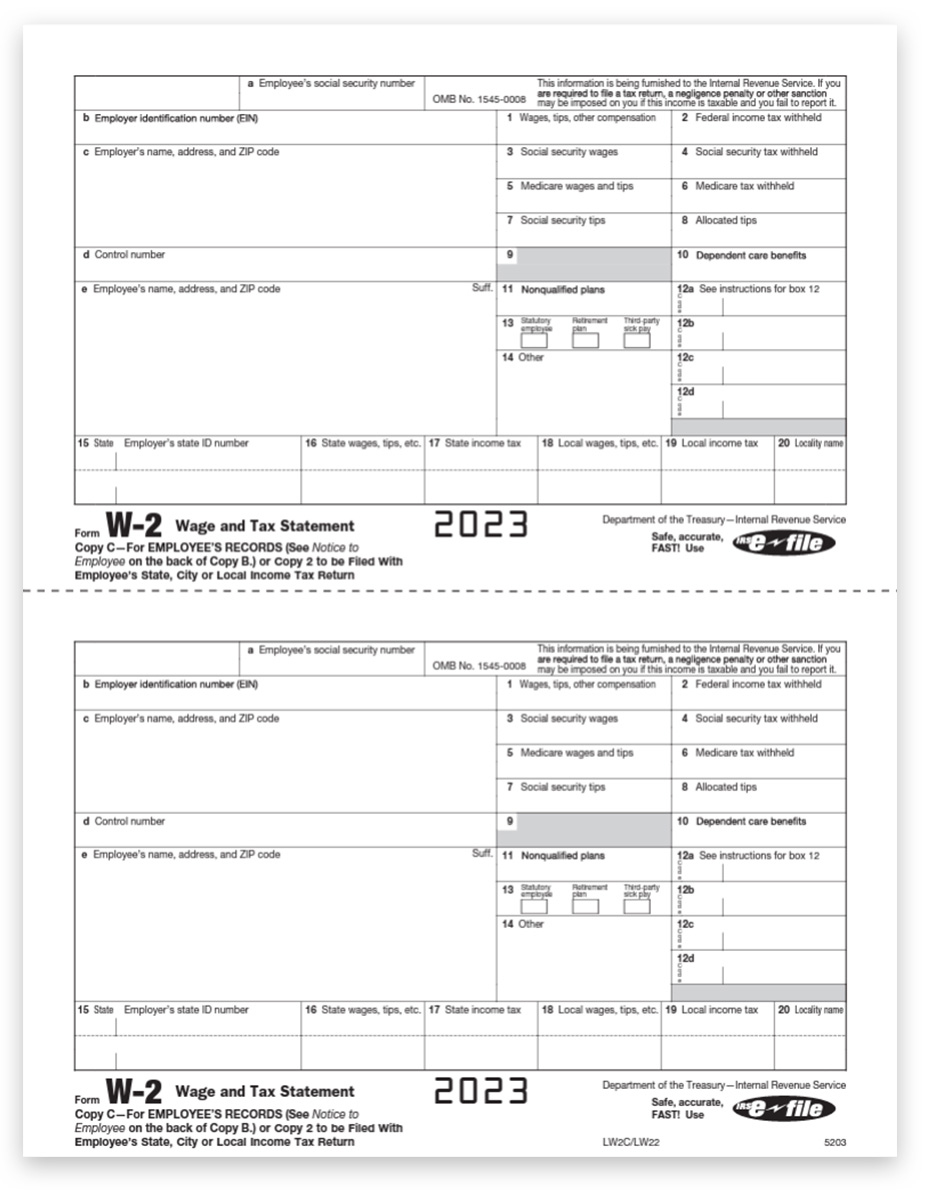

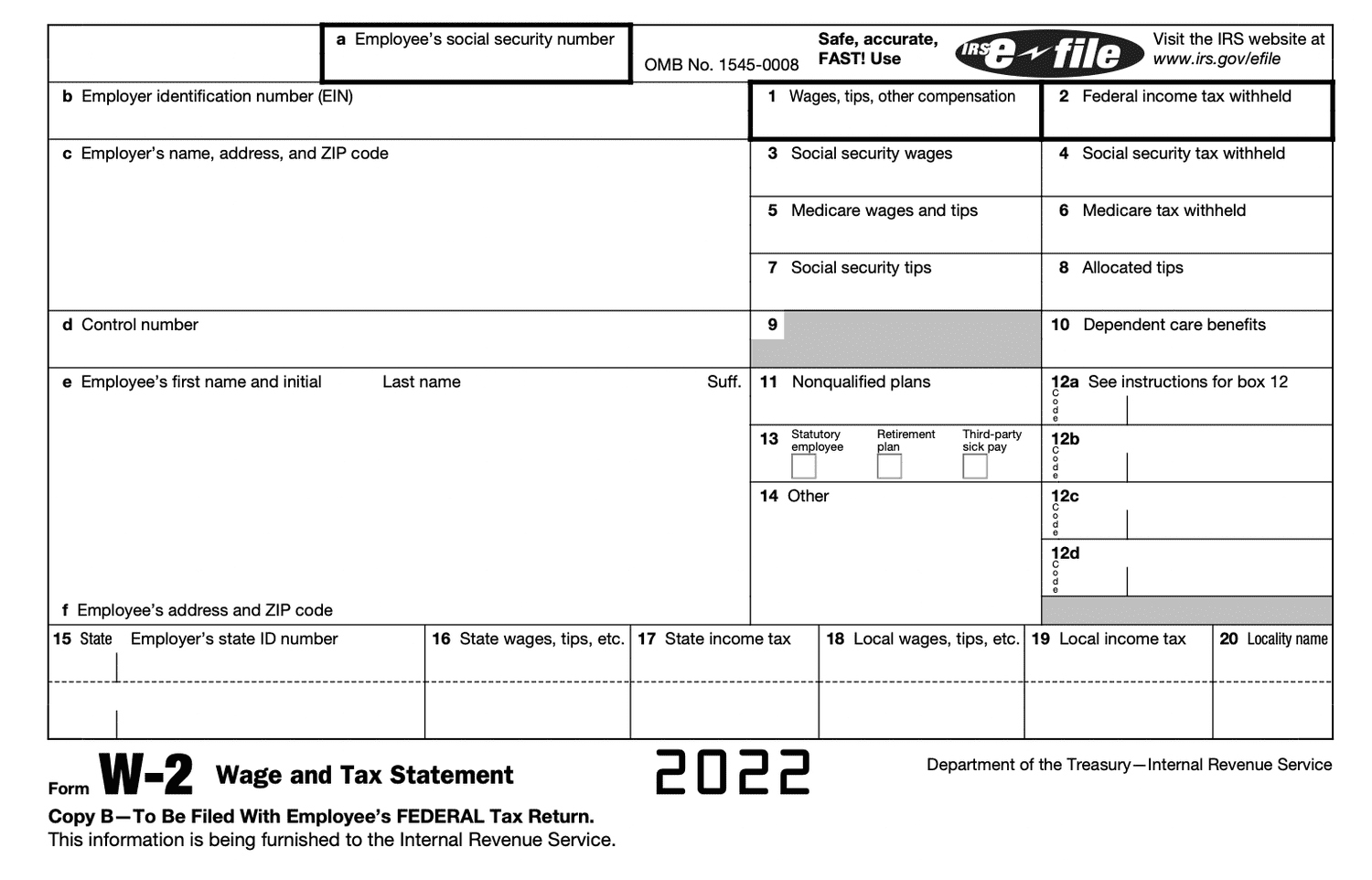

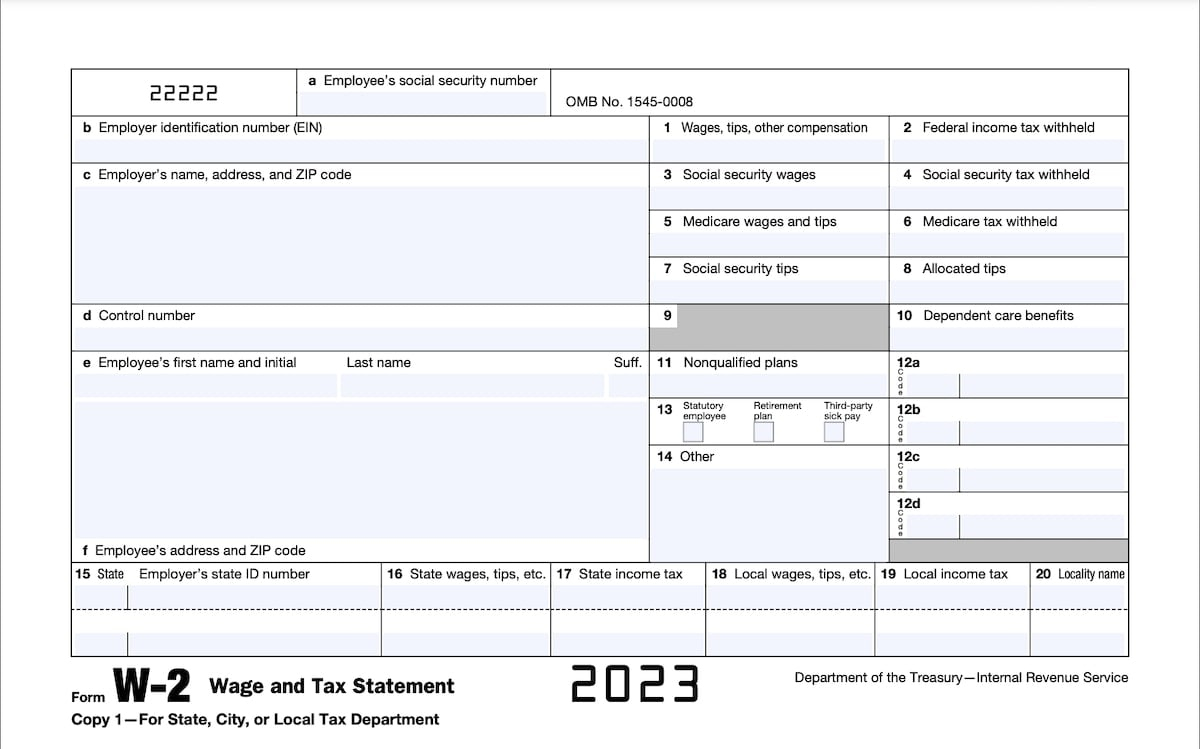

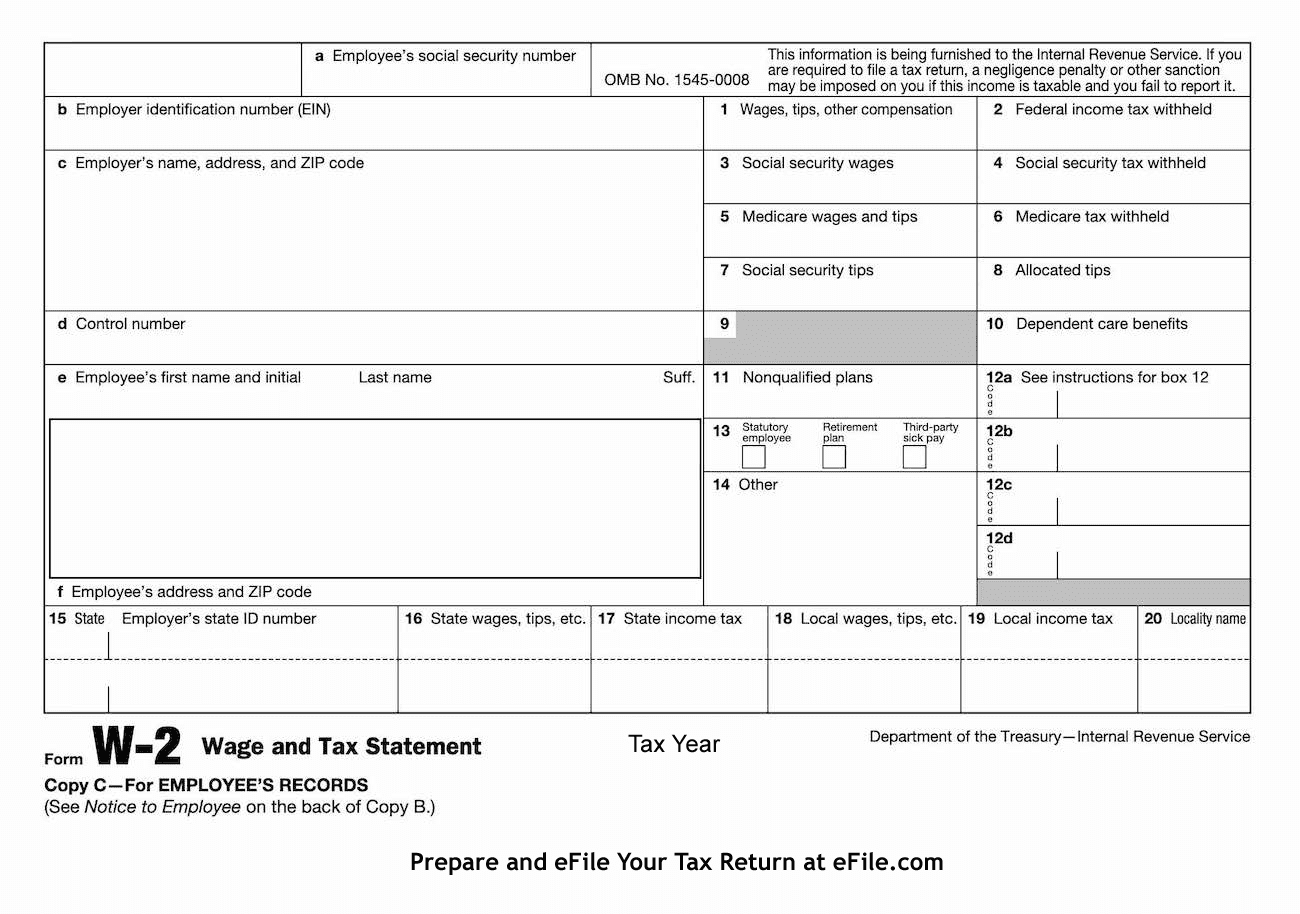

Filing Taxes W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximize Your Refund with the W2 Form!

Are you ready to make the most out of tax season? Look no further than your trusty W2 form! This small but mighty document holds the key to unlocking a potential goldmine of refunds. By understanding the secrets hidden within your W2 form, you can take control of your finances and ensure you’re getting every penny you deserve. Let’s dive in and discover how you can maximize your refund with the W2 form!

Unleash Your Refund Potential!

