Where To Get W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

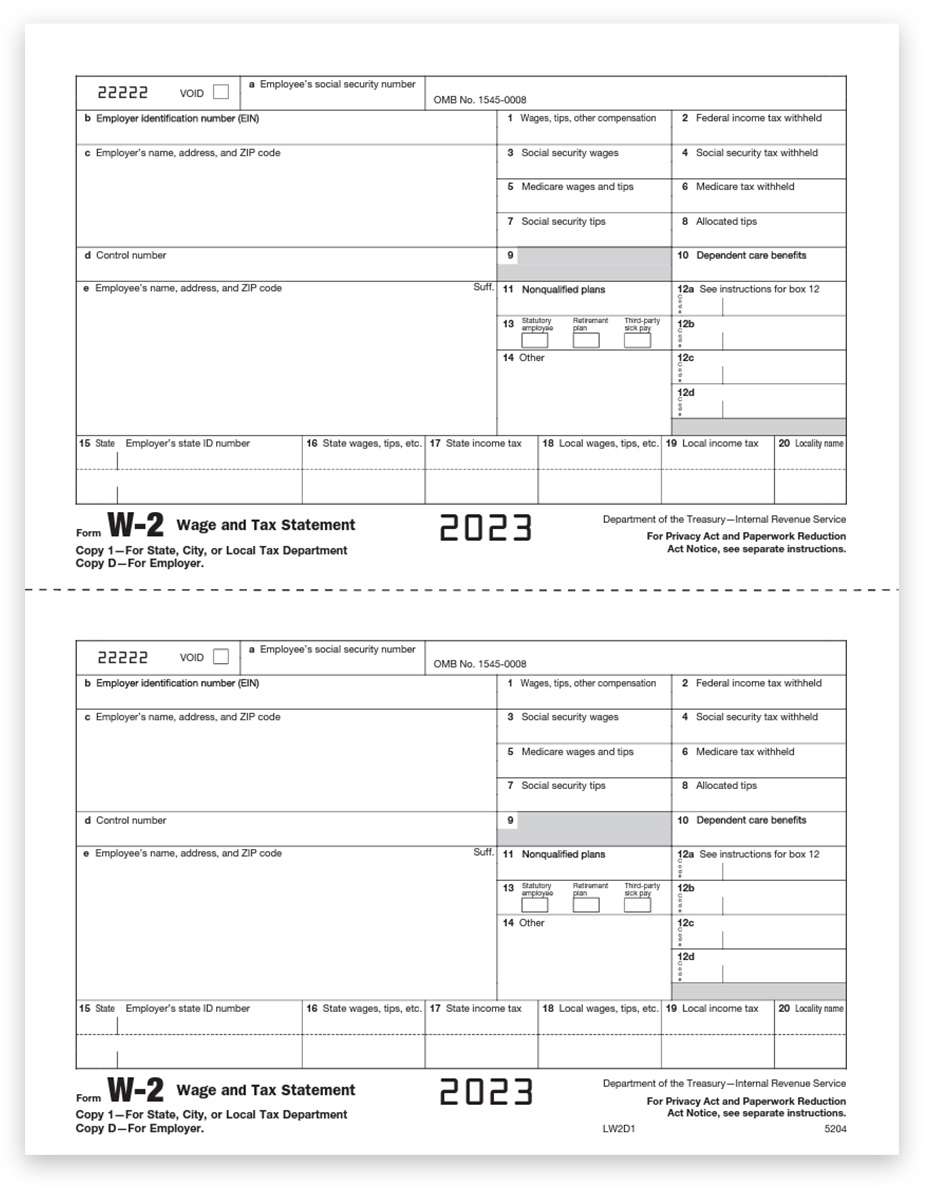

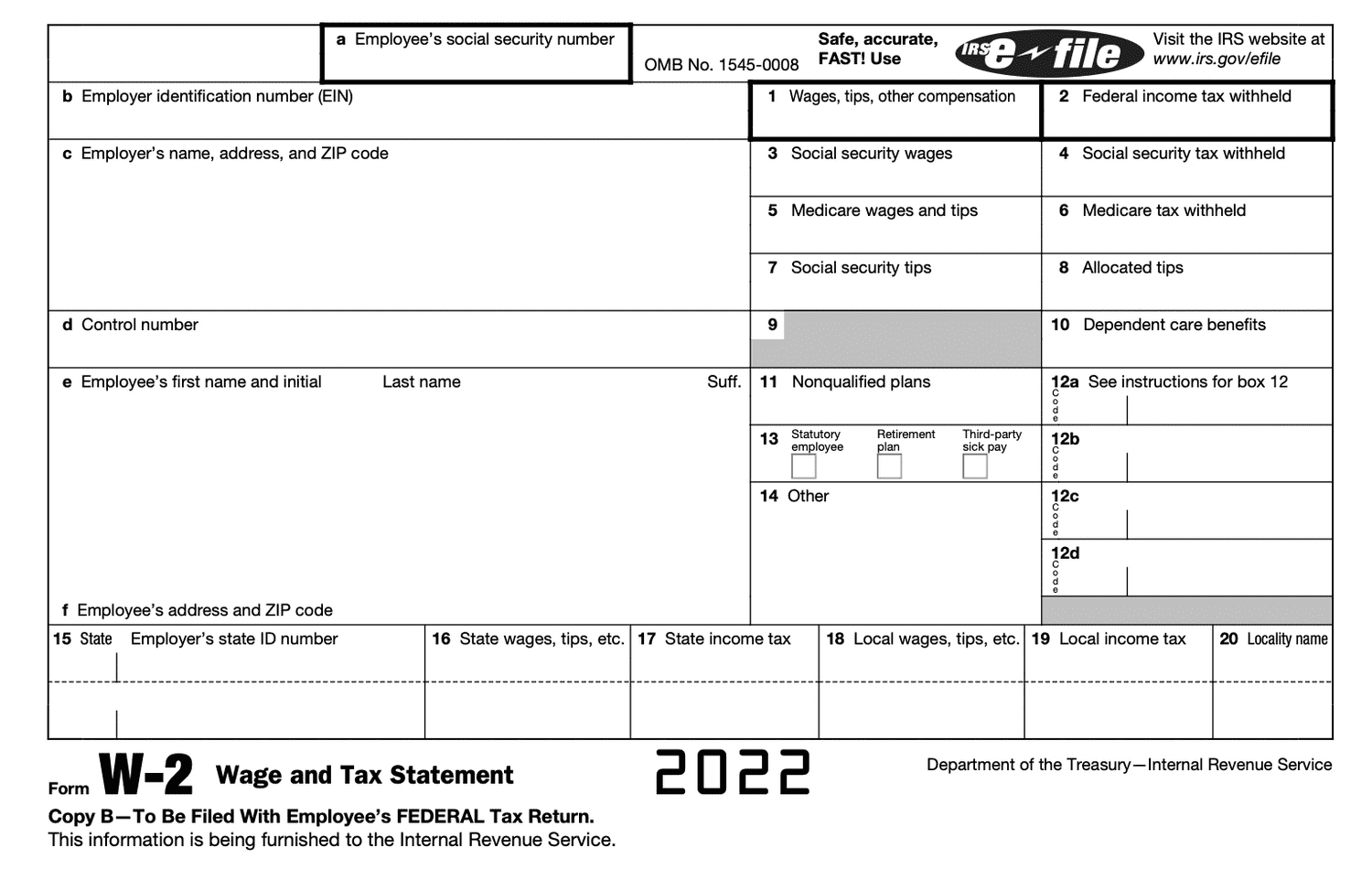

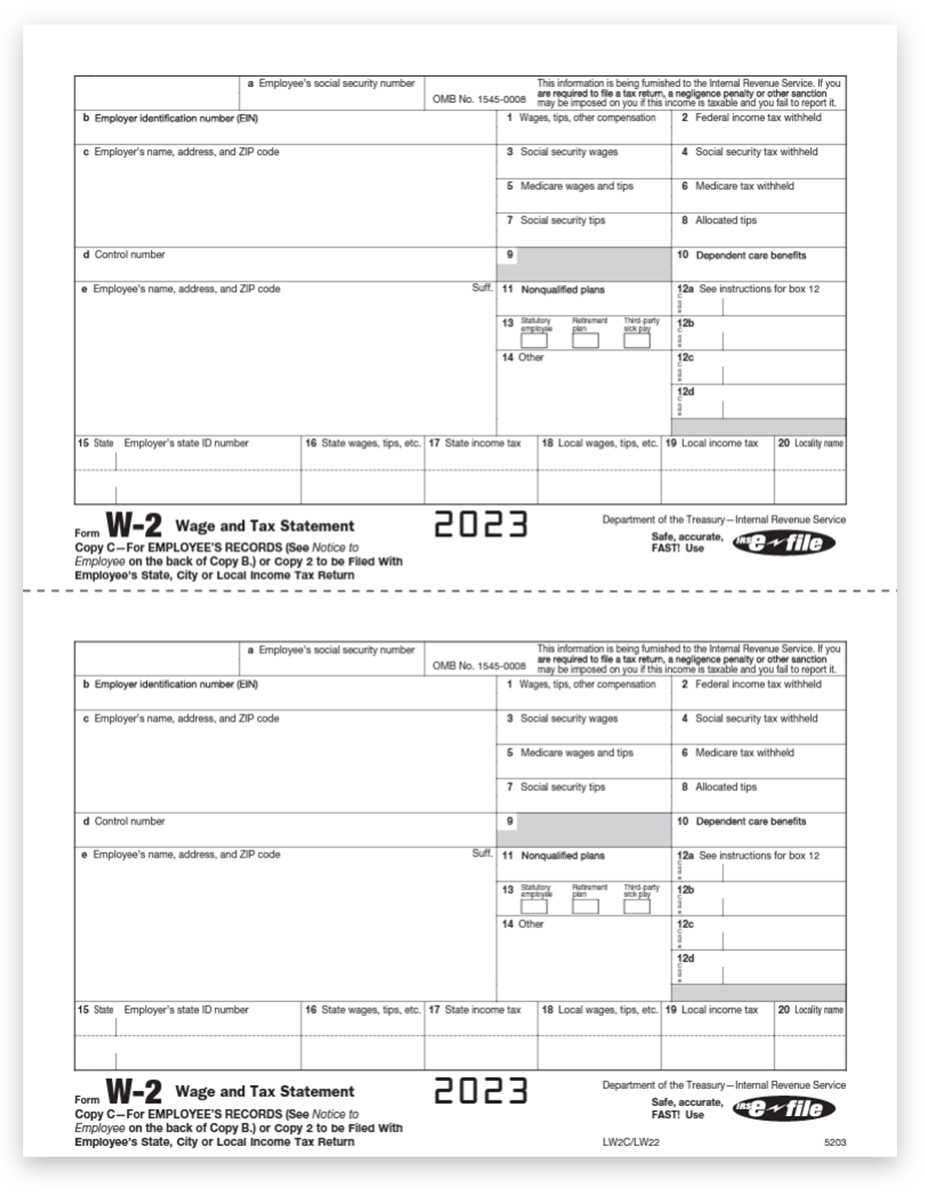

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncover Your W2 Form in a Flash!

Have you been stressing out about finding your W2 form for tax season? Fear not, because we’ve got you covered with some easy peasy tips to help you locate your W2 form in no time! With just a few simple steps, you’ll be on your way to filing your taxes with ease and confidence. Say goodbye to digging through piles of paperwork and hello to stress-free tax preparation!

If you’re an employee, the first place to check for your W2 form is your employer. Most companies provide their employees with a digital or physical copy of their W2 form by the end of January. If you haven’t received yours yet, don’t panic! Reach out to your HR department