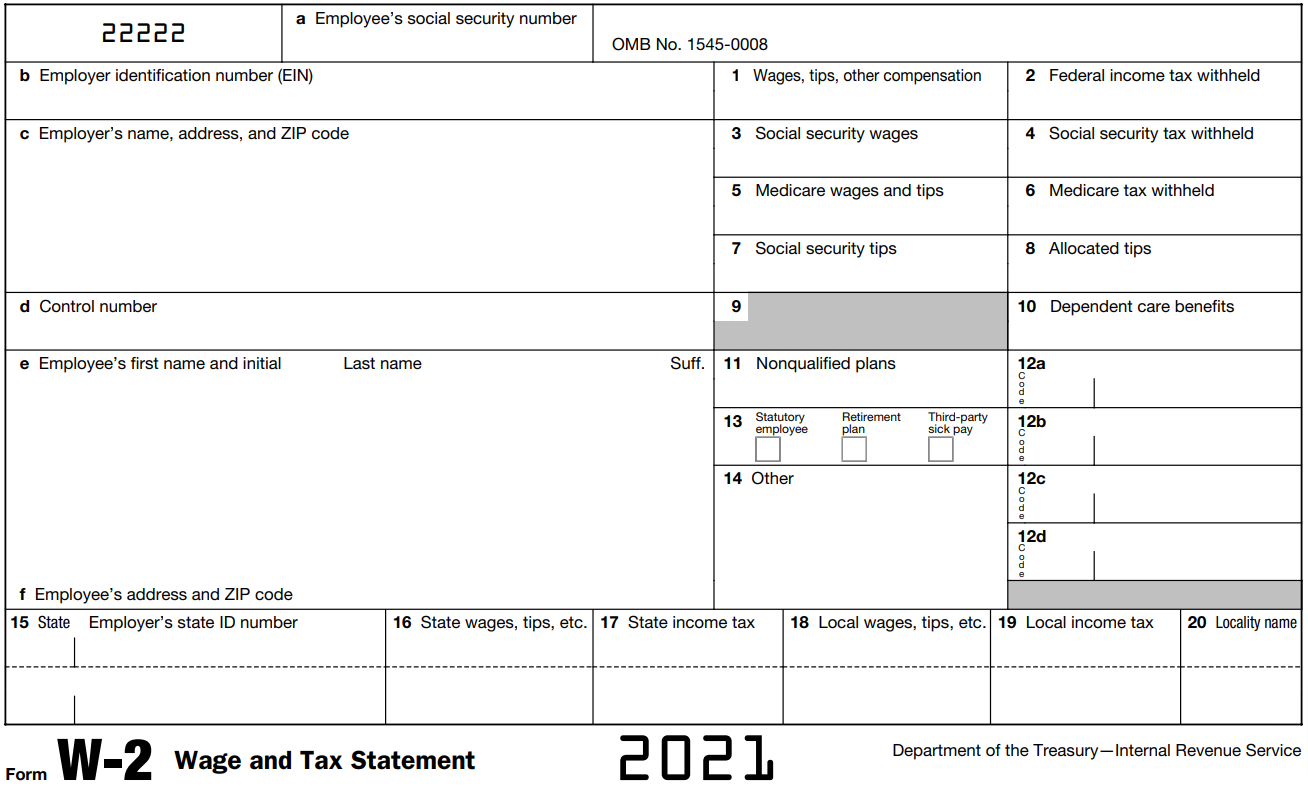

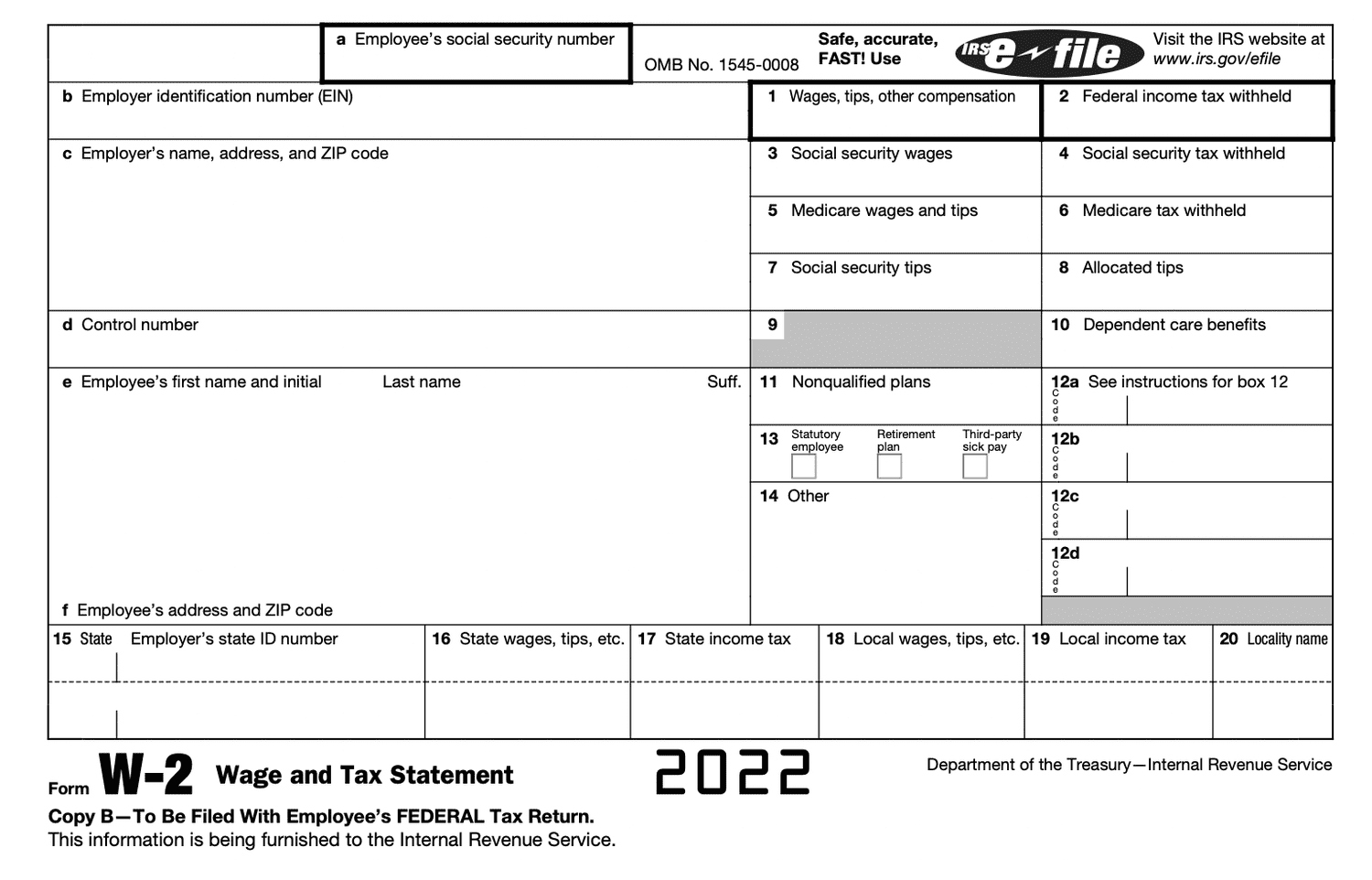

W2 Form Locality Name – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Secret Behind Your W2 Form Locality Name!

