How Do I Get My W2 Form From Social Security – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping Your W2: A Guide to Getting Your Form from Social Security

Are you ready to unwrap the mystery of your W2 form from Social Security? Look no further! This step-by-step guide will walk you through the process with ease, ensuring that you have all the information you need to file your taxes accurately. Let’s dive in and discover the secrets hidden within your W2!

Ready to Dive In: Unwrapping Your W2 Form with Ease

The first step in obtaining your W2 form from Social Security is to log in to your my Social Security account. If you don’t already have an account, don’t worry – it’s quick and easy to create one. Once you’re logged in, navigate to the My Social Security tab and select Get a Benefit Verification Letter. From there, you can access your W2 form and download it directly to your computer. It’s as simple as that!

Next, take a few minutes to review your W2 form and make sure all the information is correct. Check your name, Social Security number, and earnings for the year. If you notice any errors, be sure to contact Social Security as soon as possible to have them corrected. Once you’ve confirmed that everything is accurate, you’re ready to use your W2 form to file your taxes and claim any refunds or credits you may be eligible for. Congratulations – you’ve successfully unwrapped your W2 form from Social Security!

A Step-by-Step Guide to Getting Your W2 from Social Security

In conclusion, unwrapping your W2 form from Social Security doesn’t have to be a daunting task. With the help of this guide, you can navigate the process with confidence and ease. Remember to log in to your my Social Security account, review your W2 form for accuracy, and use the information provided to file your taxes. By following these simple steps, you’ll be well on your way to a stress-free tax season. Happy filing!