or payroll team to request a copy. They’ll be more than happy to help you out and ensure you have all the necessary documents for tax season.

Effortless Steps to Locate Your W2 Form Today!

Another easy way to access your W2 form is through online tax preparation services like TurboTax or H&R Block. These platforms often have a feature where you can import your W2 information directly by linking your account to your employer’s payroll system. This eliminates the need for physical paperwork and makes the tax filing process a breeze. Simply log in to your account, follow the prompts, and voila – your W2 form will be right at your fingertips!

If all else fails and you still can’t locate your W2 form, you can request a copy from the IRS. Fill out Form 4506-T, Request for Transcript of Tax Return, and mail it to the address provided on the form. The IRS will then send you a copy of your W2 form or a transcript of your tax return, which you can use for filing your taxes. Remember to keep track of important deadlines to ensure you have all the necessary documents in time for tax season.

Conclusion

With these easy peasy tips, finding your W2 form doesn’t have to be a daunting task. Whether you reach out to your employer, use online tax services, or request a copy from the IRS, there are plenty of options available to help you access your W2 form with ease. So take a deep breath, follow our guide, and get ready to conquer tax season like a pro! Happy filing!

Below are some images related to Where To Get W2 Form

where can i get w2 forms for 2022, where do you get w2 forms, where to file w2 form, where to find w2 form on adp, where to get w2 forms, , Where To Get W2 Form.

where can i get w2 forms for 2022, where do you get w2 forms, where to file w2 form, where to find w2 form on adp, where to get w2 forms, , Where To Get W2 Form.