Walmart W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Secret to Maximizing Your Tax Refund Potential

Are you ready to uncover the key to unlocking your tax refund potential? Look no further than Walmart W2 forms! These handy documents contain all the information you need to make sure you’re getting every penny you deserve come tax season. By utilizing your Walmart W2 forms effectively, you can take advantage of various deductions and credits that will help increase your tax refund. Say goodbye to leaving money on the table and hello to maximizing your refund potential!

Getting your hands on your Walmart W2 forms is the first step towards streamlining your tax filing process and ensuring you’re getting the most out of your tax refund. Gone are the days of sifting through piles of paperwork and struggling to gather all the necessary information for your tax return. With Walmart W2 forms, everything you need is neatly organized in one convenient document. Simply input the information into your tax filing software or provide it to your tax preparer, and you’ll be well on your way to a stress-free tax filing experience.

Streamline Your Tax Filing Process with Walmart W2 Forms

Don’t let the thought of tax season overwhelm you – with Walmart W2 forms, the process has never been easier! These forms are designed to streamline your tax filing experience, making it quick and painless to gather all the necessary information for your return. Whether you’re filing online or with the help of a professional, having your Walmart W2 forms on hand will ensure a smooth and efficient process from start to finish.

In addition to simplifying your tax filing process, Walmart W2 forms also provide valuable insight into your financial situation. By reviewing the information on your forms, you can identify areas where you may be eligible for additional deductions or credits, further maximizing your tax refund potential. With Walmart W2 forms in hand, you can take control of your finances and make sure you’re making the most of your hard-earned money. So why wait? Unlock your tax refund potential today with Walmart W2 forms!

In conclusion, Walmart W2 forms are a powerful tool that can help you unlock your tax refund potential and streamline your tax filing process. By utilizing these forms effectively, you can ensure you’re getting every penny you deserve come tax season. So don’t let tax season stress you out – embrace it with confidence knowing that Walmart W2 forms have your back. Say goodbye to tax refund worries and hello to maximizing your financial potential!

