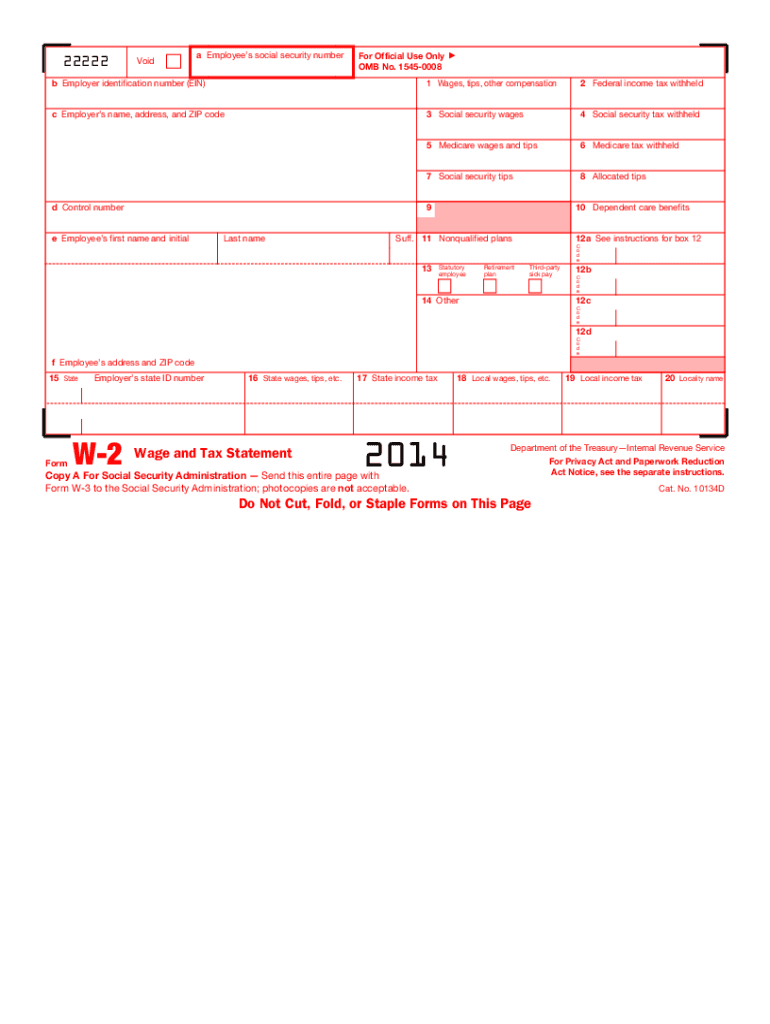

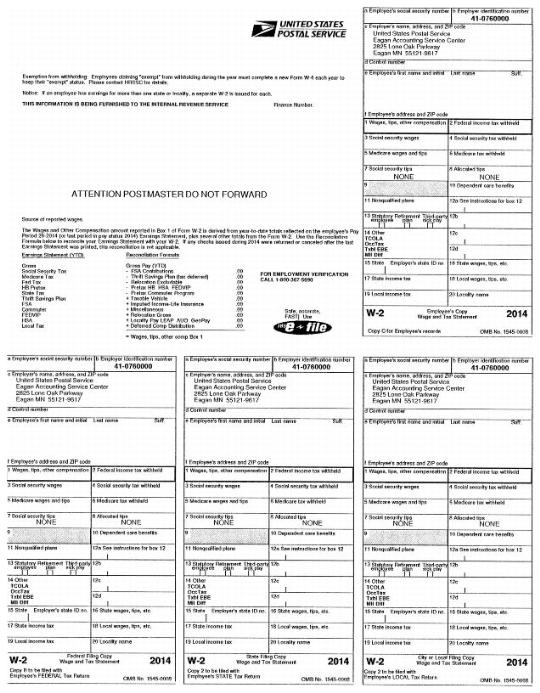

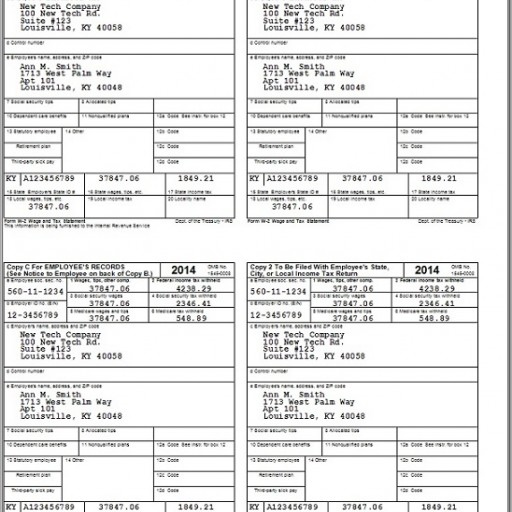

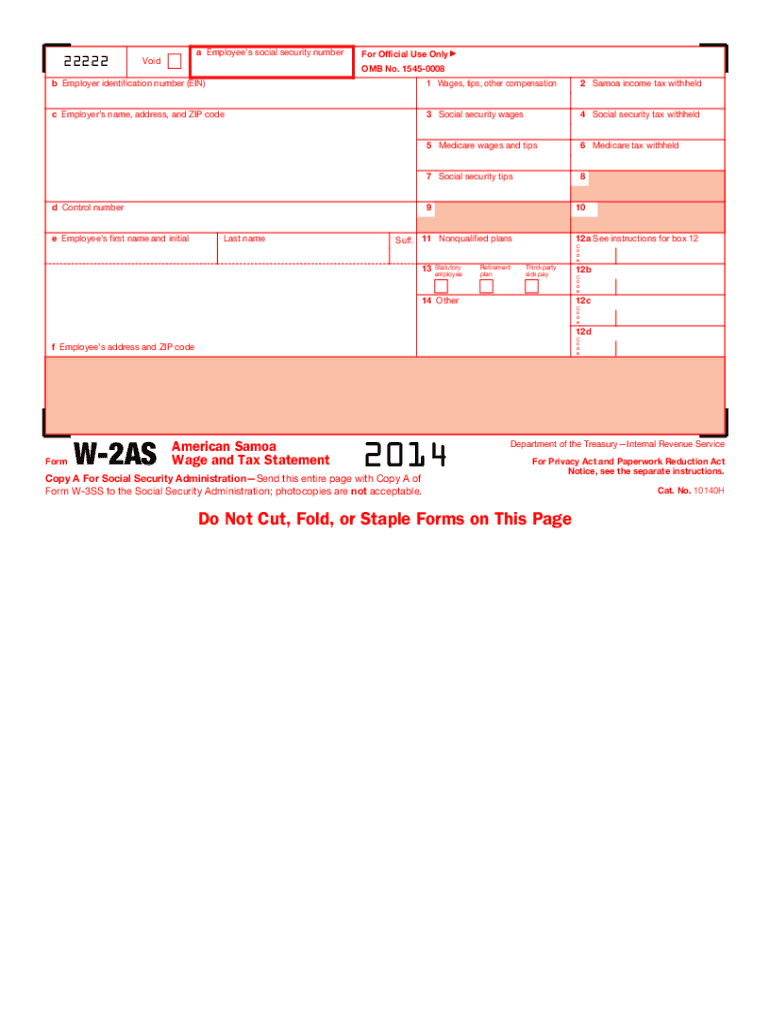

2014 W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mysteries

Ah, the arrival of the W2 form – a sure sign that tax season is upon us! While it may seem like a daunting task to decipher all those numbers and codes, fear not! Your W2 form is actually packed with valuable information that can help you better understand your financial situation for the past year. So let’s roll up our sleeves and unlock the mysteries hidden within this magical document!

Inside Your 2014 W2 Form

As you carefully unfold your W2 form, you’ll notice a series of boxes filled with numbers and letters. But don’t let them intimidate you! Each box holds a key piece of information about your earnings and taxes for the year 2014. Box 1, for example, shows your total wages, while Box 2 displays the amount of federal income tax that was withheld from your paycheck. By taking the time to review each box, you can gain a better understanding of where your money went and how it was allocated throughout the year.

But wait, there’s more! Your W2 form also provides important details about any contributions you made to retirement accounts, such as a 401(k) or IRA. Boxes 12 and 14, for example, show any pre-tax deductions you made for things like health insurance or flexible spending accounts. These contributions can have a significant impact on your overall tax liability, so be sure to review them carefully and consult with a tax professional if you have any questions. With a little bit of patience and a keen eye for detail, you can unravel the magic of your 2014 W2 form and gain a deeper insight into your financial well-being.

In conclusion, while the W2 form may seem like a mysterious puzzle at first glance, it actually holds the key to understanding your financial health for the past year. By taking the time to review each box and decipher the codes, you can gain valuable insights into your earnings, taxes, and contributions. So don’t be afraid to dive in and unravel the magic of your 2014 W2 form – you may just discover a few surprises along the way!

Below are some images related to 2014 W2 Form

2014 w2 form, 2014 w2 forms free, free blank 2014 w2 form, how to get 2014 w2, , 2014 W2 Form.

2014 w2 form, 2014 w2 forms free, free blank 2014 w2 form, how to get 2014 w2, , 2014 W2 Form.