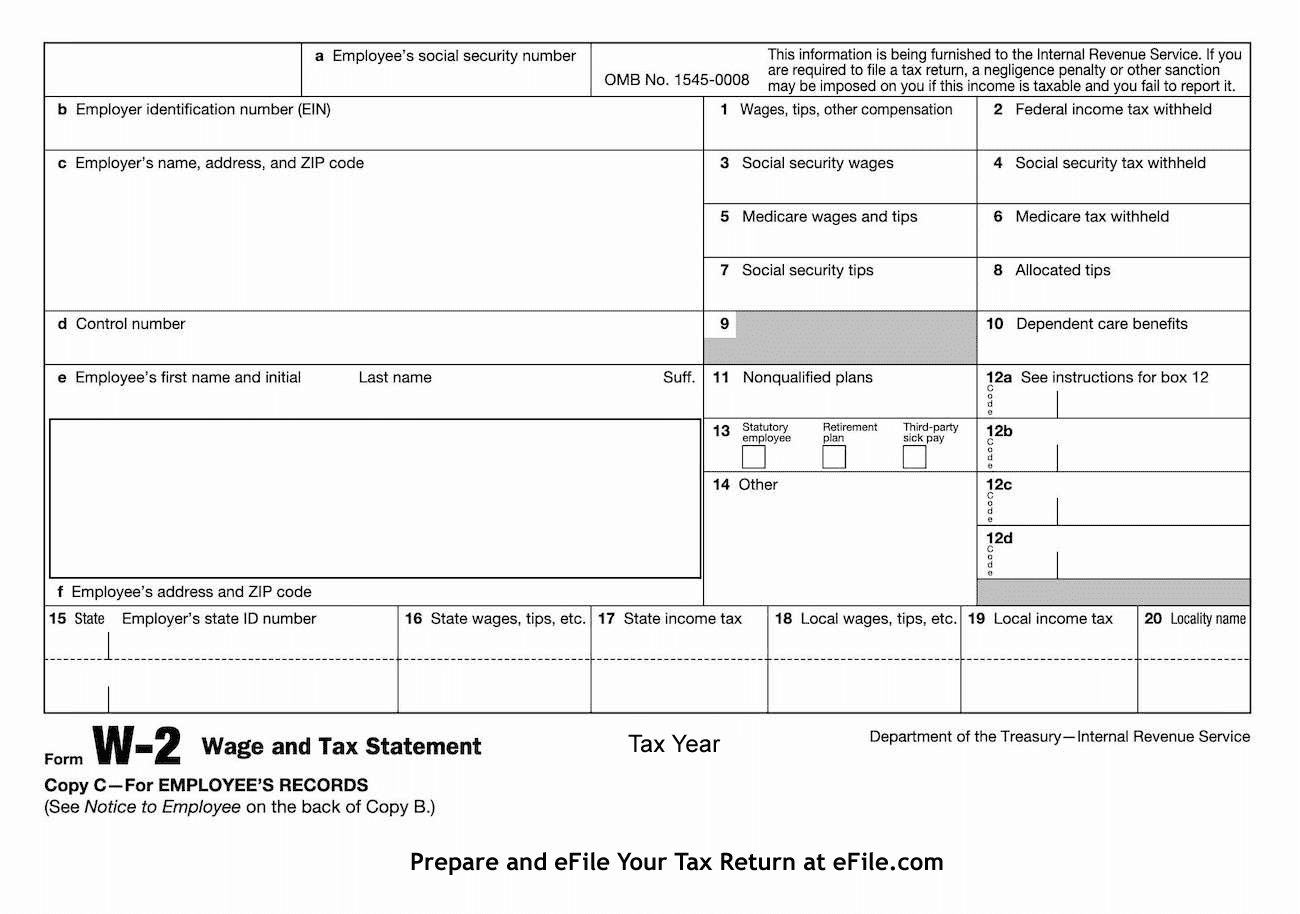

Can I File My Taxes Without My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Embrace the Unexpected: Filing Taxes sans W2 Form!

Tax time can be a daunting experience for many, but what happens when you realize you’ve misplaced your W2 form? While it may seem like a major setback, there’s no need to panic! Filing taxes without your W2 form is entirely possible and can even lead to some unexpected adventures along the way. So, take a deep breath, put on your explorer hat, and get ready to navigate the unknown with a touch of excitement!

Navigating the Unknown: Tips for Filing Without Your W2!

1. **Contact Your Employer:** The first step in filing your taxes without your W2 form is to reach out to your employer. They should be able to provide you with a copy or at least the information you need to fill out your tax return accurately. Don’t be afraid to ask for help – after all, it’s in their best interest for you to file your taxes correctly.

2. **Use Your Last Pay Stub:** If you’re unable to obtain a copy of your W2 form from your employer, don’t worry. You can use your last pay stub of the year to calculate your earnings and deductions. While this method may require some extra effort on your part, it can serve as a temporary solution until you receive your W2 form.

3. **File for an Extension:** If all else fails and you’re still unable to locate your W2 form, consider filing for an extension. This will give you more time to gather the necessary information and ensure that your tax return is accurate. Just remember to file for an extension before the tax deadline to avoid any penalties or fees.

In conclusion, while filing taxes without your W2 form may seem like a daunting task, it’s important to stay calm and approach the situation with a sense of adventure. By following these tips and taking the necessary steps, you can successfully navigate the unknown and complete your tax return with confidence. So, embrace the unexpected, take on the challenge, and let your tax time adventures begin!

Below are some images related to Can I File My Taxes Without My W2 Form

can i file back taxes without w2, can i file my taxes without my w2 form, can i file taxes without w-2, can you do your taxes without a w2 form, how can i file taxes if i lost my w2, , Can I File My Taxes Without My W2 Form.

can i file back taxes without w2, can i file my taxes without my w2 form, can i file taxes without w-2, can you do your taxes without a w2 form, how can i file taxes if i lost my w2, , Can I File My Taxes Without My W2 Form.