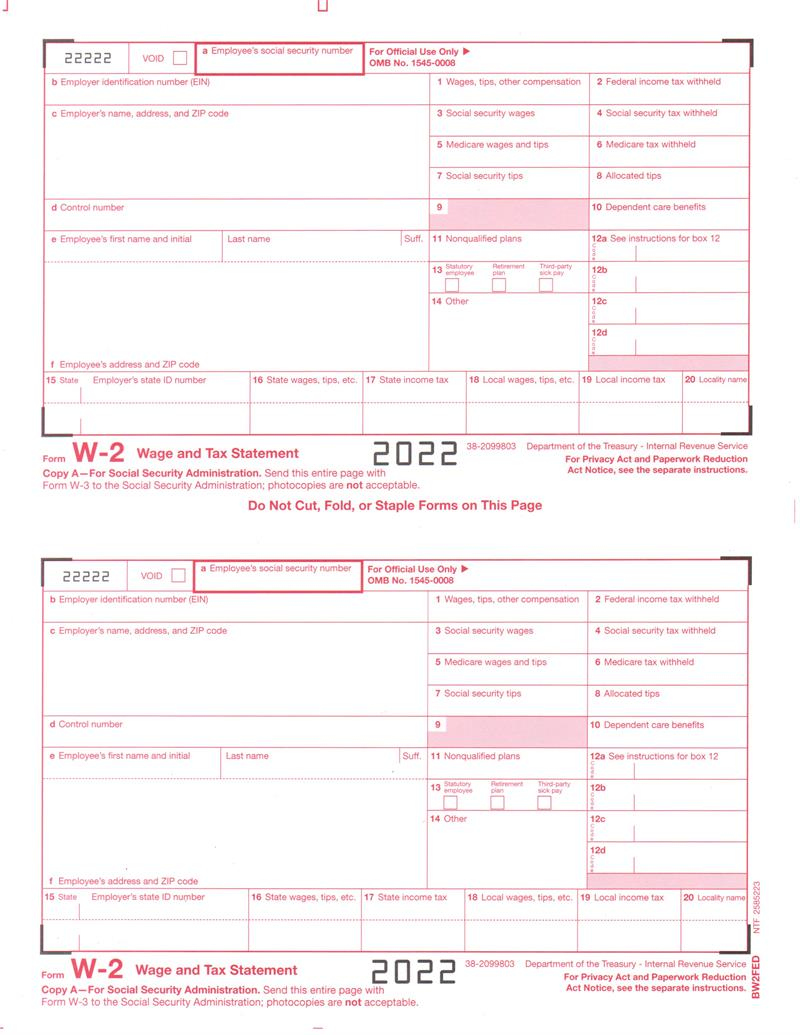

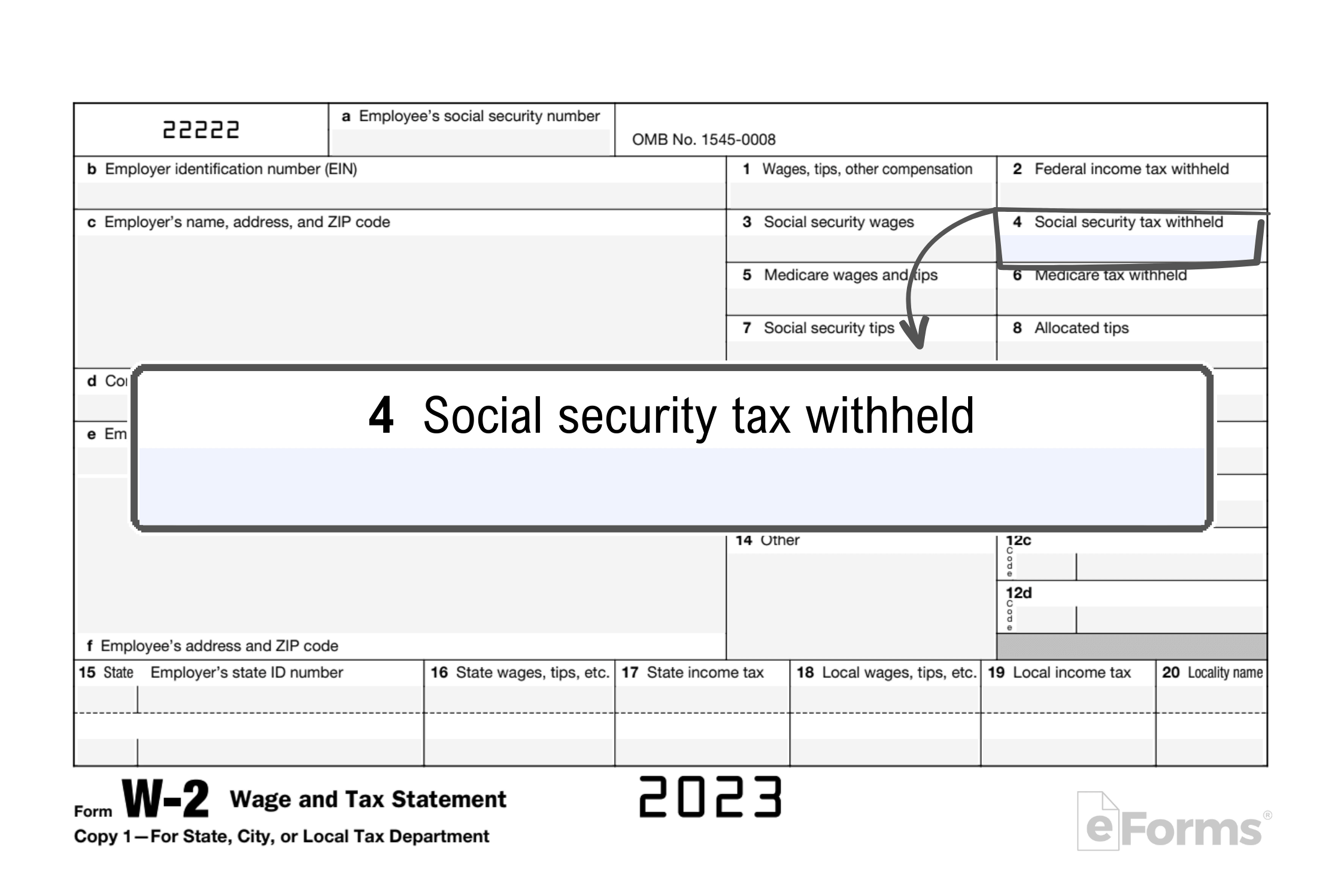

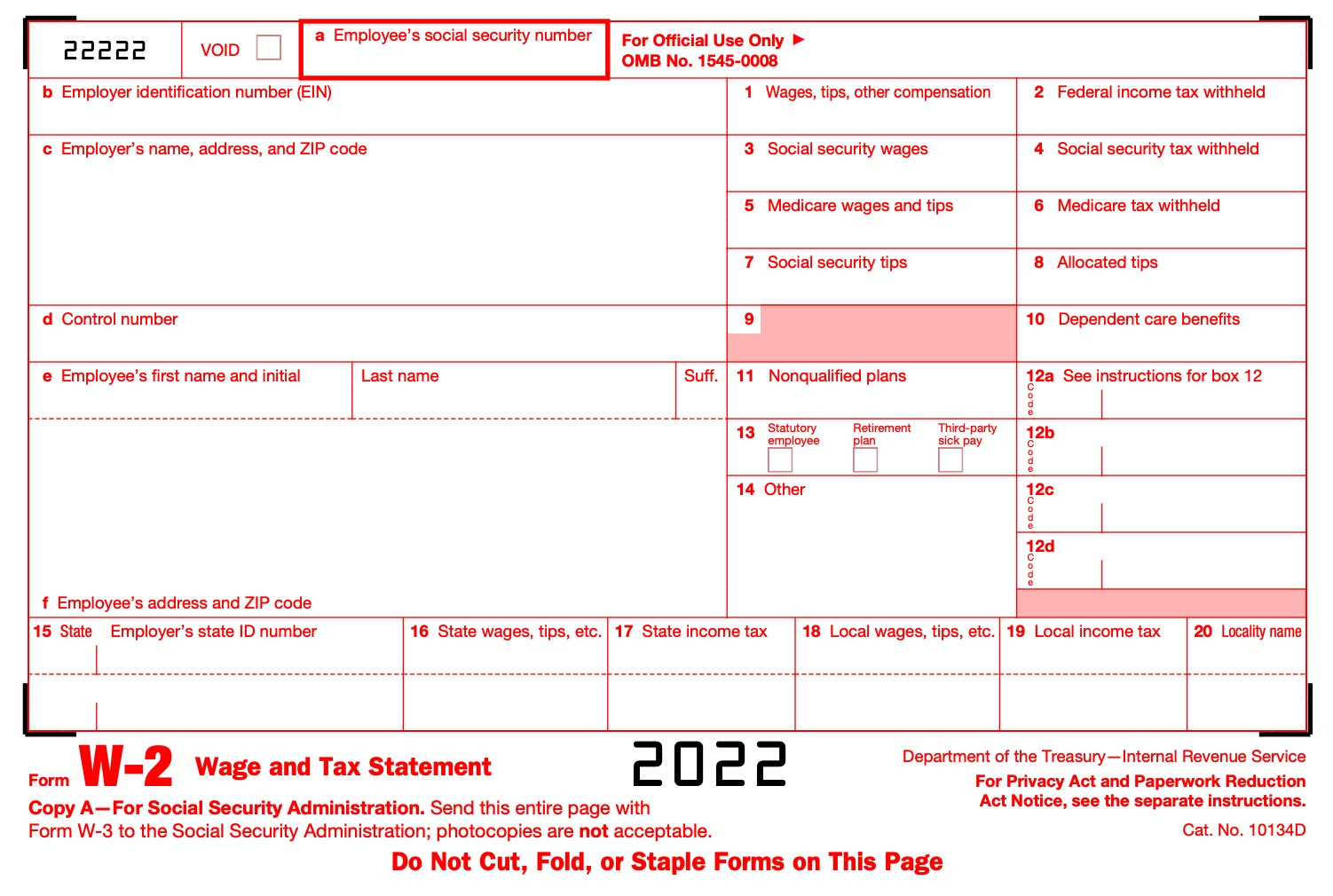

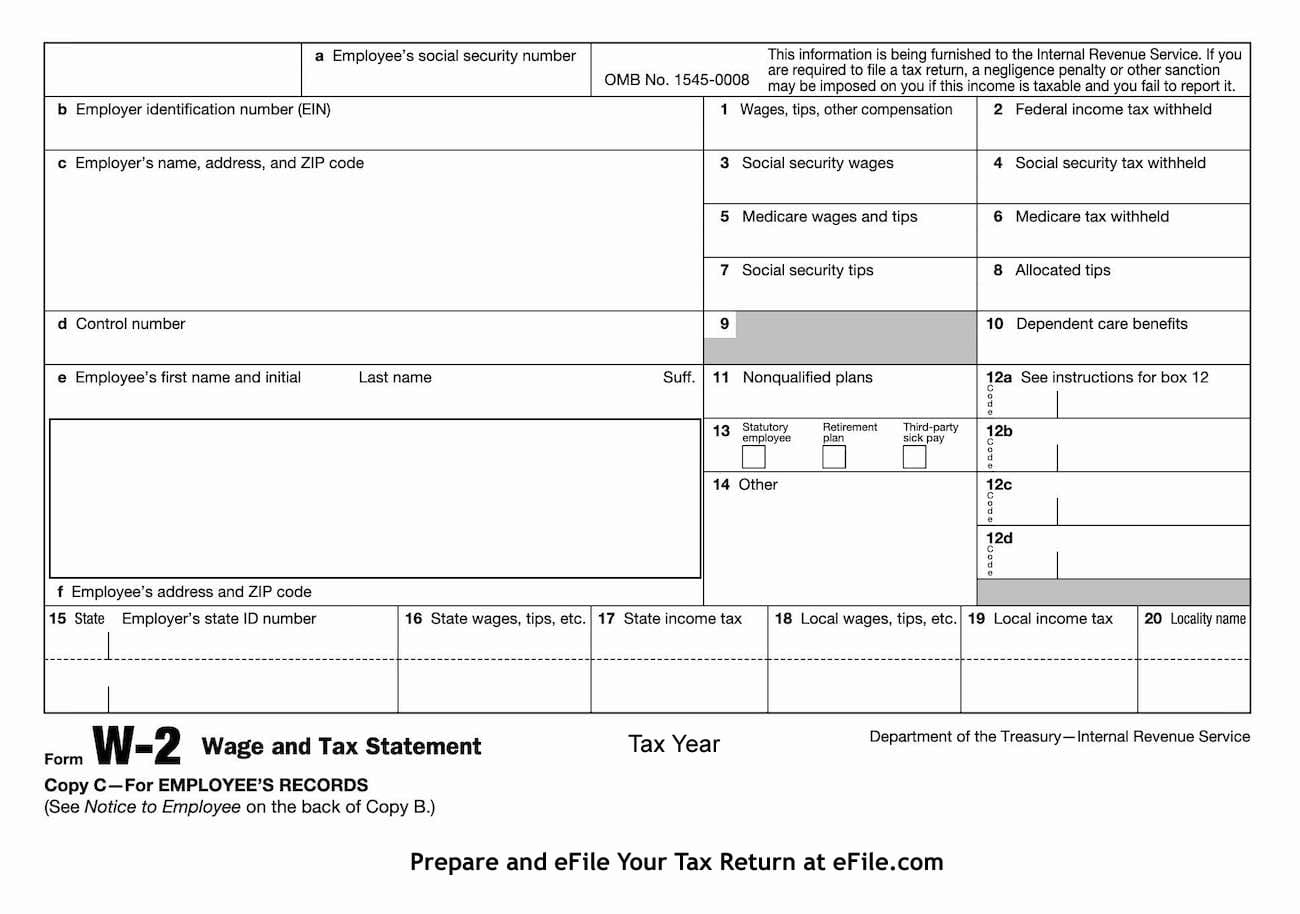

Below are some images related to How Do I Get My W2 Form From Social Security

how can i get a copy of my w2 from social security, how can i get my w2 online from social security, how do i get my w-2 form for social security, how do i get my w2 form from social security, how long does it take to get w2 from social security, , How Do I Get My W2 Form From Social Security.

how can i get a copy of my w2 from social security, how can i get my w2 online from social security, how do i get my w-2 form for social security, how do i get my w2 form from social security, how long does it take to get w2 from social security, , How Do I Get My W2 Form From Social Security.