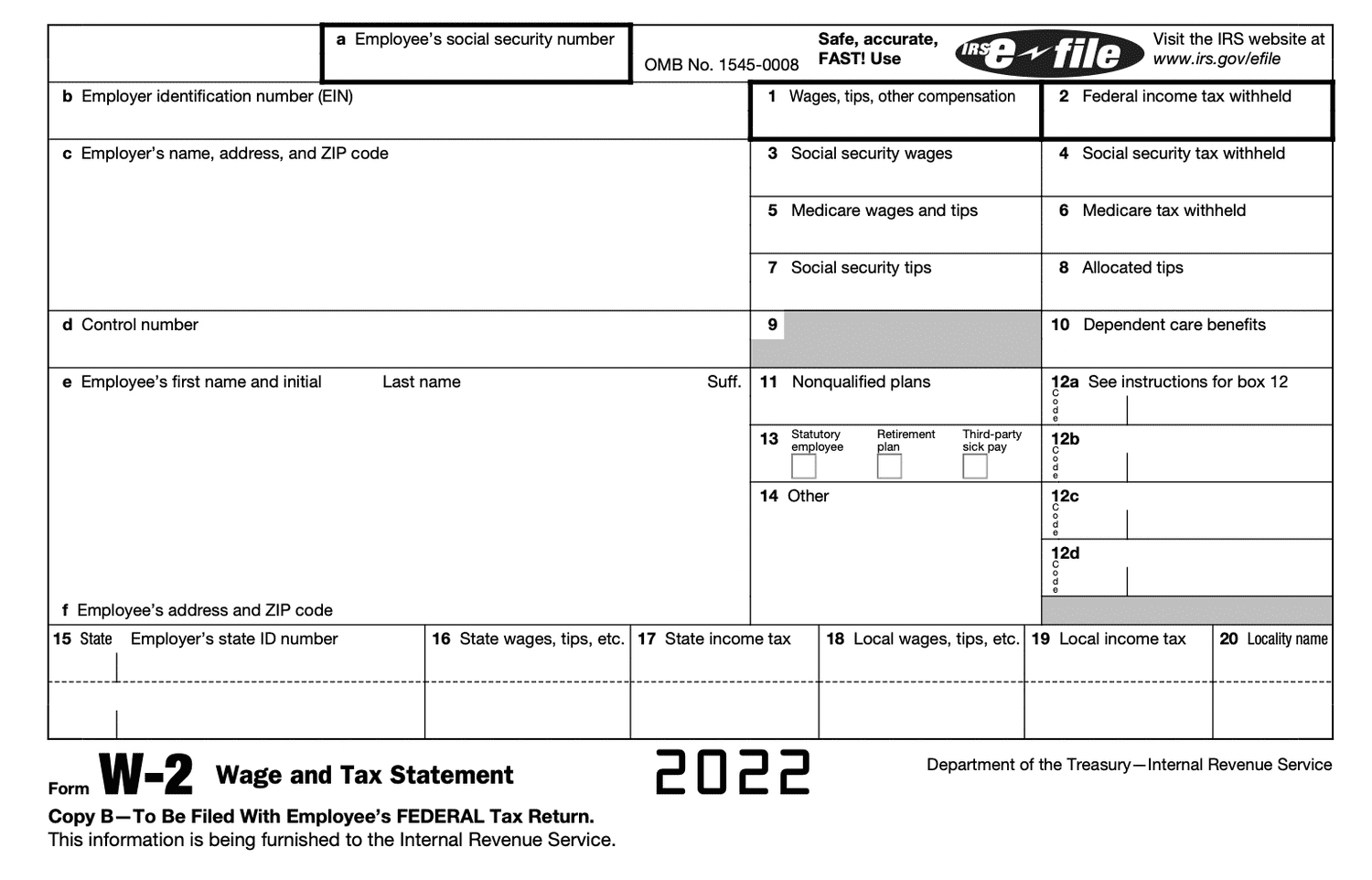

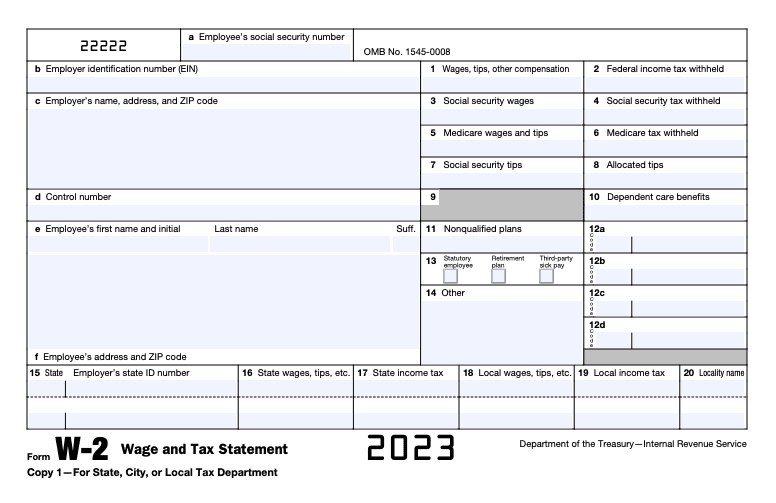

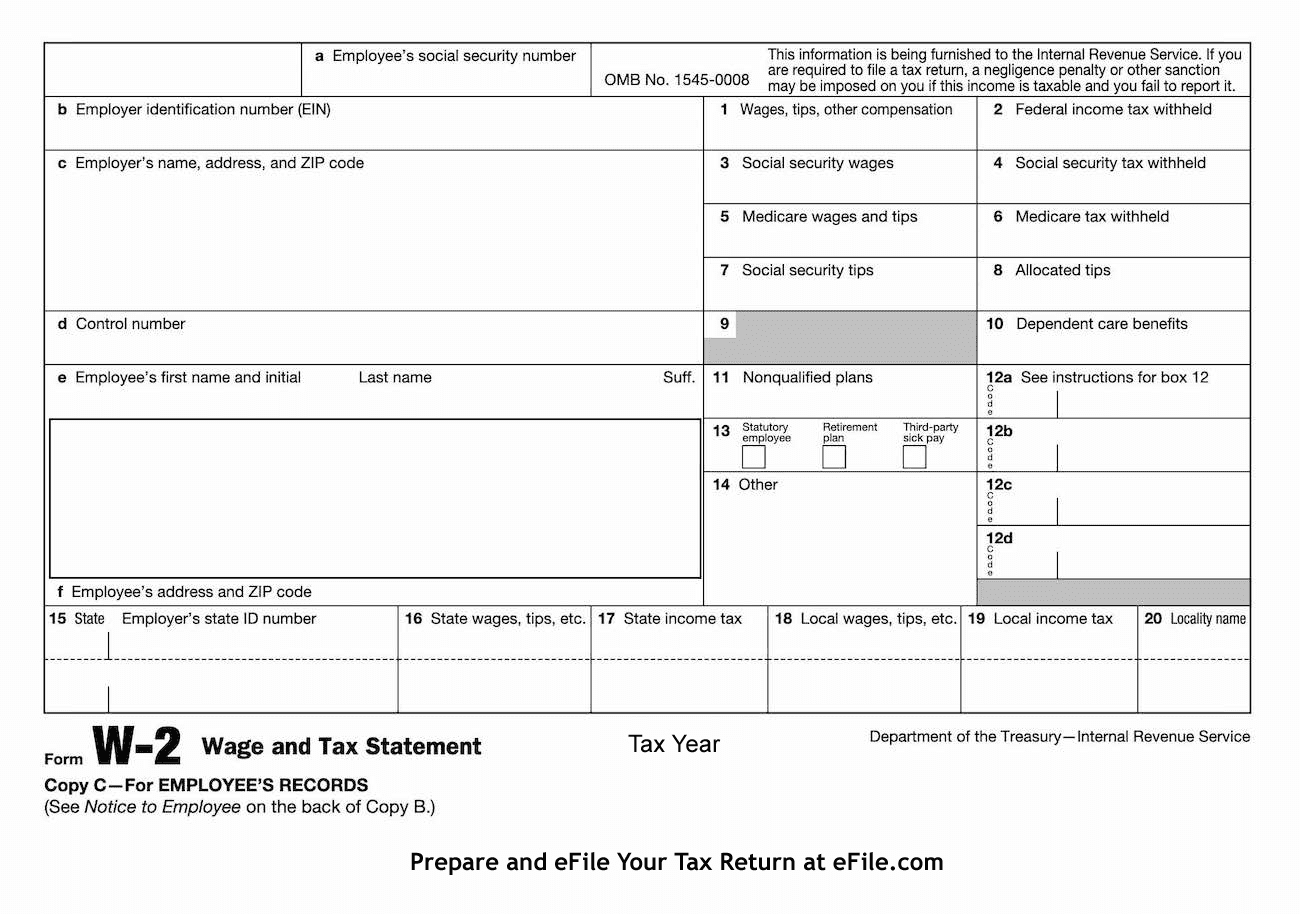

I Got 2 W2 Forms From The Same Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

