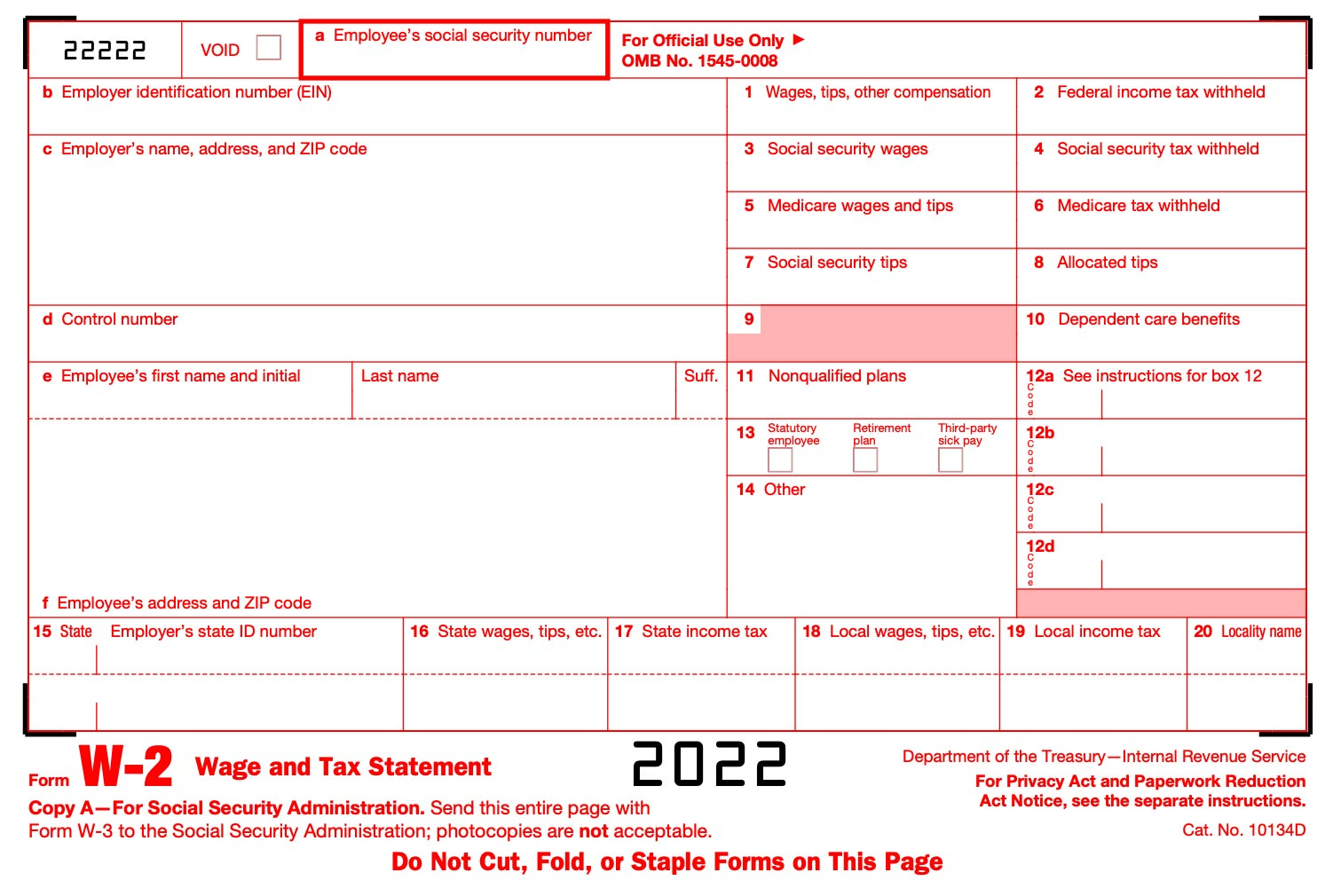

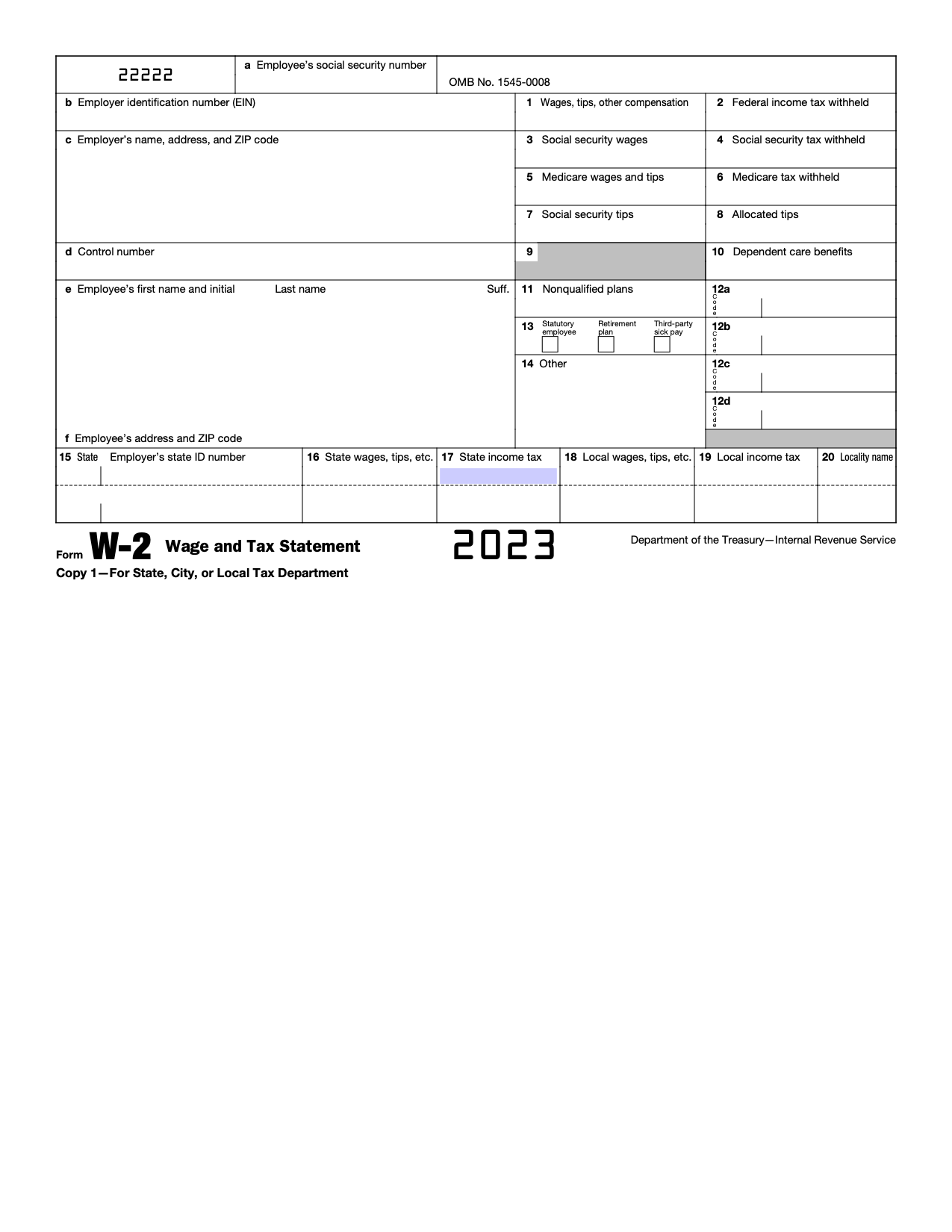

Fedex W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

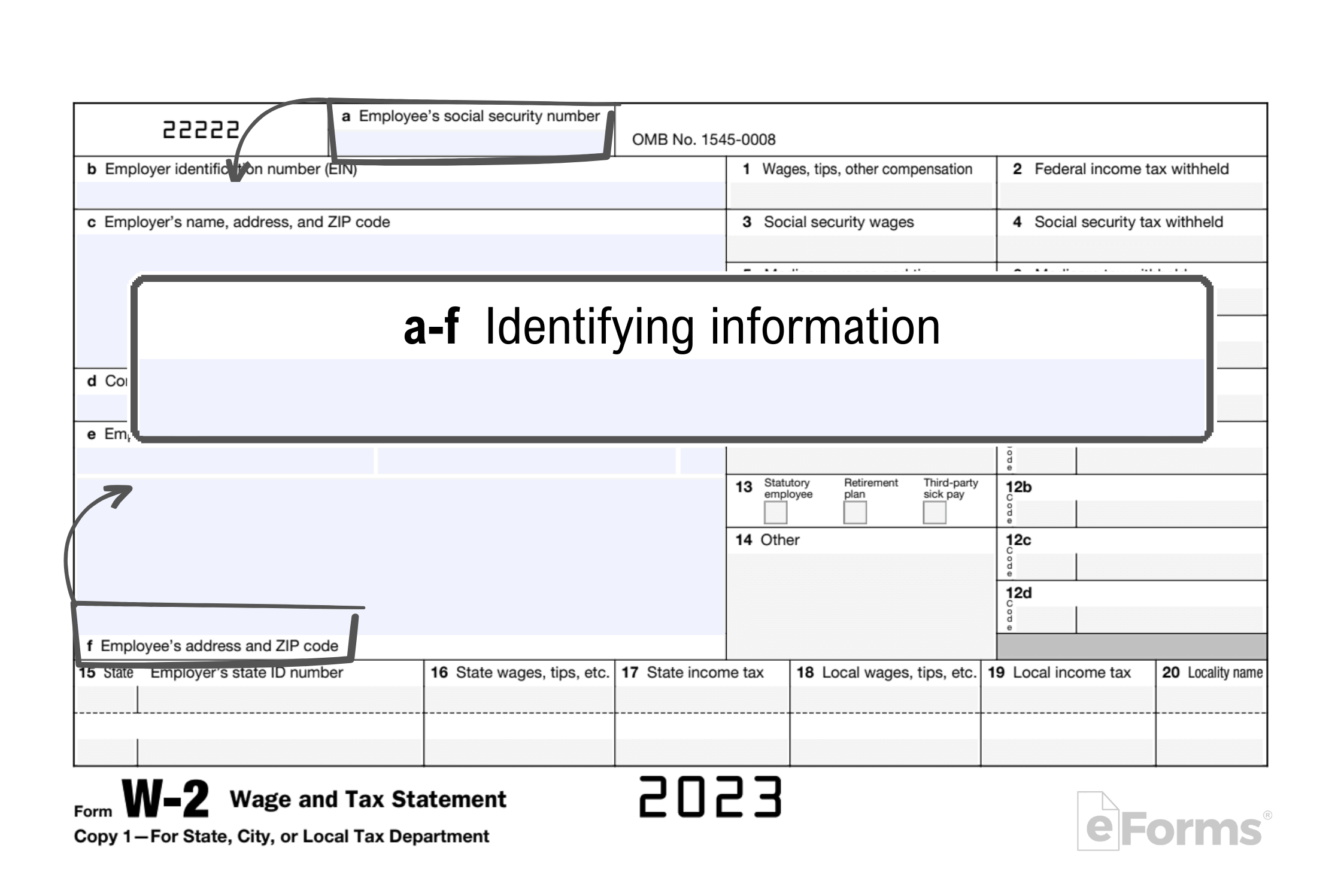

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping Your FedEx W2 Happiness

Are you ready to uncover the excitement hidden within that envelope from FedEx? It’s time to embrace the joy of tax season with your FedEx W2 form! As you eagerly tear open the package, you’re not just receiving a piece of paper – you’re unwrapping a symbol of your hard work and dedication throughout the year. Let’s dive into the thrill of unveiling your FedEx W2 happiness!

Unveiling Your Tax Season Delight

As you carefully unfold your FedEx W2 form, a sense of accomplishment washes over you. Each number and figure on the paper represents the hours you put in, the contributions you made, and the growth you achieved. It’s a tangible reminder of the effort you’ve invested in your job and the progress you’ve made professionally. With each line you read, you can’t help but feel proud of how far you’ve come and excited for the opportunities that lie ahead.

