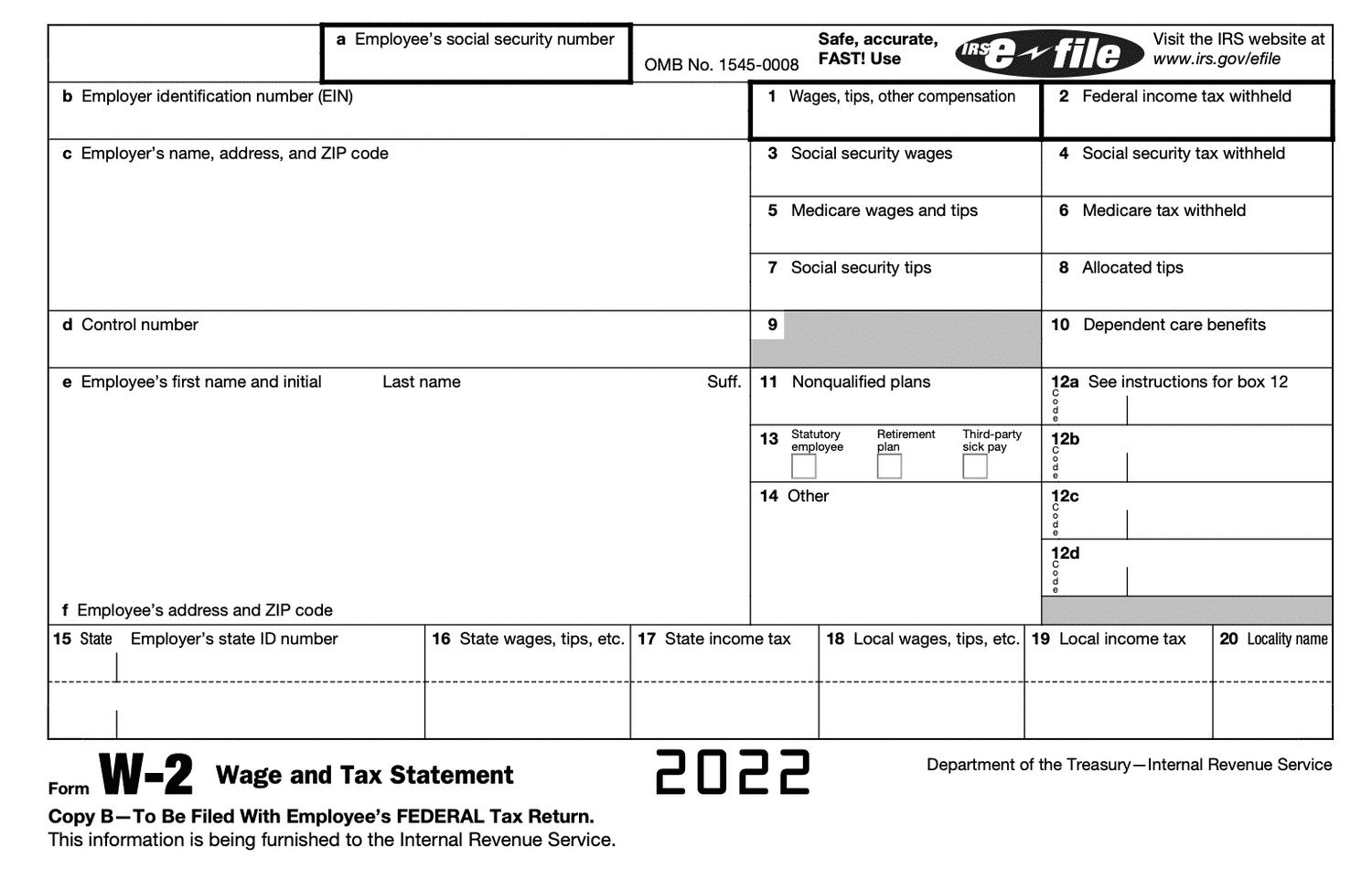

W2 1099 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding the Dance of W2s and 1099s

