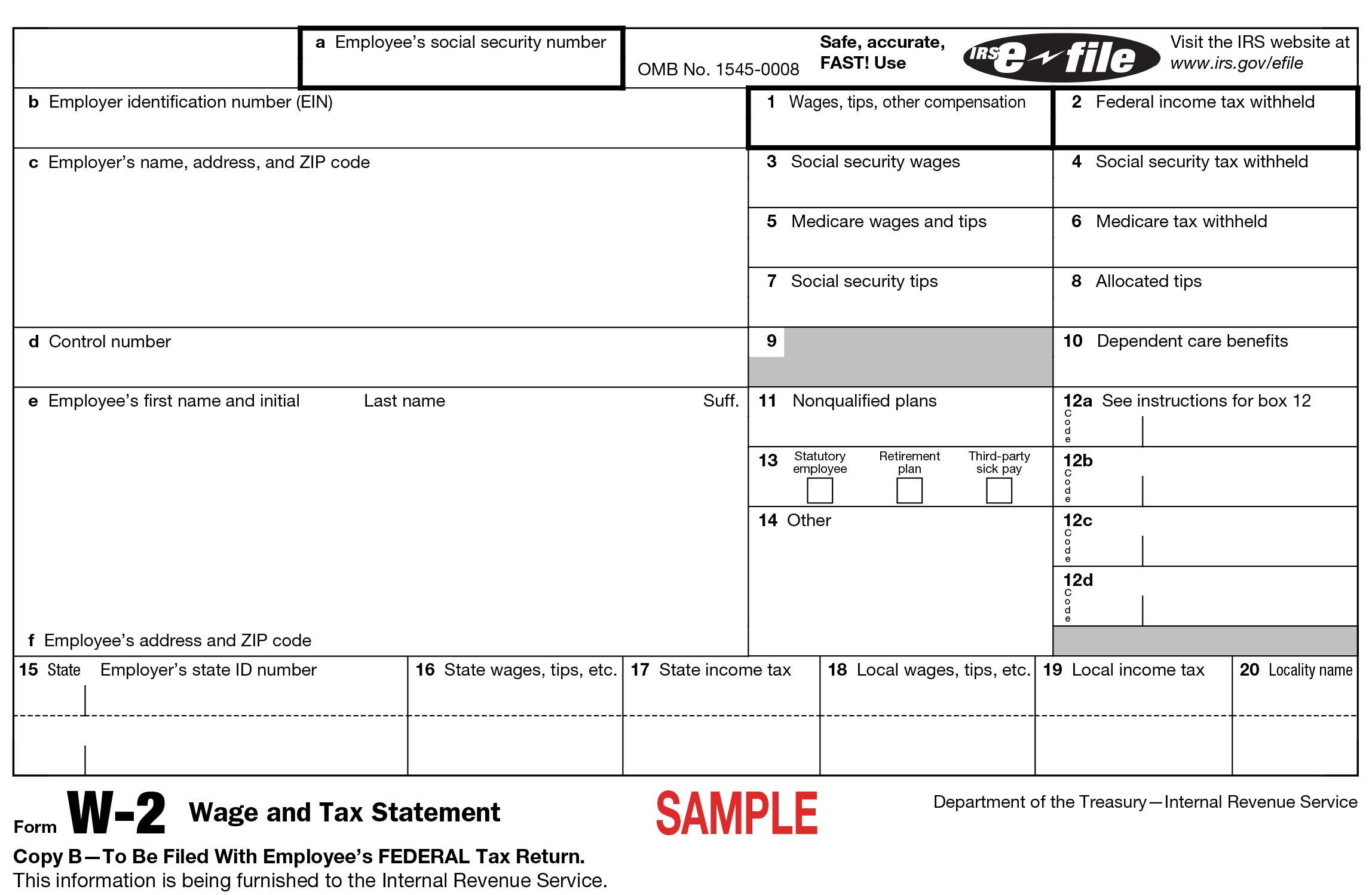

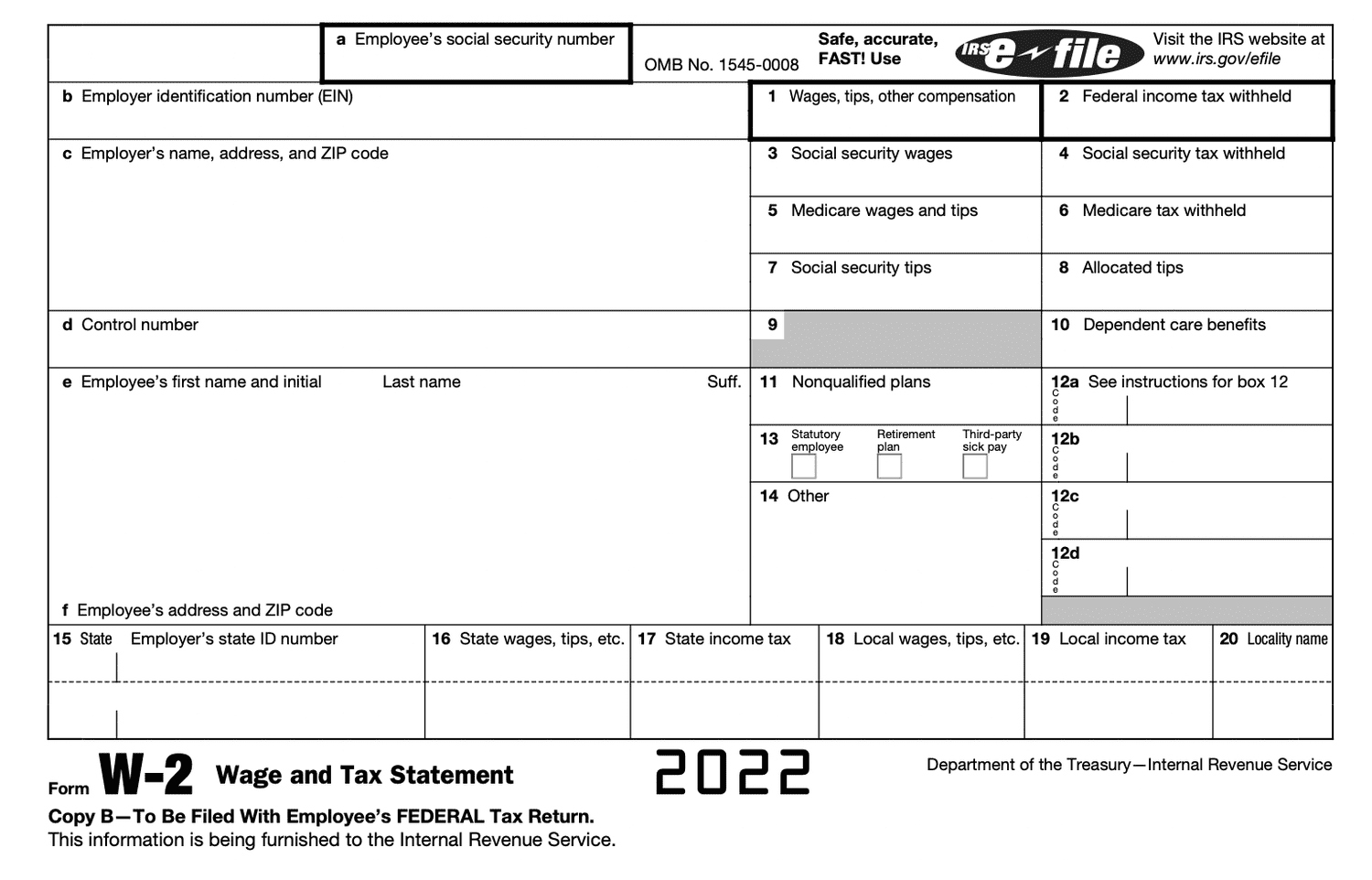

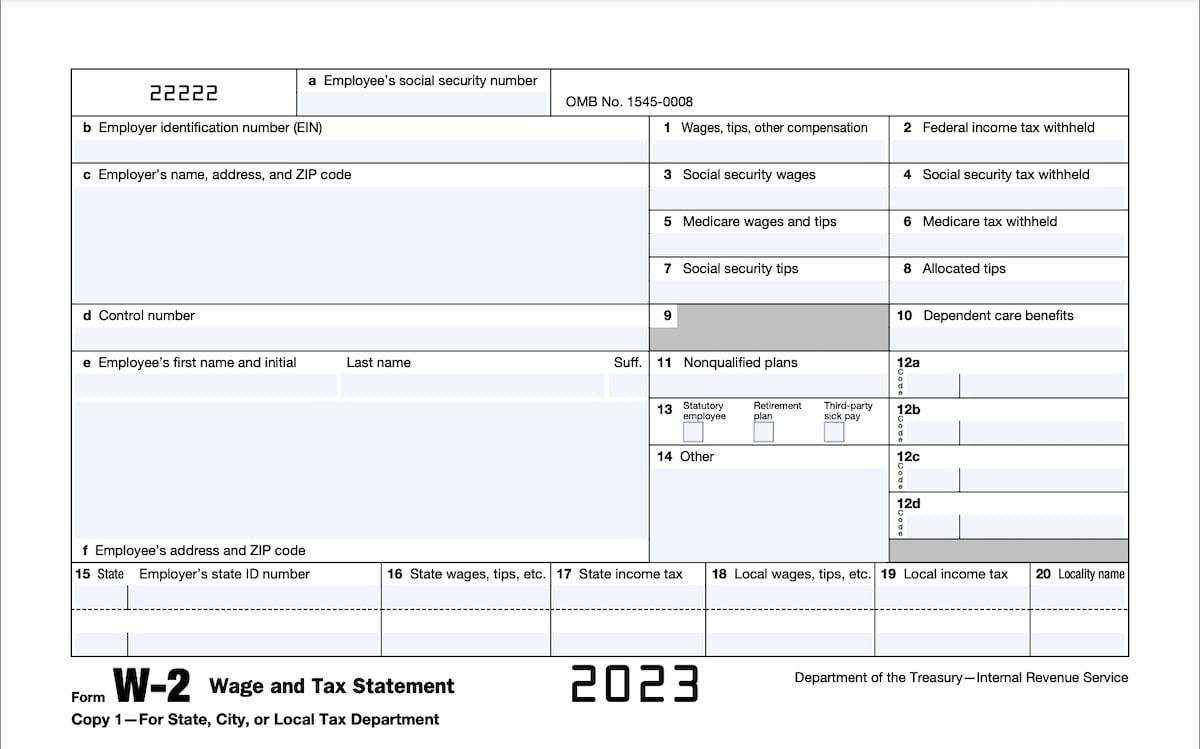

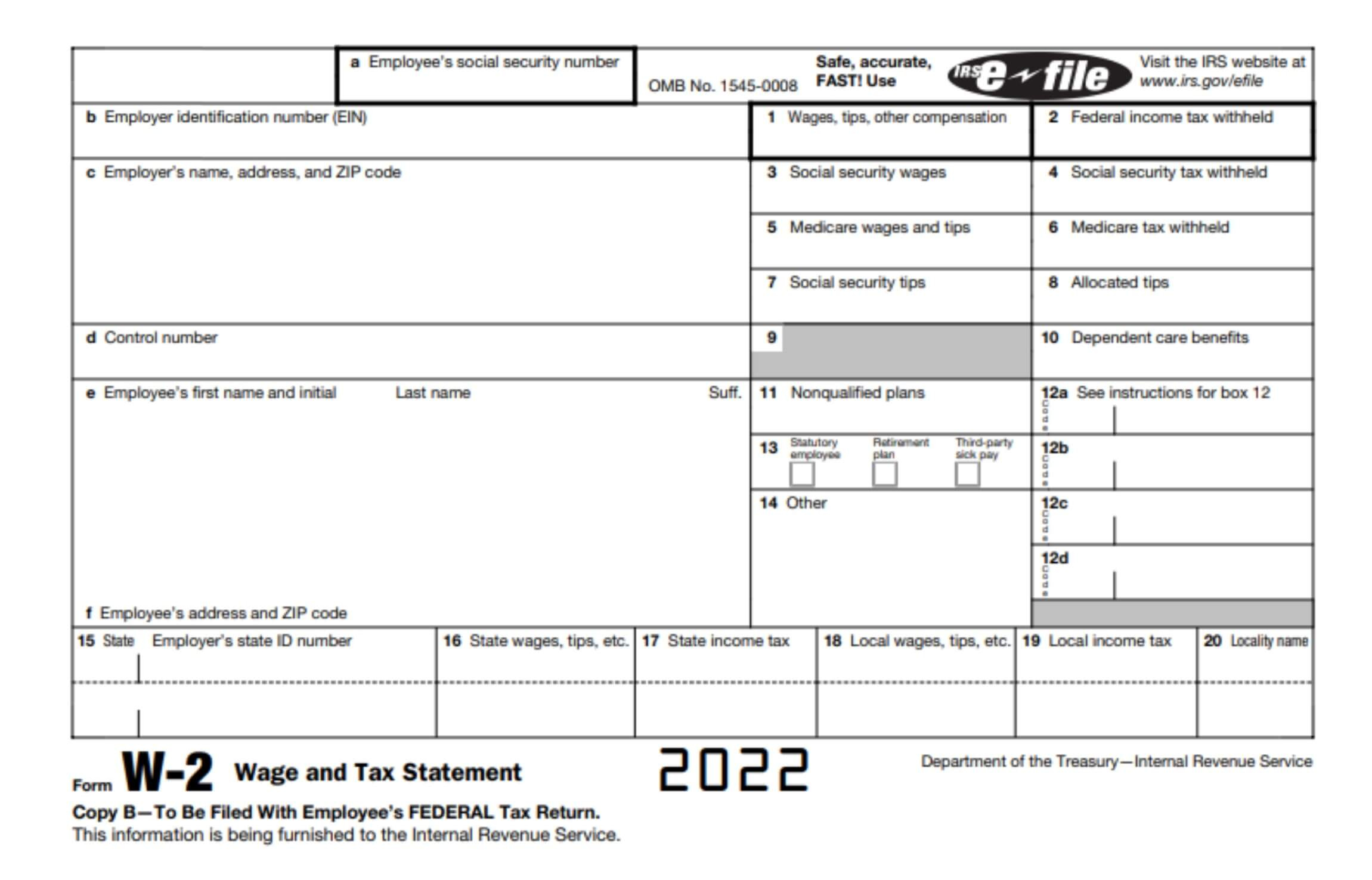

What Is 12b On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of Line 12b on Your W2!

Have you ever stared at your W2 form, scratching your head in confusion at all the numbers and codes? Fear not, for we are here to guide you through the curious case of Line 12b on your W2! This enigmatic line may seem like a jumble of letters and digits, but fear not – we will delve into its secrets and uncover the hidden meaning behind it.

The Curious Case of Line 12b on Your W2

