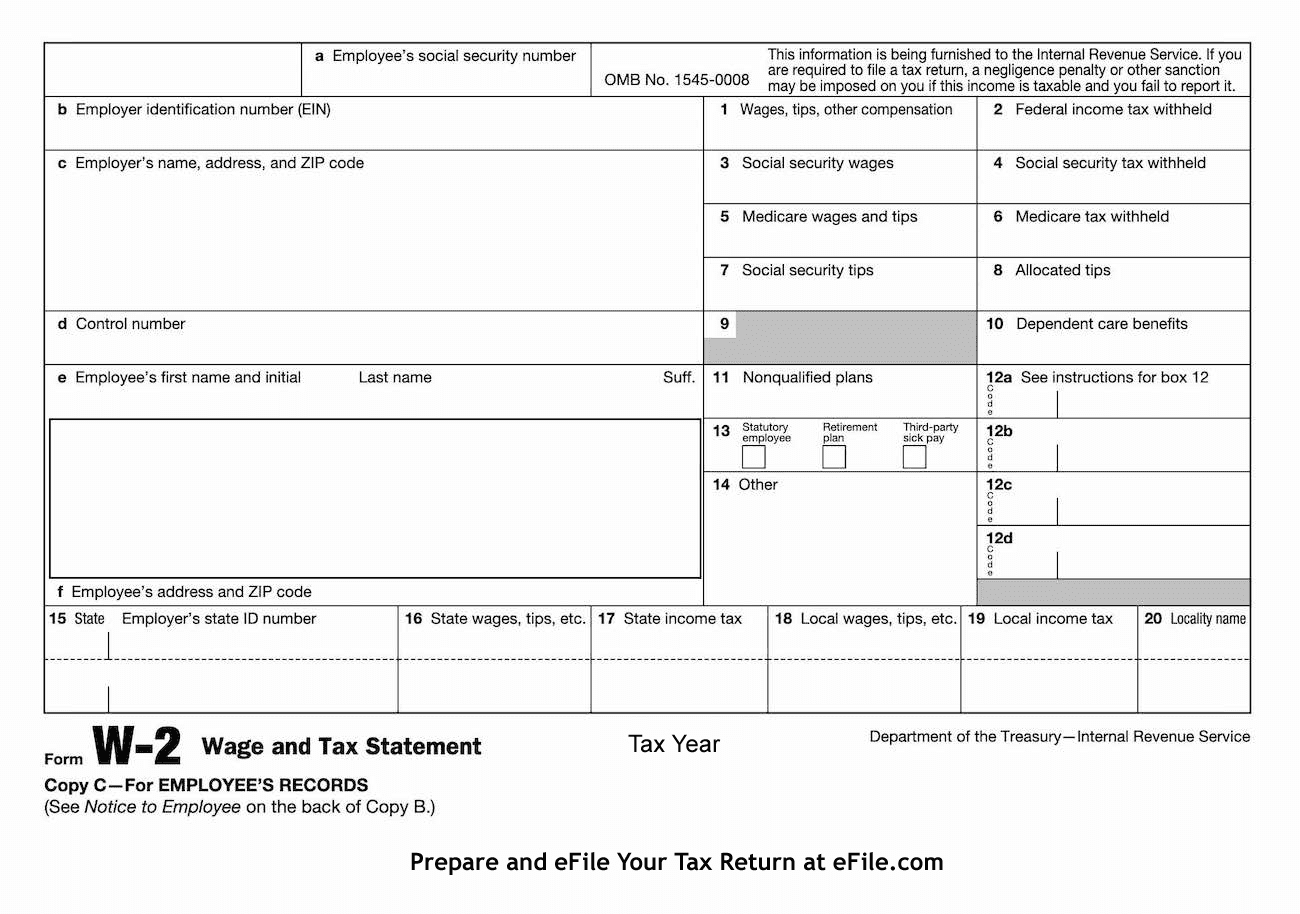

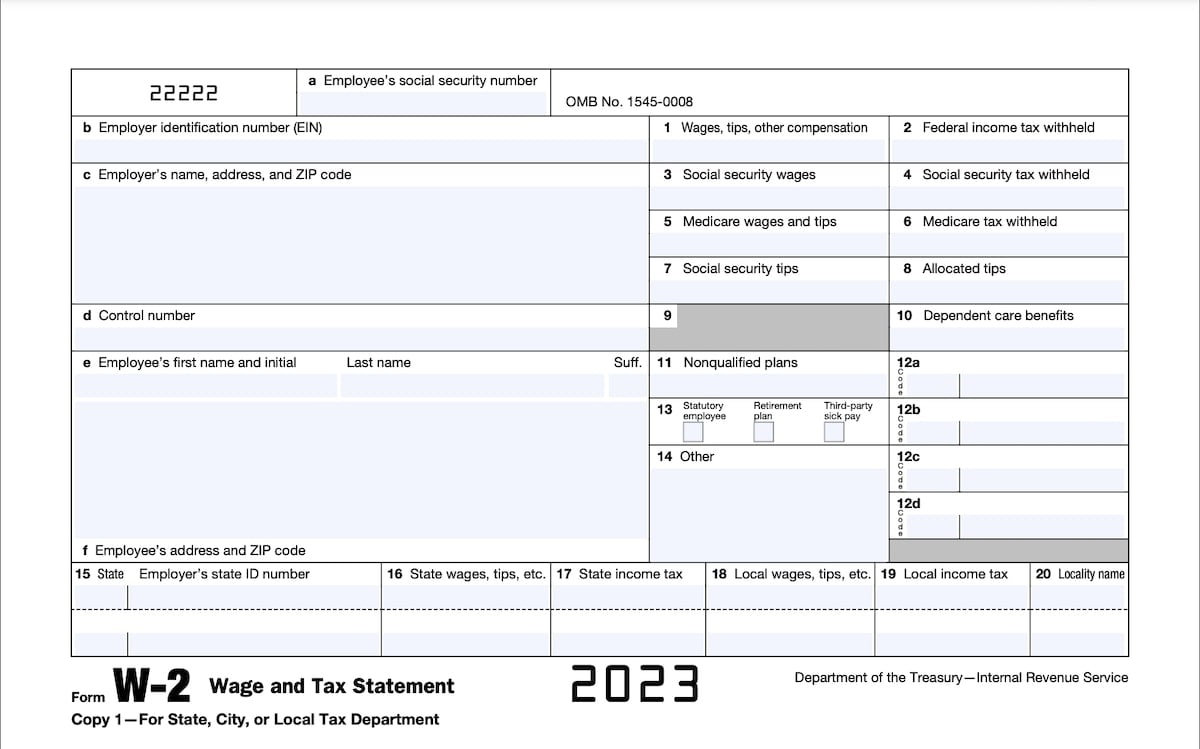

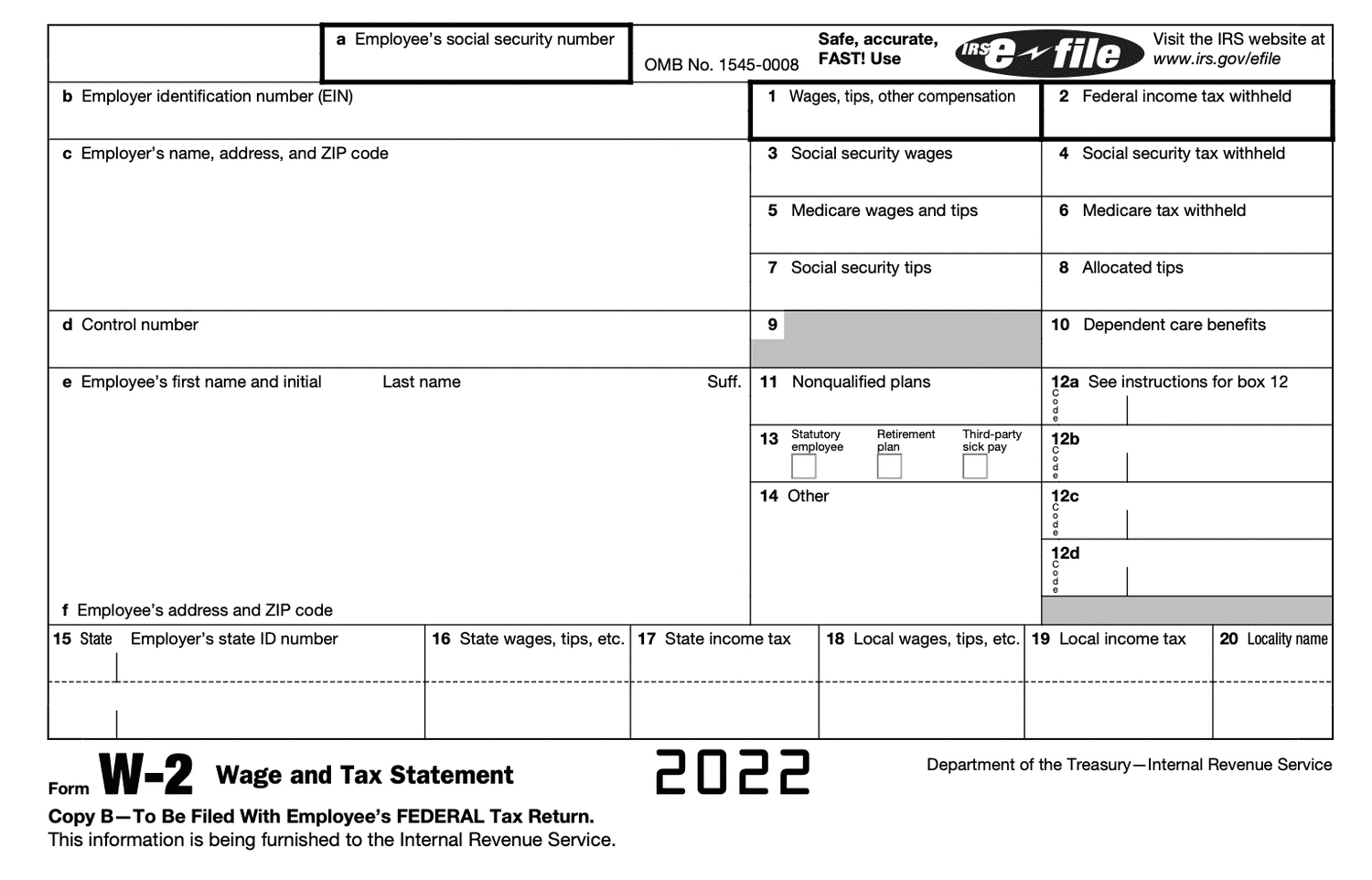

What Is A W2 Tax Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of the W2 Tax Form: A Guide for Beginners

Tax season can be a daunting time for many, especially if you’re new to the workforce and are trying to make sense of all the different tax forms that come your way. One of the most important forms you’ll encounter is the W2 form, but fear not! In this beginner’s guide, we’ll break down the complexities of the W2 form and help you navigate through it with ease.

Let’s Demystify the W2 Tax Form!

The W2 form is a crucial document that your employer provides you with at the end of the year, summarizing your earnings and the taxes that have been withheld from your paychecks. It includes important information such as your wages, tips, bonuses, and any other compensation you received throughout the year. Additionally, it details the amount of federal, state, and social security taxes that have been deducted from your earnings.

