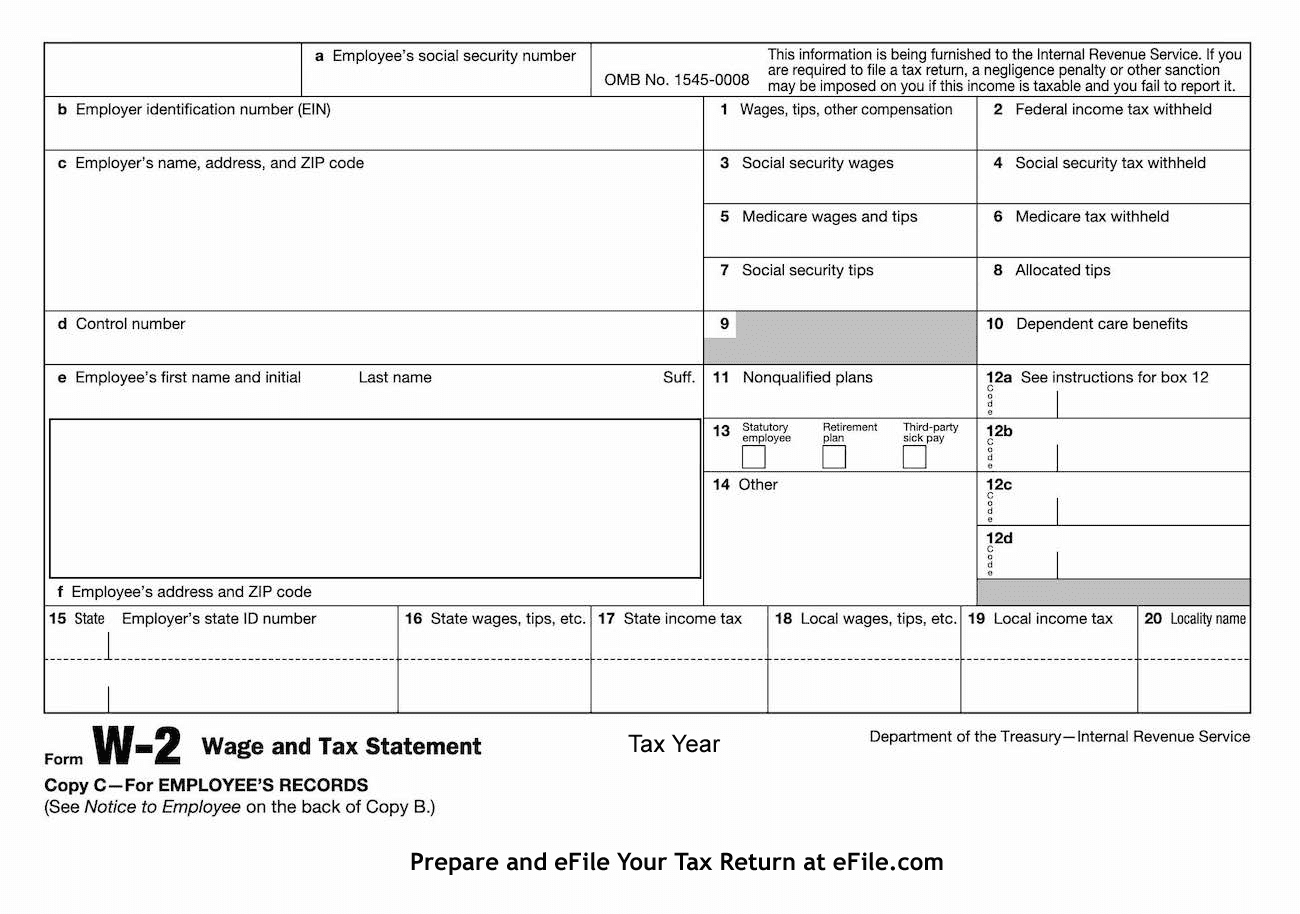

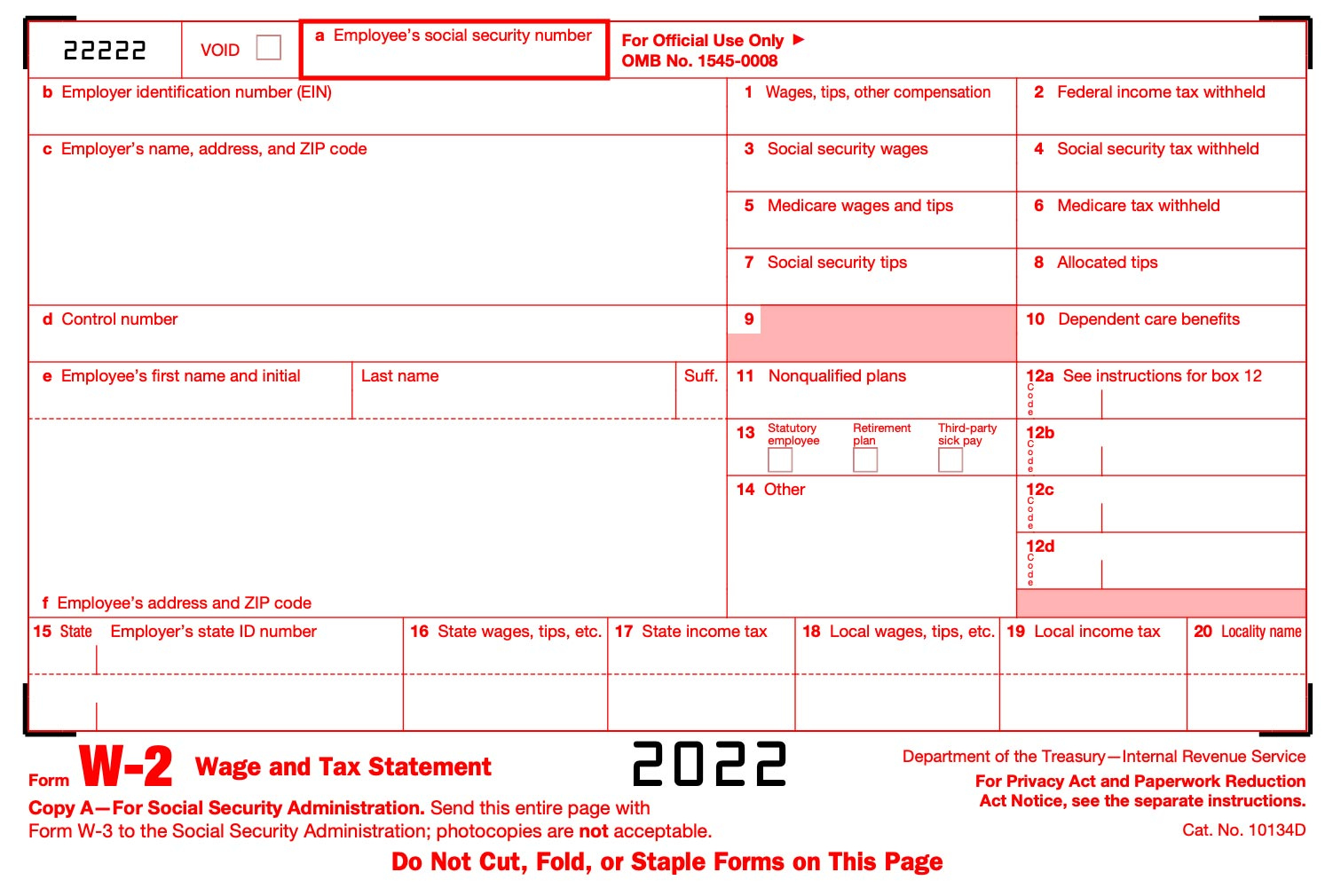

What If I Have Two W2 Forms From Different Employers – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Embrace the Juggling Act: Handling Two W2 Forms!

Are you an individual who loves a challenge and thrives in a fast-paced environment? Then juggling two W2 forms should be right up your alley! While it may seem daunting at first, managing multiple income sources can actually be a fun and rewarding experience. Embrace the juggling act by staying organized, keeping track of important deadlines, and ensuring all necessary information is accurately reported on both forms. With a positive attitude and a can-do spirit, you’ll be able to navigate through tax season with ease.

One key tip for handling two W2 forms is to create a system that works for you. Whether it’s setting reminders on your calendar, using a spreadsheet to track income and deductions, or consulting with a tax professional for guidance, find a method that helps you stay on top of your financial obligations. Remember, juggling two W2 forms is all about balance and efficiency. By staying proactive and organized, you can make the process smoother and less stressful.

Don’t forget to take advantage of any tax deductions or credits that may apply to your situation when juggling two W2 forms. With multiple income streams, you may be eligible for a variety of tax breaks that can help maximize your refund or minimize your tax liability. Keep thorough records of all your expenses and income, and be sure to consult with a tax advisor to ensure you’re taking full advantage of all available tax benefits. With a bit of extra effort and attention to detail, you can make the most of the opportunities that come with managing multiple W2 forms.

Double the Excitement: Navigating Multiple Income Streams!

Having two W2 forms means you have the exciting opportunity to diversify your income and explore new financial possibilities. Instead of viewing it as a burden, see it as a chance to broaden your horizons and take control of your financial future. Navigating multiple income streams allows you to explore different career paths, pursue new opportunities, and build a more secure financial foundation. Embrace the excitement of having two W2 forms and use it as a stepping stone towards achieving your financial goals.

One of the benefits of managing multiple income streams is the potential for increased financial stability. By diversifying your sources of income, you can better weather economic downturns and unexpected expenses. In addition, having two W2 forms can provide you with a sense of security knowing that you have multiple streams of income to rely on. Take advantage of this opportunity to build a more stable financial future for yourself and your loved ones.