Line 12b on your W2 form may leave you feeling puzzled, but fear not – there is a method to this madness! This line typically contains information regarding the amount of pretax contributions you have made to retirement plans such as a 401(k) or 403(b). These contributions are deducted from your gross income, reducing the amount of income that is subject to taxation. So, in essence, Line 12b is your ticket to saving for the future while also lowering your tax bill.

Delving deeper into Line 12b, you may also see codes such as D or E next to the amount listed. These codes indicate the type of plan to which your contributions were made. For example, D may signify a traditional 401(k) plan, while E could indicate a Roth 401(k) plan. Understanding these codes can help you better grasp how your contributions are being allocated and what tax implications they may have.

Delving Into the Secrets of Line 12b: What Does it Mean?

As you continue to decipher the mysteries of Line 12b on your W2, it’s important to remember the significance of your pretax contributions. By contributing to retirement plans, you are not only saving for your future but also taking advantage of valuable tax benefits. These contributions can help reduce your taxable income, potentially lowering your overall tax liability and increasing your savings over time.

In conclusion, Line 12b on your W2 may seem like a cryptic code at first glance, but with a little detective work, you can unlock its secrets. By understanding the meaning behind this line and the impact of your pretax contributions, you can make informed decisions about your finances and plan for a secure future. So, the next time you come across Line 12b on your W2, don your detective hat and unravel the mystery with confidence!

Below are some images related to What Is 12b On W2 Form

what does 12b mean on w2, what is 12a and 12b on w2 form, what is 12b d on w2, what is 12b dd on w2 form, what is 12b on w2 form, , What Is 12b On W2 Form.

what does 12b mean on w2, what is 12a and 12b on w2 form, what is 12b d on w2, what is 12b dd on w2 form, what is 12b on w2 form, , What Is 12b On W2 Form.