W2 Form Vs 1099 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Showdown: W2 Form Versus 1099!

Are you ready for the ultimate battle of the tax forms? It’s time to pit the W2 form against the 1099 in a showdown that will determine your tax fate! These two forms may look similar at first glance, but they serve different purposes and can have a big impact on your tax return. Let’s dive into the details and see which form comes out on top in this tax time showdown!

Battle of the Tax Forms: W2 vs 1099!

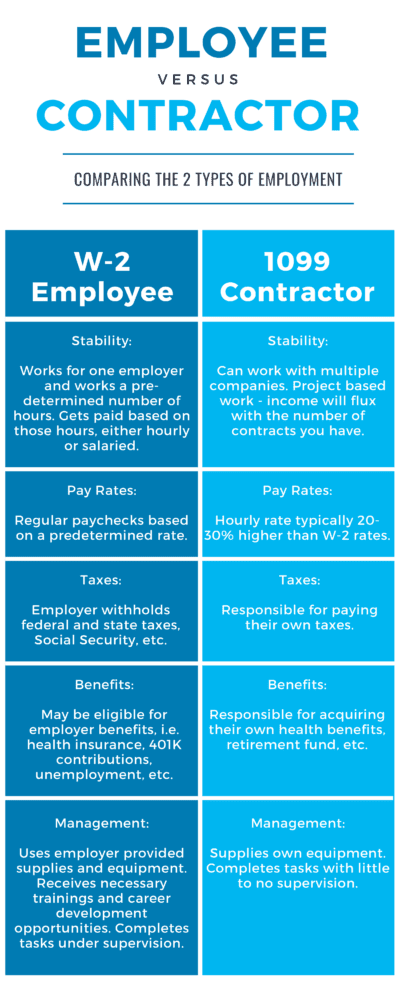

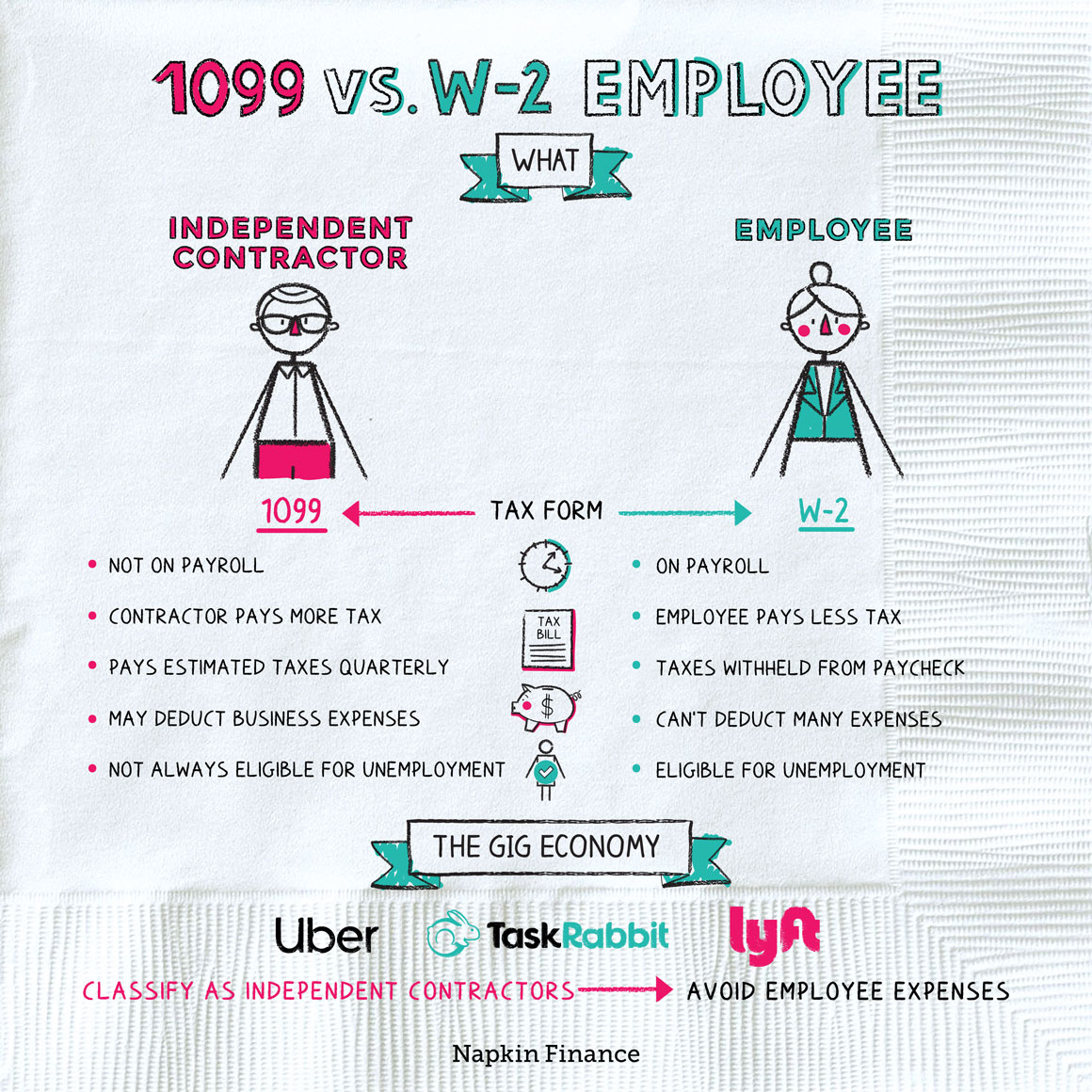

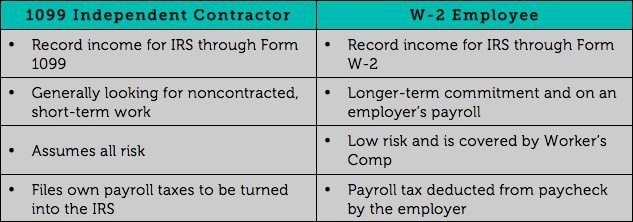

In one corner, we have the W2 form, typically provided by employers to employees. This form details your wages, taxes withheld, and other important information needed to file your taxes accurately. The W2 is straightforward and easy to understand, making it a favorite among many taxpayers. On the other hand, the 1099 form is usually given to independent contractors or freelancers who receive income from multiple sources. This form reports non-employee compensation, interest, dividends, and other types of income that may not be subject to withholding.

Deciphering the Tax Time Showdown!

When it comes to tax time, deciphering between the W2 and 1099 forms can be a daunting task. The key difference lies in how income is reported and taxed. W2 income is subject to payroll taxes, such as Social Security and Medicare, which are typically withheld by your employer. On the other hand, 1099 income is not subject to withholding, meaning you are responsible for paying self-employment taxes on that income. Understanding the nuances of each form is crucial to accurately reporting your income and avoiding any potential tax pitfalls.

In the end, both the W2 and 1099 forms play important roles in the tax world. Whether you’re a traditional employee or a freelancer, knowing how to navigate these forms can make a big difference in your tax situation. So, gather your forms, grab your calculator, and get ready to face the tax time showdown head-on. With a little bit of knowledge and a whole lot of determination, you’ll conquer your taxes like a pro!

Below are some images related to W2 Form Vs 1099

difference between w2 vs 1099, is 1099 better than w2, w2 form and 1099, w2 form vs 1099, when to use 1099 vs w2, , W2 Form Vs 1099.

difference between w2 vs 1099, is 1099 better than w2, w2 form and 1099, w2 form vs 1099, when to use 1099 vs w2, , W2 Form Vs 1099.