Form W2 Box 12 Code W – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

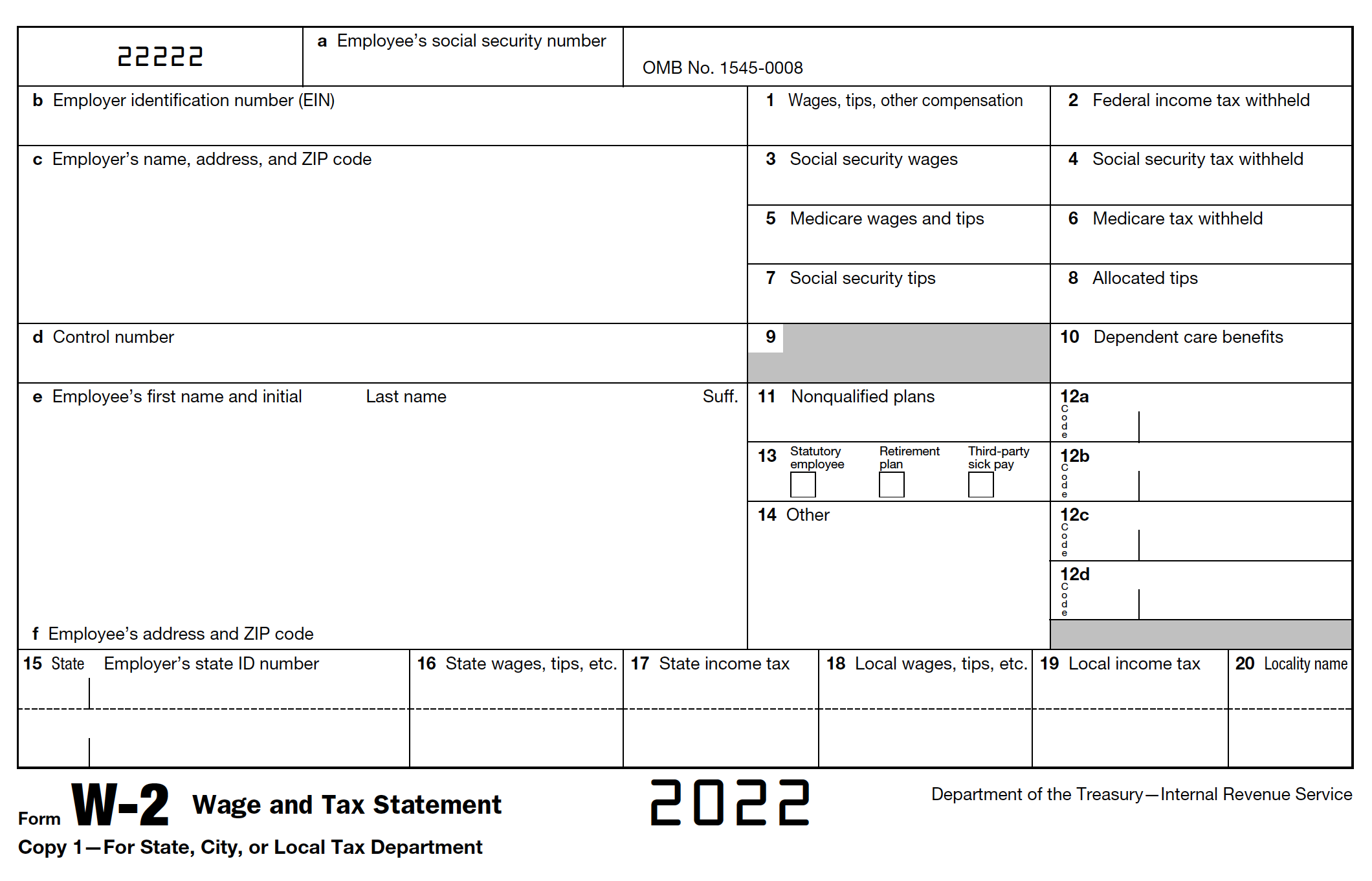

Unwrapping the Magic of Form W2 Box 12 Code W!

Have you ever received your W2 form and been puzzled by the various codes and numbers listed on it? Fear not, for we are here to unravel the mystery behind one of the most magical codes of all – Box 12 Code W! This seemingly cryptic code holds a special significance, and once you understand its enchanting powers, you’ll be amazed at the hidden treasures it reveals.

Unveiling the Mystery

Box 12 Code W on your W2 form indicates the amount of employer contributions to your Health Savings Account (HSA). This magical code allows you to see just how much your employer has contributed towards your healthcare expenses, giving you a clear picture of the benefits you receive beyond your regular salary. By decoding this code, you can better understand the value of your HSA and appreciate the investment your employer is making in your well-being.

Delving into the Enchantment

The enchantment of Box 12 Code W doesn’t stop at just showing you the employer contributions to your HSA. It also has the power to help you maximize your healthcare savings and plan for future expenses. By taking a closer look at this code, you can determine if you are making the most of your HSA benefits and make informed decisions about your healthcare spending. With a little bit of magic and a dash of financial savvy, you can unlock the full potential of Box 12 Code W and make the most of your employer-provided healthcare benefits.

In conclusion, Box 12 Code W on your W2 form is not just a random assortment of letters and numbers – it’s a magical key that unlocks a world of insight into your employer-provided healthcare benefits. By understanding the significance of this code, you can take control of your healthcare savings, plan for future expenses, and appreciate the investment your employer is making in your well-being. So embrace the magic of Box 12 Code W and let it guide you towards a brighter, healthier future!

Below are some images related to Form W2 Box 12 Code W

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] with regard to Form W2 Box 12 Code W](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-with-regard-to-form-w2-box-12-code-w.jpg)

form w-2 box 12a code w, form w-2 line 12 code w, form w2 box 12 code w, irs form w-2 box 12 code w, is w2 box 12 code w taxable, , Form W2 Box 12 Code W.

form w-2 box 12a code w, form w-2 line 12 code w, form w2 box 12 code w, irs form w-2 box 12 code w, is w2 box 12 code w taxable, , Form W2 Box 12 Code W.