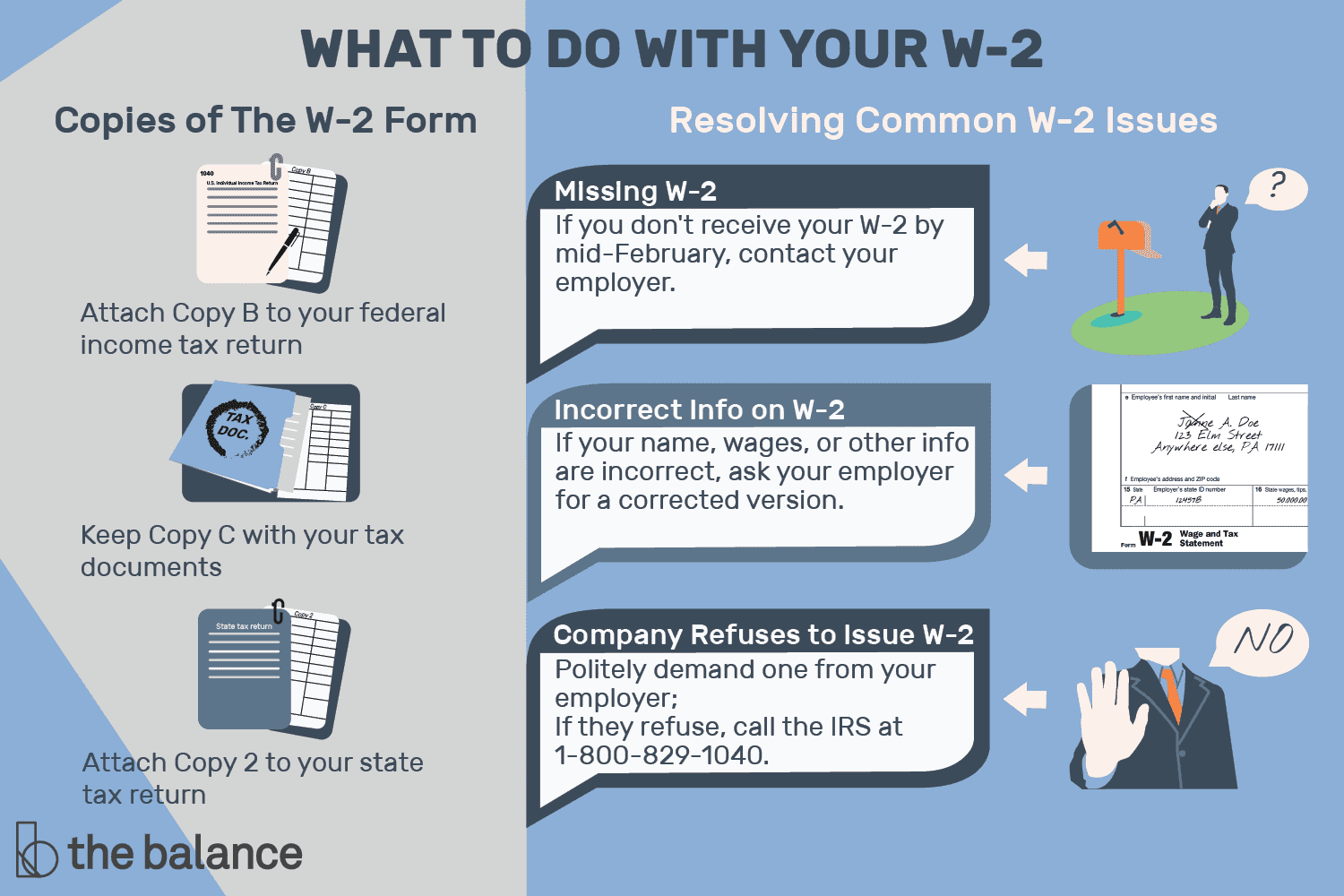

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Excitement: Receiving 2 W2 Forms from One Employer!

Have you ever received not one, but two W2 forms from your employer? It may seem like a mistake at first, but fear not – this unexpected surprise can actually be quite beneficial! Instead of dreading tax season, why not double the excitement by receiving two W2 forms from one employer?

If you find yourself in this unique situation, consider yourself lucky! Getting two W2 forms from one employer means you may have worked in different departments or locations throughout the year. This can provide you with a more comprehensive picture of your earnings and tax withholdings, which can ultimately benefit you when filing your taxes. So, instead of seeing it as a hassle, see it as a golden opportunity to maximize your tax benefits and potentially increase your tax refund!

Not to mention, having two W2 forms can also give you a better understanding of your career growth within the company. It can show that you have taken on additional responsibilities or worked extra hours, which could potentially lead to a promotion or raise in the future. So, embrace the double dose of W2 forms and see it as a reflection of your hard work and dedication in the workplace!

Double the Benefits: How to Make the Most of 2 W2 Forms!

Now that you have two W2 forms in hand, it’s time to make the most of this unexpected windfall. Start by carefully reviewing both forms to ensure all the information is accurate and matches your records. If you notice any discrepancies or errors, be sure to contact your employer immediately to get them corrected.

