Where To Mail W2 And W3 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Happy Mail: How to Send W2s and W3s with a Smile

Sending out tax forms can be a daunting task, but it doesn’t have to be! With a little creativity and a positive attitude, you can make the process of mailing W2s and W3s a fun and cheerful experience. In this guide, we’ll show you how to spread joy and happiness while completing this important task.

Spread Joy: The Ultimate Guide to Mailing Tax Forms

1. **Personalize Your Packages**: Instead of sending out plain, boring envelopes, why not add a touch of personalization to your tax form packages? You can use colorful stickers, fun stamps, or even hand-written notes to make each envelope feel special. Your employees will appreciate the extra effort and it will make the whole process more enjoyable for you as well.

2. **Include a Thank You Card**: Along with their tax forms, consider including a thank you card to show your employees how much you value their hard work. A simple note of appreciation can go a long way in making them feel valued and respected. It’s a small gesture that will make a big impact on the overall mood of tax season.

3. **Celebrate with Treats**: Who says mailing tax forms can’t be a cause for celebration? Consider adding a small treat, like a piece of candy or a mini chocolate bar, to each package. It’s a sweet surprise that will bring a smile to your employees’ faces and make the whole process feel a little bit more festive.

In conclusion, sending out W2s and W3s doesn’t have to be a dull and dreary task. By adding a touch of creativity and spreading joy through personalized packages, thank you cards, and treats, you can make the process of mailing tax forms a fun and delightful experience for both you and your employees. So put on a smile, grab your envelopes, and send out those tax forms with happiness and cheer!

