How To Fill Out W2 Form If Single – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Inner Tax Pro: Mastering the W2 Form

So, you’re single and ready to file your taxes – but where do you even start? Fear not, my friend, for the W2 form is here to save the day! This seemingly daunting piece of paper is actually your ticket to getting that sweet tax refund. With a little guidance and some know-how, you’ll be filling out your W2 form like a pro in no time.

First things first, let’s break down what exactly a W2 form is. Essentially, it’s a document that your employer provides you with at the end of the year, detailing your earnings and taxes withheld throughout the year. This information is crucial for accurately filing your taxes and ensuring you get the refund you deserve. So, grab your W2 form and let’s dive into the wonderful world of tax filing!

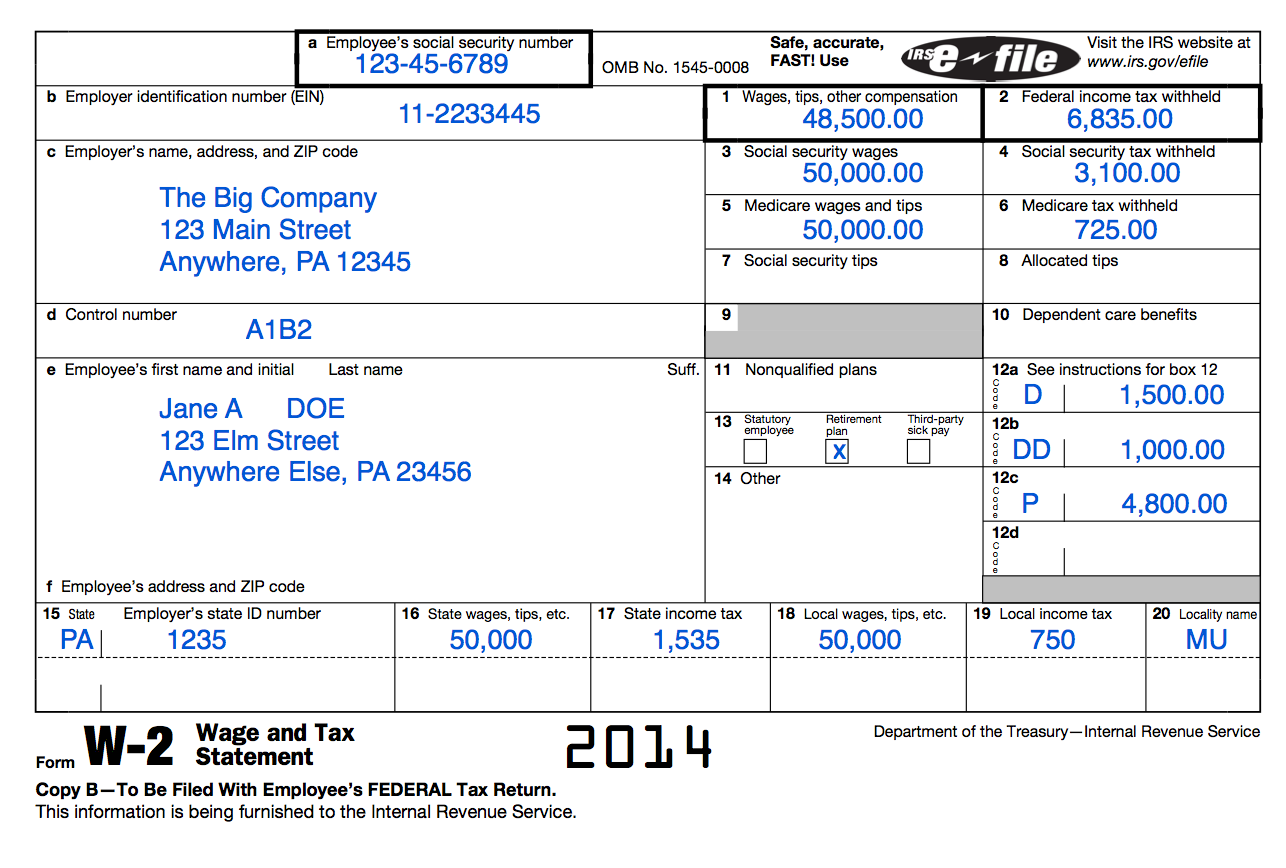

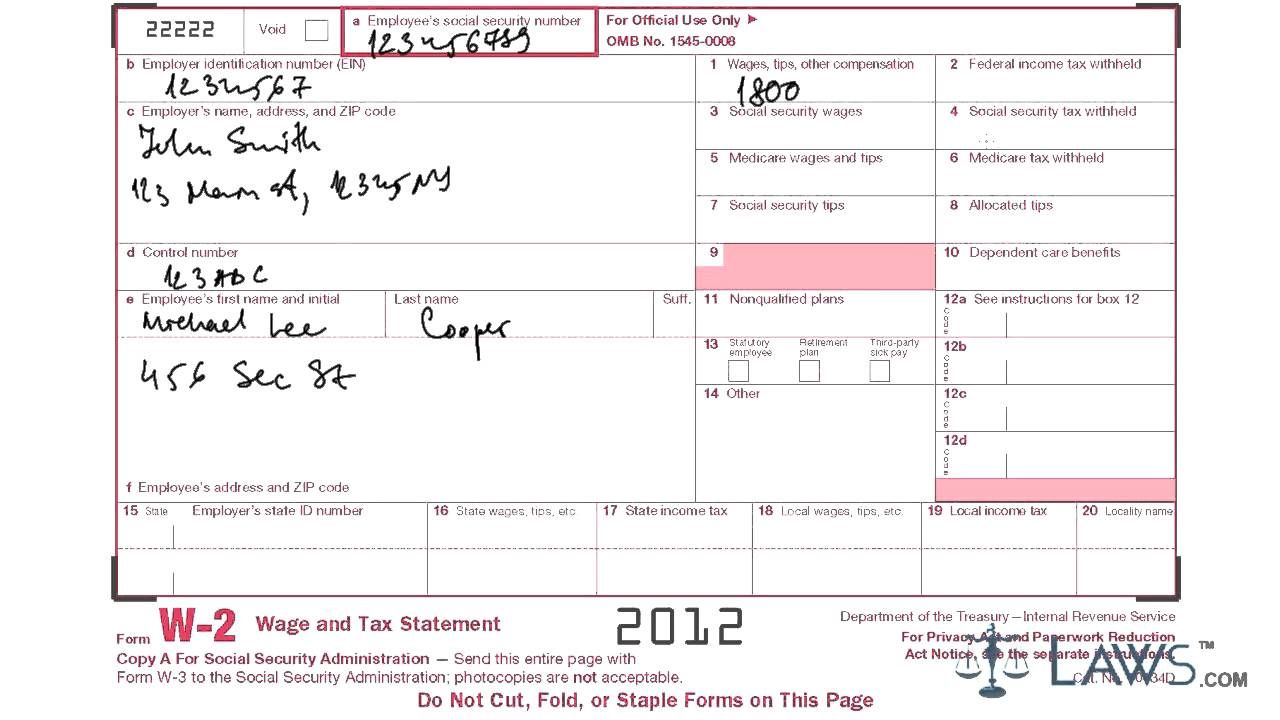

Now that you’ve got your W2 form in hand, it’s time to start filling in those juicy details. The first section of the form will ask for basic information such as your name, address, and social security number. Make sure to double-check all of this information for accuracy – you wouldn’t want any typos causing unnecessary delays in your tax refund. Once you’ve got the basics down, it’s time to move on to the real meat of the form – your earnings and taxes withheld. Don’t worry, it may seem overwhelming at first, but with a little patience and attention to detail, you’ll have this section filled out in no time.

Singledom Simplified: A Step-by-Step Guide to Filing Out Your W2 Form