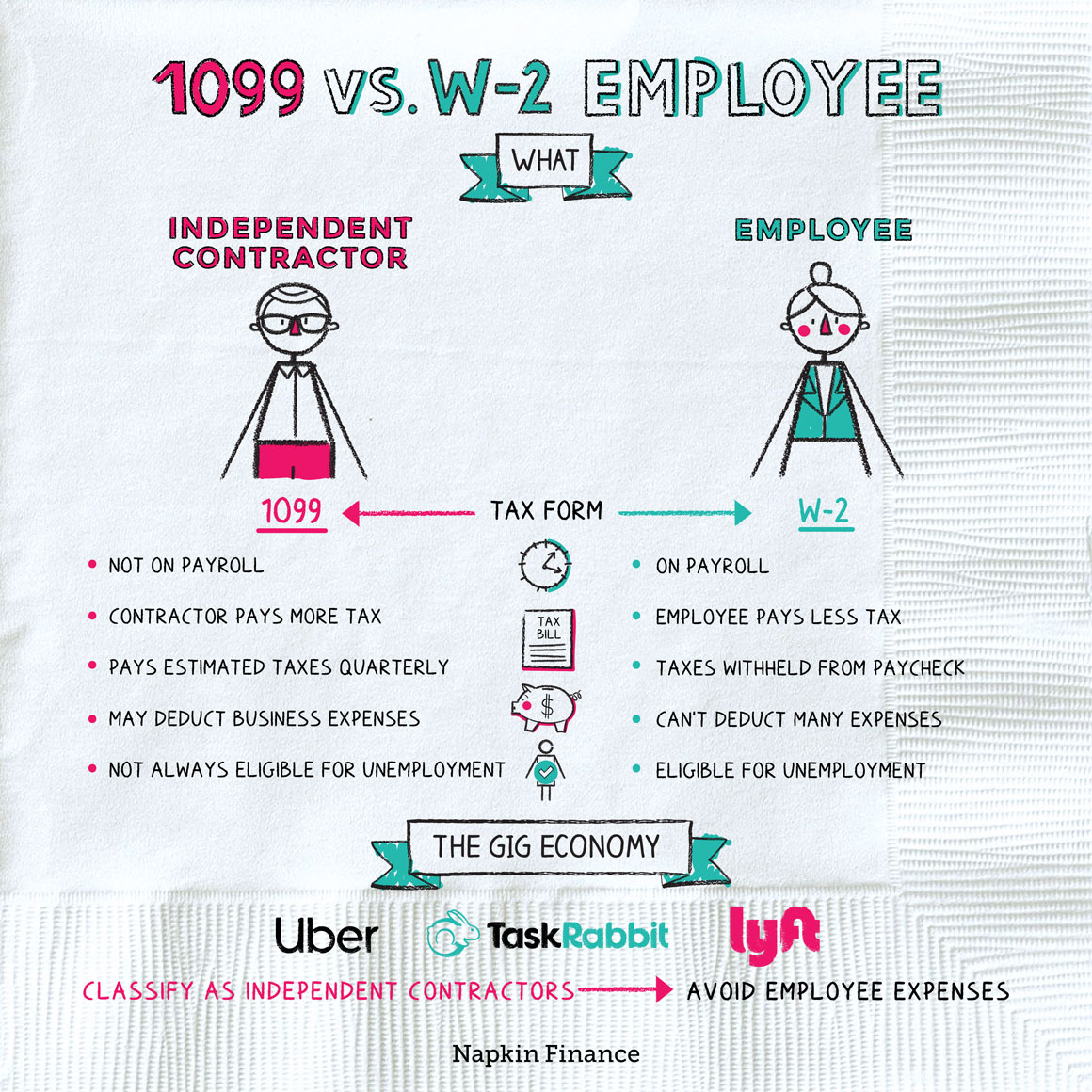

Tax season can be a daunting time of year for many individuals, especially when it comes to deciphering the difference between W2s and 1099s. These two forms play a crucial role in determining how much you owe (or are owed) come tax time. But fear not, for with a little bit of knowledge and a whole lot of confidence, you can navigate through this annual dance with ease and grace.

Unraveling the Mystery Behind W2s and 1099s

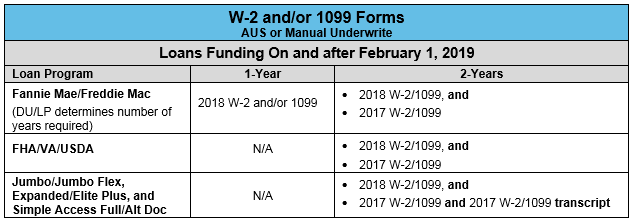

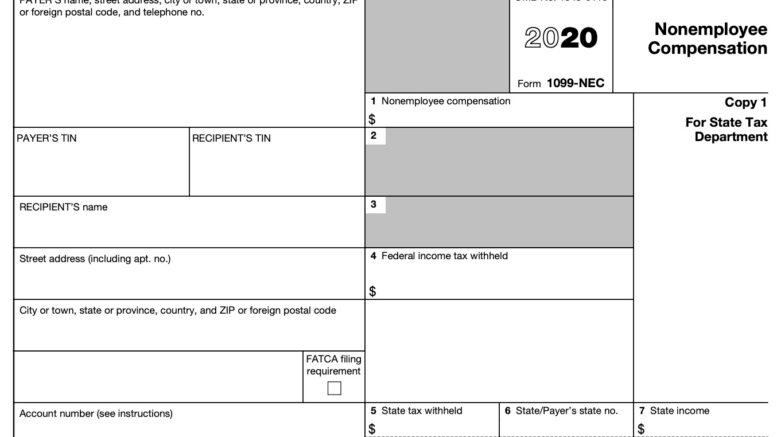

Let’s start with the basics: W2s are typically issued by employers to employees, detailing their earnings and taxes withheld throughout the year. This form is essential for filing your taxes and ensuring that you report all your income accurately. On the other hand, 1099s are given to independent contractors, freelancers, and other self-employed individuals to report income received from various sources. Understanding the distinction between these two forms is key to avoiding any tax-related headaches down the road.

When it comes to tax season, knowledge is power. By familiarizing yourself with the ins and outs of W2s and 1099s, you can approach this time of year with confidence and peace of mind. Remember, it’s not about the complexity of the dance, but rather the willingness to learn the steps and glide through tax season with a smile on your face. So embrace the rhythm of W2s and 1099s, and waltz your way to a stress-free tax season.

Below are some images related to W2 1099 Forms

can i file my 1099 with my w2, order w2 and 1099 forms from irs, quickbooks w2 and 1099 forms, w-2/1099 form download, w-2/1099 form meaning, , W2 1099 Forms.

can i file my 1099 with my w2, order w2 and 1099 forms from irs, quickbooks w2 and 1099 forms, w-2/1099 form download, w-2/1099 form meaning, , W2 1099 Forms.