W2-C Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Dive into the Enchantment of the W2-C Form!

Oh, the magic of the W2-C form! It may seem like just another piece of paperwork, but hidden within its numbers and boxes is a world of enchantment waiting to be discovered. This seemingly ordinary form holds the key to unlocking the secrets of your tax information, helping you understand your earnings and deductions in a whole new light. So, grab your wand (or pen) and let’s dive into the enchanting world of the W2-C form!

The first thing you’ll notice when unraveling the magic of the W2-C form is the wealth of information it contains. From your total earnings to the amount of taxes withheld, every number on this form plays a crucial role in painting a picture of your financial year. But don’t be intimidated by the jumble of figures and codes – with a little bit of patience and a sprinkle of curiosity, you’ll soon be able to decipher the mysteries hidden within.

As you continue to explore the depths of the W2-C form, you’ll uncover the secrets of your tax obligations and entitlements. By understanding the information presented on this form, you’ll be better equipped to navigate the complex world of taxes and make informed decisions about your financial future. So, don’t be afraid to embrace the magic of the W2-C form and harness its power to take control of your financial destiny!

Unlocking the Secrets of the W2-C Form Magic!

Now that you’ve scratched the surface of the W2-C form’s magic, it’s time to delve even deeper and unlock its full potential. By studying each section of the form with a keen eye and an open mind, you’ll begin to see patterns and connections that will help you make sense of your financial situation. So, grab a magnifying glass and embark on a journey of discovery as you uncover the secrets of the W2-C form!

One of the most fascinating aspects of the W2-C form is its ability to reveal hidden opportunities for saving money. By analyzing the information presented on this form, you may uncover deductions and credits that you were previously unaware of, allowing you to maximize your tax refund and keep more money in your pocket. So, don’t underestimate the power of the W2-C form – it could be the key to unlocking a treasure trove of financial benefits!

As you close in on the final pages of the W2-C form, you’ll feel a sense of accomplishment and empowerment knowing that you’ve successfully unraveled its mysteries. Armed with a newfound understanding of your tax information, you’ll be better equipped to make informed decisions about your finances and plan for a brighter future. So, embrace the magic of the W2-C form and let it guide you on a journey towards financial success and prosperity!

In conclusion, the W2-C form may seem like a mundane document at first glance, but in reality, it is a powerful tool that can help you take control of your financial destiny. By diving into its enchanting world and unlocking its secrets, you’ll gain a deeper understanding of your tax information and discover opportunities for saving money. So, don’t be afraid to embrace the magic of the W2-C form and let it guide you towards a brighter financial future. Happy exploring!

