Meijer Former Employee W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Tax Refund Treasure: Meijer’s Former Employee W2!

Are you a former employee of Meijer? Well, guess what – you may have a hidden treasure waiting for you in the form of your employee tax refund! With tax season right around the corner, now is the perfect time to uncover the financial rewards that are rightfully yours. Don’t let your hard-earned money go to waste – it’s time to unlock your tax refund treasure with your Meijer’s former employee W2!

Discover Your Hidden Treasure: Meijer’s Employee Tax Refund!

As a former employee of Meijer, you may be entitled to a tax refund based on your earnings and tax withholdings from the previous year. Your W2 form holds the key to unlocking this hidden treasure, as it provides detailed information about your income, taxes paid, and any potential refunds owed to you. By taking the time to review and file your W2, you can ensure that you receive the maximum refund possible and put that extra money back into your pocket where it belongs.

Uncover Your Financial Rewards with Your Former Employee W2!

Uncovering your financial rewards with your Meijer’s former employee W2 is not only a smart financial move, but it can also be a rewarding experience. Whether you plan to use your tax refund for a special purchase, savings goal, or debt repayment, knowing that you are getting back what you deserve can bring a sense of accomplishment and peace of mind. So don’t delay – take the time to unlock your tax refund treasure today and reap the benefits of your hard work and dedication as a former Meijer employee.

In conclusion, your Meijer’s former employee W2 is more than just a piece of paper – it’s a key to unlocking your tax refund treasure! By discovering and uncovering the financial rewards that are rightfully yours, you can make the most of tax season and put that extra money to good use. So don’t wait any longer – seize the opportunity to unlock your tax refund treasure with your Meijer’s former employee W2 and enjoy the financial benefits that come with it. Happy filing!

