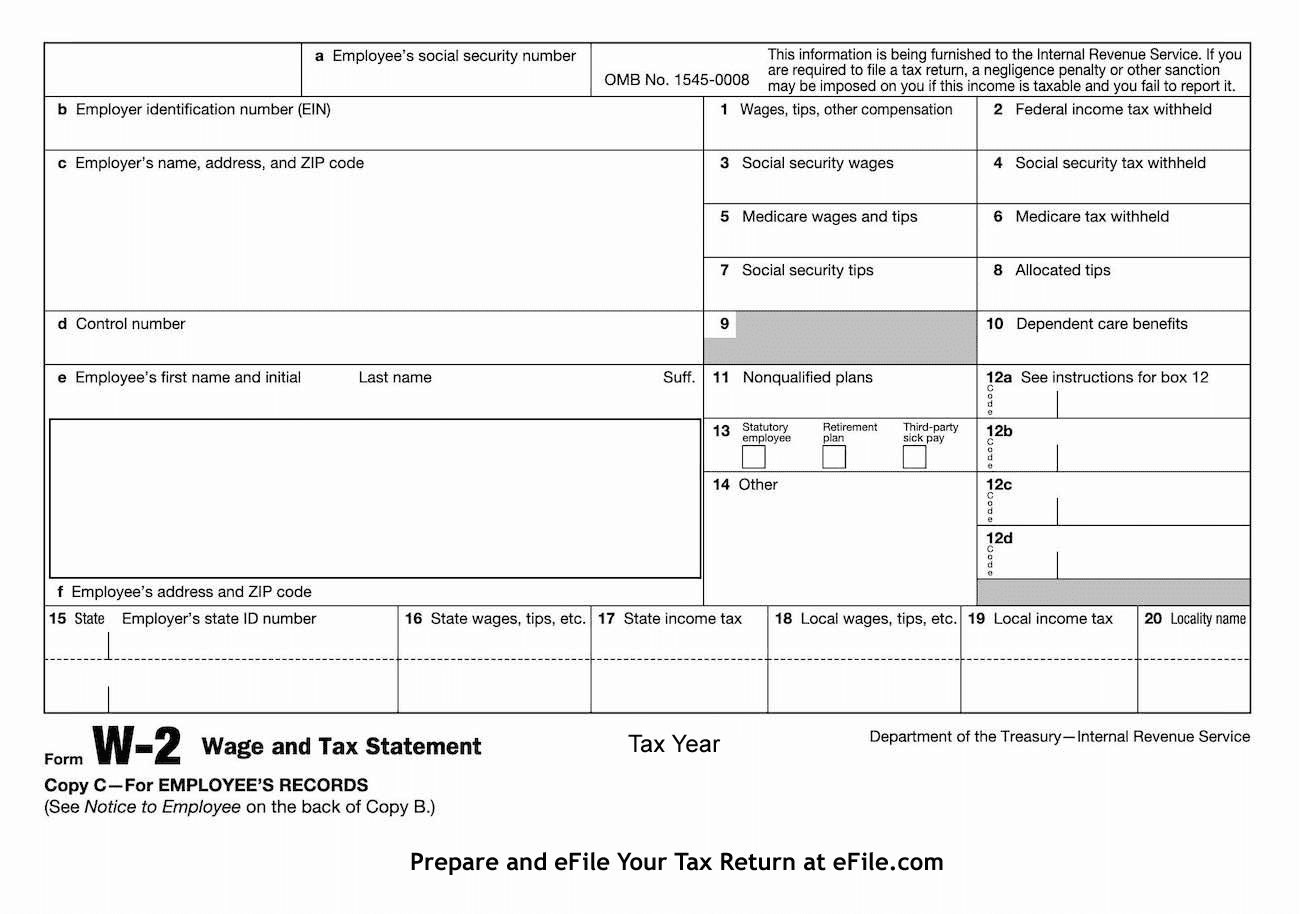

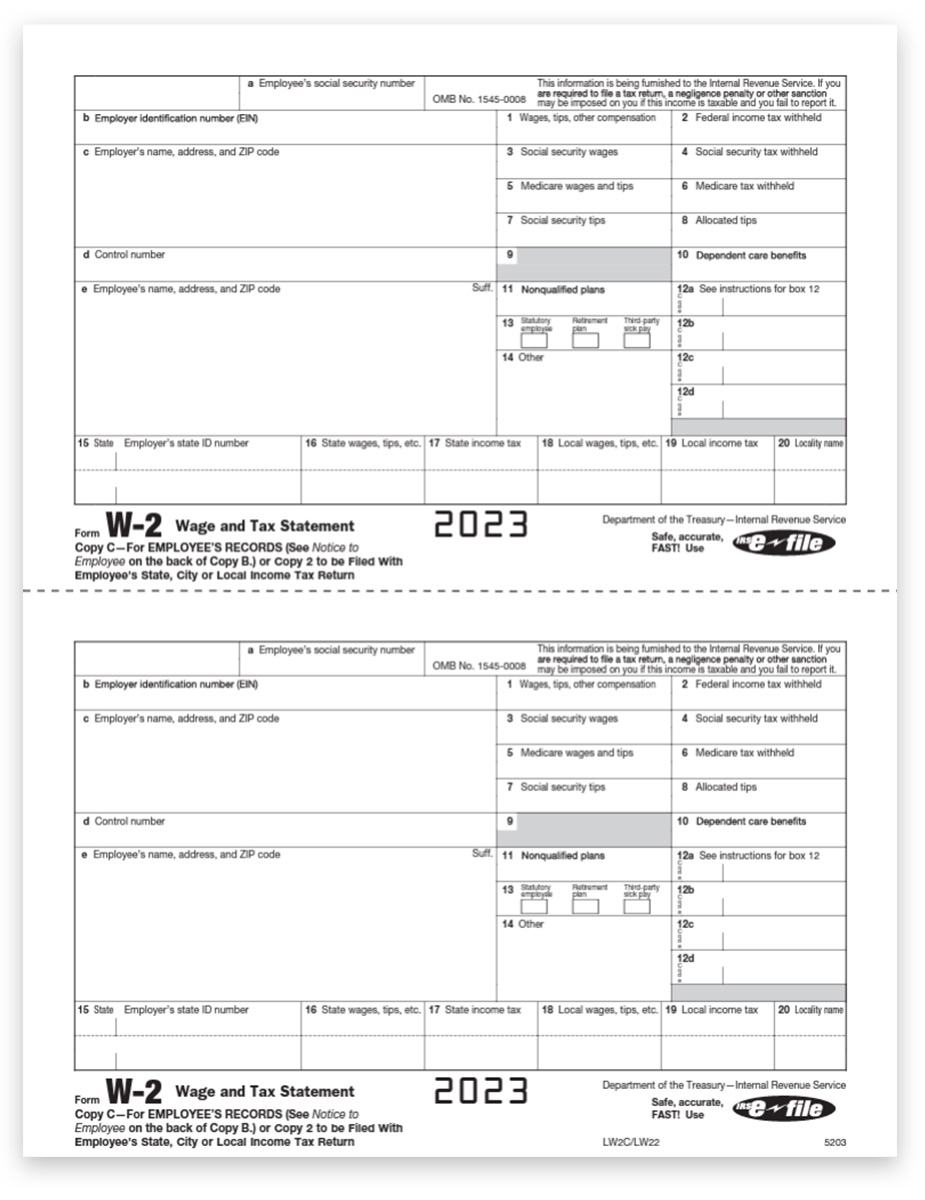

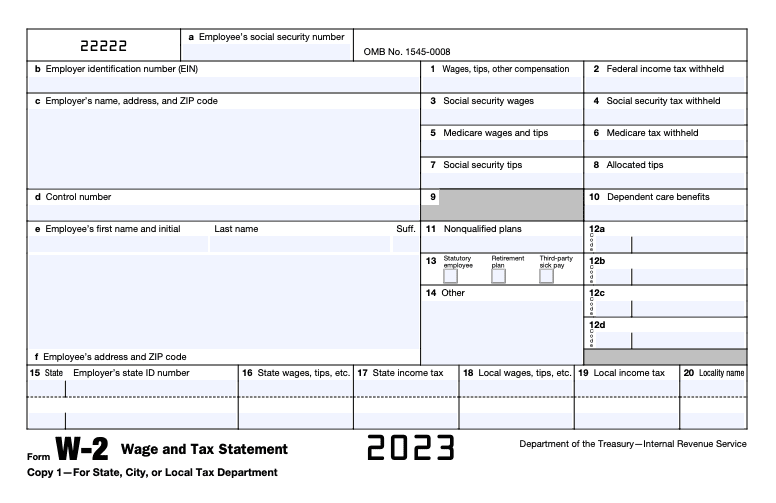

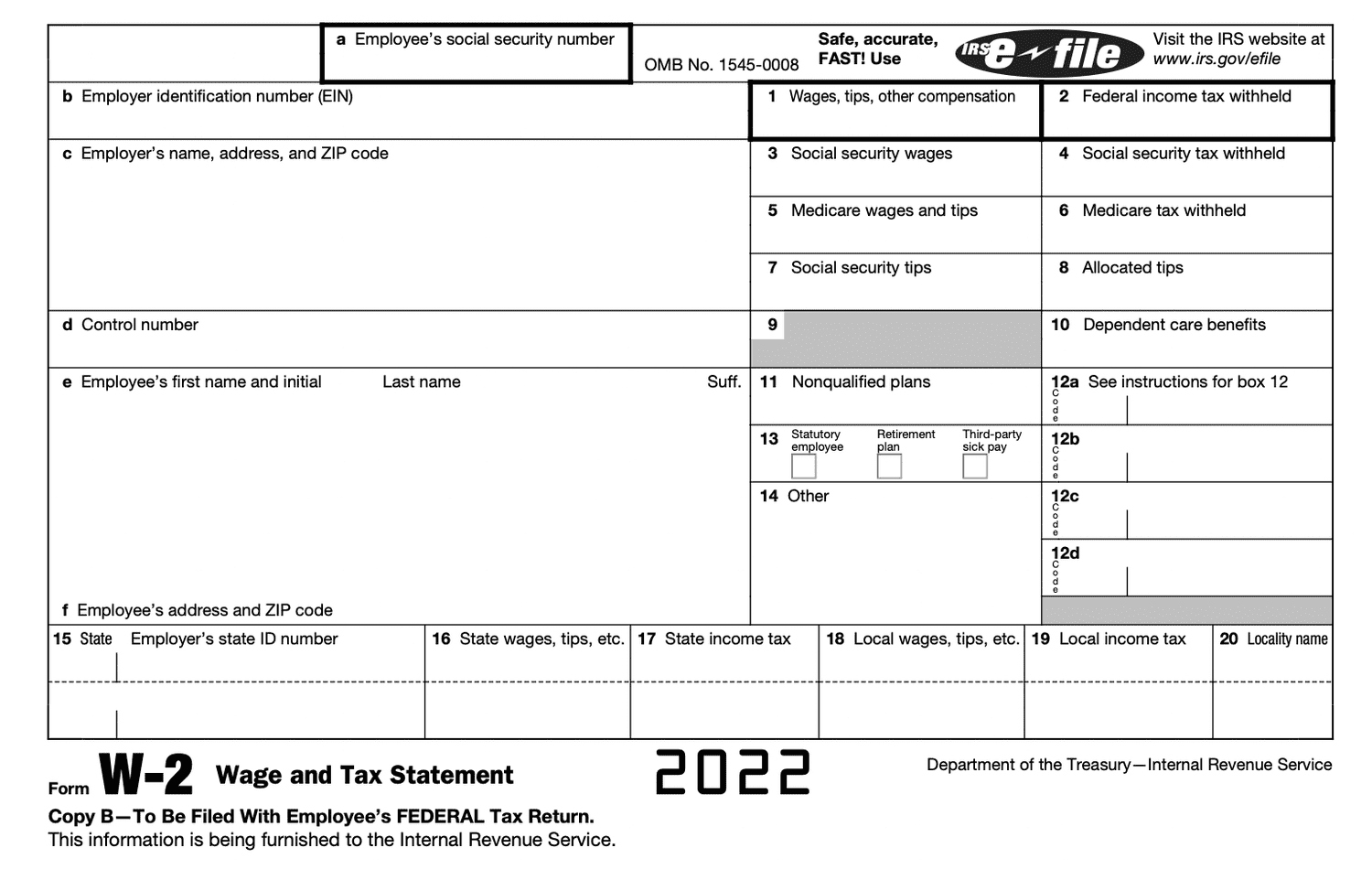

I Received 2 W2 Forms From Same Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Fun: My Surprise with 2 W2 Forms!

Have you ever received a surprise that left you feeling both excited and a bit overwhelmed? Well, that’s exactly how I felt when I received not one, but two W2 forms in the mail this year! As I eagerly tore open the envelopes, I couldn’t help but wonder what this unexpected twist in my tax season would entail. Little did I know, this double dose of paperwork was about to add a whole new layer of excitement to my tax-filing experience!

Twice the Paperwork: My Experience with 2 W2 Forms