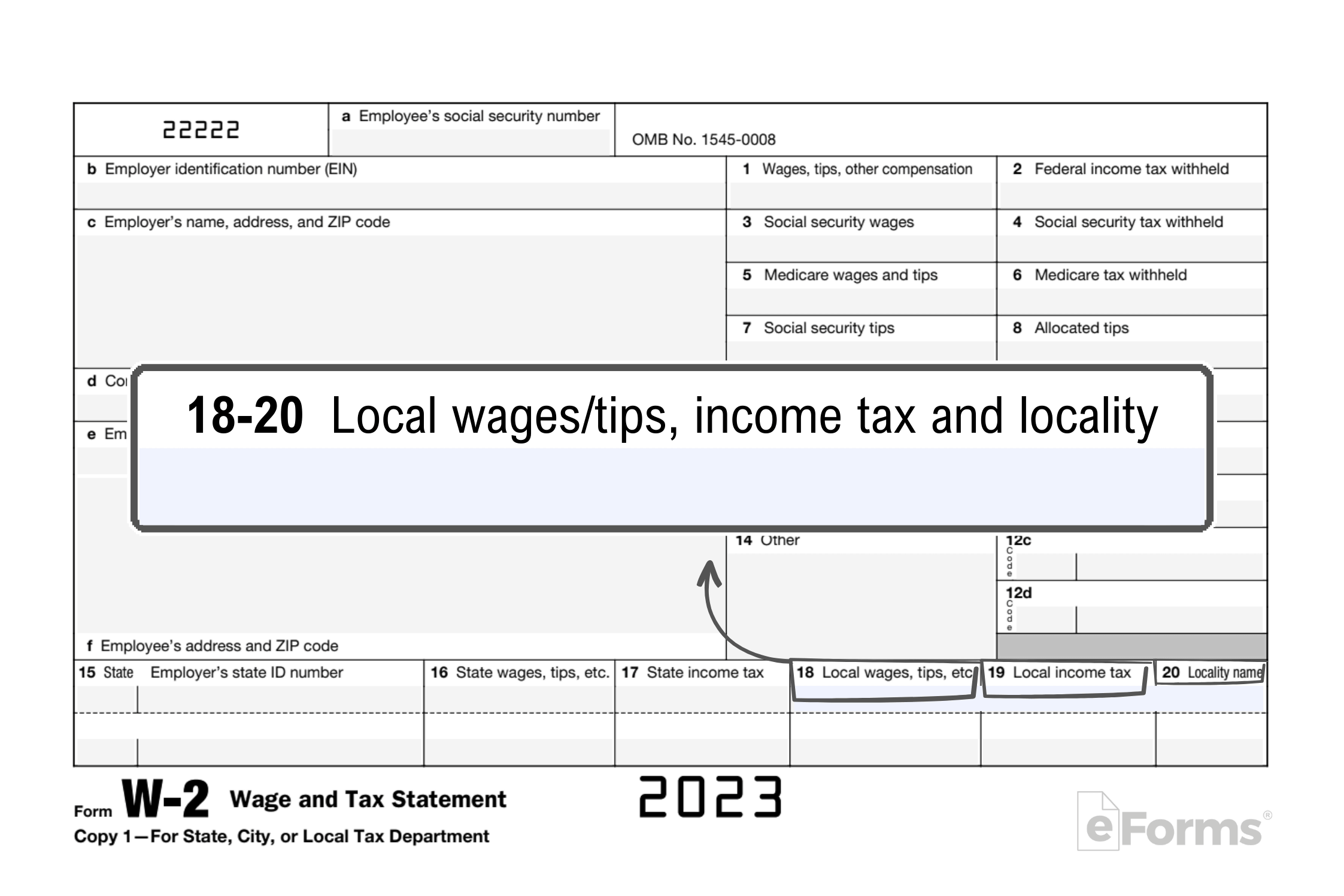

Have you ever received your W2 form and wondered what exactly that locality name means? Well, you’re not alone! The locality name on your W2 form might seem like a random assortment of letters and numbers, but it actually holds valuable information about where you work and how your taxes are calculated. Unlocking the mystery behind your W2 form locality name can help you better understand your tax situation and make informed financial decisions.

Let’s Dive into the Intriguing World of W2 Locality Names!

The locality name on your W2 form is typically a combination of letters and numbers that represent the specific location where you work. This information is used to determine the correct tax rates and deductions for your area. For example, if you work in a different city or state than where you live, the locality name on your W2 form will reflect that difference. Understanding your locality name can also help you identify any potential errors on your W2 form and ensure that you are paying the correct amount of taxes.

In addition to determining tax rates, the locality name on your W2 form can also provide valuable insight into your employer’s payroll system. Different employers may use different locality names based on their location or the specific tax regulations in that area. By familiarizing yourself with your W2 form locality name, you can gain a better understanding of how your employer handles payroll taxes and deductions. This knowledge can empower you to ask questions and seek clarification if you notice any discrepancies on your W2 form.

Overall, the locality name on your W2 form may seem like a small detail, but it plays a significant role in determining your tax obligations and understanding your employer’s payroll practices. By taking the time to unlock the mystery behind your W2 form locality name, you can gain a deeper understanding of your tax situation and make more informed financial decisions. So next time you receive your W2 form, take a closer look at that locality name and see what secrets it holds!

Below are some images related to W2 Form Locality Name

2 locality names on w2, w-2 form box 20 locality name, w2 form locality name, w2 locality name is a number, what is locality name on w2, , W2 Form Locality Name.

2 locality names on w2, w-2 form box 20 locality name, w2 form locality name, w2 locality name is a number, what is locality name on w2, , W2 Form Locality Name.