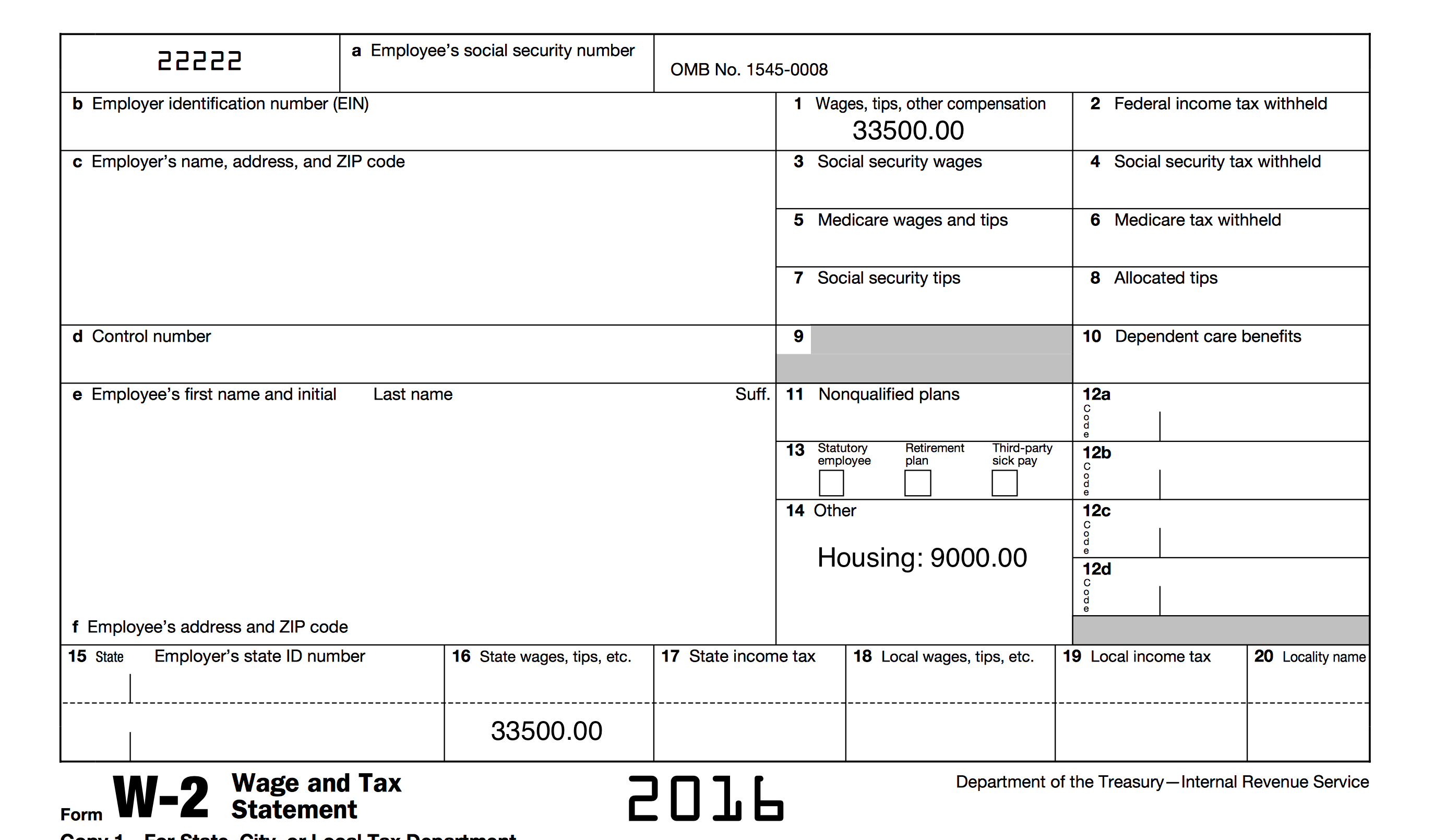

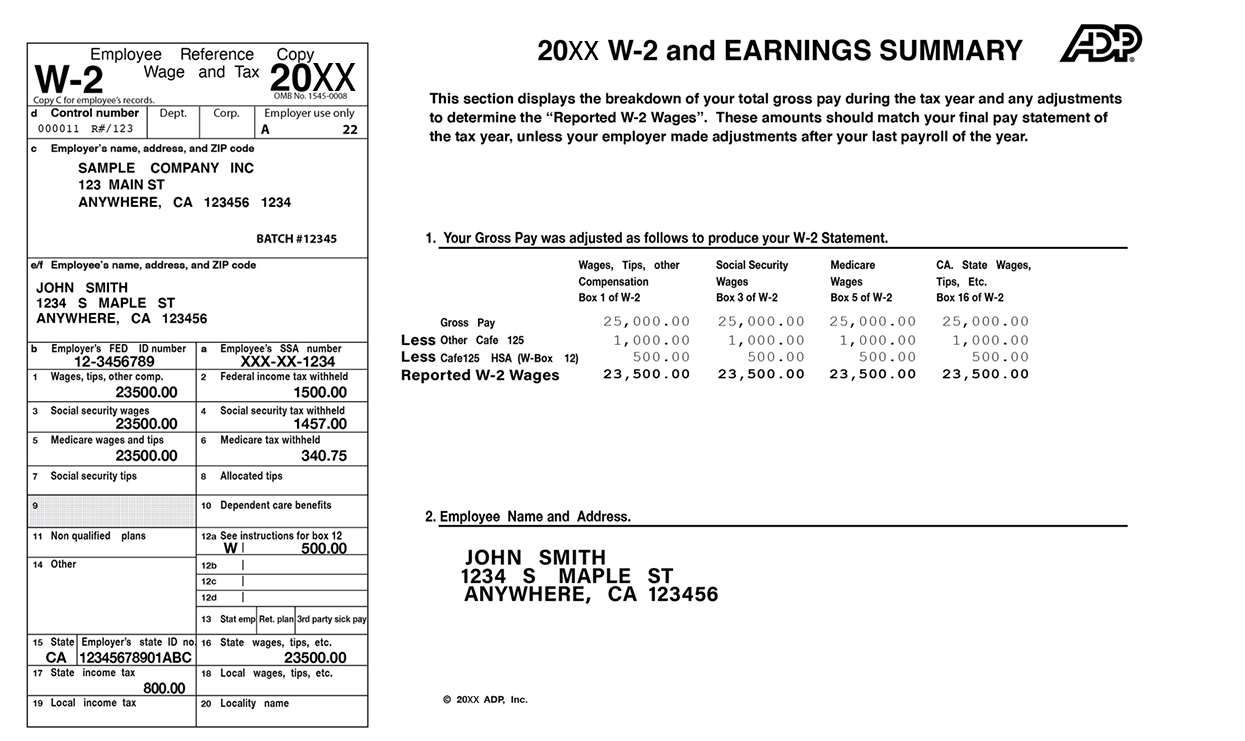

SSI W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tis the Season for SSI W2s!

The holiday season may be over, but there’s still plenty to celebrate as tax season rolls around! For those receiving Supplemental Security Income (SSI), the arrival of the SSI W2 form is cause for cheer and excitement. This important document outlines the income you received from SSI throughout the year, providing you with the necessary information to file your taxes accurately and efficiently. So, grab a cup of cocoa, cozy up by the fireplace, and let’s unwrap the SSI W2 together in this festive guide to tax season!

Deck the Halls with Tax Forms!

As you eagerly tear open the envelope containing your SSI W2, you’ll notice all the details you need to report your income to the IRS. From the total amount of SSI benefits you received to any federal or state taxes withheld, every line on the form plays a crucial role in helping you complete your tax return. So, put on your favorite holiday playlist, gather your tax documents, and get ready to deck the halls with tax forms as you navigate the ins and outs of the SSI W2.

The SSI W2 isn’t just a piece of paper – it’s a key to unlocking potential tax deductions and credits that can help you maximize your refund or minimize your tax liability. By carefully reviewing your SSI W2, you can identify any opportunities to save money on your taxes, such as claiming the Earned Income Tax Credit or the Child Tax Credit. As you delve into the world of tax deductions and credits, remember that each dollar saved is a reason to celebrate, making tax season a truly festive time of year!