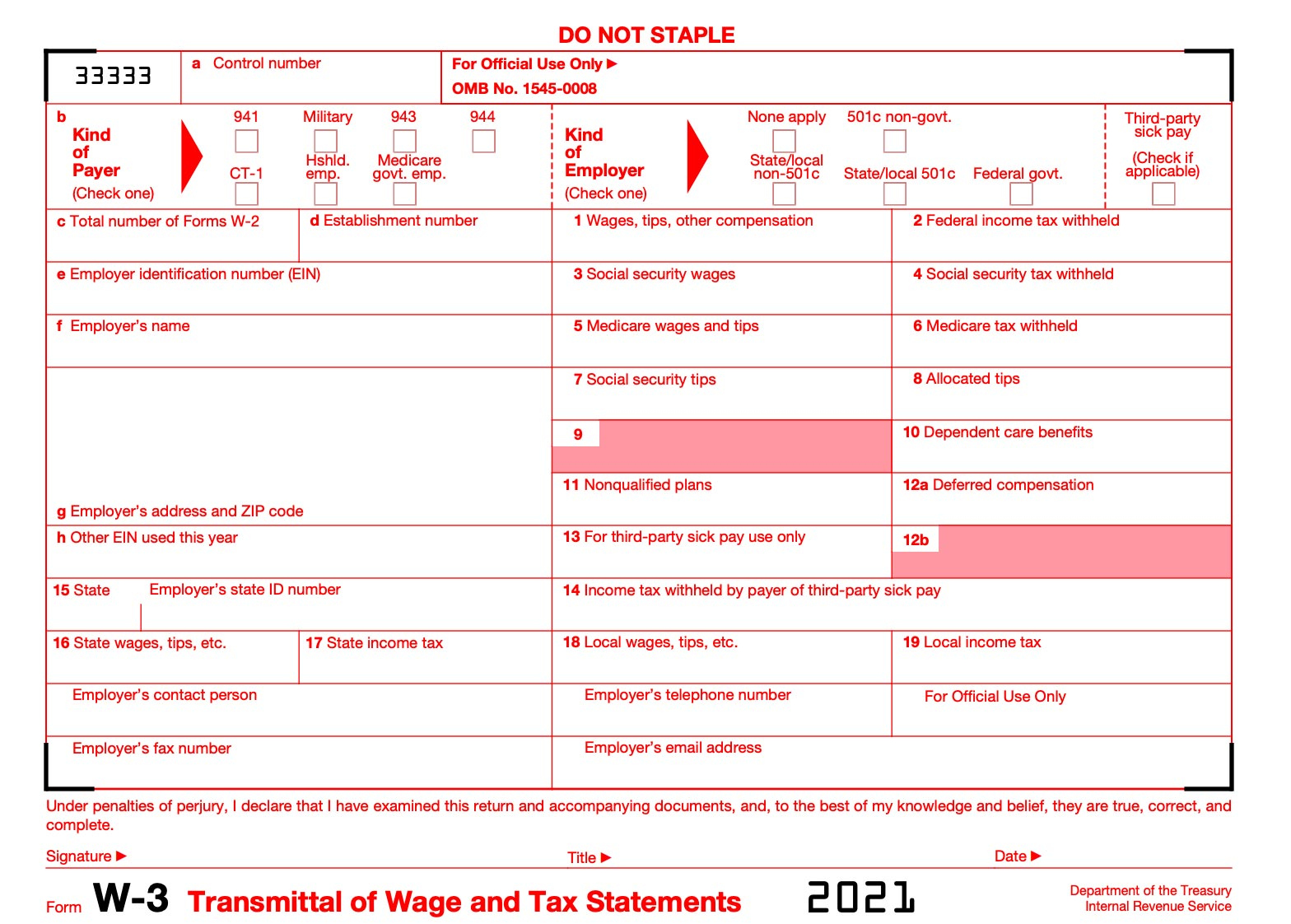

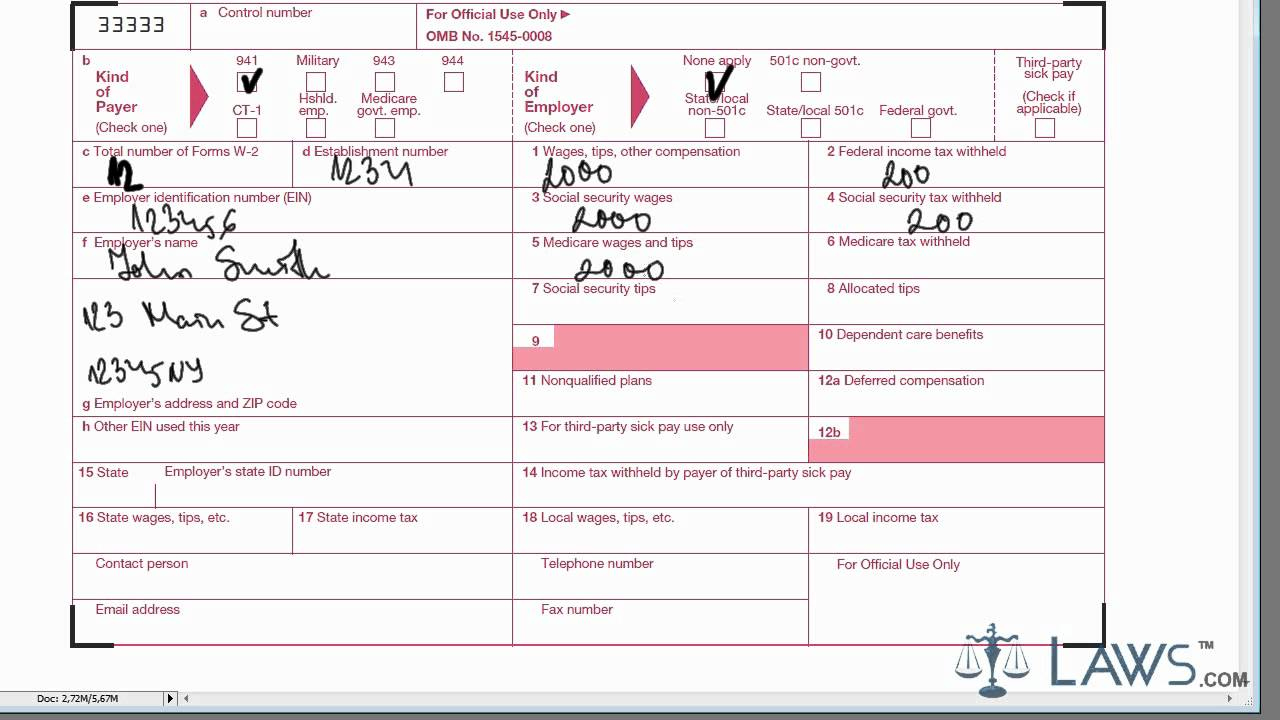

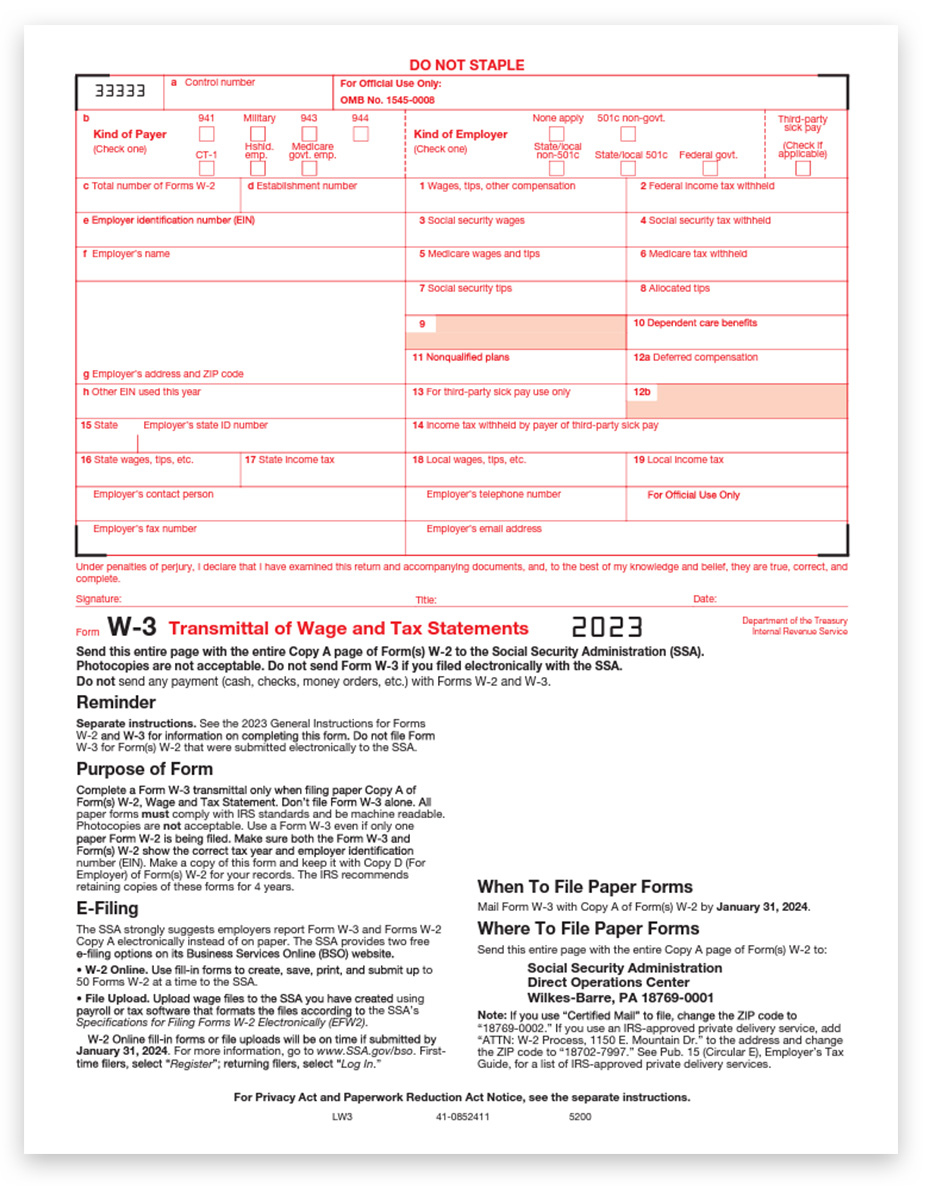

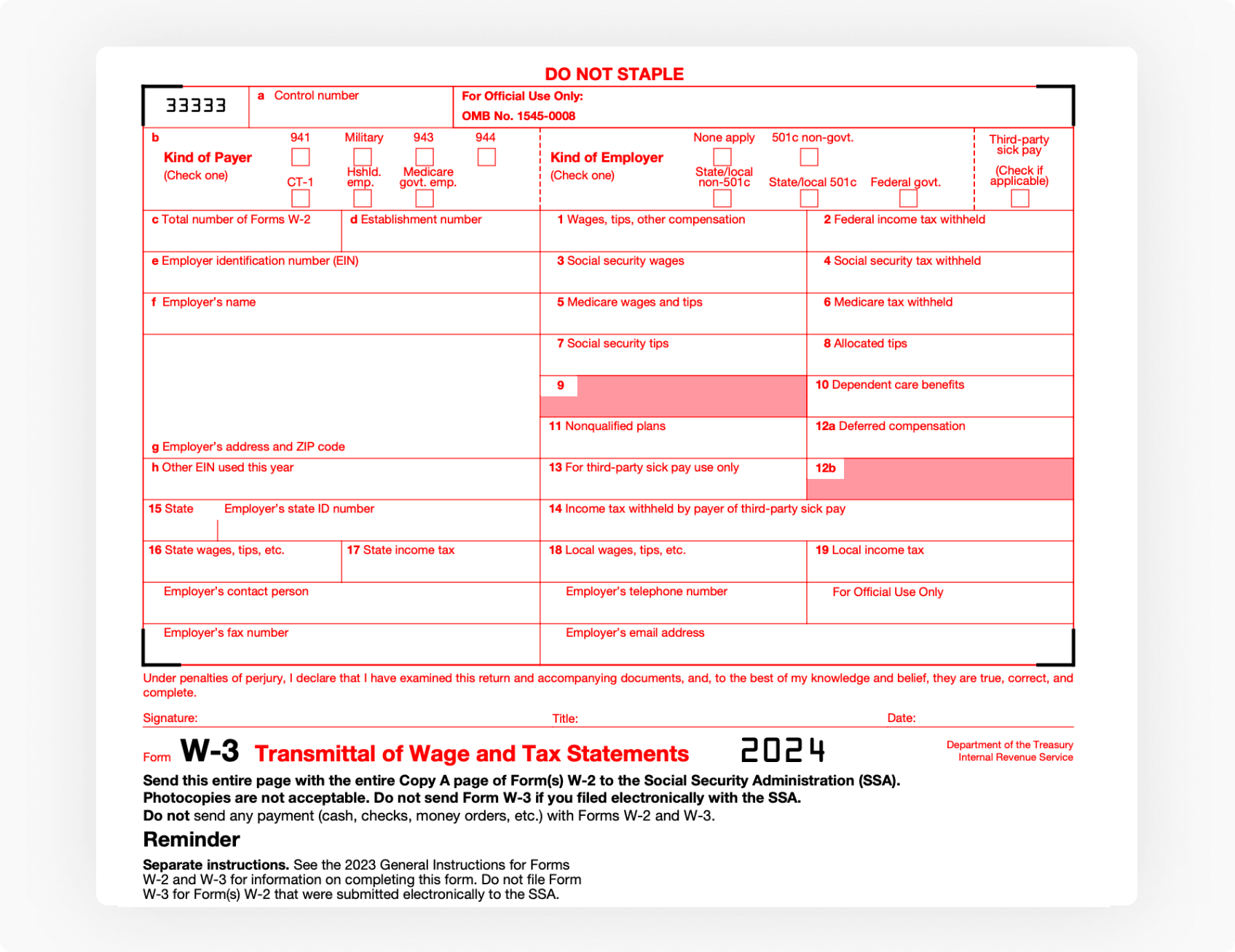

Below are some images related to Where To Mail W2 And W3 Forms

where can i get w2 and w3 forms, where to mail missouri w2 and w3 forms, where to mail w2 and w3 forms, where to mail w2 and w3 forms pdf, where to mail w3 and w2, , Where To Mail W2 And W3 Forms.

where can i get w2 and w3 forms, where to mail missouri w2 and w3 forms, where to mail w2 and w3 forms, where to mail w2 and w3 forms pdf, where to mail w3 and w2, , Where To Mail W2 And W3 Forms.