Now that you’ve conquered the basics, it’s time to get into the nitty-gritty details of your W2 form. The next section will ask for information on your wages, tips, and other compensation. This is where you’ll report your earnings for the year, so make sure to gather all of your pay stubs and records to ensure accuracy. Remember, the more accurate your information, the better chance you have of maximizing your tax refund.

Once you’ve tackled the earnings section, it’s time to move on to the taxes withheld section. Here, you’ll report the federal, state, and local taxes that have been withheld from your pay throughout the year. This information is crucial for determining whether you owe additional taxes or are entitled to a refund. Be sure to carefully review this section and ensure that all numbers are correct before submitting your W2 form.

Congratulations, you’ve made it through the W2 form maze! With your form filled out and ready to go, all that’s left to do is submit it along with your tax return. Remember, the key to a successful tax filing is accuracy and attention to detail, so don’t rush through this process. Take your time, double-check your work, and before you know it, you’ll be on your way to a stress-free tax season. Single and ready to file? More like single and slaying the tax game!

Below are some images related to How To Fill Out W2 Form If Single

how should a single person fill out a w2, how to fill out a w2 single with one dependent, how to fill out w-2 form when single, how to fill out w2 form if single, how to fill out w2 form if single with one child, , How To Fill Out W2 Form If Single.

how should a single person fill out a w2, how to fill out a w2 single with one dependent, how to fill out w-2 form when single, how to fill out w2 form if single, how to fill out w2 form if single with one child, , How To Fill Out W2 Form If Single.