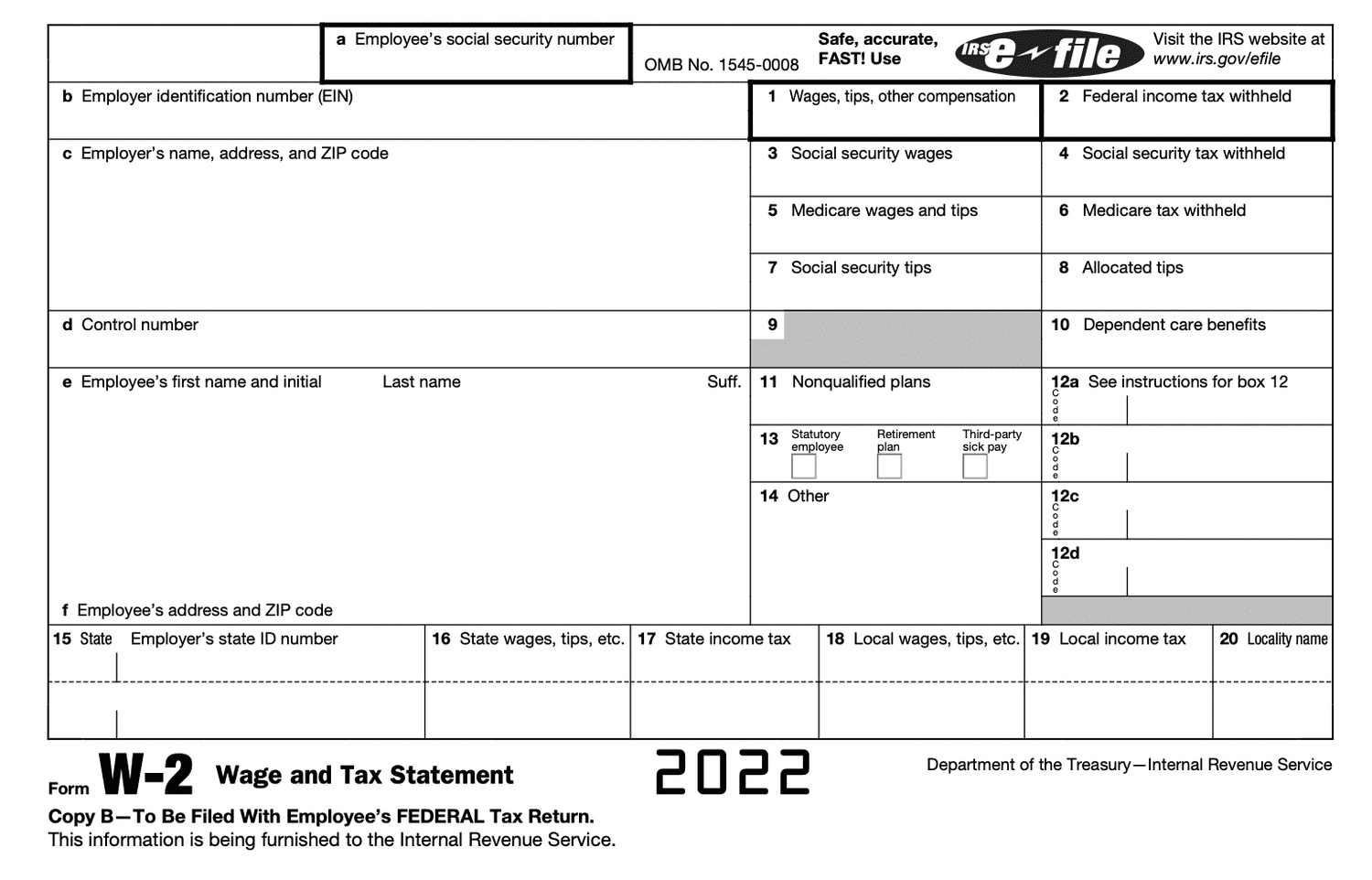

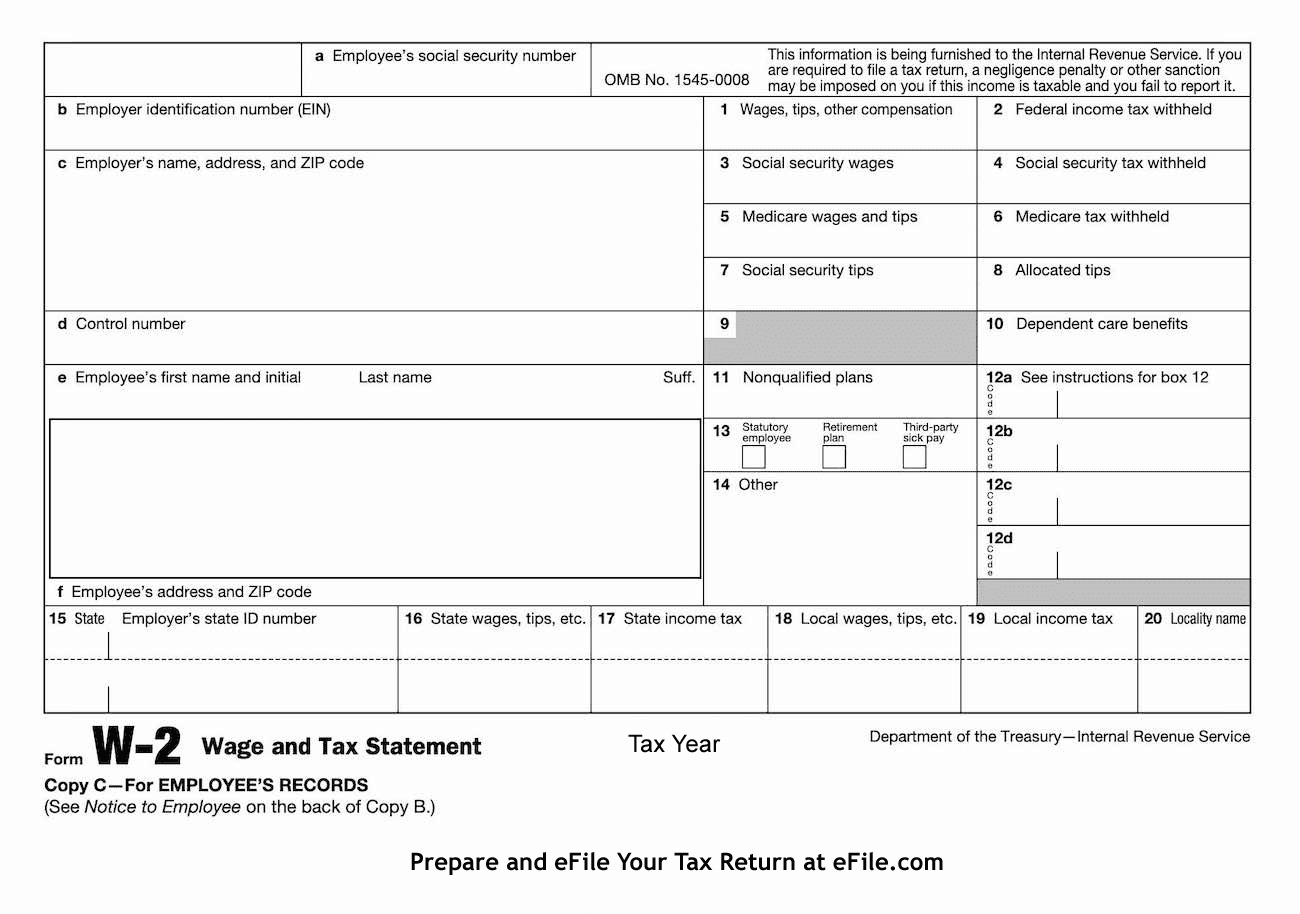

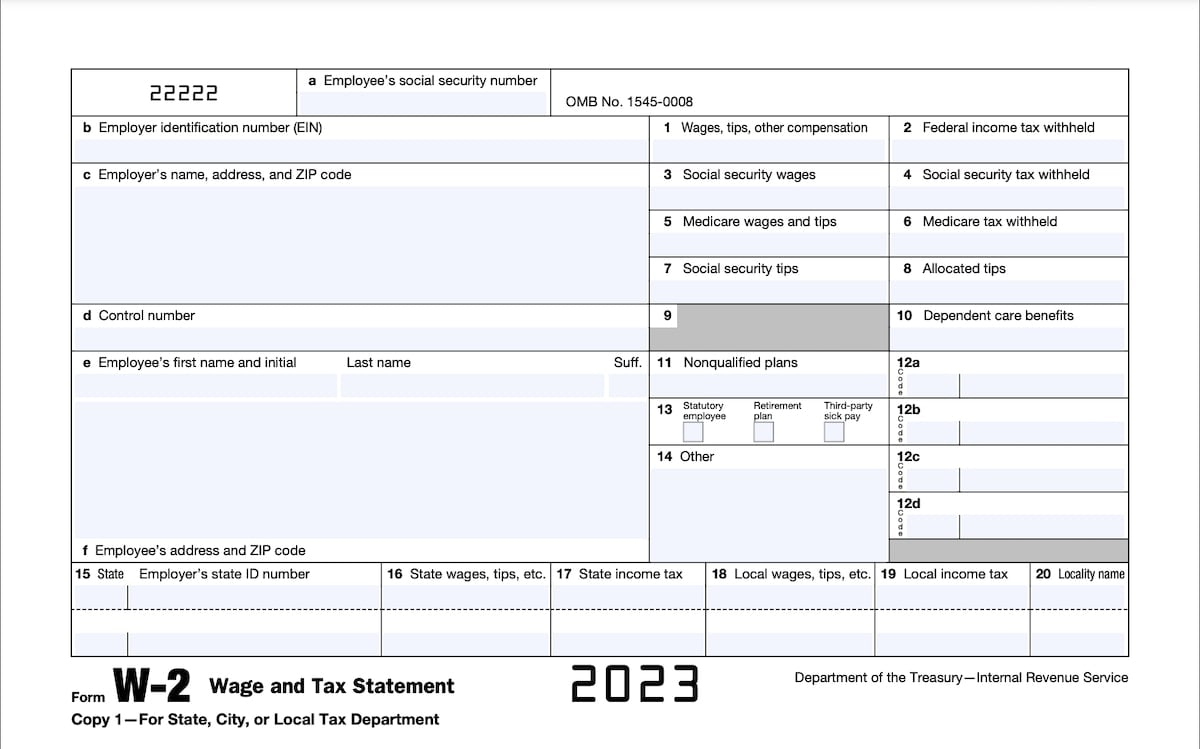

W2 Form Requirements – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Lowdown on W2 Fun: All You Need to Know!

Are you ready to embark on a journey into the exciting world of W2 forms? Buckle up and get ready to uncover some fascinating facts about everyone’s favorite tax document. From decoding the mysterious numbers to understanding the importance of this crucial piece of paperwork, we’ve got you covered. Let’s dive in and explore the lowdown on W2 fun!

Get Ready to Dive into W2 Fun Facts!

Ah, the W2 form – that magical piece of paper that arrives in your mailbox every January, signaling the start of tax season. But do you really know what all those boxes and numbers mean? Fear not, we’re here to break it down for you in a fun and easy-to-understand way. From learning how to read your W2 to discovering the significance of each section, get ready to become a W2 wizard in no time!

Did you know that your W2 form not only provides information about your wages and taxes withheld but also plays a crucial role in determining your tax refund or liability? That’s right – the numbers on your W2 can directly impact how much money you get back from the government or how much you owe. So, it’s essential to review your W2 carefully and make sure all the information is accurate. After all, who doesn’t love a bigger tax refund?