Navigating multiple income streams also opens up the possibility of exploring new interests and pursuing your passions. With two W2 forms, you have the flexibility to take on side gigs, freelance projects, or part-time work that aligns with your interests and goals. Use this opportunity to expand your skill set, grow your network, and create new opportunities for yourself. Embrace the excitement of having two W2 forms and let it inspire you to reach new heights in your career and personal life.

In conclusion, juggling two W2 forms may seem like a daunting task at first, but with the right mindset and approach, it can be a fun and rewarding experience. Embrace the challenge, stay organized, and take advantage of the opportunities that come with managing multiple income streams. By staying proactive, exploring new possibilities, and maximizing tax benefits, you can navigate through tax season with ease and set yourself up for a more secure financial future. So, double the fun and enjoy the thrill of juggling two W2 forms!

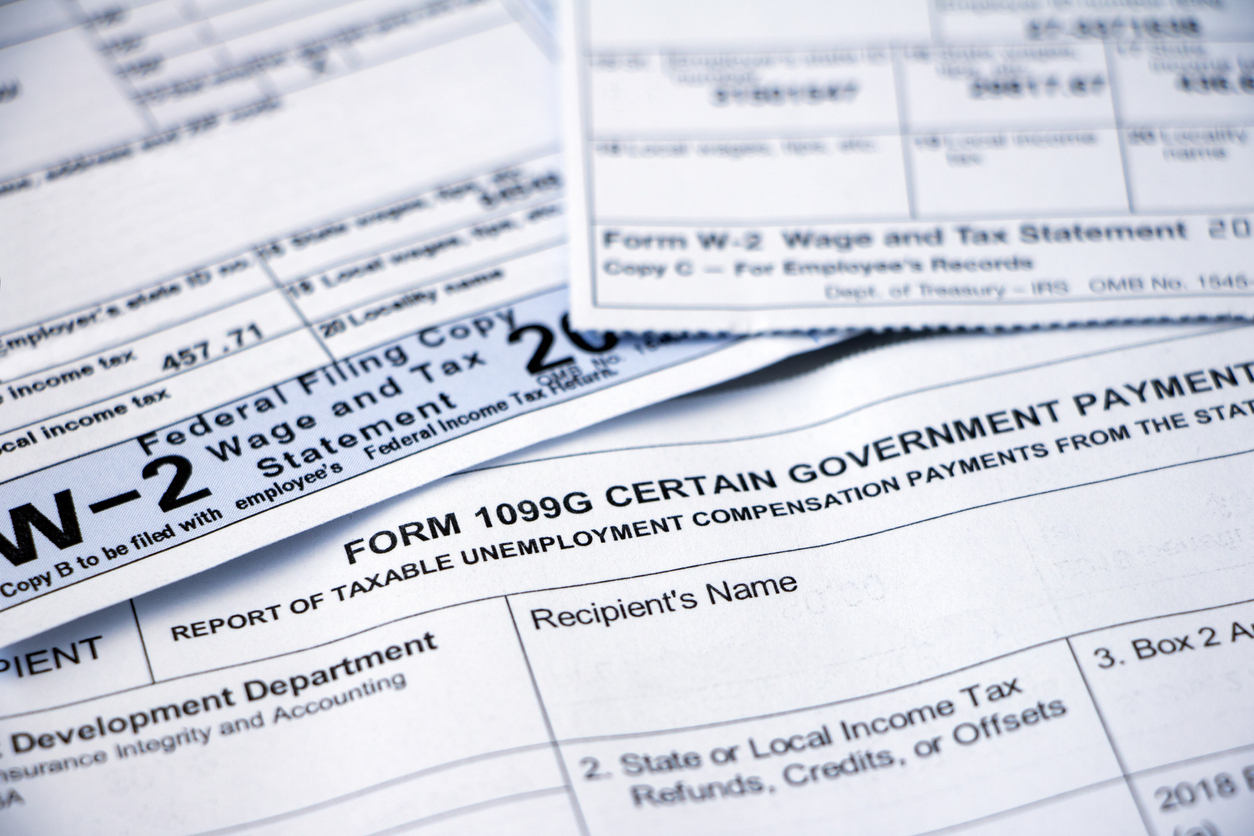

Below are some images related to What If I Have Two W2 Forms From Different Employers

can you get two w2 from same employer, if i have 2 w2 forms from different employers do i have to file both, what if i have two w2 forms from different employers, why did i get two different w2s from the same employer, why do i have 2 w2 forms from the same employer, , What If I Have Two W2 Forms From Different Employers.

can you get two w2 from same employer, if i have 2 w2 forms from different employers do i have to file both, what if i have two w2 forms from different employers, why did i get two different w2s from the same employer, why do i have 2 w2 forms from the same employer, , What If I Have Two W2 Forms From Different Employers.