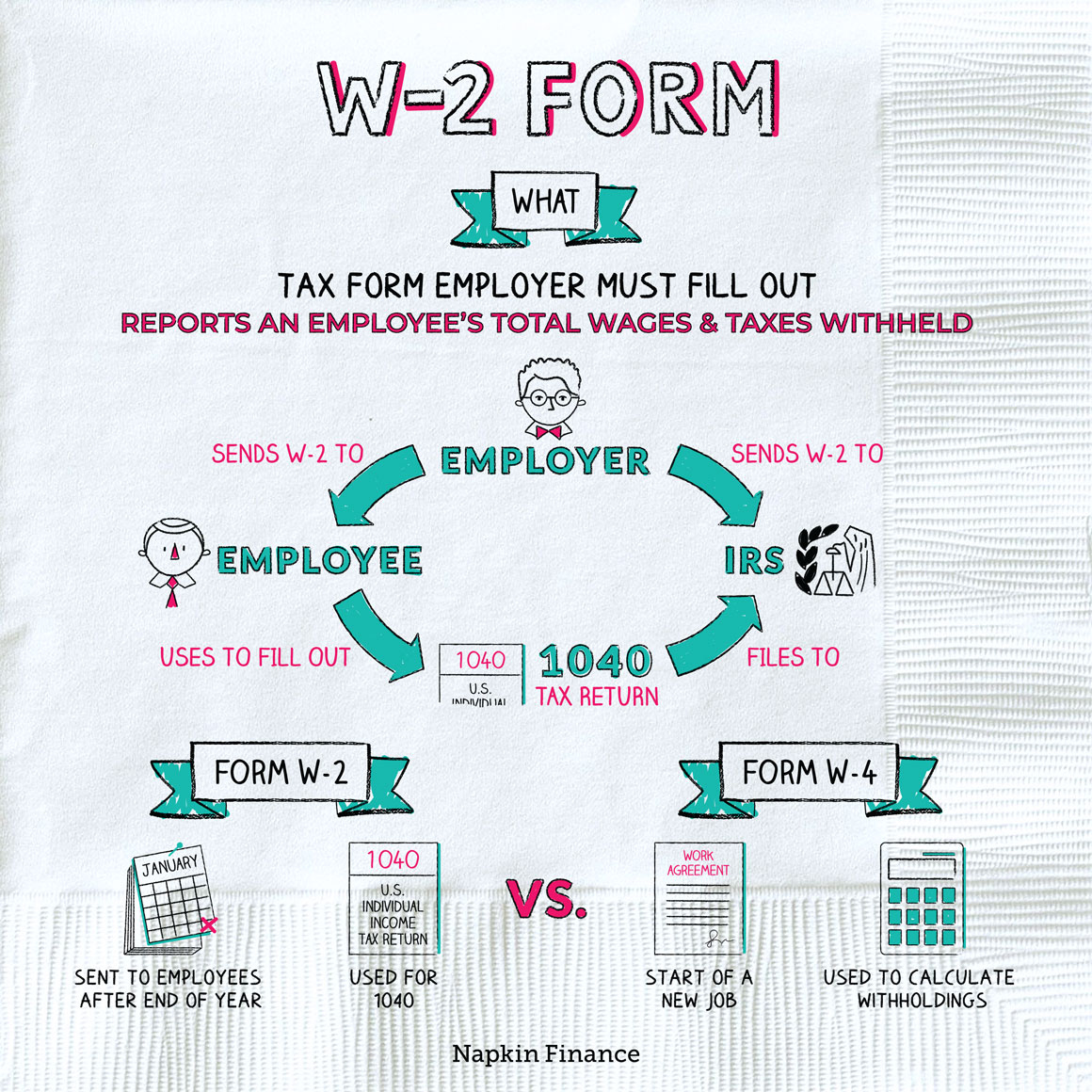

1040 Form Vs W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

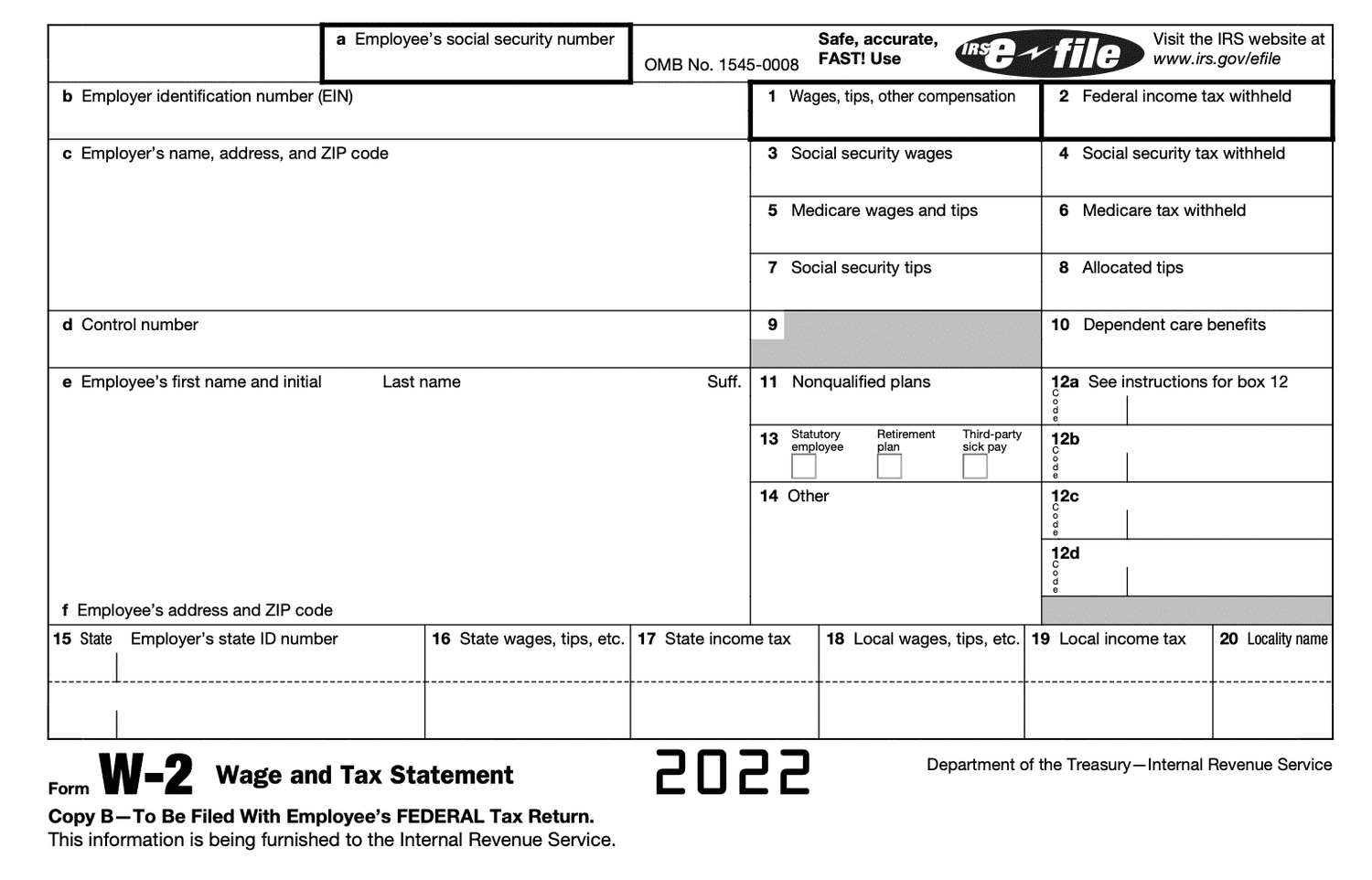

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Showdown: 1040 Form vs. W2 – Who Will Win?

It’s that time of year again – tax season! As you gather all your documents and prepare to file your taxes, you may find yourself faced with a decision: should you use the 1040 Form or the W2? These two tax forms are the titans of tax time, each with its own strengths and weaknesses. Let’s dive into this tax time showdown and see which form will come out on top!

