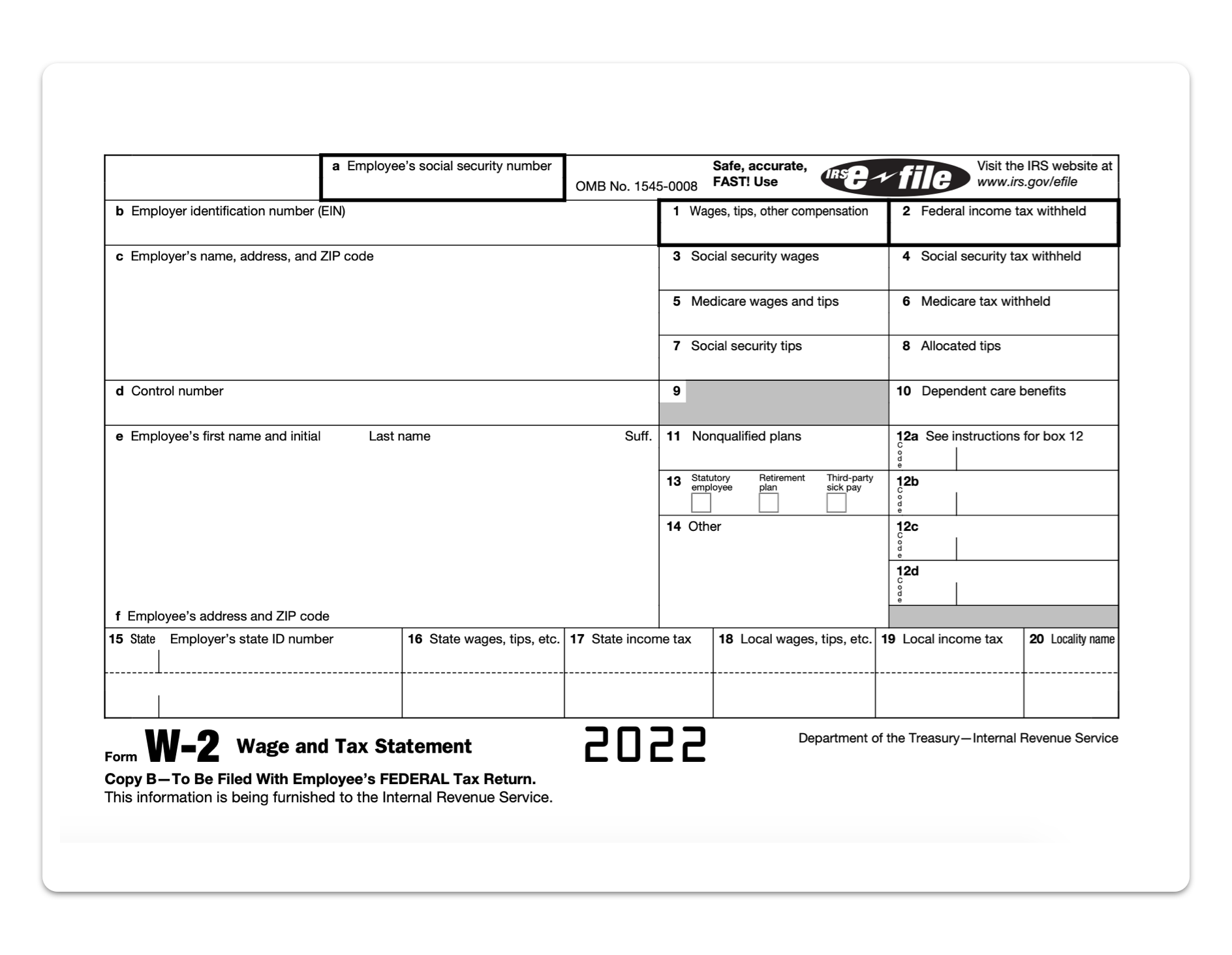

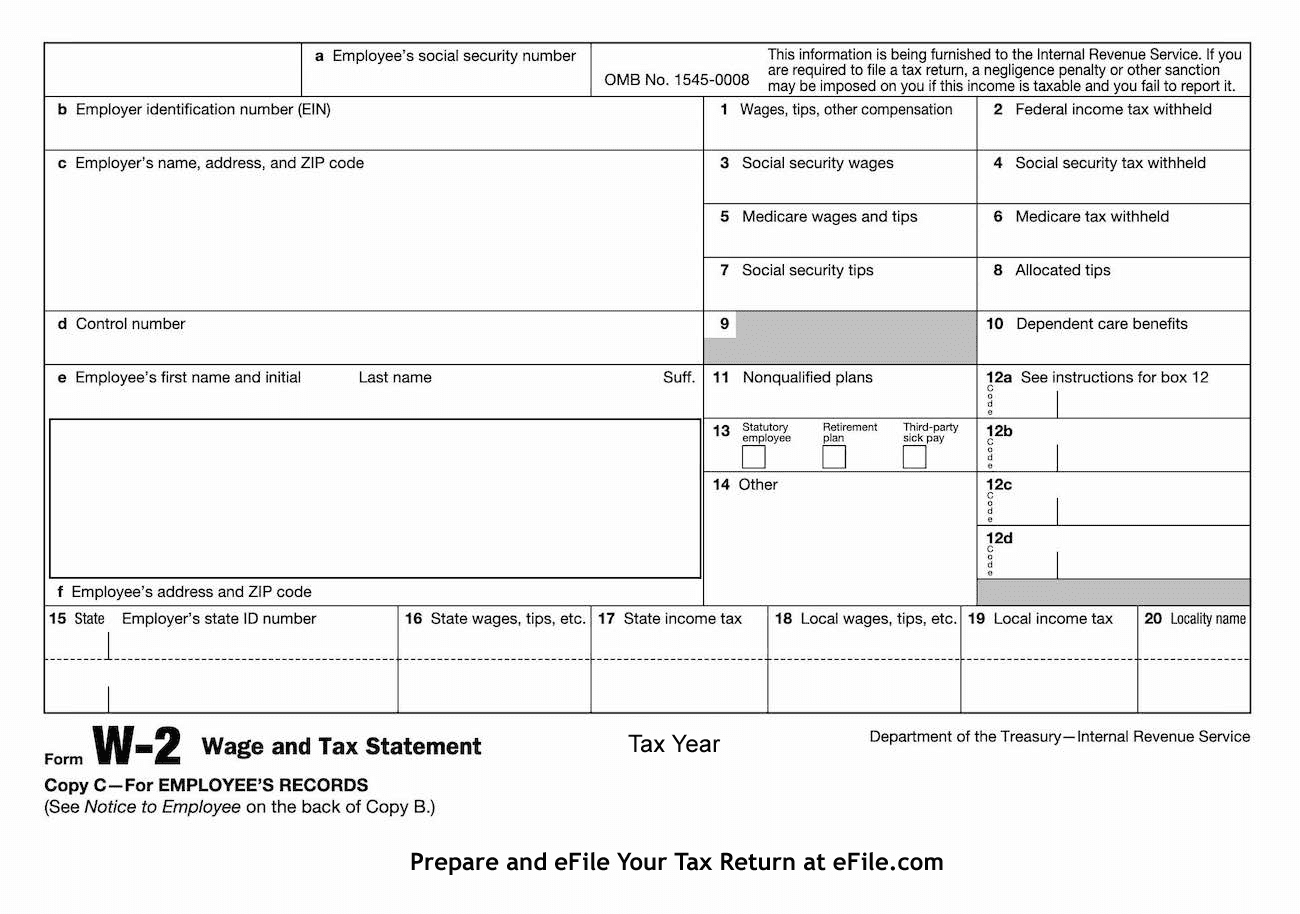

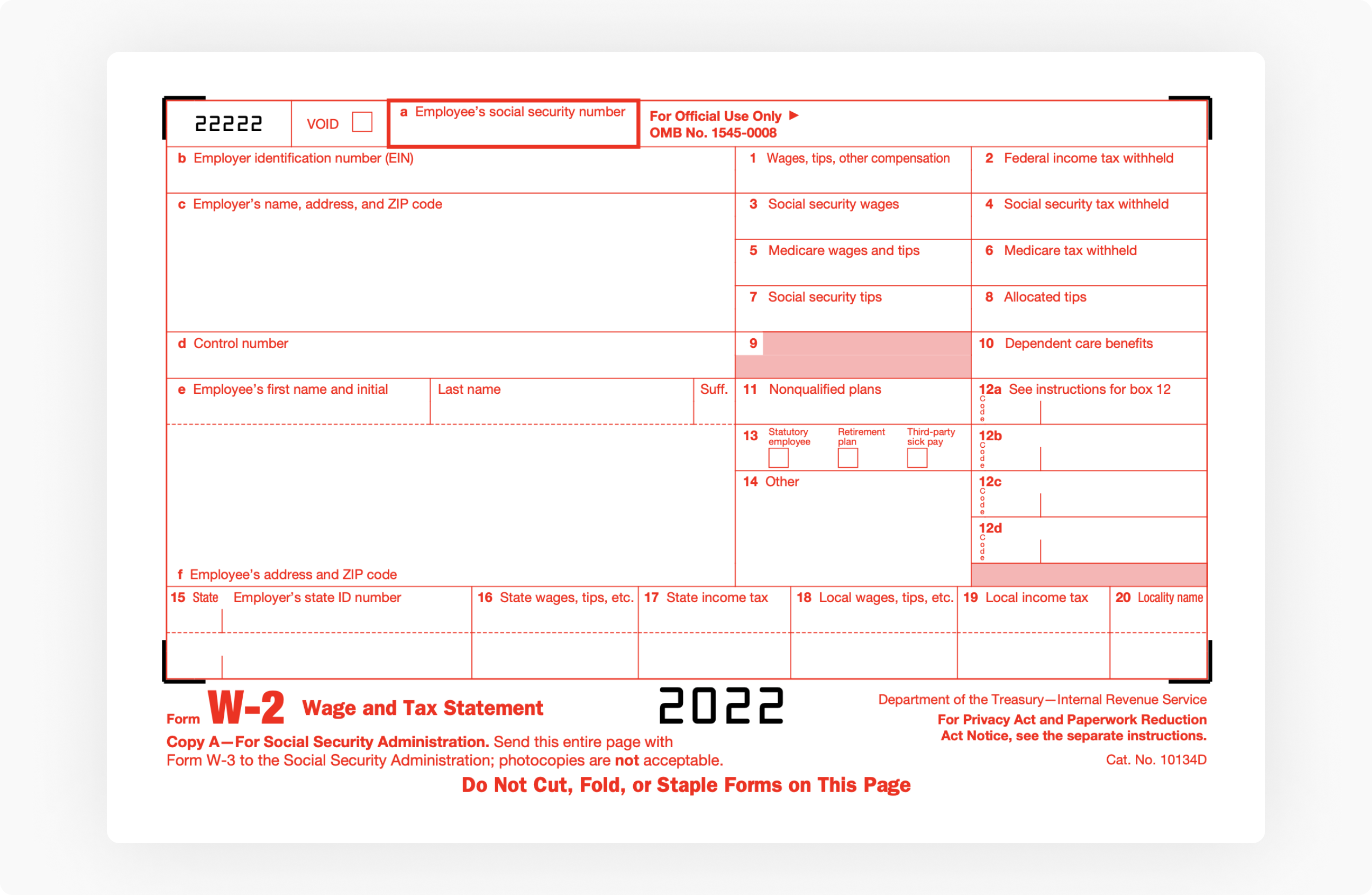

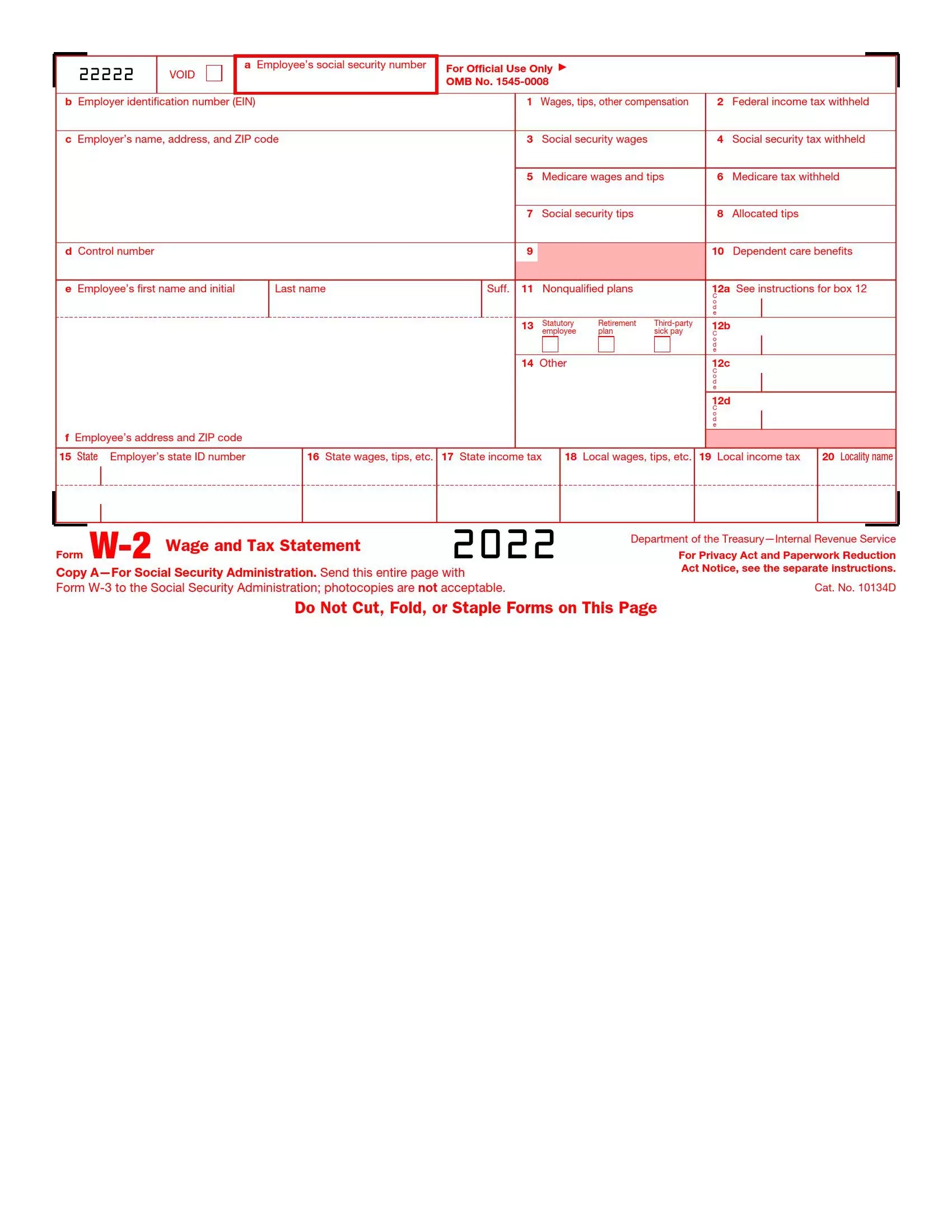

Lost W2 Form 2022 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Great W2 Hunt: Finding Your Financial Fairy Tale Ending in 2022

Are you ready to embark on an exciting adventure in 2022 that could lead you to your very own financial fairy tale ending? Look no further than the Great W2 Hunt! This year, unleash your inner financial detective and embark on a quest to find your missing W2 forms. With a little determination