The numbers on your FedEx W2 form may seem daunting at first glance, but they hold the key to unlocking a world of possibilities. As you begin to decipher the information, you start to see the bigger picture – the impact of your hard work on your financial well-being. Whether it’s planning for future goals, budgeting for expenses, or simply understanding your overall financial situation, your FedEx W2 form is a valuable tool that can help you navigate the world of taxes and finances with confidence.

Embracing the Joy of Your FedEx W2 Form

With your FedEx W2 form in hand, you have the power to take control of your financial future and make informed decisions about your money. Whether you’re filing your taxes, setting financial goals, or simply reflecting on your achievements, your FedEx W2 form is a valuable resource that can guide you towards a brighter and more secure future. So go ahead, embrace the joy of your FedEx W2 form and let it be a beacon of happiness in the sometimes stressful world of taxes and finances.

In conclusion, unwrapping your FedEx W2 form is more than just a routine task – it’s an opportunity to celebrate your hard work, accomplishments, and potential for growth. So take a moment to revel in the joy of your FedEx W2 happiness and use it as a stepping stone towards a brighter and more prosperous future. Happy tax season!

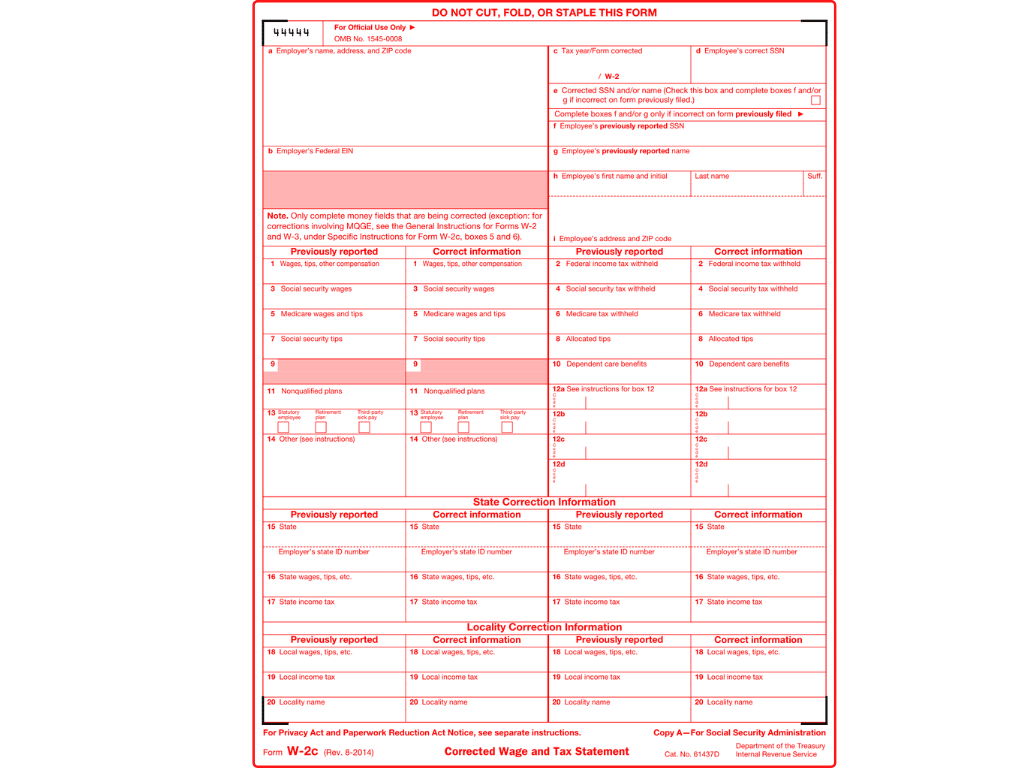

Below are some images related to Fedex W2 Forms

does fedex mail w2 forms, fedex w2 forms, fedex w2 online sign in, how can i get my fedex w2 online, how do i get my w2 from fedex, , Fedex W2 Forms.

does fedex mail w2 forms, fedex w2 forms, fedex w2 online sign in, how can i get my fedex w2 online, how do i get my w2 from fedex, , Fedex W2 Forms.