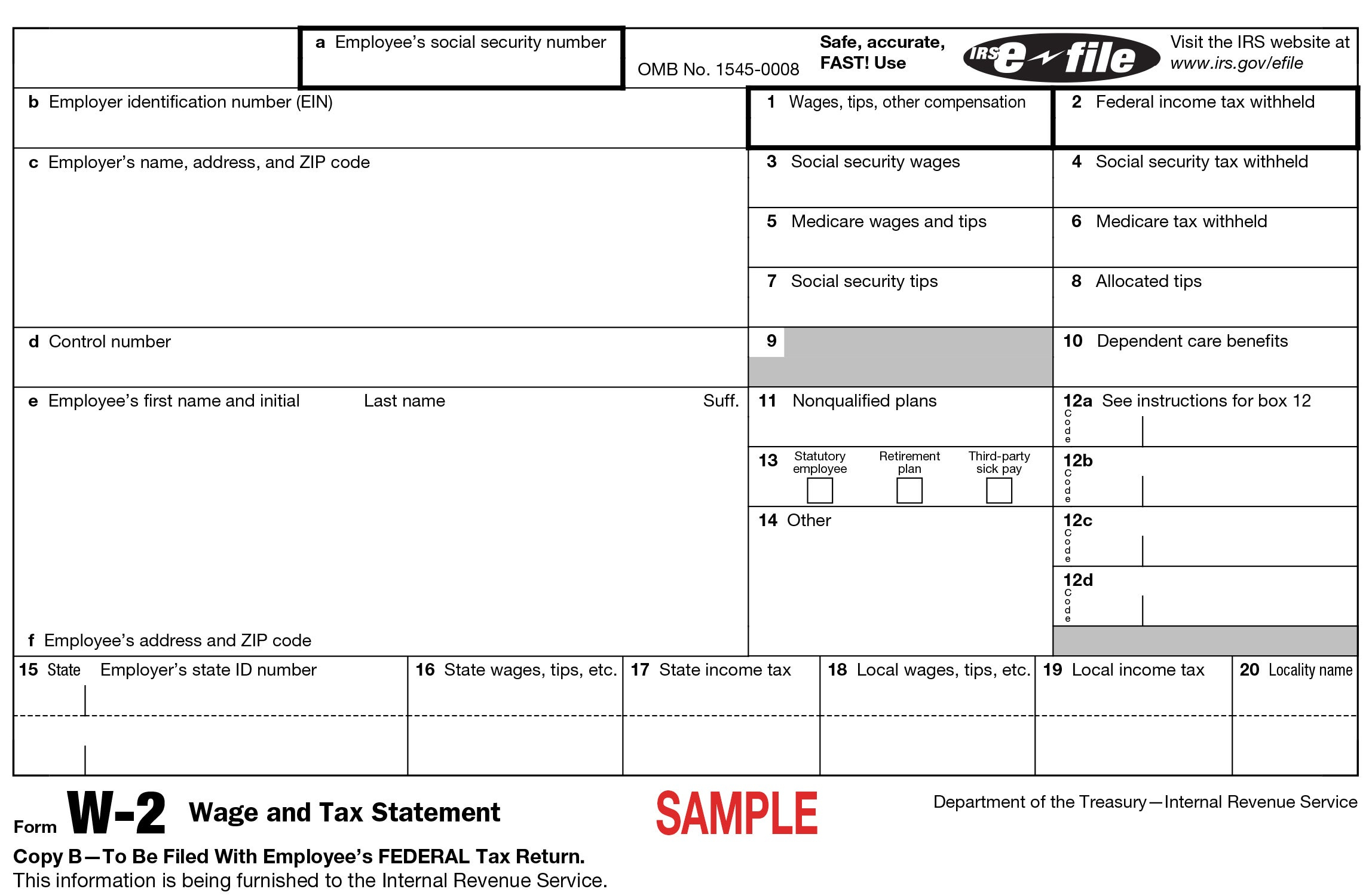

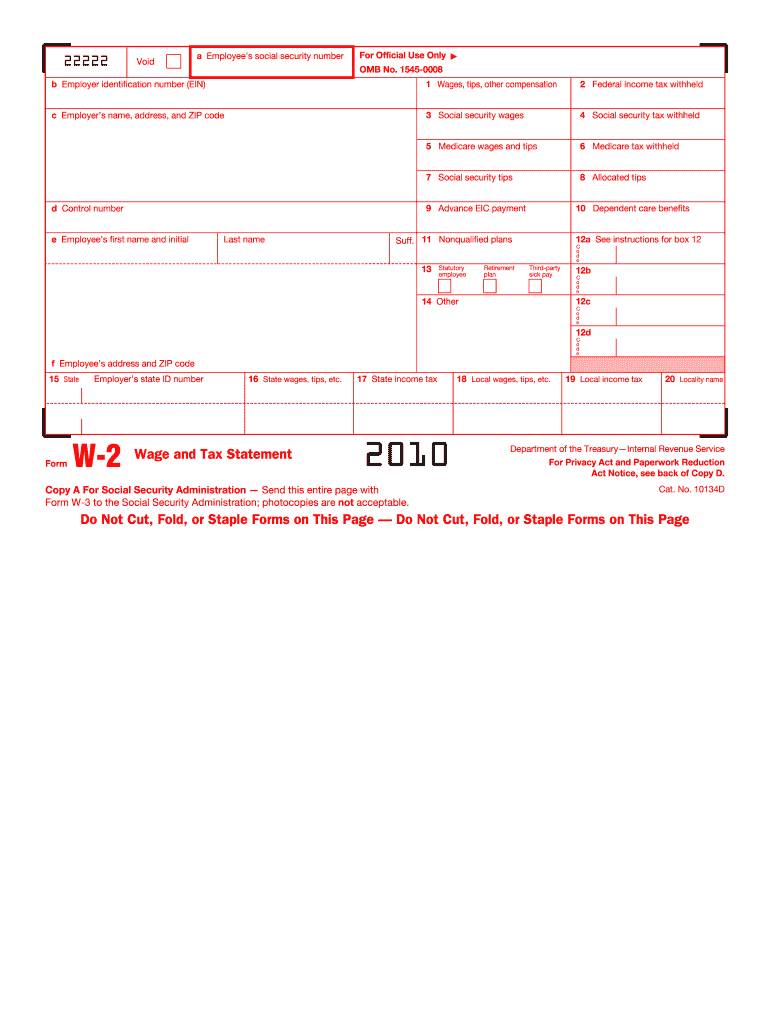

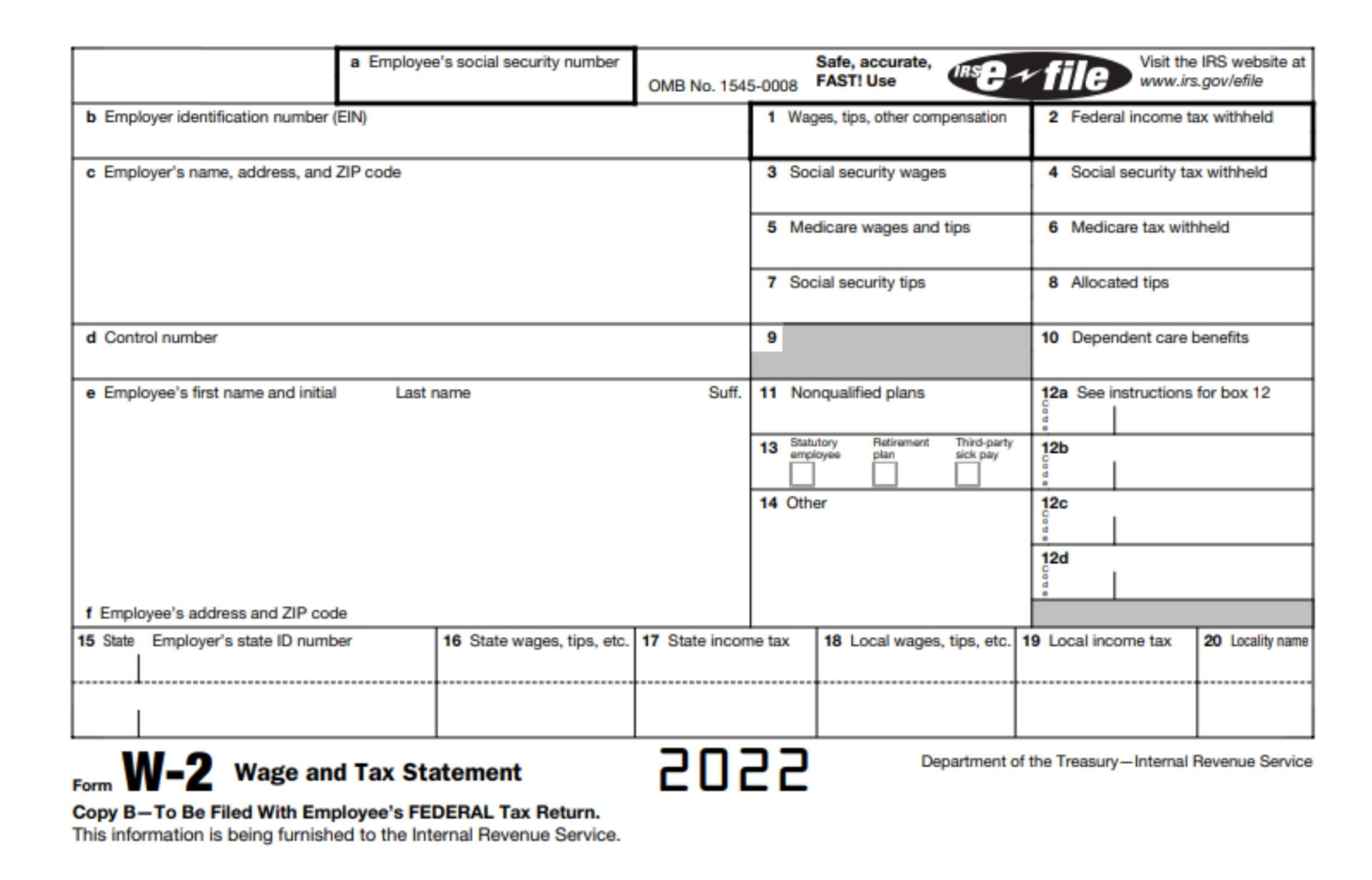

What Is Line 12a On A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of Line 12a on Your W2!

Have you ever looked at your W2 form and been puzzled by the numbers and codes? One particularly mysterious line is Line 12a, which seems to hold some sort of secret message. Fear not, dear taxpayers, for we are here to help you decode the enigma of Line 12a and unlock its hidden meaning!

Decoding the Enigma of Line 12a on Your W2!

Line 12a on your W2 form refers to the amount of money that your employer contributed to your 401(k) retirement account during the tax year. This amount is not included in your taxable income for the year, which means you won’t have to pay taxes on it until you withdraw the money from your 401(k) in the