Battle of the Tax Forms: 1040 Form vs. W2

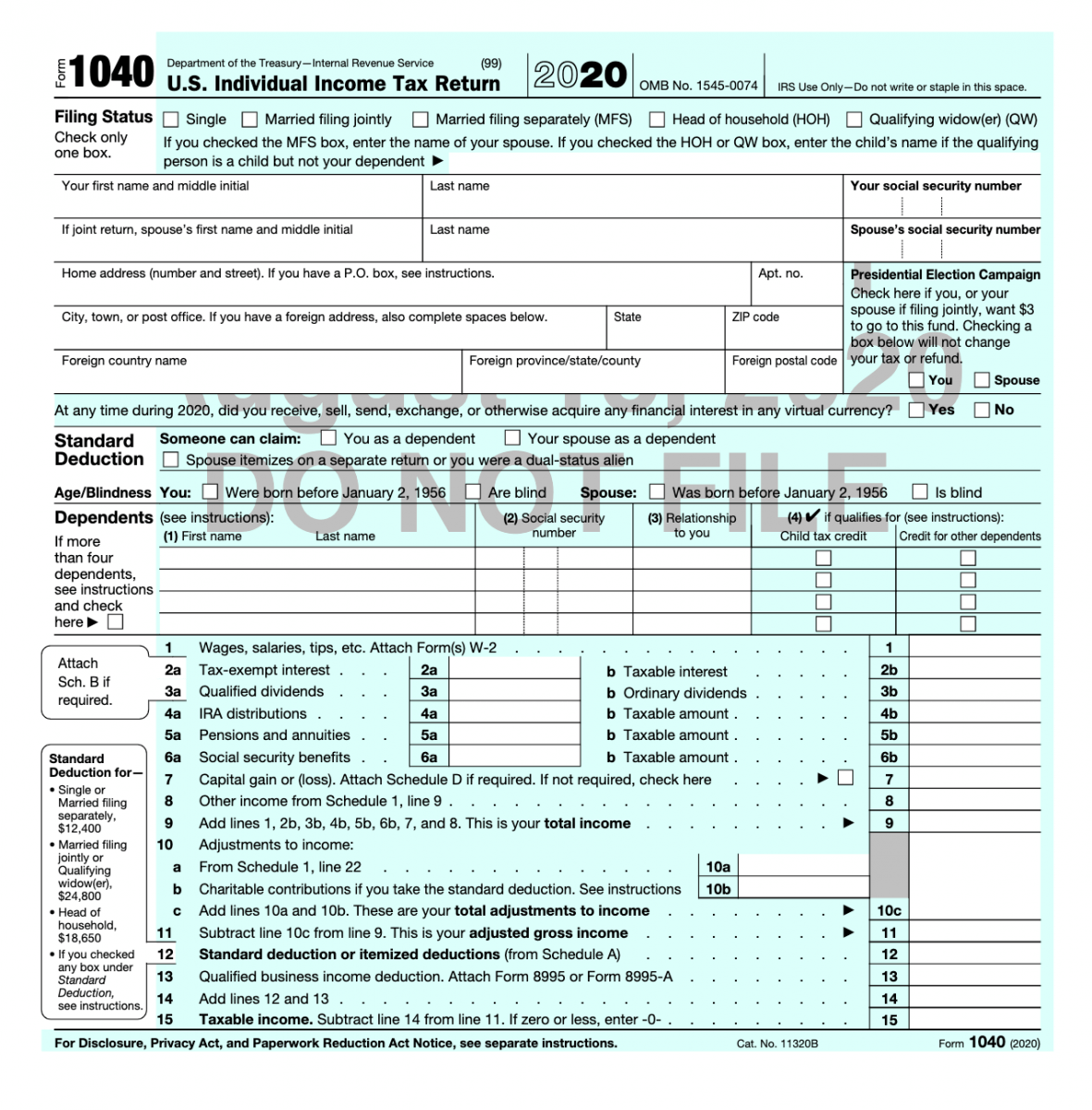

In one corner, we have the 1040 Form – the classic tax form that most Americans are familiar with. This form is the go-to for those who have more complex tax situations, such as self-employed individuals or those with multiple sources of income. The 1040 Form allows for more deductions and credits, giving taxpayers the opportunity to potentially lower their tax bill. However, filling out the 1040 Form can be time-consuming and complicated, requiring a keen attention to detail.

And in the other corner, we have the W2 – the simpler, more straightforward tax form that is provided by employers to employees. The W2 form lays out all the information you need to file your taxes, including your wages, tips, and taxes withheld. For those with straightforward tax situations, the W2 form can be a quick and easy way to file your taxes. However, the W2 may not provide as many opportunities for deductions and credits as the 1040 Form, potentially resulting in a higher tax bill.

Clash of the Titans: Which Will Reign Supreme?

So, which form will come out victorious in this tax time showdown? The answer ultimately depends on your individual tax situation. If you have a more complex financial situation with multiple sources of income, investments, or deductions, the 1040 Form may be the way to go. However, if you have a simple tax situation and just need to report your income from your job, the W2 form may be the quicker and easier option.

In the end, both the 1040 Form and the W2 have their strengths and weaknesses. The key is to choose the form that best fits your individual tax situation and allows you to accurately report your income and deductions. Whichever form you choose, just remember to file your taxes on time and accurately to avoid any penalties or fees. Good luck in this tax time showdown – may the best form win!

Conclusion

As tax season heats up, the battle between the 1040 Form and the W2 rages on. Will the complexity of the 1040 Form reign supreme, or will the simplicity of the W2 take the crown? Whichever form you choose, remember that the ultimate goal is to accurately report your income and deductions to ensure a smooth and successful tax filing process. So gather your documents, choose your form, and may the odds be ever in your favor this tax season!

Below are some images related to 1040 Form Vs W2

1040 form or w2, 1040 form vs w2, irs 1040 form vs w2, is w2 same as 1040, what’s the difference between a w2 and 1040, , 1040 Form Vs W2.

1040 form or w2, 1040 form vs w2, irs 1040 form vs w2, is w2 same as 1040, what’s the difference between a w2 and 1040, , 1040 Form Vs W2.