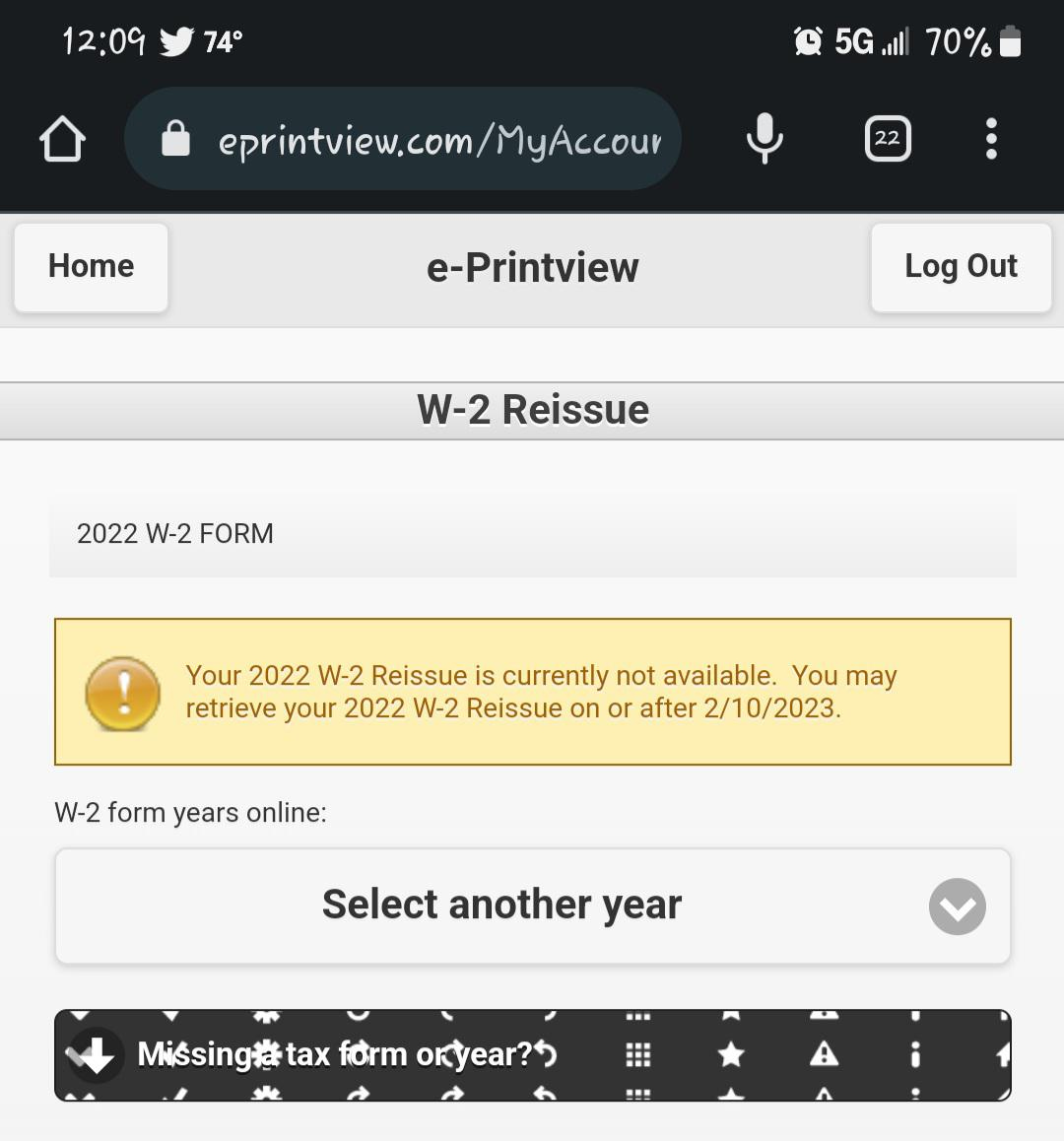

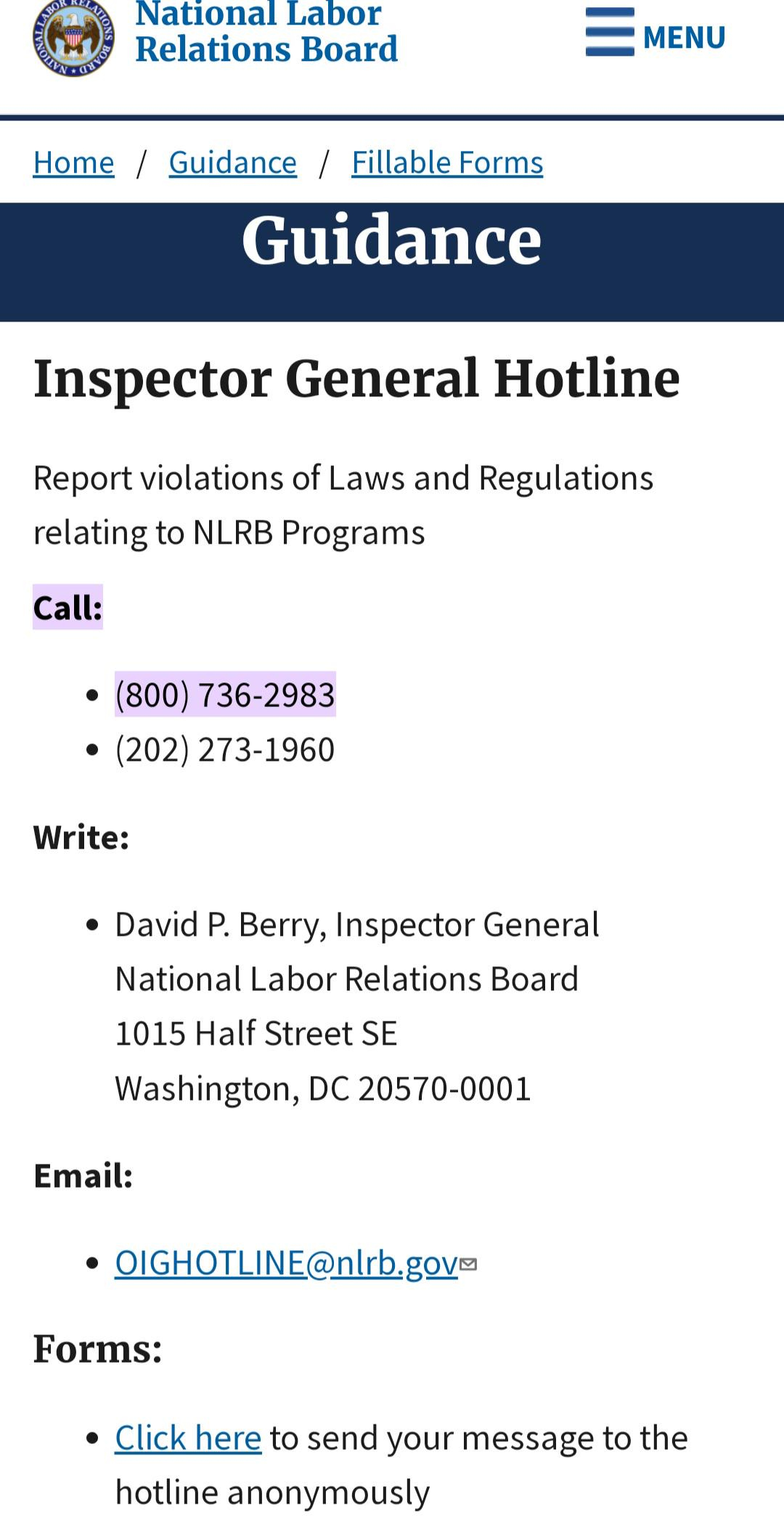

Below are some images related to Meijer Former Employee W2

does meijer mail w2, how do i get my w2 from meijer if i no longer work there, how do i get my w2 from walmart as a former employee, how to get my w2 from meijer, meijer former employee w2, , Meijer Former Employee W2.

does meijer mail w2, how do i get my w2 from meijer if i no longer work there, how do i get my w2 from walmart as a former employee, how to get my w2 from meijer, meijer former employee w2, , Meijer Former Employee W2.