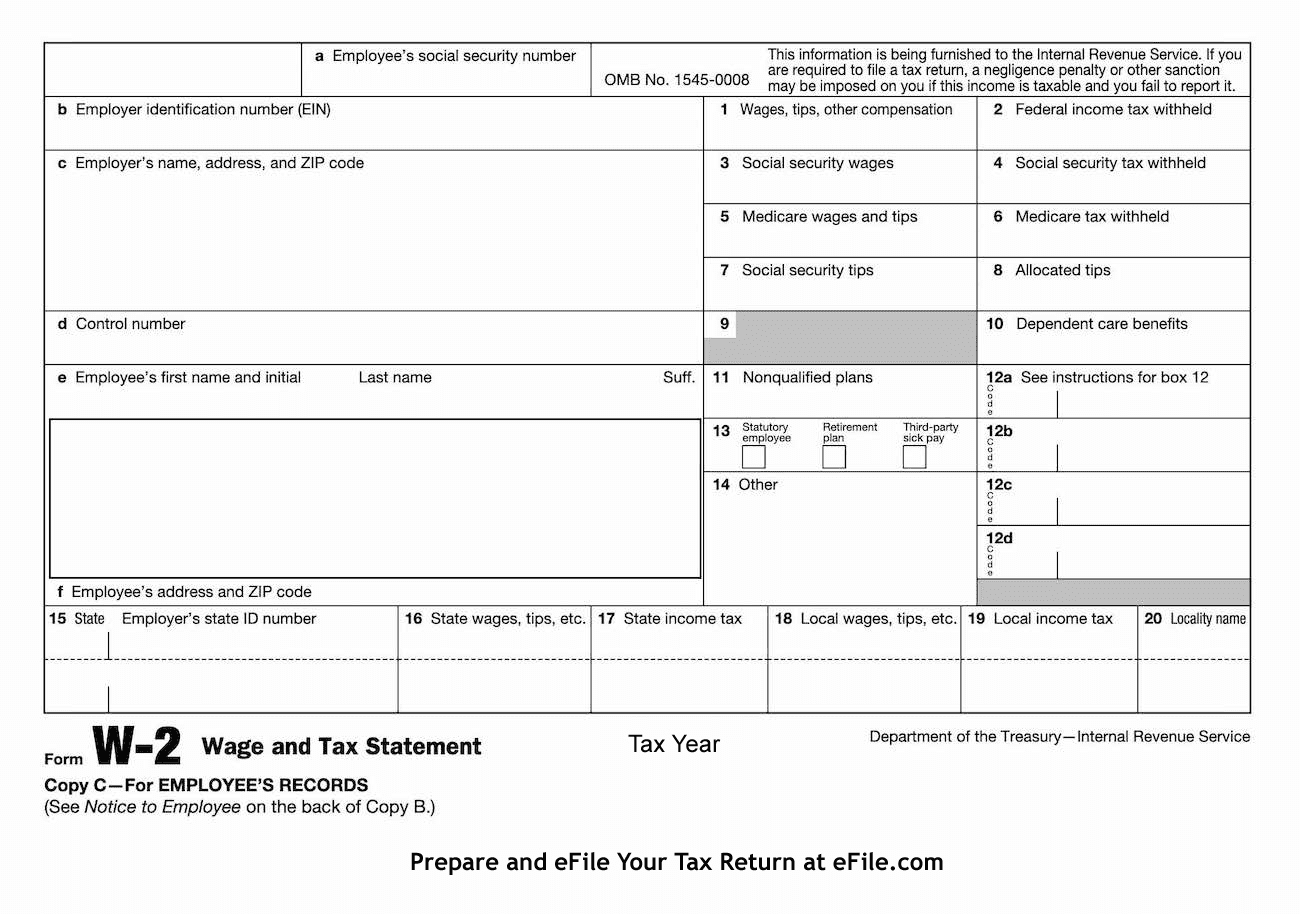

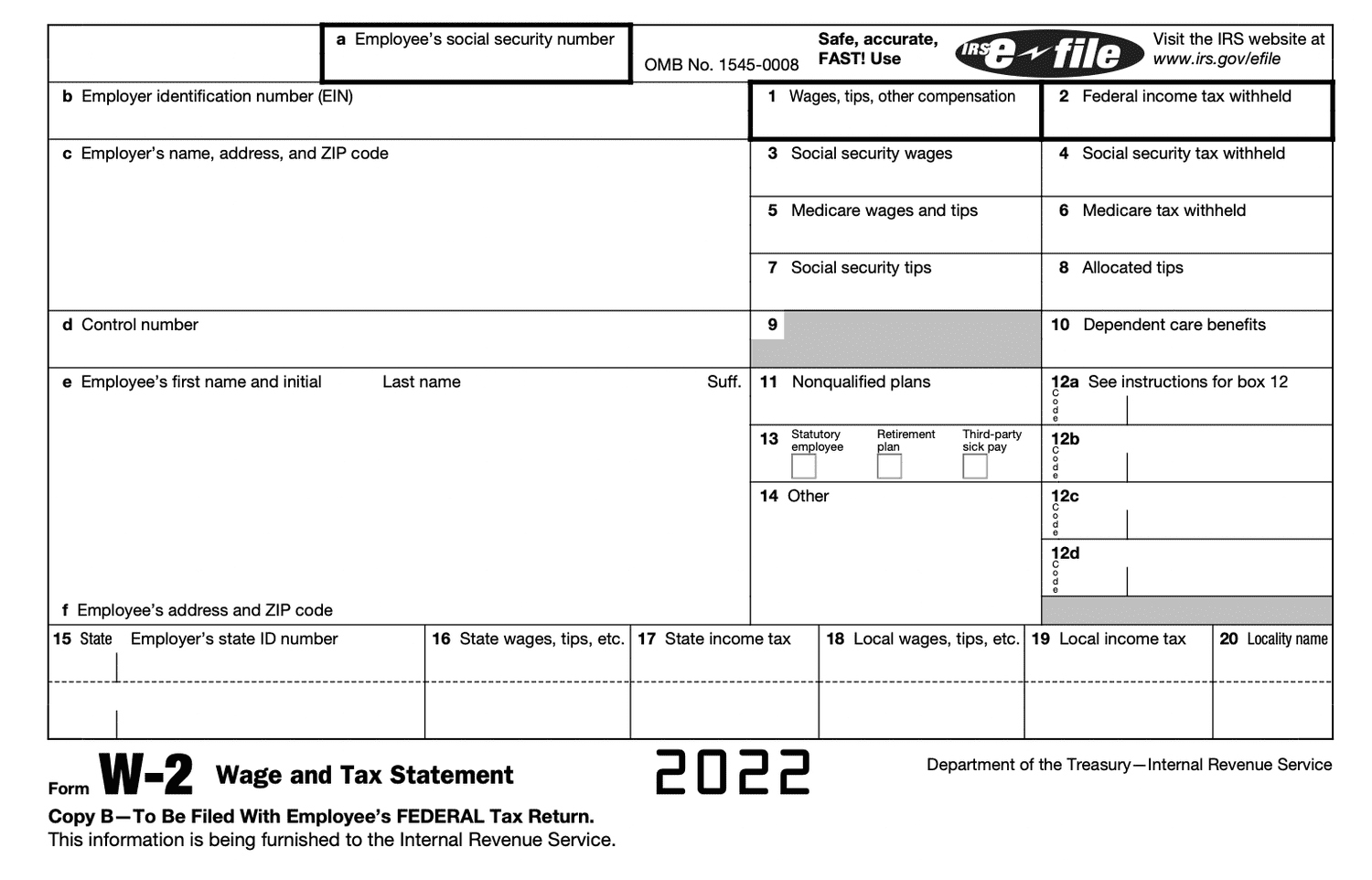

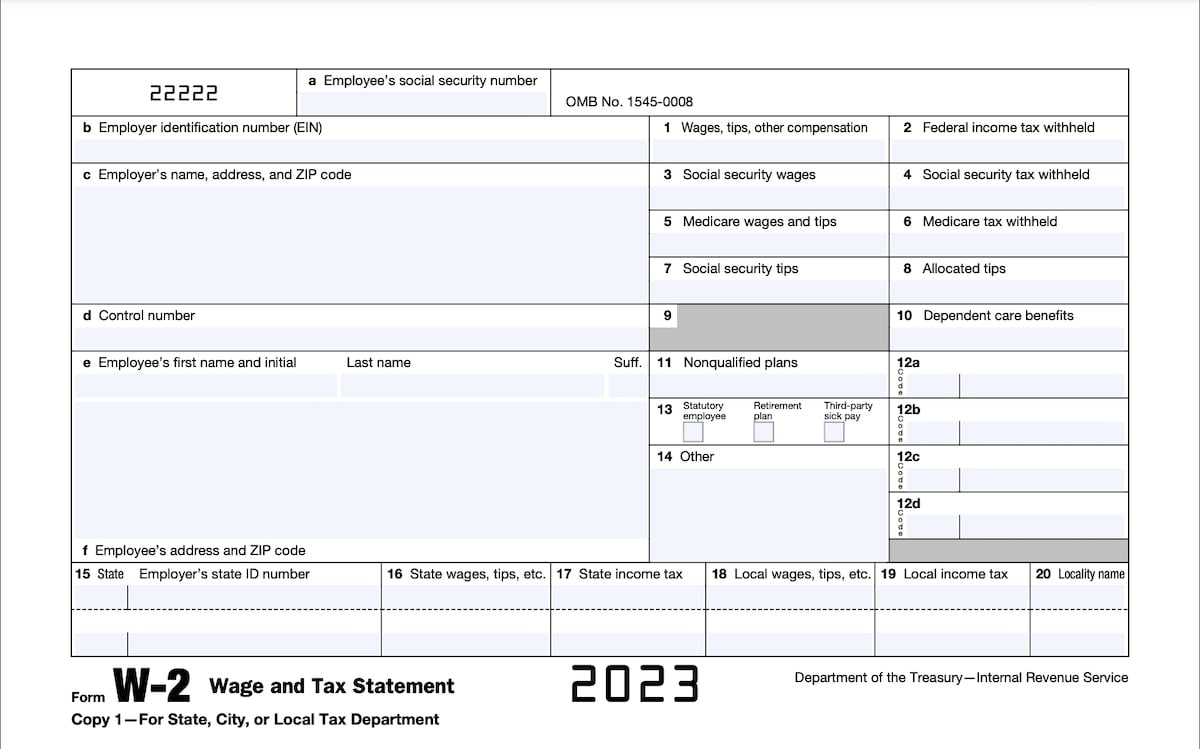

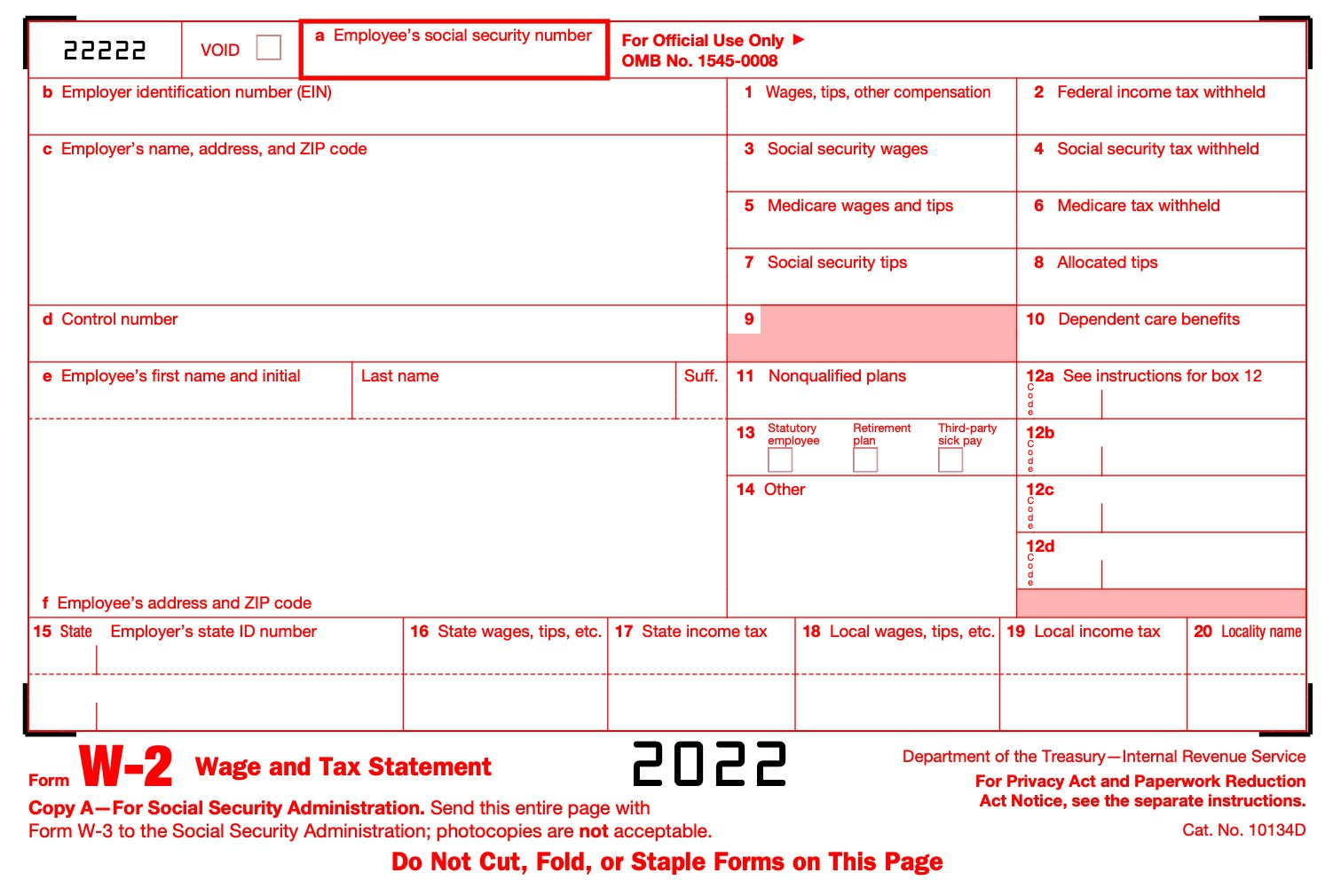

How Do Employers Get W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery: How Employers Obtain W2s

Have you ever wondered how employers manage to get their hands on those elusive W2 forms every tax season? It’s like a well-kept secret, a mystery waiting to be unraveled. But fear not, dear reader, for today we shall delve into the world of W2 retrieval and shed some light on the process. So grab a cup of coffee and join us on this enlightening journey!

Cracking the Code: How Employers Snag W2s

So, how do employers actually get their hands on W2 forms? Well, the process is actually quite simple once you know the ins and outs. Typically, employers have a dedicated payroll department or use a third-party payroll service to handle all things related to employee