Next, take advantage of having two W2 forms by comparing your earnings, tax withholdings, and deductions from both forms. This can help you identify any potential tax savings or credits you may be eligible for. Additionally, consider consulting with a tax professional to ensure you are maximizing your tax benefits and minimizing your tax liability.

Lastly, use this opportunity to set financial goals for the upcoming year. Whether it’s saving for a big purchase, paying off debt, or investing in your future, having a clear understanding of your earnings and tax situation can help you make informed financial decisions moving forward. So, embrace the double the fun of having two W2 forms and use it as a stepping stone towards achieving your financial goals!

In conclusion, receiving two W2 forms from one employer may initially seem like a surprise, but it can actually provide you with a range of benefits and opportunities. From gaining a more comprehensive view of your earnings and tax withholdings to potentially identifying tax savings and credits, having two W2 forms can be a valuable asset during tax season. So, embrace the double dose of W2 forms and make the most of this unexpected gift from your employer. Double the excitement, double the benefits – it’s time to make tax season a little more fun!

Below are some images related to I Got 2 W2 Forms From The Same Employer

can you get two w2 from same employer, i got 2 w2 forms from the same employer, i have 2 w2 forms from different employers, i have 2 w2 forms from the same employer, what if i have 2 w2 forms from the same employer, , I Got 2 W2 Forms From The Same Employer.

can you get two w2 from same employer, i got 2 w2 forms from the same employer, i have 2 w2 forms from different employers, i have 2 w2 forms from the same employer, what if i have 2 w2 forms from the same employer, , I Got 2 W2 Forms From The Same Employer.