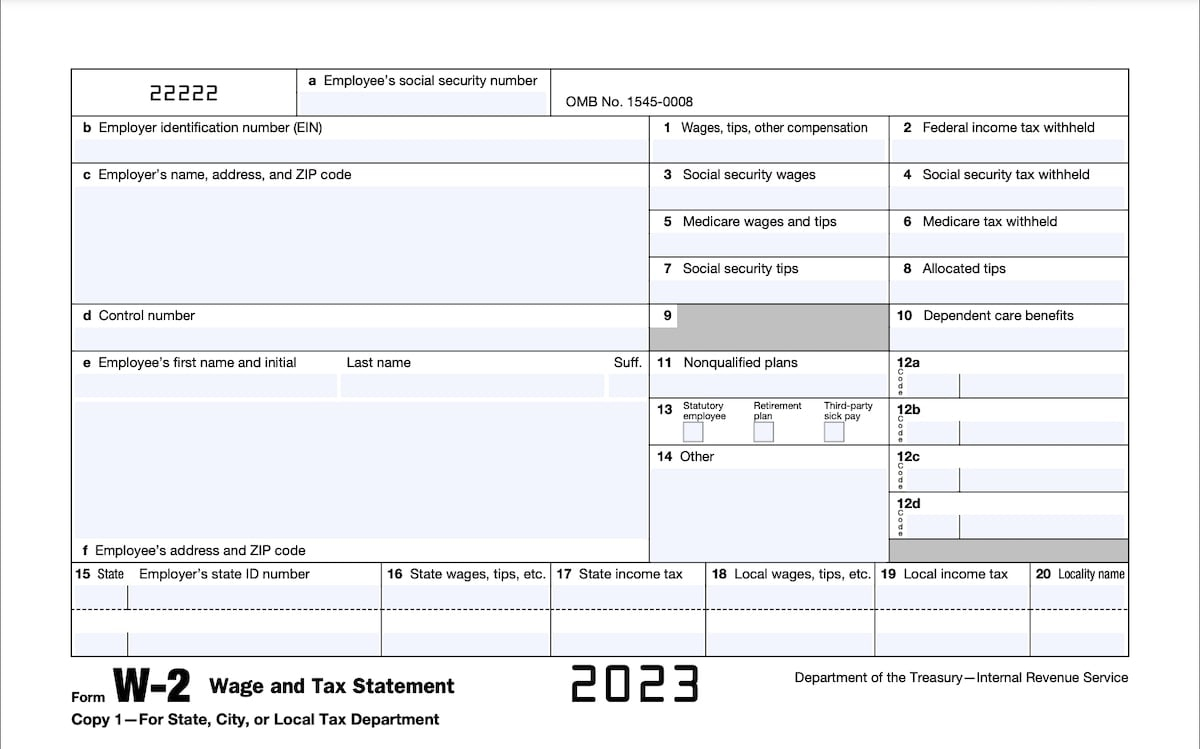

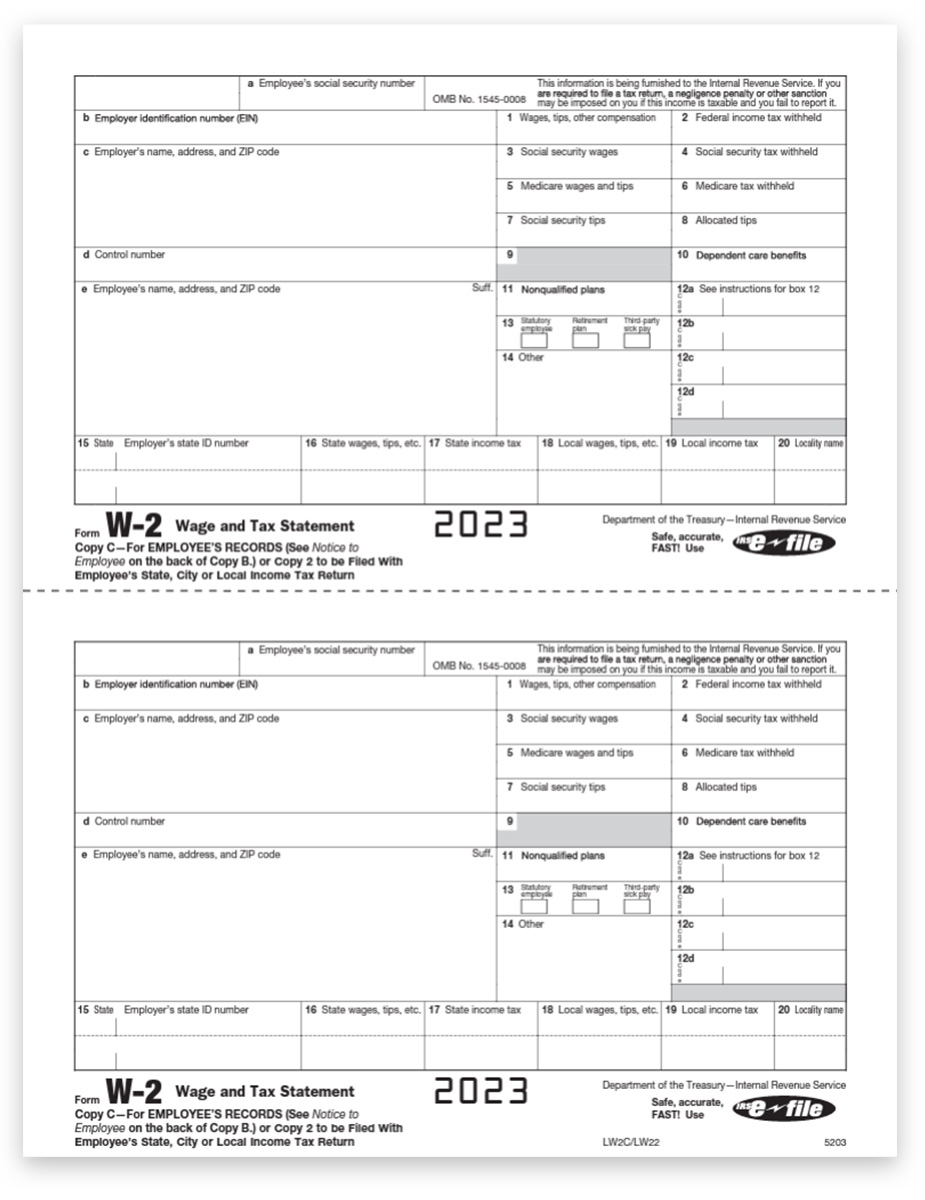

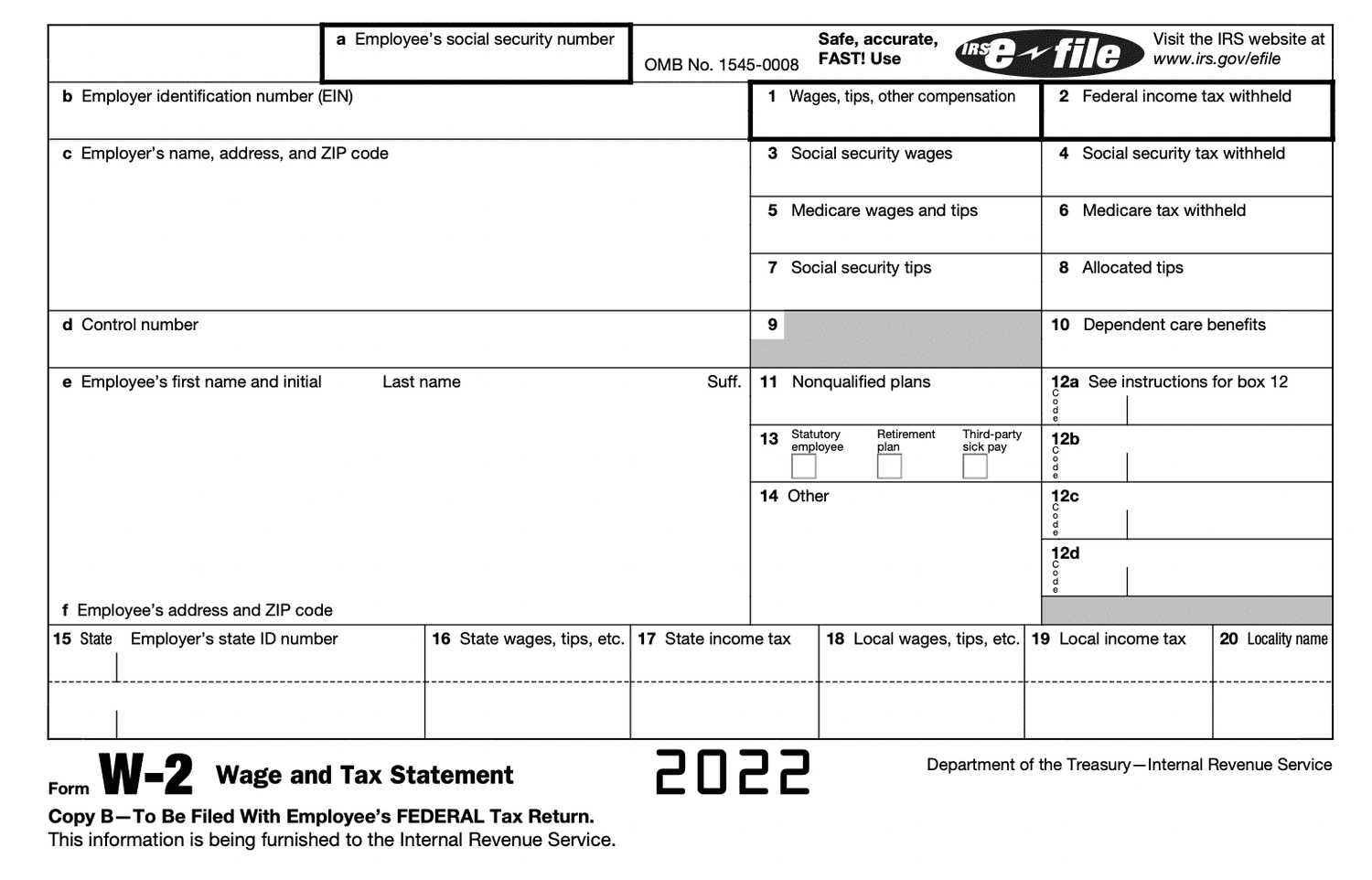

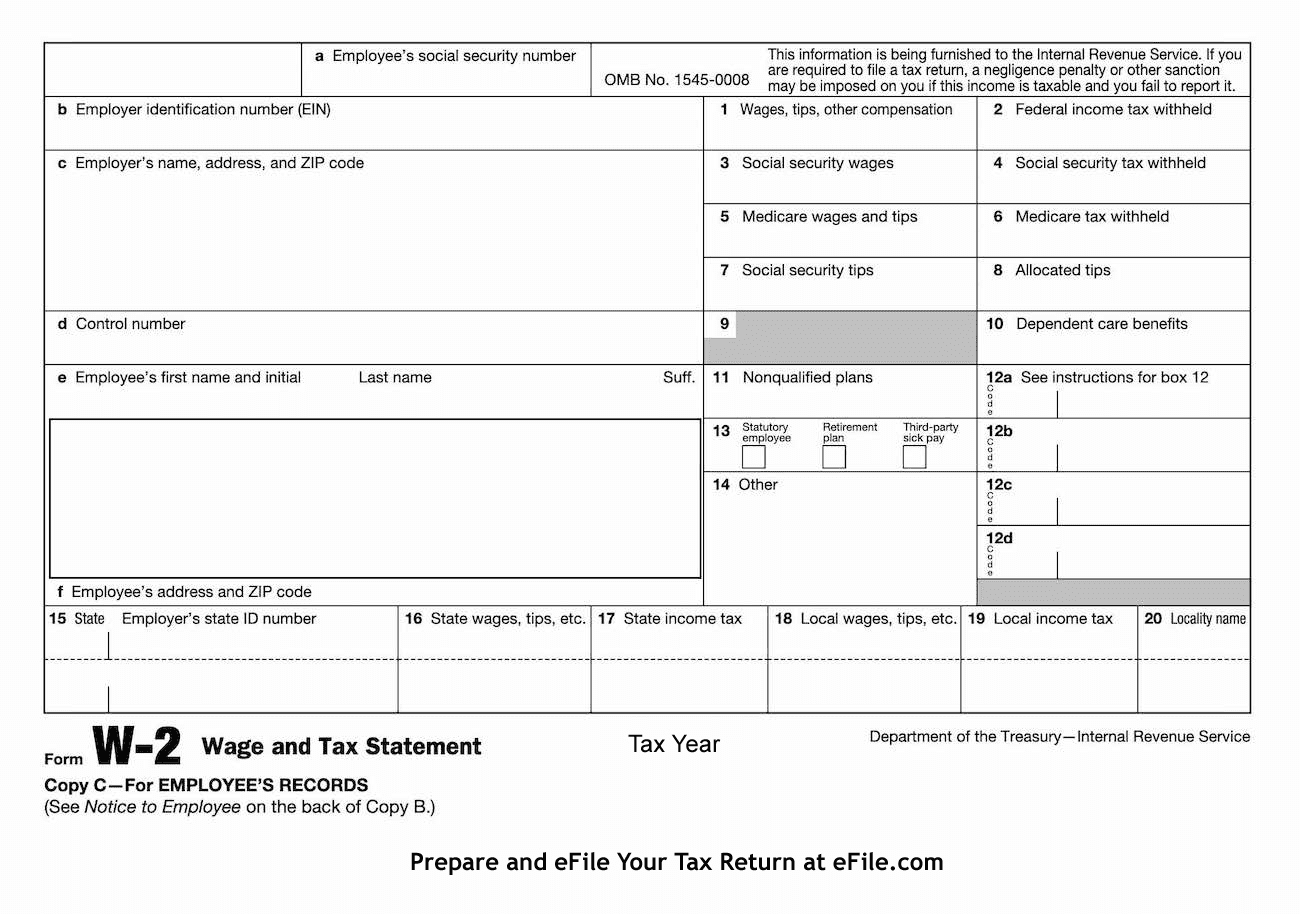

W2 Forms For New Employees – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Let’s Get Started: Understanding W2 Forms for New Hires

Welcome to the team! As a new hire, one of the first things you’ll encounter is your W2 form. While it may seem confusing at first, understanding this essential document is crucial for your financial well-being. The W2 form is a summary of your earnings and taxes withheld by your employer throughout the year. It provides all the information you need to file your taxes accurately and efficiently. So, let’s dive in and demystify the world of W2 forms!

When you receive your W2 form, the first thing you’ll notice is your personal information, including your name, address, and social security number. Make sure all