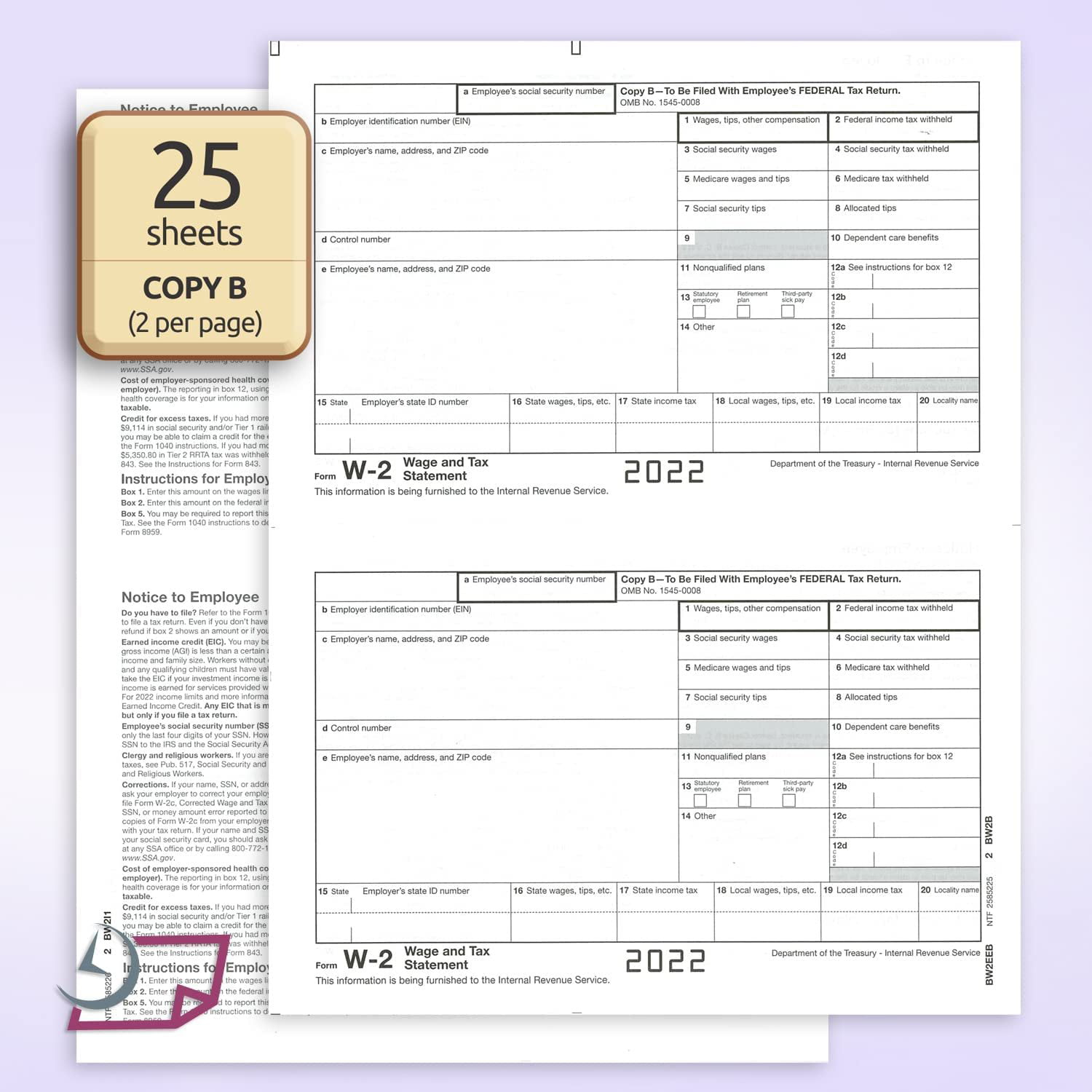

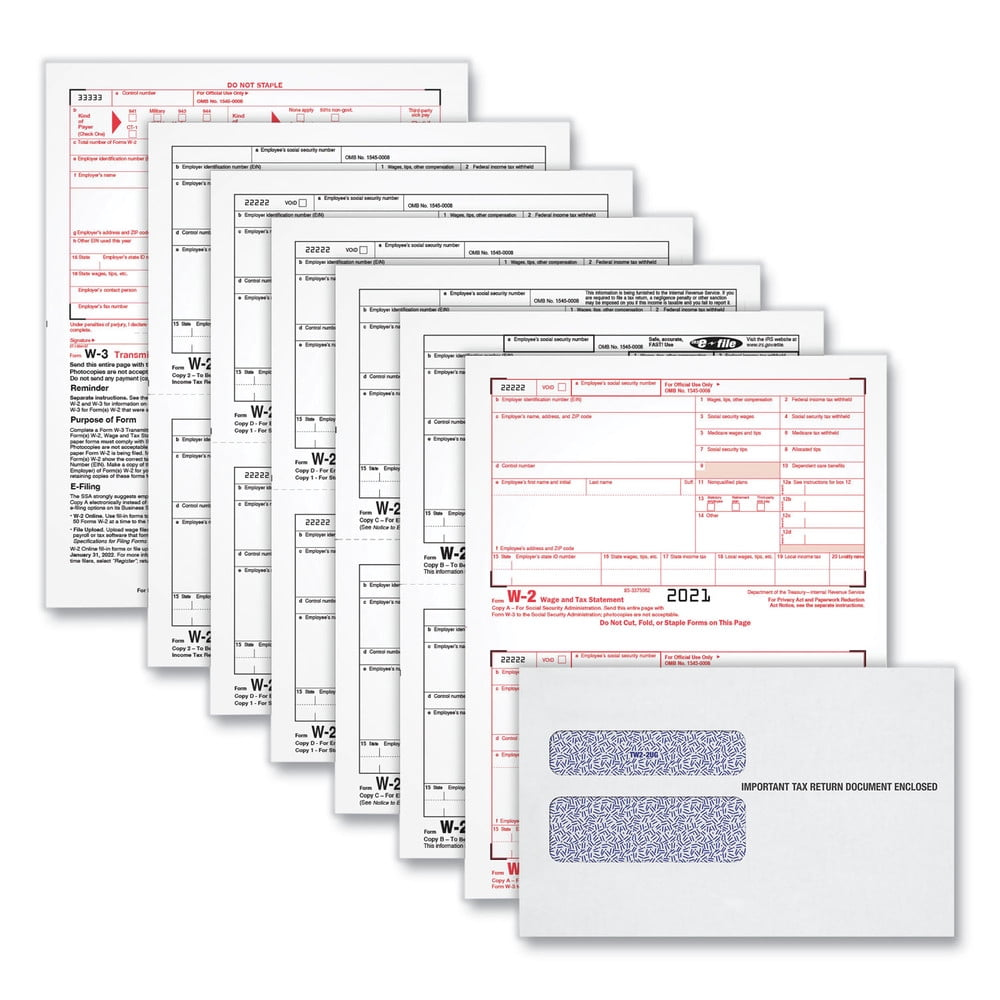

Below are some images related to Walmart W2 Forms

walmart online w2 release date 2023, walmart online w2 website, walmart w2 form 2022, walmart w2 form former employee, walmart w2 forms, , Walmart W2 Forms.

walmart online w2 release date 2023, walmart online w2 website, walmart w2 form 2022, walmart w2 form former employee, walmart w2 forms, , Walmart W2 Forms.