How To Fill Out W2 Form For New Job – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

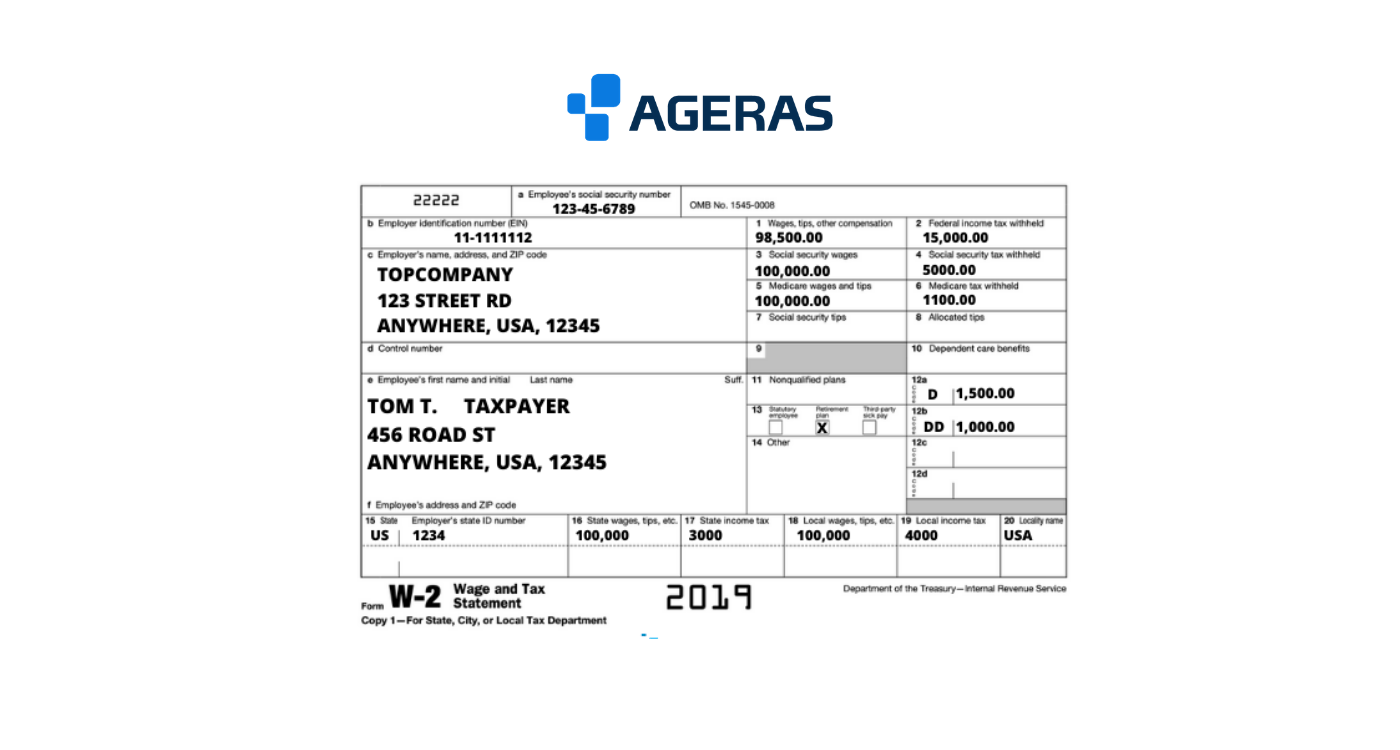

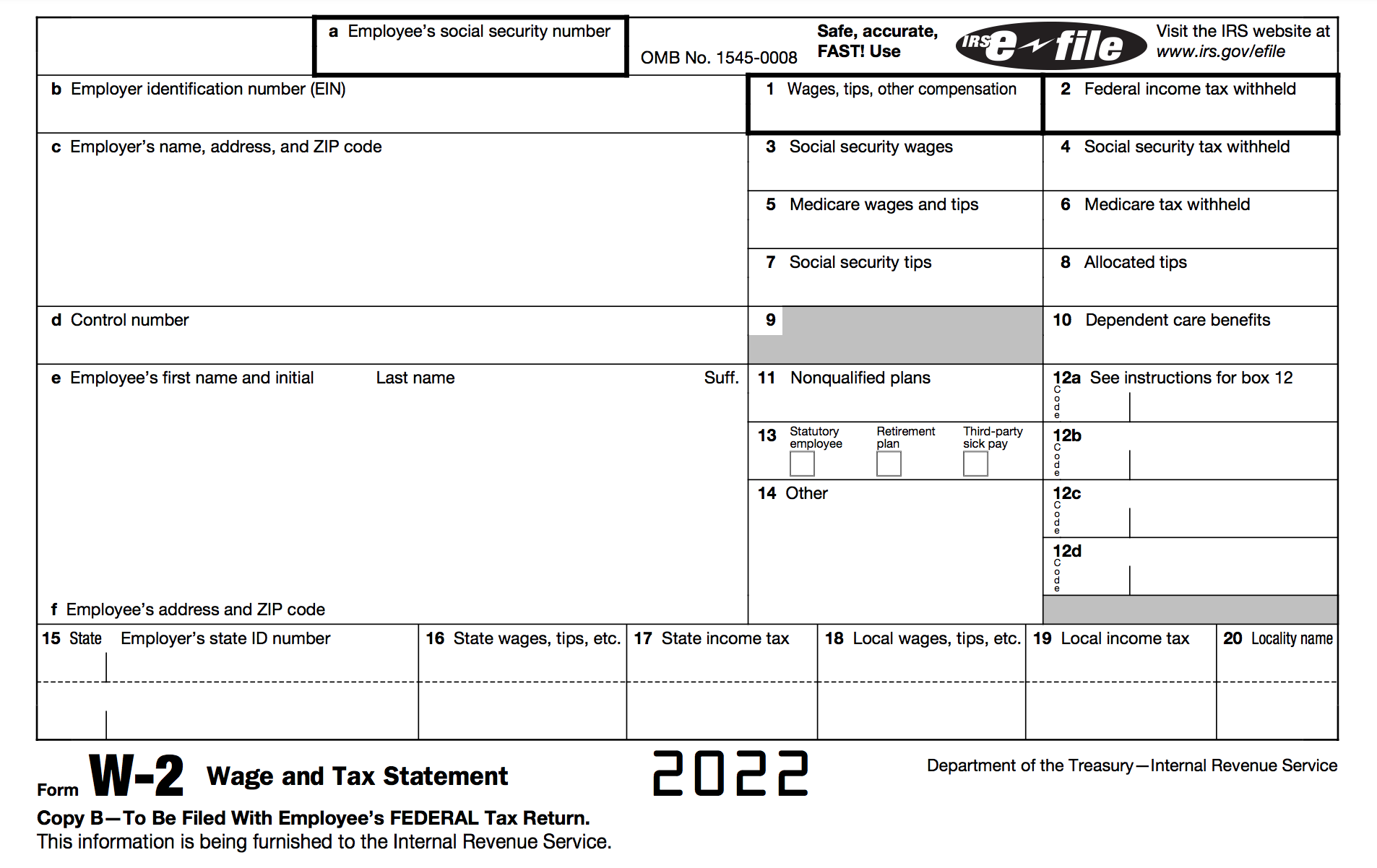

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering Your W2: The Ultimate Guide for New Job Forms!

So, you’ve landed a new job – congratulations! Now it’s time to dive into the world of W2 forms and navigate the sometimes confusing sea of numbers and boxes. Don’t worry, though, because we’ve got you covered with this ultimate guide to mastering your W2 like a pro. Let’s unleash your inner W2 wizardry and make tax season a breeze!

Unleash Your W2 Wizardry: A Beginner’s Guide!

First things first, let’s break down what exactly a W2 form is. Your W2 is a crucial document that your employer provides you with at the end of each tax year. It outlines all the income you earned, as well as the taxes that were withheld from your paychecks throughout the year. This form is essential for filing your taxes accurately and ensuring you receive any refunds you may be owed. Understanding the basics of your W2 is the first step in mastering this important document.