The W2 form is more than just a slip of paper with numbers on it – it’s a roadmap to maximizing your refund potential. By carefully reviewing each section of your W2 form, you can identify opportunities to minimize your tax liability and maximize your refund. From deductions and credits to retirement contributions and healthcare expenses, the W2 form provides valuable insight into where you can make strategic financial decisions to benefit your bottom line. So don’t just glance over your W2 form – take the time to unleash its full refund potential!

Unlock the Secrets of Your W2 Form!

One of the most powerful secrets hidden within your W2 form is the opportunity to adjust your tax withholding. By carefully reviewing your W2 form and understanding how your withholdings impact your refund, you can make informed decisions about adjusting your withholding allowances. Whether you’re looking to increase your refund or maximize your take-home pay throughout the year, the W2 form offers valuable insights into how you can optimize your tax situation. So don’t be afraid to dive into the details of your W2 form and unlock the secrets that can help you achieve your financial goals.

In conclusion, your W2 form is not just a boring piece of paperwork – it’s a valuable tool that can help you maximize your refund and take control of your financial future. By unleashing the refund potential hidden within your W2 form and unlocking its secrets, you can make informed decisions that benefit your bottom line. So the next time tax season rolls around, don’t overlook the power of your W2 form – harness its potential and watch your refund grow!

Below are some images related to Filing Taxes W2 Form

can i use a copy of my w2 to file taxes, can i use a printed w2 to file taxes, can someone use your w2 to file taxes, file taxes multiple w2 forms, file w2 taxes online, , Filing Taxes W2 Form.

can i use a copy of my w2 to file taxes, can i use a printed w2 to file taxes, can someone use your w2 to file taxes, file taxes multiple w2 forms, file w2 taxes online, , Filing Taxes W2 Form.