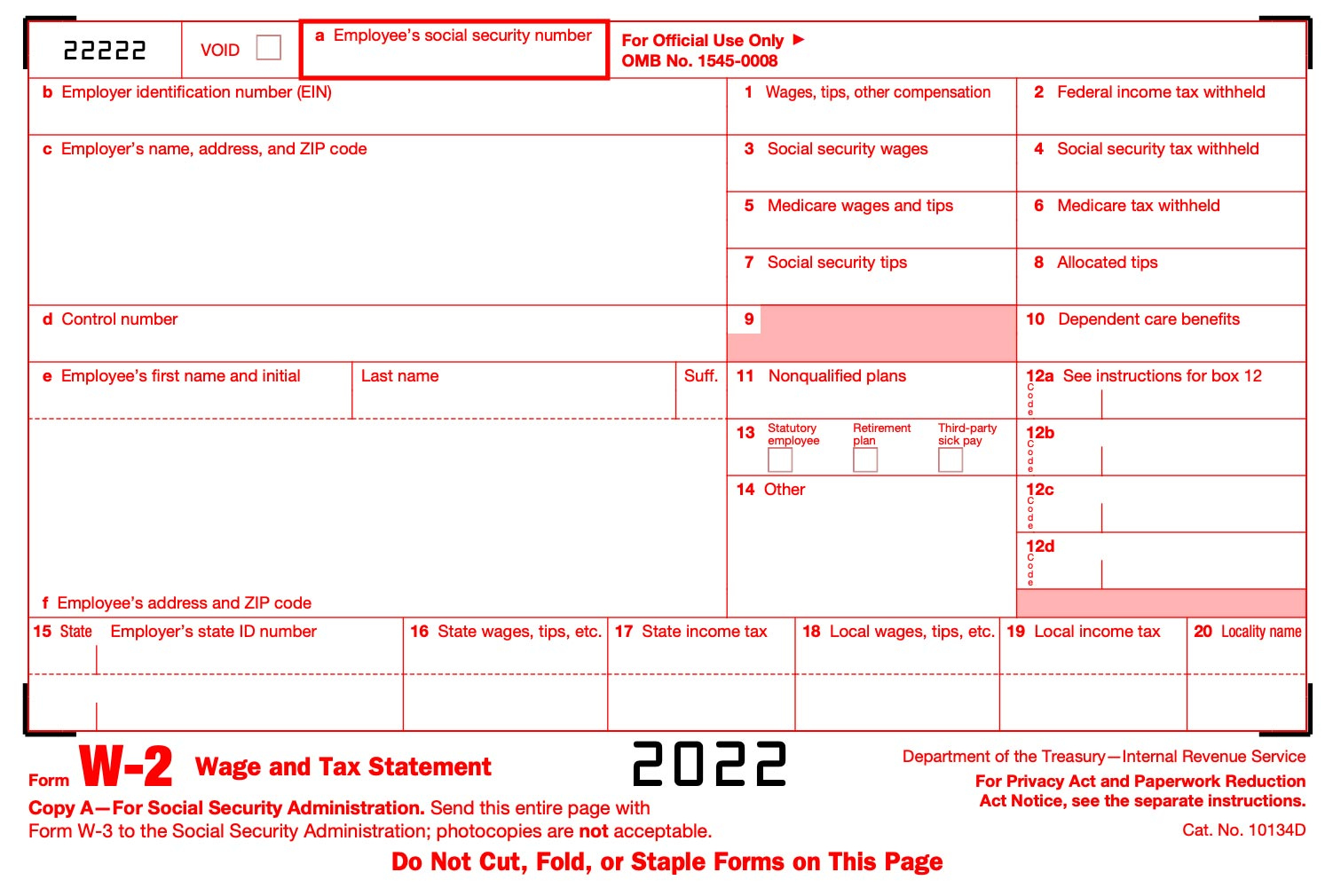

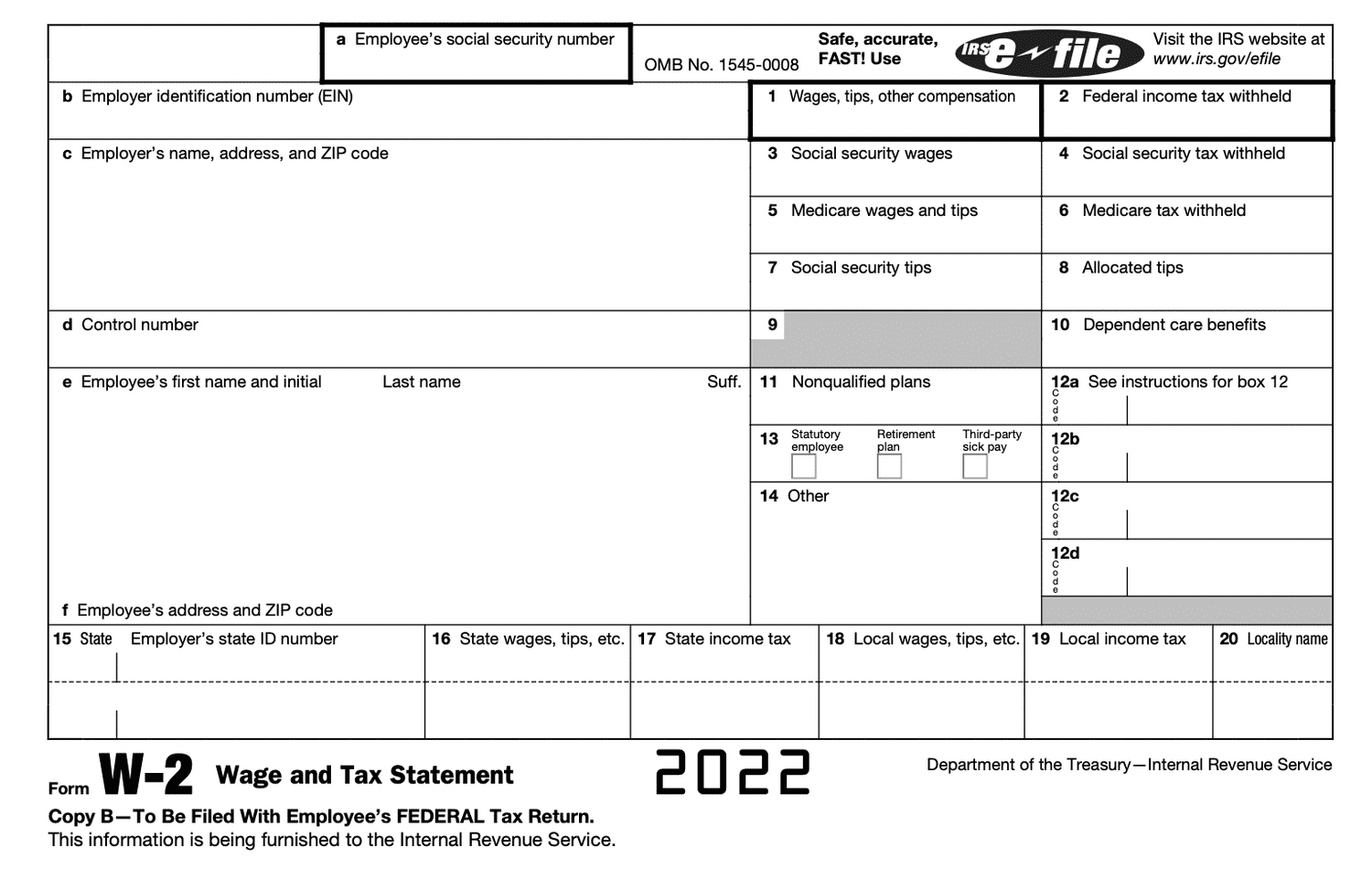

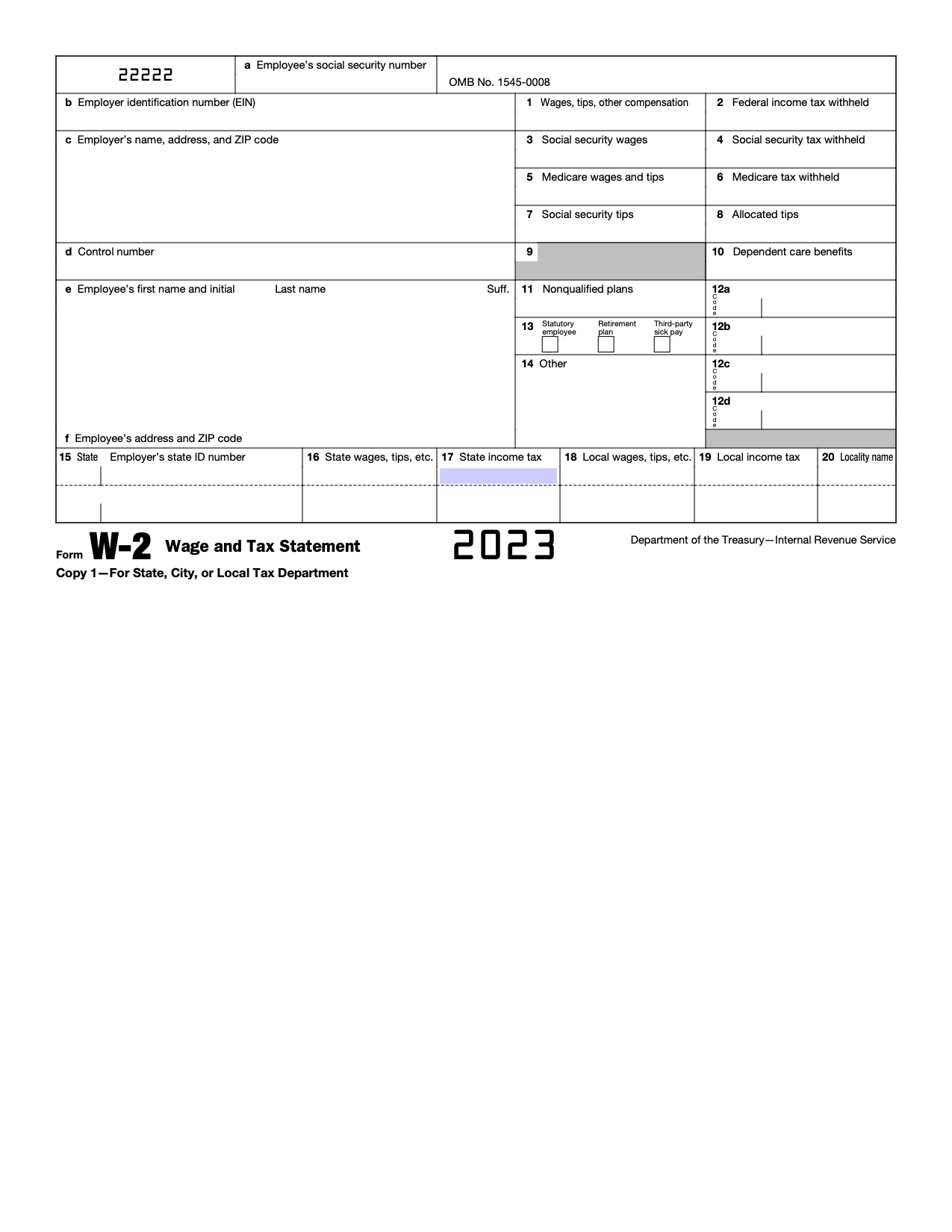

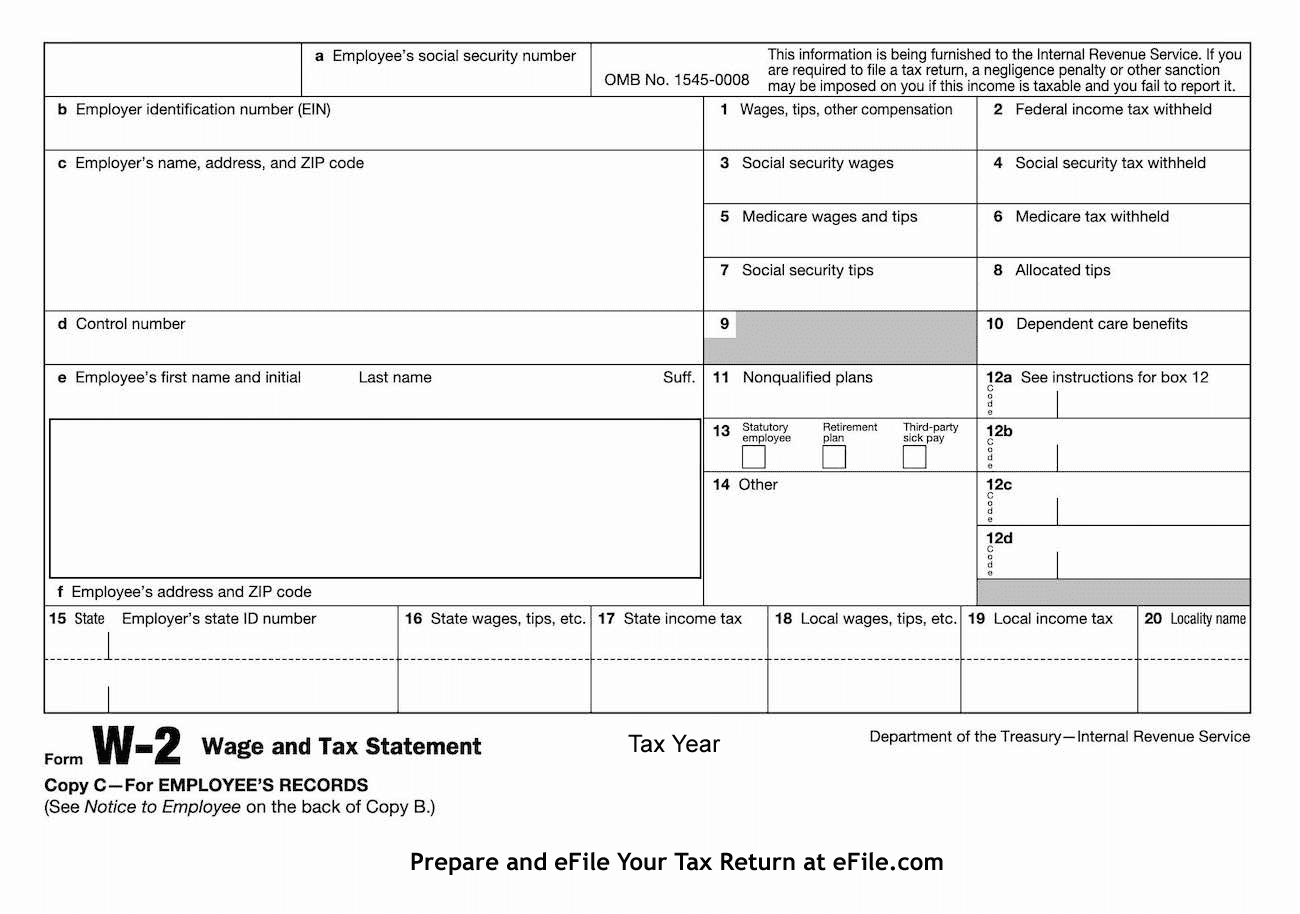

IRS Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of IRS Form W2

Are you ready to uncover the hidden secrets of your W2 form? Let’s embark on a magical journey into the world of taxes and discover the wonders that lie within this seemingly ordinary piece of paper. From deciphering codes to unlocking financial insights, the IRS Form W2 holds the key to understanding your income and taxes like never before. So grab your wand (or pen) and let’s delve into the mysteries of your W2 form today!

