Box D W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of Box D on Your W2 Form

If you’ve ever received a W2 form at the end of the year, you may have noticed a mysterious box labeled Box D. While it may seem like just another mundane part of your tax paperwork, Box D actually holds a magical secret waiting to be discovered. In this article, we will take you on a whimsical journey as we explore the enchantment of Box D and unlock its hidden treasures.

Discover the Enchantment of Box D on Your W2 Form

As you gaze upon your W2 form, your eyes may be drawn to the intriguing Box D nestled among the other boxes of numbers and codes. What could this mystical box possibly contain? Well, prepare to be dazzled, because Box D is where the magic of your dependent care benefits shines through. If your employer provides you with dependent care assistance, the amount they contribute will be listed in this enchanted box. It’s like discovering a hidden gem in a treasure chest!

But the magic doesn’t stop there. The amount listed in Box D is not just for show – it can actually work wonders for your taxes. By including this amount in your tax calculations, you may be able to reduce your taxable income and potentially lower your tax bill. It’s like having a fairy godmother granting your tax wishes and making tax season a little less stressful. So, don’t overlook the power of Box D – it may just be the key to unlocking a tax-saving spell.

Unlocking the Secrets of Box D: A Magical Journey

Now that you understand the enchantment of Box D, it’s time to embark on a magical journey to unlock its secrets. By taking a closer look at the amount listed in this box and understanding how it can impact your taxes, you can make the most of this hidden treasure. Whether you’re new to the world of tax forms or a seasoned pro, exploring the wonders of Box D can help you navigate the tax landscape with confidence and charm.

In conclusion, don’t underestimate the magic of Box D on your W2 form. This seemingly ordinary box holds the key to unlocking tax-saving opportunities and making your tax season a little more enchanting. So, the next time you receive your W2 form, be sure to give Box D the attention it deserves. Who knows – it may just sprinkle a little tax magic into your life.