compensation. These payroll experts work diligently to ensure that all tax documents, including W2s, are generated accurately and in a timely manner. Employers are required by law to provide employees with their W2 forms by the end of January each year, so the pressure is on to get everything in order.

But wait, there’s more! Employers don’t just sit back and wait for the W2 forms to magically appear. They actively reach out to their employees to verify mailing addresses and ensure that the forms are sent to the correct location. In some cases, employers may even offer electronic delivery options for W2 forms, making the process even more convenient for everyone involved. It’s all about communication and attention to detail when it comes to snagging those elusive W2 forms.

Unveiling the Secrets: Employers’ W2 Retrieval

Now that we’ve uncovered some of the mystery behind how employers obtain W2 forms, let’s talk about the actual retrieval process. Once the payroll department or third-party service has generated the W2 forms, employers must ensure that they are securely stored and distributed to employees. This may involve mailing out physical copies, providing access to electronic versions, or a combination of both. Employers must also keep detailed records of when and how the W2 forms were distributed, as this information may be required in the event of an audit.

In some cases, employees may misplace or never receive their W2 forms, creating a headache for both the employer and the employee. In these situations, employers may need to reissue the forms or provide copies to the employee upon request. It’s all part of the process of ensuring that everyone has the information they need to file their taxes accurately and on time. So the next time you receive your W2 form, take a moment to appreciate the behind-the-scenes work that goes into making it happen.

In conclusion, the process of how employers obtain W2 forms is not as mysterious as it may seem. It’s all about careful planning, communication, and attention to detail. Employers work diligently to ensure that their employees have all the information they need to file their taxes accurately and on time. So the next time tax season rolls around, you can rest easy knowing that your employer has you covered when it comes to those elusive W2 forms. Happy filing!

Below are some images related to How Do Employers Get W2 Forms

do employers have w2 forms, how can i get a copy of my w2 from my employer, how do employers get w2 forms, how do i get a w2 from my employer, where do employers send w2 forms, , How Do Employers Get W2 Forms.

do employers have w2 forms, how can i get a copy of my w2 from my employer, how do employers get w2 forms, how do i get a w2 from my employer, where do employers send w2 forms, , How Do Employers Get W2 Forms.