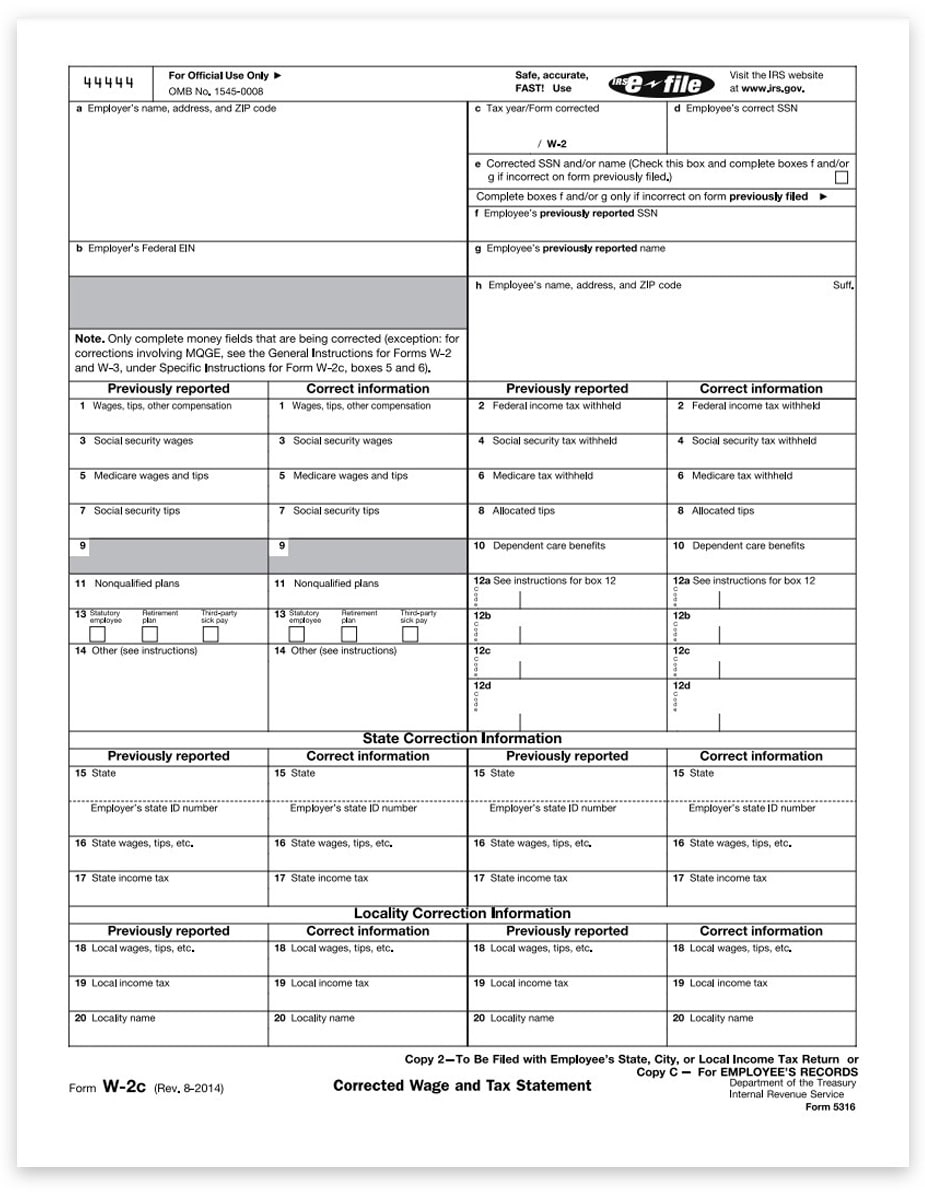

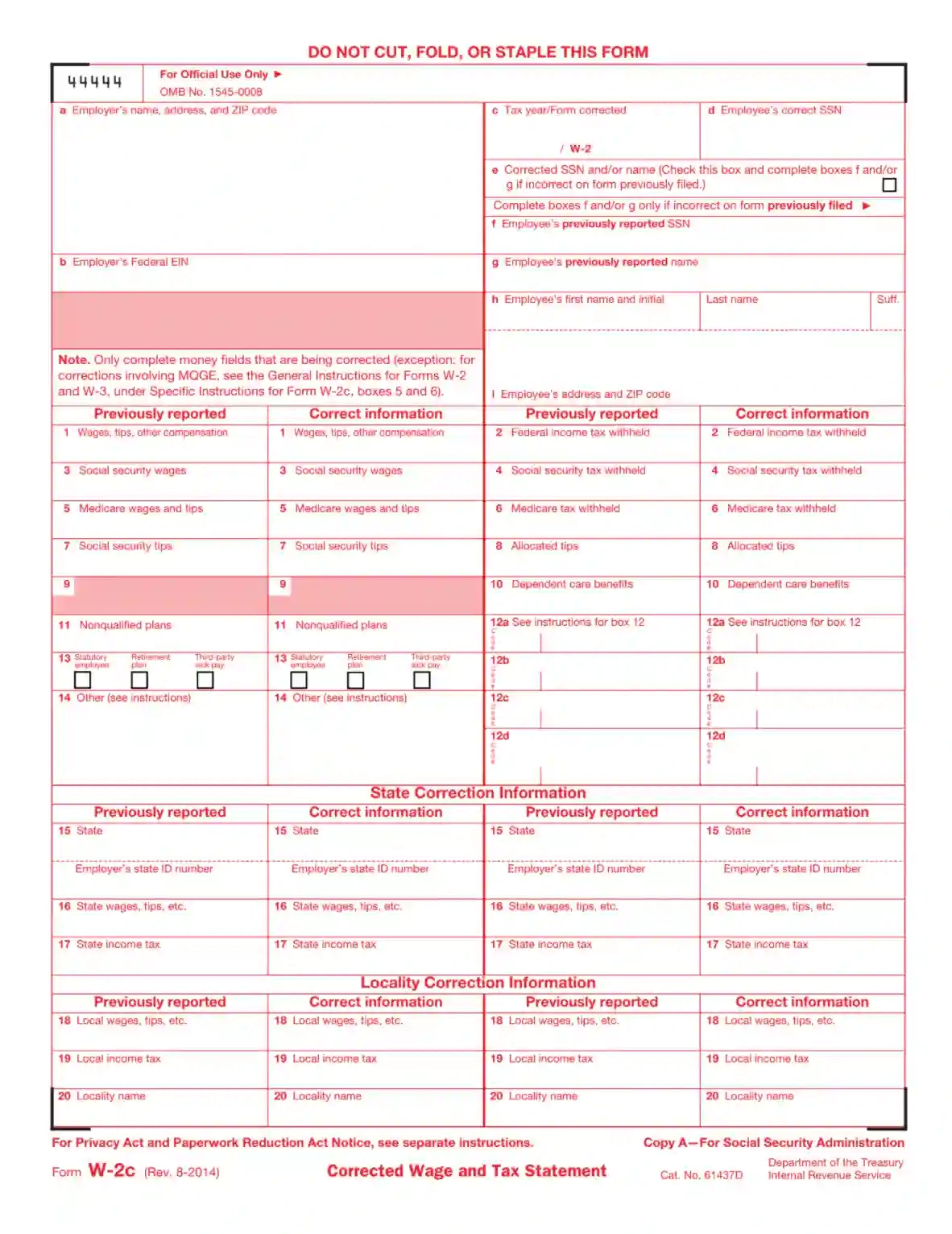

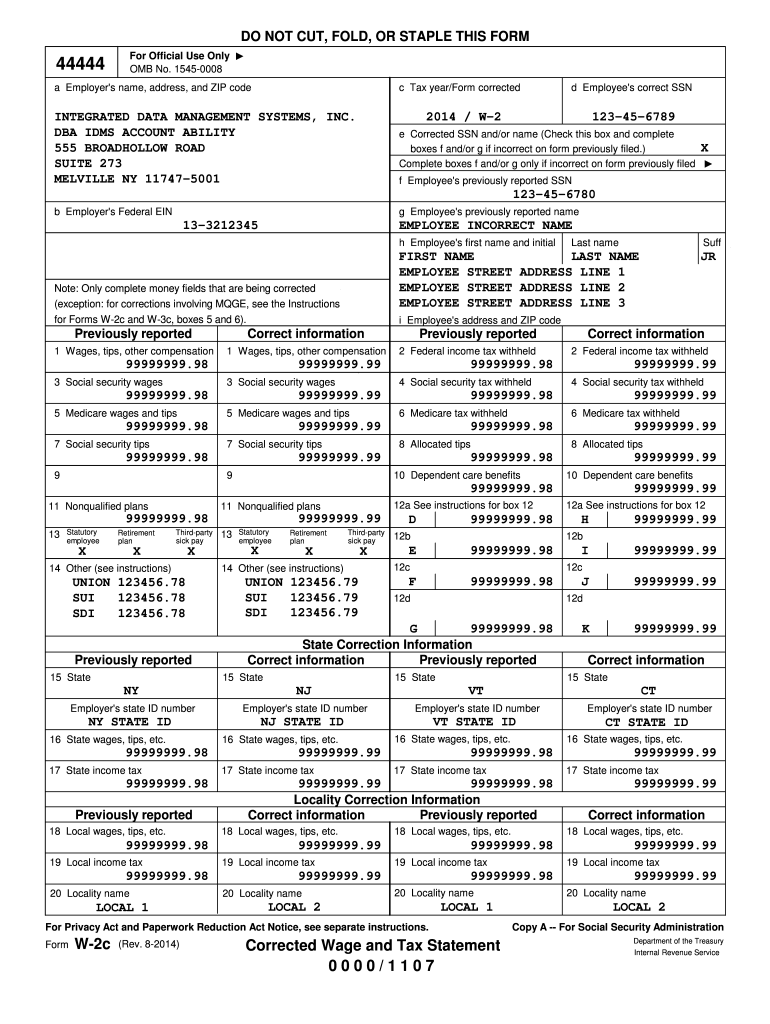