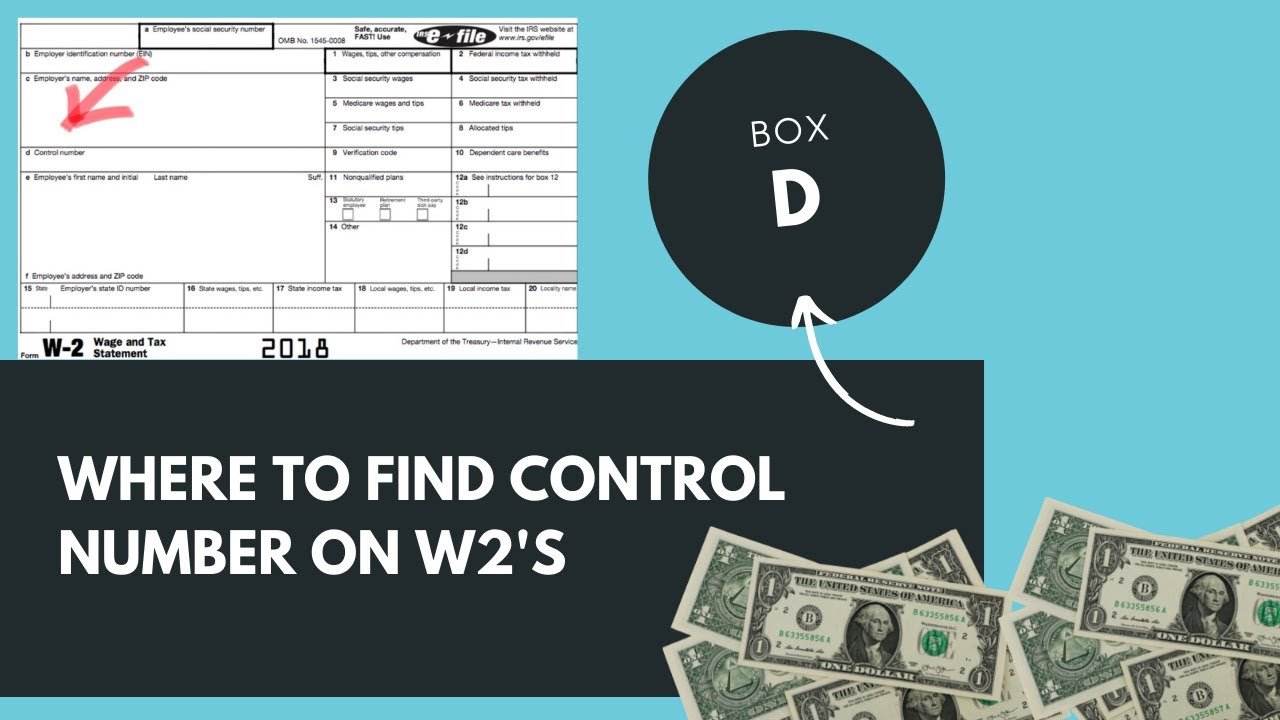

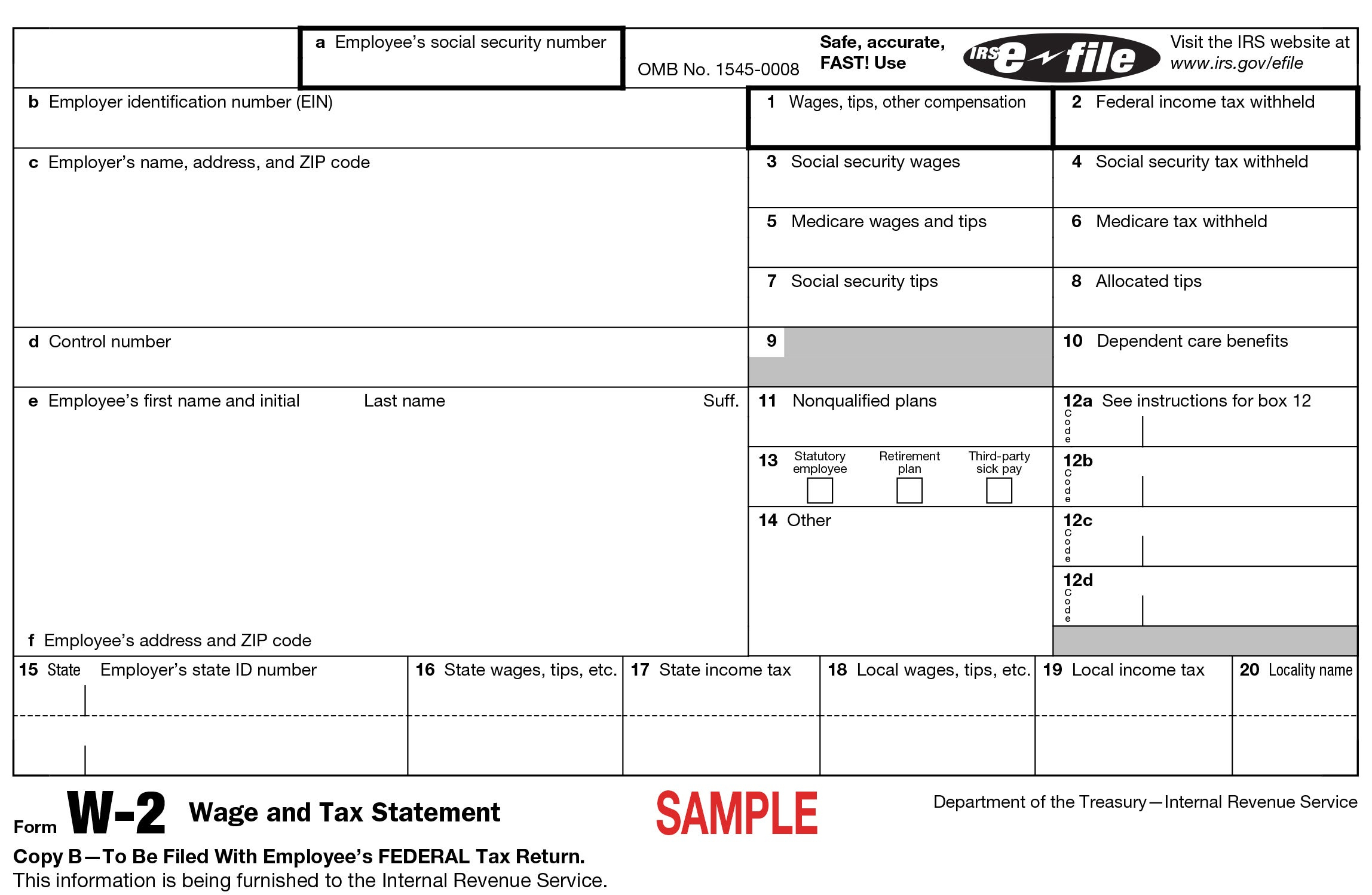

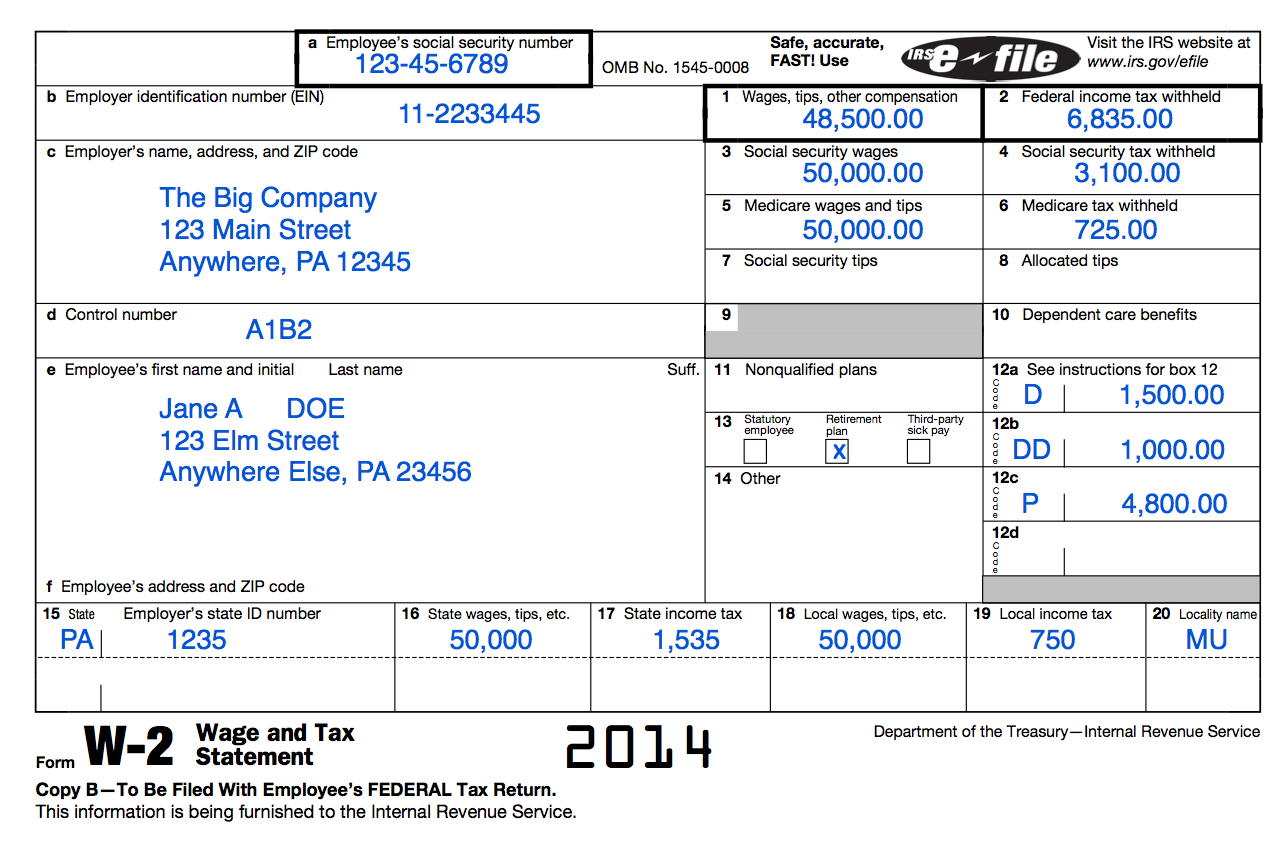

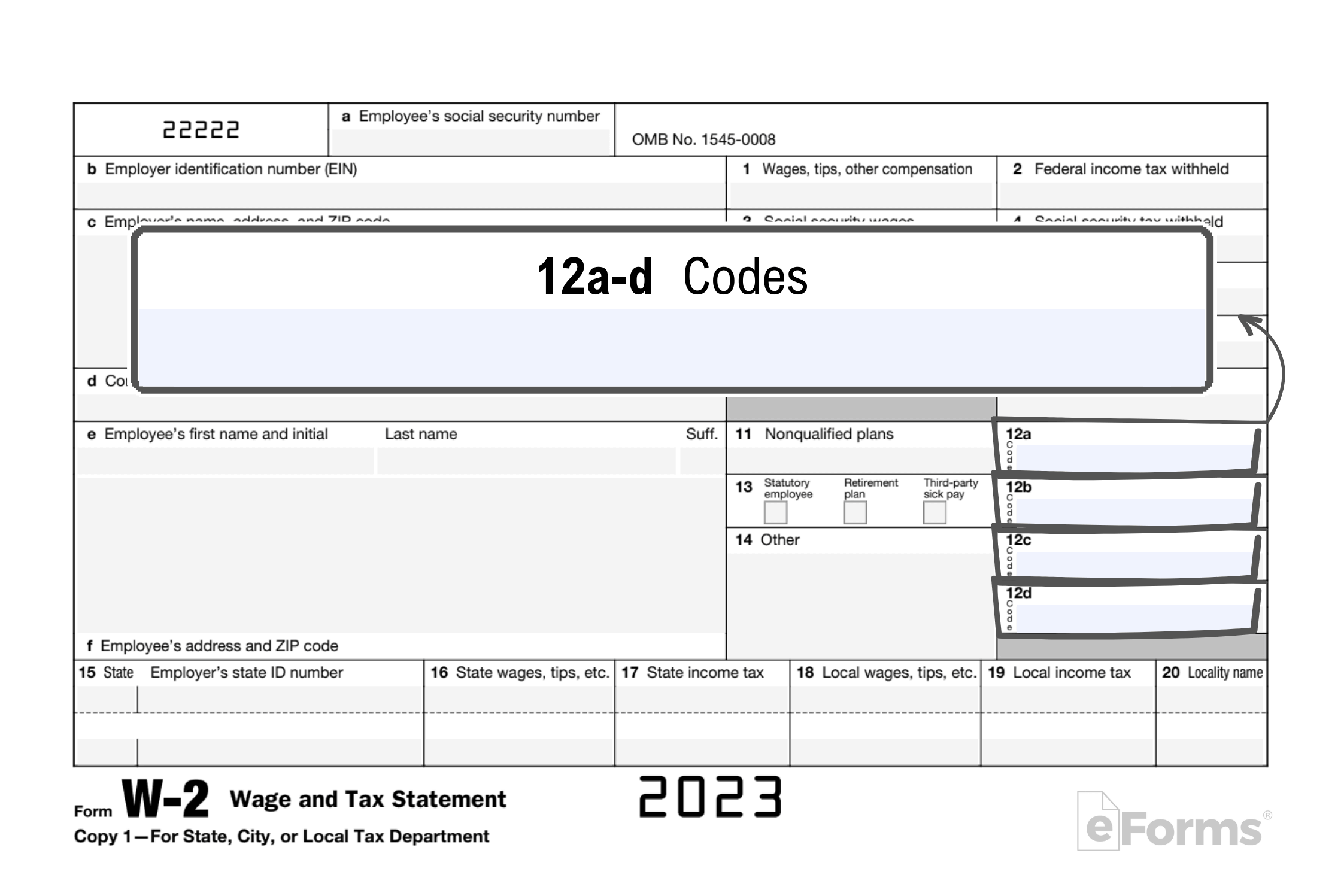

Below are some images related to Box D W2 Form

box 12 d on w2 form, box d on w2 form 2021, box d w2 form, what is box d and dd on w2, what is box d on w2, , Box D W2 Form.

box 12 d on w2 form, box d on w2 form 2021, box d w2 form, what is box d and dd on w2, what is box d on w2, , Box D W2 Form.