Understanding your W2 form is essential for filing your taxes accurately and efficiently. The form is divided into various boxes, each containing specific information about your income and taxes. For example, Box 1 shows your total wages, tips, and other compensation, while Box 2 displays the federal income tax that has been withheld. By carefully reviewing each box on your W2 form, you can ensure that your tax return is error-free and that you are maximizing any potential refunds.

Your Beginner’s Guide to Understanding W2s

If you’re feeling overwhelmed by the complexities of the W2 form, don’t worry – you’re not alone! Many beginners find the language and terminology on the form confusing, but with a little guidance, you’ll soon become a W2 expert. Take the time to review each section of your W2 form, paying special attention to any discrepancies or unfamiliar terms. If you have any questions or need further clarification, don’t hesitate to reach out to your employer or a tax professional for assistance.

By familiarizing yourself with the W2 form and understanding its contents, you’ll be better equipped to handle tax season like a pro. Remember, the W2 form is a valuable tool that can help you accurately report your income and taxes to the IRS. So, take a deep breath, grab your W2 form, and dive in – you’ve got this!

In conclusion, unraveling the mystery of the W2 tax form doesn’t have to be a daunting task. With a positive attitude and a willingness to learn, you can navigate through your W2 form with ease and confidence. By following this beginner’s guide and taking the time to understand the ins and outs of the form, you’ll be well on your way to mastering your taxes like a pro. So, embrace the challenge, ask questions when needed, and remember that you’re not alone in this tax-filing journey. Happy tax season!

Below are some images related to What Is A W2 Tax Form

what does a w2 tax form look like, what is a 1040 tax form vs w2, what is a w2 tax form, what is a w2 tax form for employees, what is a w4 tax form vs w2, , What Is A W2 Tax Form.

what does a w2 tax form look like, what is a 1040 tax form vs w2, what is a w2 tax form, what is a w2 tax form for employees, what is a w4 tax form vs w2, , What Is A W2 Tax Form.