As you prepare to file your taxes and submit your SSI W2 to the IRS, remember that you’re not alone in this journey. Whether you seek assistance from a tax professional, use tax preparation software, or rely on resources provided by the IRS, help is available to guide you through the process. So, embrace the season of tax filing with a positive attitude, a dash of holiday spirit, and a commitment to accuracy. With the SSI W2 as your trusty companion, you’ll be well on your way to a successful tax season and a brighter financial future. Happy tax-filing, and may your refunds be merry and bright!

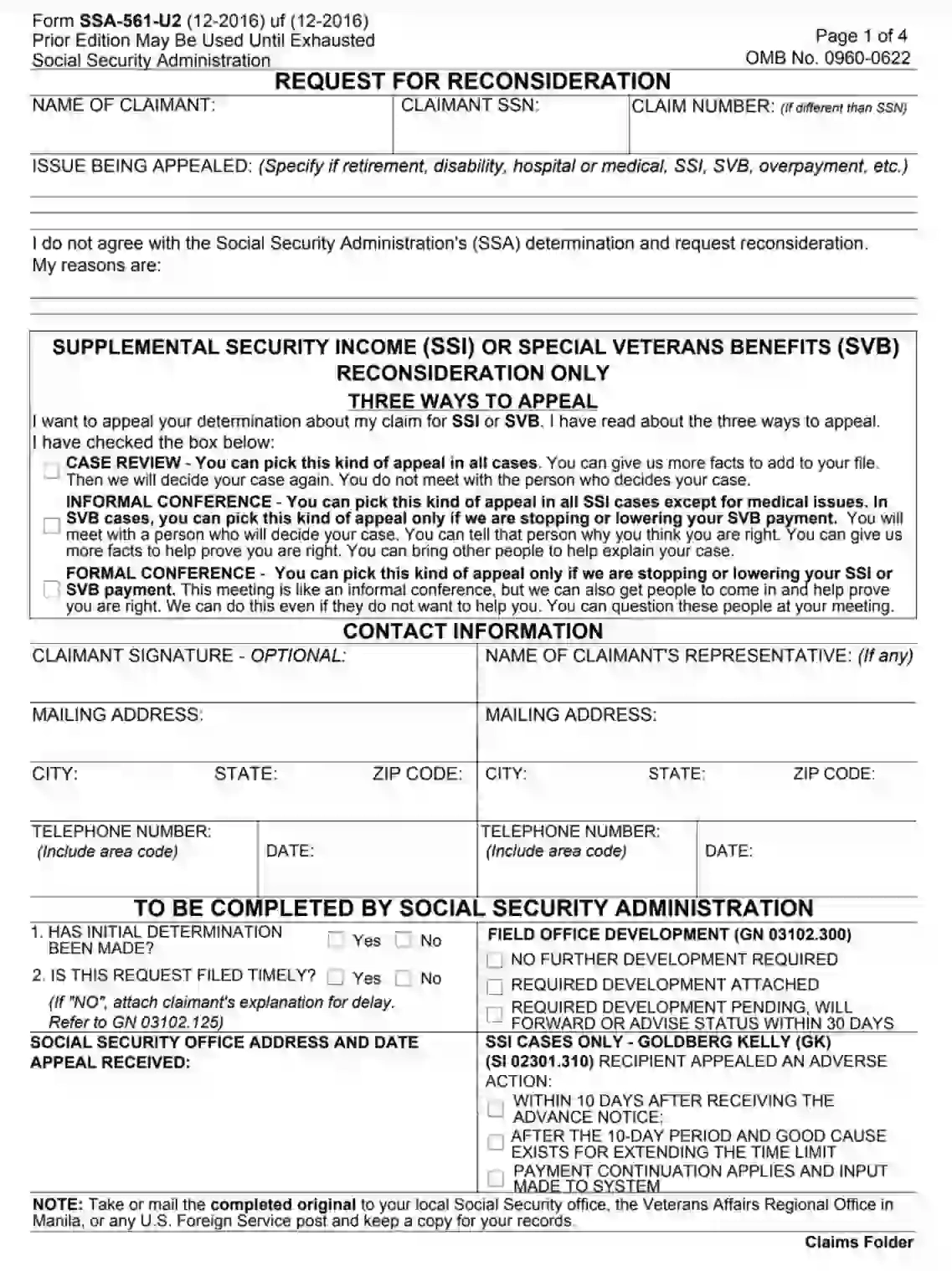

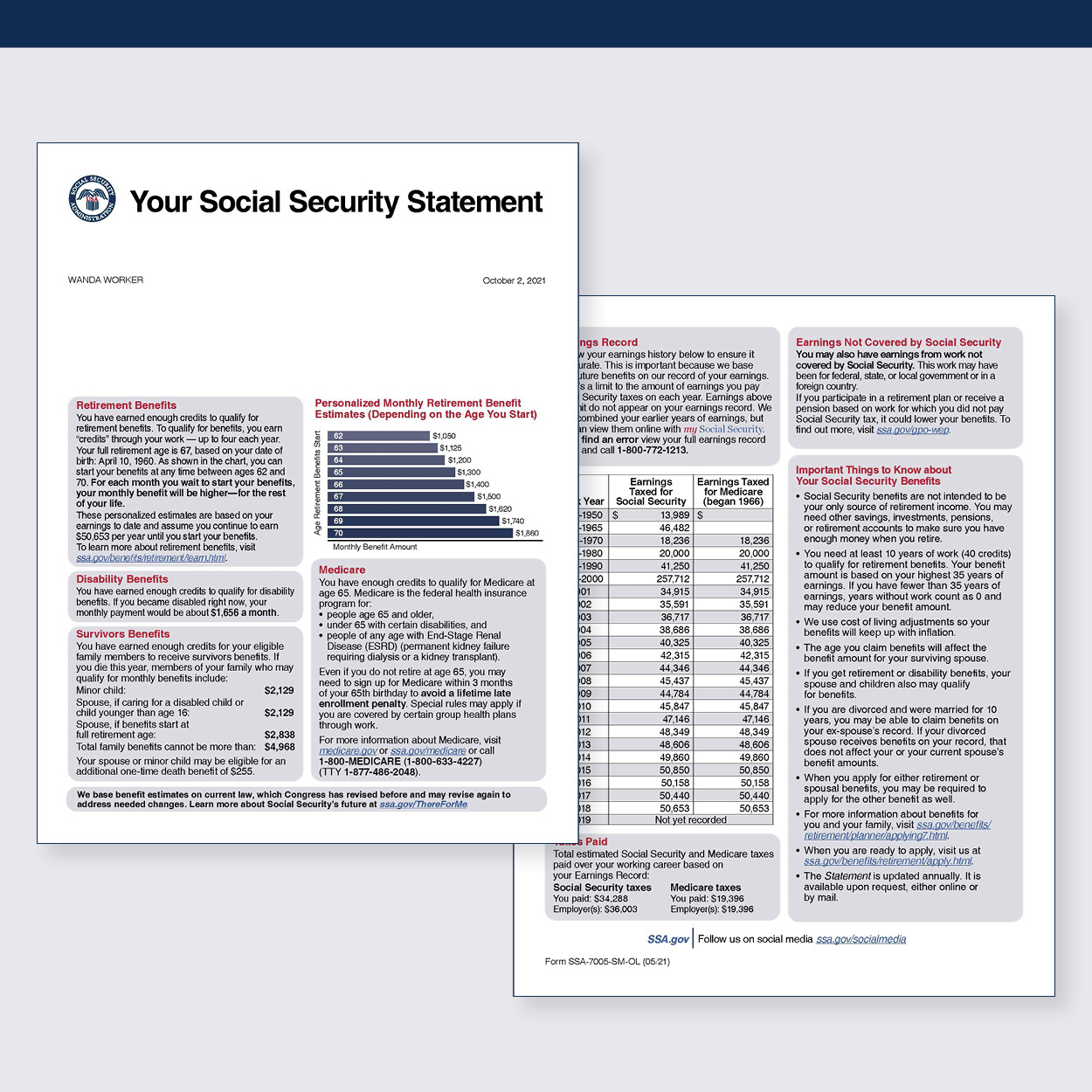

Below are some images related to Ssi W2 Forms

can you get a w2 from ssi, does social security mail w2 forms, how do i get my ss w2, social security office w2 forms, social security w2 form request, , Ssi W2 Forms.

can you get a w2 from ssi, does social security mail w2 forms, how do i get my ss w2, social security office w2 forms, social security w2 form request, , Ssi W2 Forms.