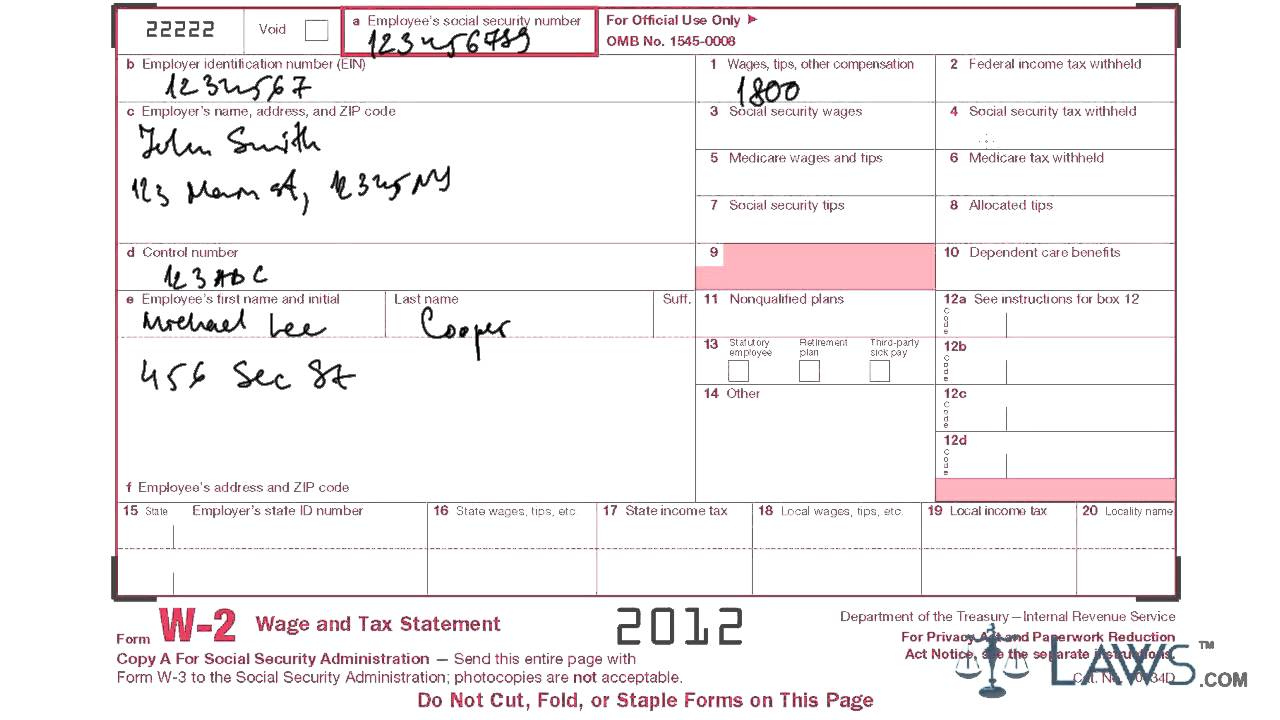

Next, it’s important to know how to read your W2 form like a pro. Each section of the form contains valuable information that will help you understand your tax situation. The most crucial sections to pay attention to are your total wages, federal income tax withheld, Social Security and Medicare taxes withheld, and any other deductions or credits you may be eligible for. By decoding these numbers and understanding what they mean, you’ll be well on your way to conquering your W2 forms with confidence.

Now that you’ve got a handle on the basics, it’s time to take your W2 wizardry to the next level. Make sure to double-check all the information on your form for accuracy, including your name, address, and Social Security number. Any mistakes could lead to delays in processing your tax return or even trigger an audit. Additionally, keep your W2 in a safe place and make copies for your records. By mastering the art of managing your W2 forms, you’ll be well-equipped to handle tax season like a seasoned pro.

In conclusion, mastering your W2 forms doesn’t have to be a daunting task. With a bit of knowledge and a touch of wizardry, you can decode, understand, and conquer your W2 like a true champ. So, embrace your inner W2 wizard, and let the magic of tax season begin!

Below are some images related to How To Fill Out W2 Form For New Job

how do you fill out the new w2 form, how to fill out new w2, how to fill out w2 for new job, how to fill out w2 form for new job, , How To Fill Out W2 Form For New Job.

how do you fill out the new w2 form, how to fill out new w2, how to fill out w2 for new job, how to fill out w2 form for new job, , How To Fill Out W2 Form For New Job.