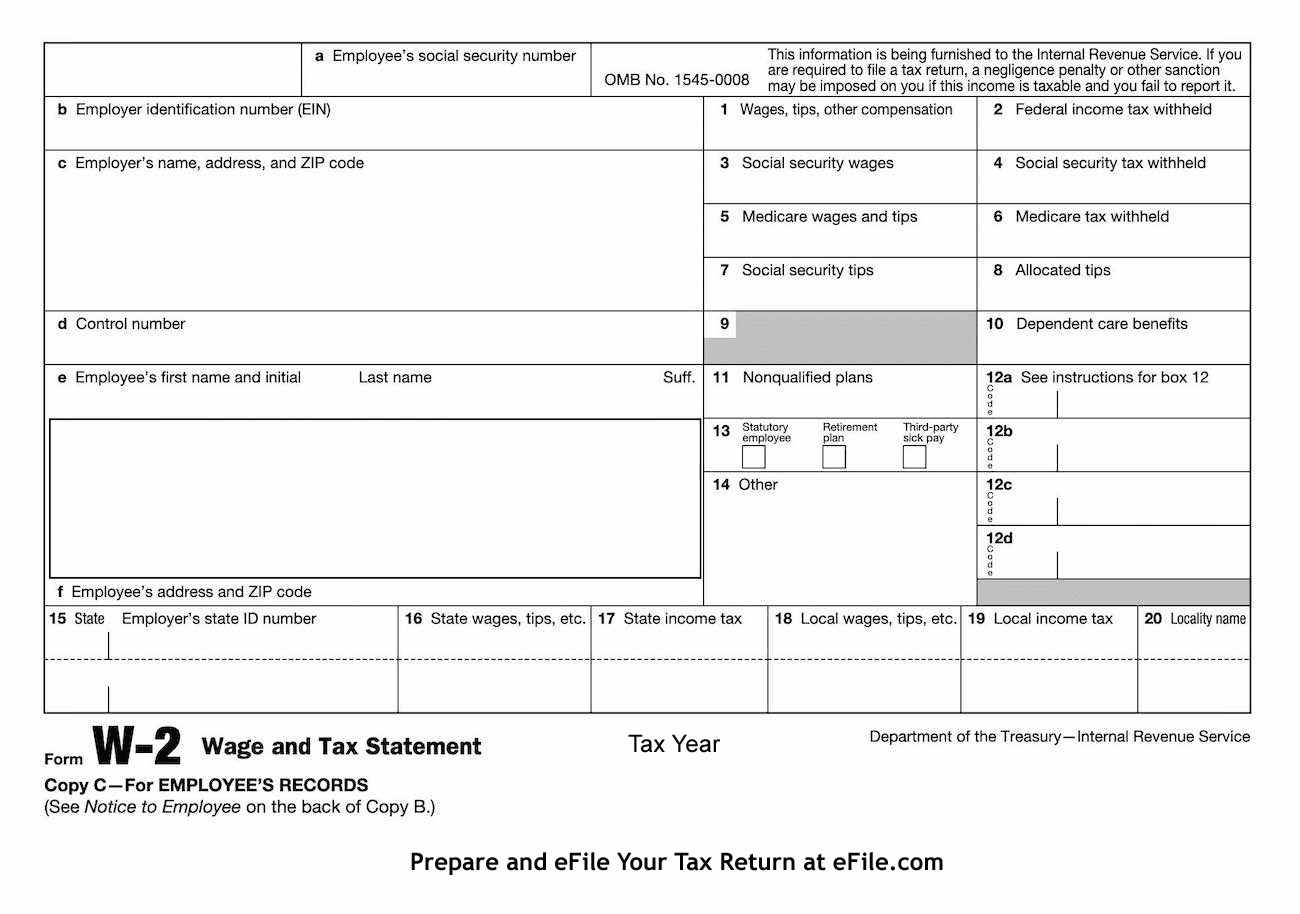

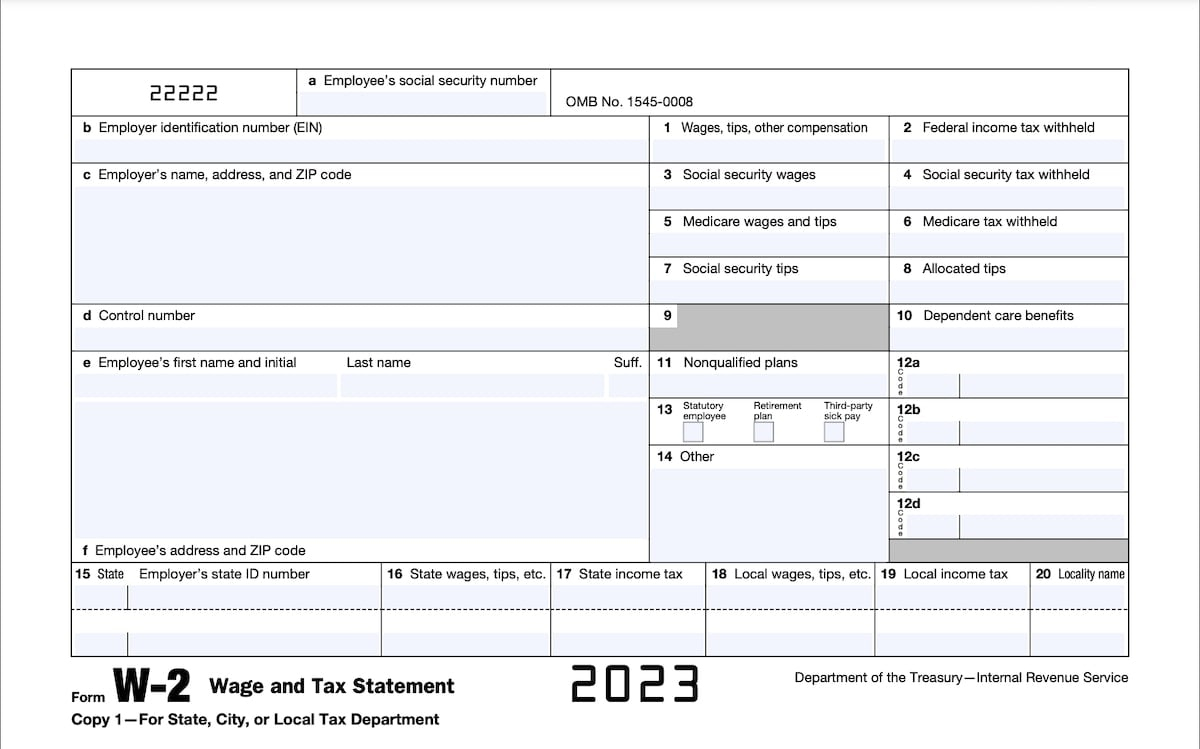

Previous W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover Your Hidden Wealth: Unlocking the Treasure Trove!

Have you ever wondered if there’s a hidden treasure trove waiting to be discovered in your old W2 forms? Well, the good news is that there just might be! Your old W2 forms hold valuable information about your past earnings, tax withholdings, and more. By unlocking the secrets within these seemingly mundane documents, you could potentially uncover a wealth of financial opportunities that you never even knew existed. So why wait any longer? It’s time to dust off those old W2 forms and start digging for gold!

Exciting News: Your Old W2 Forms Are Ready to Reveal Riches!

It’s time to get excited, because your old W2 forms are like a buried treasure chest just waiting to be opened. Each form is a key that unlocks a wealth of information about your past earnings, tax payments, and potential refunds. By taking the time to review and understand your old W2 forms, you could potentially uncover missed deductions, credits, or even unclaimed refunds that could put extra money back in your pocket. So don’t overlook the hidden riches that lie within your old W2 forms – they could be the key to unlocking a brighter financial future!

So what are you waiting for? Dust off those old W2 forms and start sifting through the numbers for hidden gems. You never know what treasures you might find buried within those seemingly ordinary documents. With a little bit of time and effort, you could uncover financial opportunities that you never even knew existed. So go ahead, unlock the treasure trove that awaits you in your old W2 forms – your future self will thank you for it!

Below are some images related to Previous W2 Forms

how can i get a copy of my past w2 forms, how can i retrieve old w2 forms, previous w2 forms, , Previous W2 Forms.

how can i get a copy of my past w2 forms, how can i retrieve old w2 forms, previous w2 forms, , Previous W2 Forms.