Discover the Enchantment of IRS Form W2!

As you gaze upon your W2 form for the first time, you may be overwhelmed by the myriad of numbers and boxes staring back at you. But fear not, for each element of this form holds a special significance in unraveling the story of your earnings and taxes. From your total wages to the amount of taxes withheld, every detail on your W2 form plays a crucial role in calculating your tax liability. So take a closer look and let the magic of numbers guide you through the enchanted realm of tax season.

In addition to providing a snapshot of your annual earnings, your W2 form also reveals important details about your employer and tax withholdings. By examining Box 12 for special codes and Box 14 for additional information, you can uncover hidden gems that may impact your tax return. Whether it’s tax-deferred contributions to a retirement plan or reimbursements for work-related expenses, these mysterious codes hold the key to maximizing your tax savings. So don’t overlook these hidden treasures as you navigate the enchanted world of tax forms.

As you reach the final section of your W2 form, you will encounter a magical number known as your taxable income. This crucial figure serves as the foundation for calculating your tax liability and determining your refund or balance due. By understanding how your income, deductions, and credits impact this number, you can wield the power of knowledge to optimize your tax return. So embrace the magic of IRS Form W2 and let it guide you towards financial prosperity and tax success.

Below are some images related to Irs Form W2

irs form w2, irs form w2 2022, irs form w2 2023, irs form w2 2024, irs form w2 and w3, , Irs Form W2.

irs form w2, irs form w2 2022, irs form w2 2023, irs form w2 2024, irs form w2 and w3, , Irs Form W2.