the details are correct to avoid any discrepancies when filing your taxes. Next, you’ll find your total wages earned for the year in box 1. This includes your regular salary, bonuses, and any other income earned through your employer. It’s essential to double-check this information to ensure accuracy.

Moving on, you’ll see the taxes withheld from your paycheck throughout the year in boxes 2-6. These include federal income tax, Social Security tax, Medicare tax, and any state and local taxes. Understanding these deductions is crucial as they determine how much you may owe or get refunded when you file your taxes. By familiarizing yourself with these numbers, you’ll be better equipped to handle your finances and plan for the upcoming tax season.

Navigating Your W2: A Step-by-Step Guide for Team Members

Now that you have a basic understanding of your W2 form let’s navigate through it step by step. Start by reviewing boxes 12-14, which list any additional compensation or benefits provided by your employer, such as health insurance premiums, retirement contributions, or other perks. These amounts may impact your taxable income, so it’s essential to take note of them.

Next, check box 17 to see if you participated in any employer-sponsored retirement plans, such as a 401(k) or IRA. Contributions to these plans are tax-deferred, meaning they reduce your taxable income for the year. Understanding how these contributions impact your taxes can help you maximize your savings and plan for retirement effectively.

Lastly, review box 13 to see if you received any third-party sick pay or other benefits throughout the year. These amounts are typically taxable and should be included in your total income when filing your taxes. By thoroughly examining each section of your W2 form, you’ll be better equipped to manage your finances and make informed decisions regarding your taxes.

In conclusion, the W2 form is a vital document that every new hire should understand. By familiarizing yourself with its contents and implications, you’ll be better prepared to navigate the world of taxes and financial planning. Remember, if you have any questions or need assistance with your W2 form, don’t hesitate to reach out to your employer or a tax professional. Welcome to the team, and happy tax season!

Below are some images related to W2 Forms For New Employees

do employers have to mail w2 forms to employees, how do employers get w2 forms, printable w2 form for new employee, w2 form for employees 2023, w2 form for new hire, , W2 Forms For New Employees.

do employers have to mail w2 forms to employees, how do employers get w2 forms, printable w2 form for new employee, w2 form for employees 2023, w2 form for new hire, , W2 Forms For New Employees.