future. It’s like a little gift from your employer, helping you save for retirement without having to worry about paying taxes on it right now.

If you see a number on Line 12a of your W2 form, it’s a good sign that your employer is contributing to your retirement savings. It’s important to take advantage of this benefit and continue to contribute to your 401(k) as well. Saving for retirement is crucial, and having your employer contribute to your 401(k) is a great start. So next time you see Line 12a on your W2, you can smile knowing that you’re on the right track to a secure financial future.

Remember, Line 12a on your W2 form is nothing to fear – it’s actually a positive sign that your employer is helping you save for retirement. By understanding the meaning behind this mysterious line, you can feel more confident in your financial future and continue to make smart decisions when it comes to saving for retirement. So go ahead, decode the enigma of Line 12a and embrace the secrets it holds – your future self will thank you for it!

Below are some images related to What Is Line 12a On A W2 Form

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] pertaining to What Is Line 12A On A W2 Form](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-pertaining-to-what-is-line-12a-on-a-w2-form.jpg)

what is box 12a and 12b on w-2 form, what is box 12a dd on a w2 form, what is box 12a on my w2 form, what is line 12a and 12b on w-2, what is line 12a code dd on w2 form, , What Is Line 12a On A W2 Form.

what is box 12a and 12b on w-2 form, what is box 12a dd on a w2 form, what is box 12a on my w2 form, what is line 12a and 12b on w-2, what is line 12a code dd on w2 form, , What Is Line 12a On A W2 Form.