How Can I Get W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

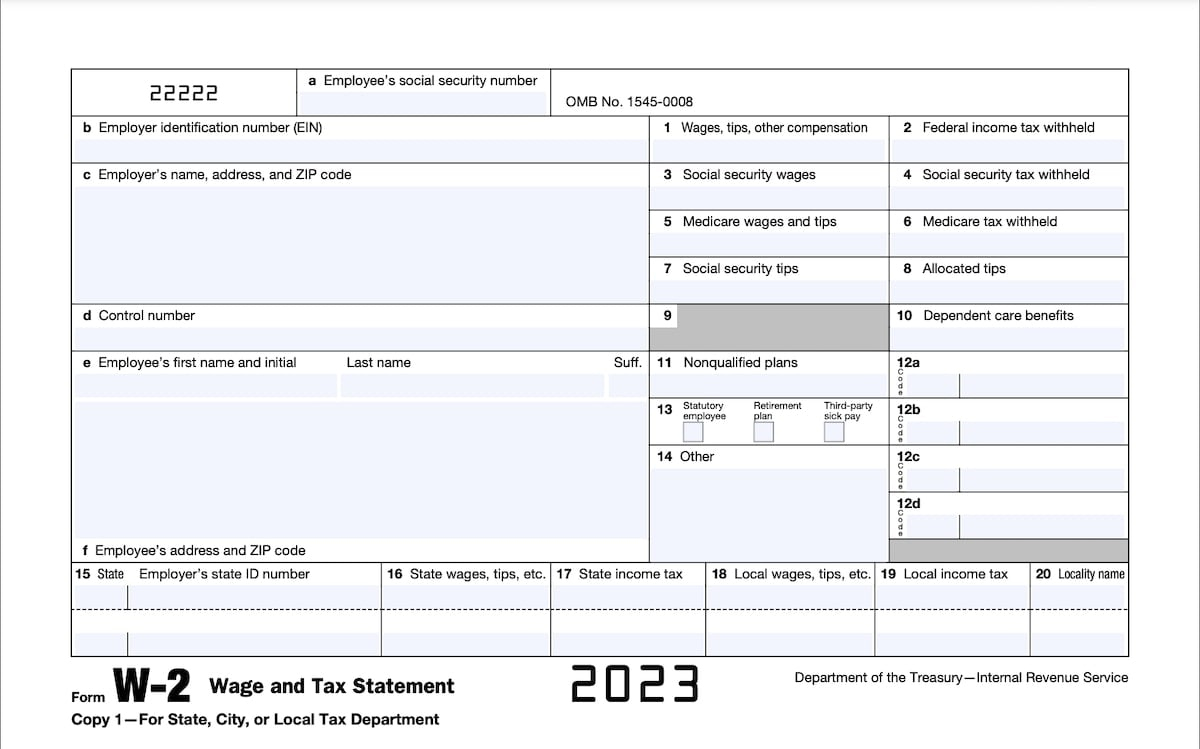

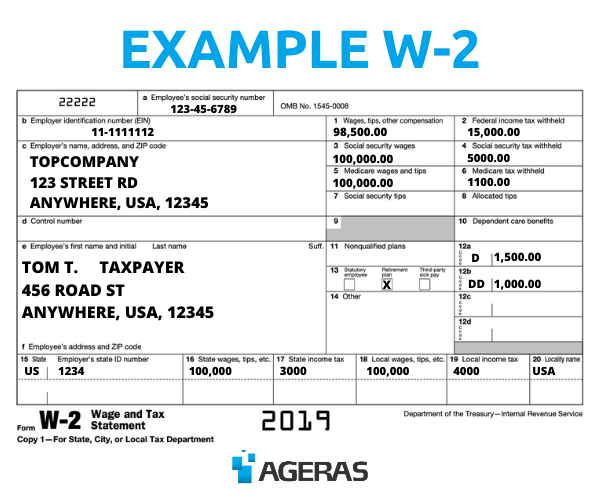

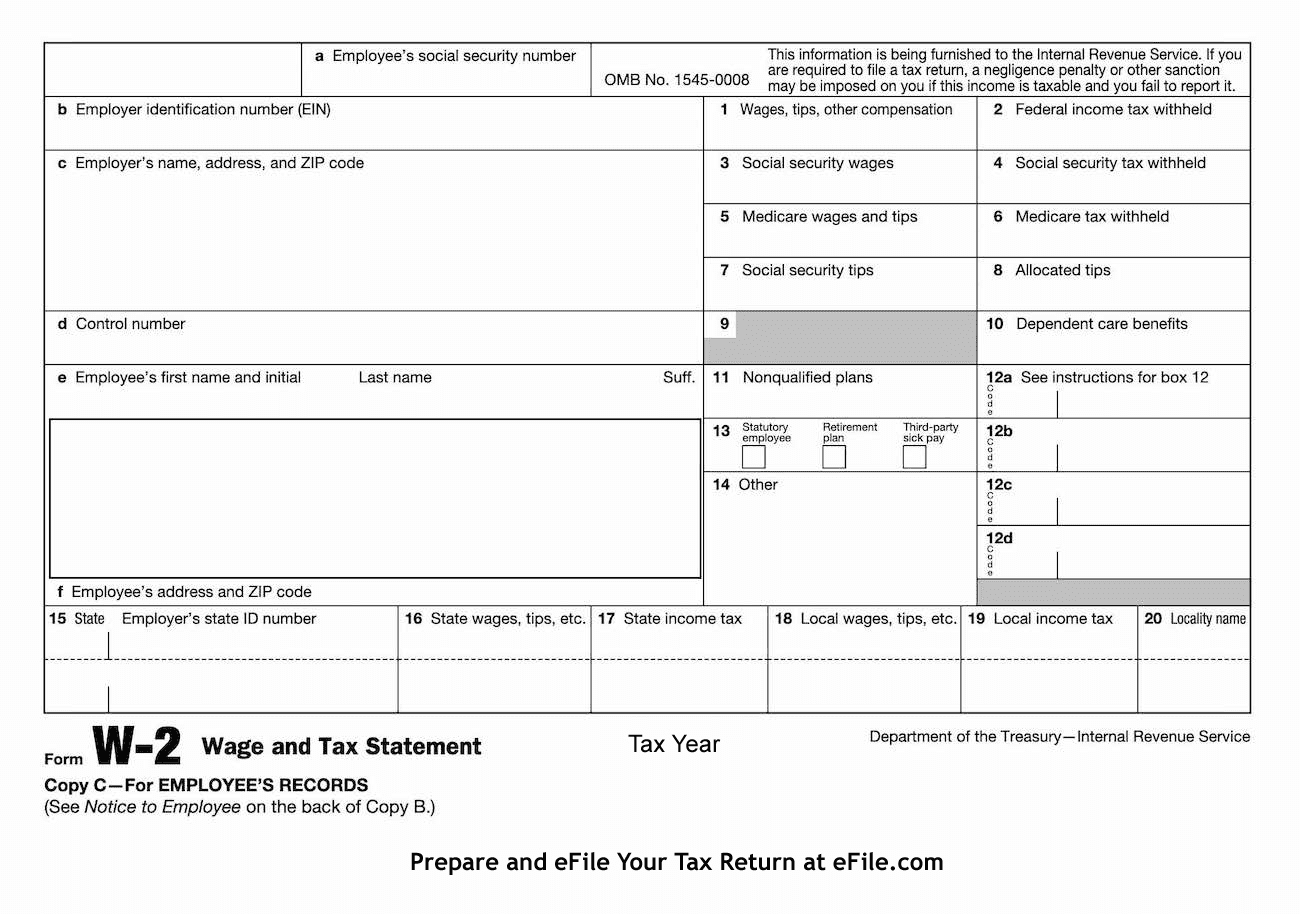

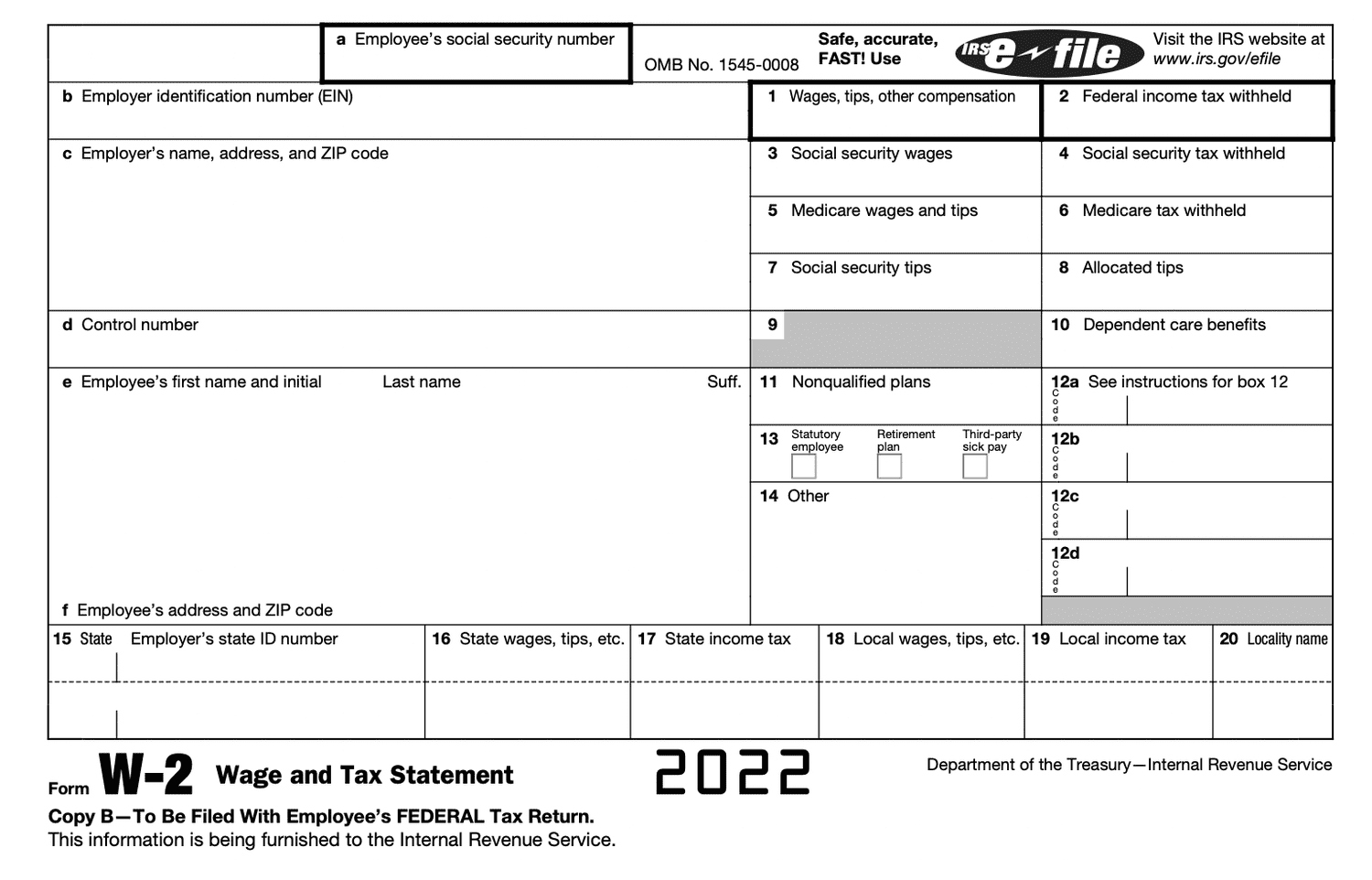

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash the Power of Your W2 Form!

Ah, the elusive W2 form – that magical document that holds the key to unlocking your tax refund! If you’re like many people, the thought of tracking down your W2 form can feel like trying to find a needle in a haystack. But fear not! With a little bit of know-how and some handy tips, you can easily access your W2 form and get one step closer to that sweet tax refund.

When it comes to your W2 form, knowledge is power. Understanding what this document is and why it’s important can help demystify the process of obtaining it. Your W2 form is a statement of your earnings and taxes withheld throughout the year, provided by your