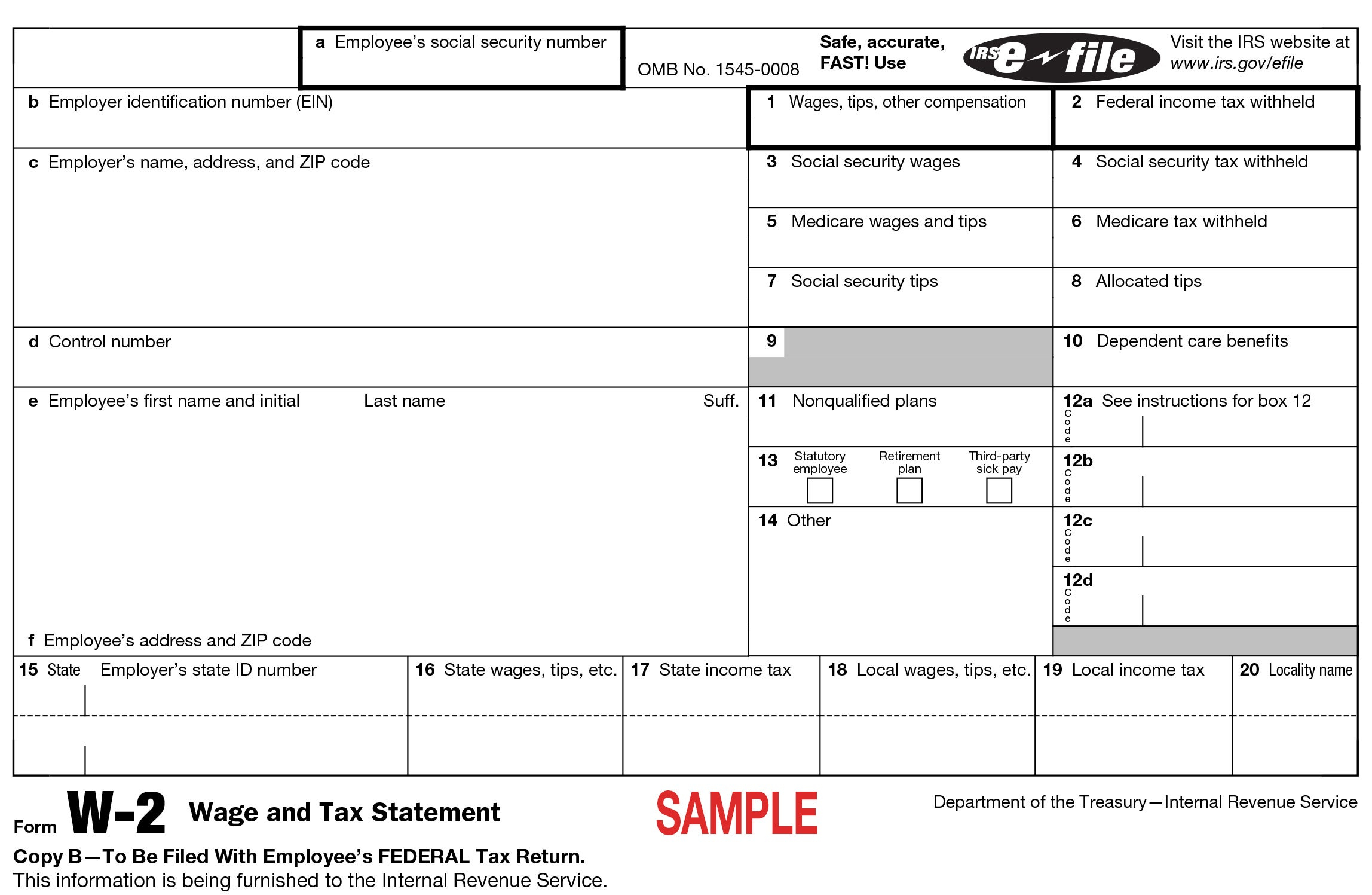

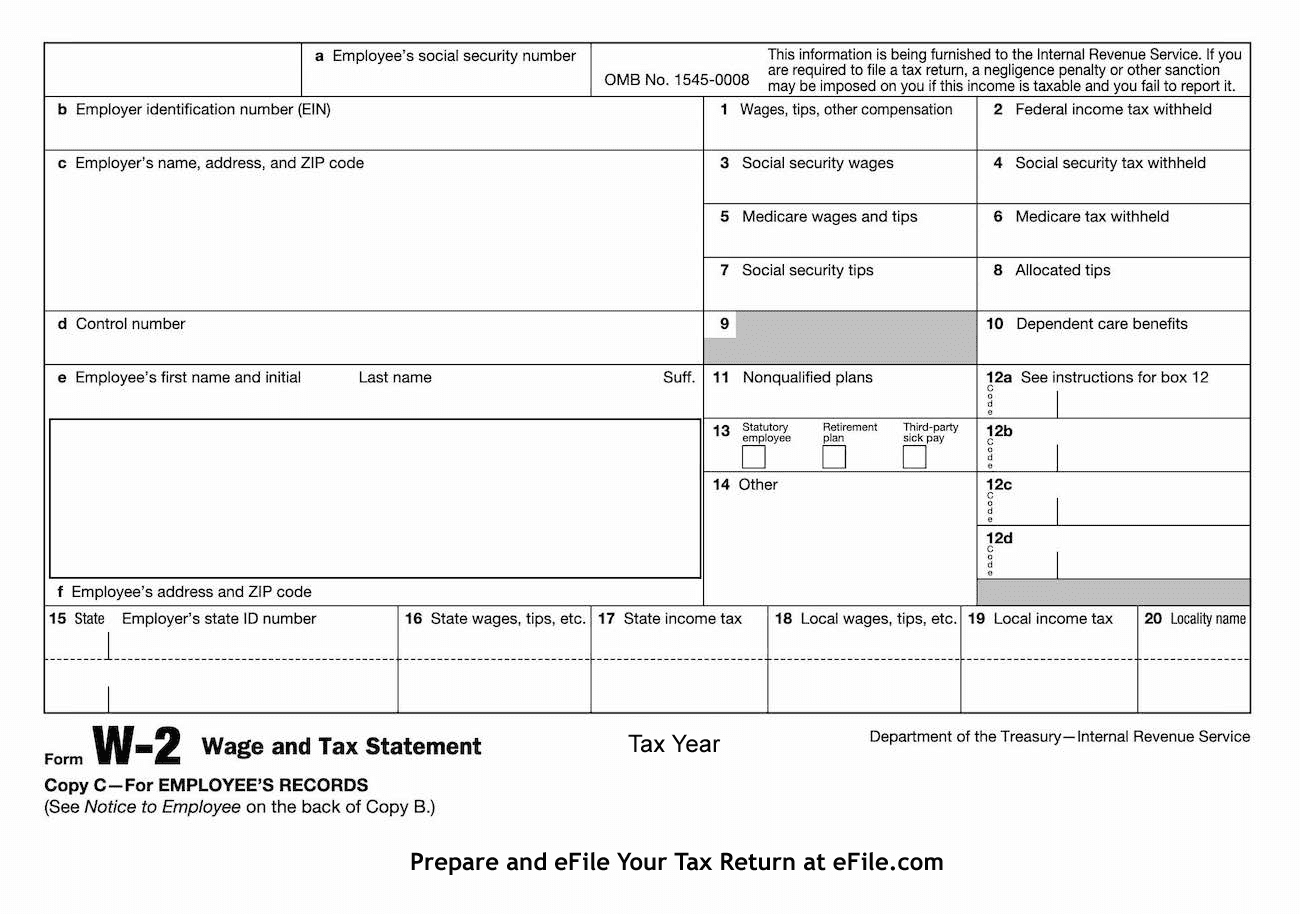

What Is Dd On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Diving into the Mysterious World of Dd on W2 Form!

Do you ever find yourself scratching your head when you come across the mysterious Dd on your W2 form? Fear not, for today we are going to embark on a journey to unravel this enigma and discover the secrets behind the cryptic code! So grab your diving gear and let’s dive deep into the intriguing world of Dd on W2 forms!

Discovering the Intriguing Dd on W2 Form!

As you gaze upon your W2 form, you may notice the curious presence of the letters Dd nestled among the sea of numbers and figures. But what does it mean? Well, hold onto your snorkel because here’s the scoop – Dd on a W2 form typically refers to the amount of employer-sponsored health coverage that you received during the tax year. This information is crucial for determining whether you qualify for certain tax benefits related to health insurance. So next time you spot Dd on your W2 form, you can rest assured that it’s not some alien code – it’s just your health coverage information!

But wait, there’s more to this mysterious Dd on your W2 form! In addition to health coverage, Dd may also encompass other types of employer-provided benefits, such as contributions to a flexible spending account or health savings account. These benefits are designed to help you save money on healthcare expenses and plan for your future financial well-being. So when you see Dd on your W2 form, remember that it’s not just a random letter – it’s a symbol of the valuable benefits that your employer provides to support your health and financial security.

Unraveling the Enigma: Diving into Dd on W2 Form!

Now that we’ve delved into the depths of Dd on your W2 form, you may be feeling like a seasoned explorer of the tax world! By understanding the significance of Dd, you can better navigate the murky waters of tax season and make informed decisions about your health and financial future. So the next time you receive your W2 form and encounter the mysterious Dd, you can take a deep breath and dive in with confidence, knowing that you hold the key to unlocking its secrets. Happy diving!

Below are some images related to What Is Dd On W2 Form

what does dd on w2 form means, what is 12 dd on w2 form, what is box dd on w2 form, what is d and dd on w2 form, what is dd on my w2 form, , What Is Dd On W2 Form.

what does dd on w2 form means, what is 12 dd on w2 form, what is box dd on w2 form, what is d and dd on w2 form, what is dd on my w2 form, , What Is Dd On W2 Form.