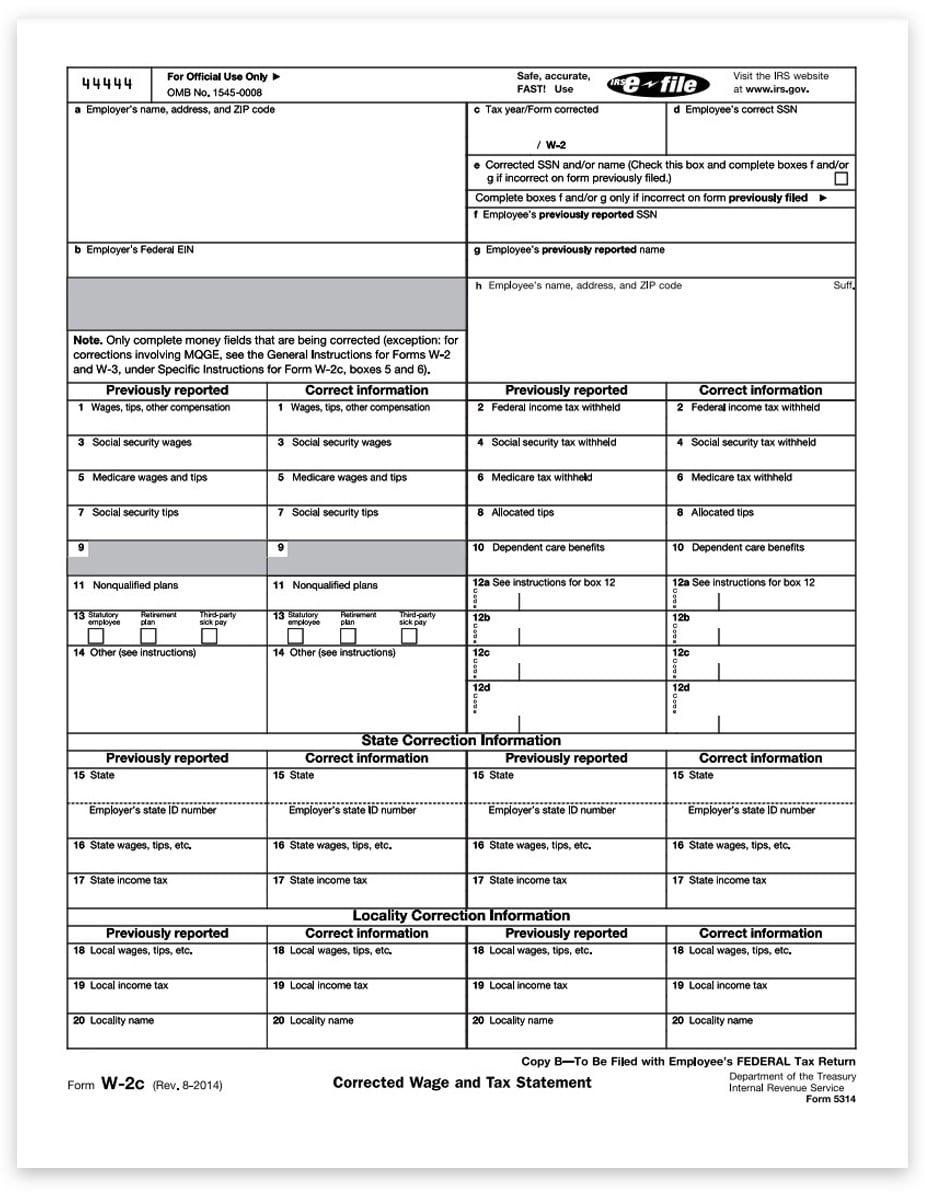

Below are some images related to W2-C Form

w-2/w-2c consent form, w-2/w-2c forms, w2c form, w2c form 2024, w2c form example, , W2-C Form.

w-2/w-2c consent form, w-2/w-2c forms, w2c form, w2c form 2024, w2c form example, , W2-C Form.