As I sat down to examine both of my W2 forms, I quickly realized that this was going to be a bit more complicated than I had originally anticipated. With double the income sources to account for, I had to carefully cross-reference both forms to ensure that I was accurately reporting all of my earnings. While it may have been a bit more time-consuming than usual, I couldn’t help but feel a sense of pride in my ability to tackle this challenge head-on.

In the end, navigating through the process of dealing with two W2 forms turned out to be a valuable learning experience for me. Not only did I gain a better understanding of my financial situation, but I also developed a newfound sense of confidence in my ability to handle unexpected surprises. So, if you ever find yourself in a similar situation, remember that with a positive attitude and a little bit of extra effort, you can turn a potentially daunting task into a rewarding adventure. Double the fun, indeed!

Below are some images related to I Received 2 W2 Forms From Same Employer

can you get two w2 from same employer, i got 2 different w2 forms from same employer, i received 2 w2 forms from same employer, what if i have two w2 forms from different employers, why did i get two different w2s from the same employer, , I Received 2 W2 Forms From Same Employer.

can you get two w2 from same employer, i got 2 different w2 forms from same employer, i received 2 w2 forms from same employer, what if i have two w2 forms from different employers, why did i get two different w2s from the same employer, , I Received 2 W2 Forms From Same Employer.