employer. It’s essential for filing your taxes accurately and ensuring you receive any refund you’re owed. So, don’t let this important piece of paperwork slip through the cracks – take control of your financial future by unlocking the magic of your W2 form.

Discover Simple Tricks to Access Your W2 Form with Ease!

Now that you know the importance of your W2 form, let’s dive into some simple tricks to help you access it with ease. First and foremost, reach out to your employer. Most companies provide W2 forms to their employees by the end of January, either in person or electronically. If you haven’t received yours, don’t hesitate to ask your HR department for a copy. Another option is to check online. Many employers offer access to electronic W2 forms through their payroll systems, making it quick and convenient to download and print your form. And if all else fails, you can always contact the IRS. They can help you obtain a copy of your W2 form if all other avenues have been exhausted.

When it comes to unlocking your W2 magic, persistence is key. Don’t be afraid to follow up with your employer or the IRS if you encounter any roadblocks in obtaining your form. Remember, this document is crucial for filing your taxes and securing any refund you’re owed. By taking the time to track down your W2 form, you’re one step closer to maximizing your financial well-being. So, roll up your sleeves, tap into your inner detective, and unleash the power of your W2 form!

Below are some images related to How Can I Get W2 Form

how can i get my w2 form 2021, how can i get my w2 from former employer, how can i get w2 form, how can i get w2 form online, how can i get w2 forms from previous years, , How Can I Get W2 Form.

how can i get my w2 form 2021, how can i get my w2 from former employer, how can i get w2 form, how can i get w2 form online, how can i get w2 forms from previous years, , How Can I Get W2 Form.