How To Obtain Old W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Financial Past: Finding Old W2 Forms

Ever feel like you’re missing out on financial opportunities because you can’t remember where you worked a few years ago? Or maybe you’re ready to take the next step in your financial future but need to prove your income from years past. Don’t worry, there’s a solution! By digging up your old W2 forms, you can unlock your financial past and discover hidden treasures that could help you on your journey to financial success.

Digging Up Your Money Trail

It’s like going on a treasure hunt, but instead of searching for gold coins, you’re looking for pieces of paper that hold the key to your financial history. Start by checking your old email accounts for any digital copies of past W2 forms. If you can’t find them there, reach out to your previous employers to see if they can provide you with copies. And don’t forget to check your filing cabinet or old folders for any physical copies you may have kept over the years. The more W2 forms you uncover, the more complete your financial picture will become.

Remember, the information on your W2 forms is crucial for things like filing your taxes, applying for loans, or even just keeping track of your earning history. By putting in the effort to dig up your money trail, you’re not only unlocking your financial past but also setting yourself up for future financial success.

Discovering Lost Treasure: Your Old W2 Forms

Once you’ve gathered all your old W2 forms, take some time to review them and make sure all the information is accurate. Look for any discrepancies or missing forms that could be affecting your financial records. By having a complete set of W2 forms from previous years, you’ll have a clearer understanding of your income history and be better equipped to make informed financial decisions moving forward.

Think of your old W2 forms as the map to your financial past – each form holds a piece of the puzzle that, when put together, paints a vivid picture of your earning journey. So don’t let those forms gather dust in a forgotten drawer – unlock your financial past, discover lost treasures, and pave the way for a brighter financial future.

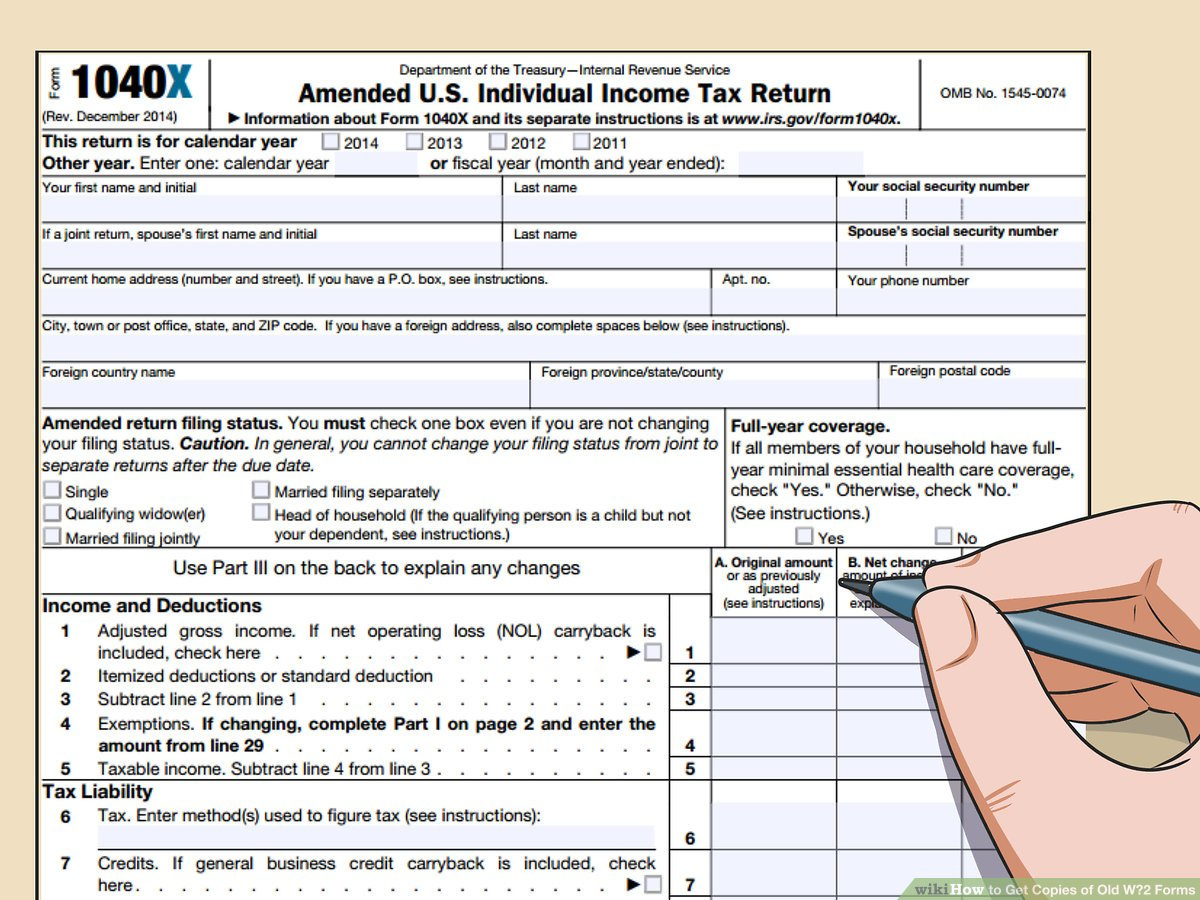

Below are some images related to How To Obtain Old W2 Forms

how can i retrieve old w2 forms, how do i locate old w2 forms, how to find old w2 forms, how to get old w2 forms fast, how to obtain old w2 forms, , How To Obtain Old W2 Forms.

how can i retrieve old w2 forms, how do i locate old w2 forms, how to find old w2 forms, how to get old w2 forms fast, how to obtain old w2 forms, , How To Obtain Old W2 Forms.