and a sprinkle of magic, you can turn this potentially daunting task into a fun and rewarding experience.

Unleash Your Inner Financial Detective

As you dust off your sleuthing hat and grab your magnifying glass, get ready to unleash your inner financial detective. The first step in the Great W2 Hunt is to gather all the necessary information you’ll need to track down your W2 forms. Check your email inbox, dig through your files, and reach out to previous employers if needed. With a keen eye for detail and a can-do attitude, you’ll be well on your way to cracking the case of the missing W2s.

Once you’ve gathered all the clues, it’s time to start piecing together the puzzle. Organize your documents and double-check all the information to ensure nothing slips through the cracks. Don’t be afraid to ask for help if you need it – whether it’s from a trusted friend, a financial advisor, or even a friendly neighborhood accountant. By staying focused and persistent, you’ll soon uncover the missing pieces of your financial fairy tale.

As you near the end of your W2 adventure, take a moment to reflect on how far you’ve come. Whether you’ve faced challenges along the way or breezed through the hunt with ease, remember that every step brings you closer to your happily ever after. So, put on your crown, raise your glass, and toast to a successful Great W2 Hunt in 2022. Cheers to finding your financial fairy tale ending!

Below are some images related to Lost W2 Form 2022

lost w2 form 2022, what do i do if i lost my w2 2020, what to do if i lost my w2 forms, what to do if you lost your w2 2021, , Lost W2 Form 2022.

lost w2 form 2022, what do i do if i lost my w2 2020, what to do if i lost my w2 forms, what to do if you lost your w2 2021, , Lost W2 Form 2022.