But wait, there’s more to the W2 than just numbers and figures. Your W2 also contains valuable information about your employer, such as their identification number and address. This information is essential for filing your taxes correctly and ensuring that everything is in order with the IRS. So, next time you receive your W2, take a moment to appreciate all the vital details it provides and the role it plays in your financial life. Who knew a simple form could hold so much power?

Unveiling the Secrets of W2 Forms!

Now that you’ve mastered the basics of W2 forms, it’s time to uncover some of the secrets hidden within this seemingly mundane document. Did you know that the information on your W2 is confidential and should be kept secure to protect your identity and prevent fraud? It’s crucial to treat your W2 with care and only share it with trusted individuals when necessary. After all, your financial information is precious and should be safeguarded at all costs.

Another interesting tidbit about W2 forms is that they come in multiple copies, each serving a different purpose. From the employee copy to the employer copy, each version is essential for various parties involved in the tax filing process. So, make sure to keep track of all your W2 copies and distribute them accordingly to ensure smooth sailing come tax time. Organization is key when it comes to handling your W2 forms like a pro!

Lastly, did you know that you can access your W2 online through your employer’s payroll system? Many companies now offer the option to view and download your W2 electronically, making it easier than ever to access this vital document. So, if you’re tired of waiting for snail mail to deliver your W2, be sure to check with your employer to see if online access is available. Say goodbye to paper clutter and hello to the convenience of digital W2 forms!

In conclusion, the world of W2 forms is full of surprises and valuable information just waiting to be discovered. From understanding the significance of each number to unraveling the secrets hidden within the document, there’s a lot more to W2 fun than meets the eye. So, the next time you receive your W2, take a moment to appreciate all the knowledge it contains and the role it plays in your financial journey. Who knew a tax form could be so fascinating? Get ready to embrace the W2 fun and become a tax-savvy superstar!

Below are some images related to W2 Form Requirements

w2 distribution requirements, w2 form requirements, w2 requirements, what documents are needed for a w2, , W2 Form Requirements.

w2 distribution requirements, w2 form requirements, w2 requirements, what documents are needed for a w2, , W2 Form Requirements.