I Forgot To File One Of My W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Oops! One W2 Slip Through – What Now?

Have you ever experienced the sinking feeling of realizing that one of your W2 forms has somehow gone missing? Don’t worry, you’re not alone! It’s a common mistake that can happen to anyone. Whether it got lost in the mail, misplaced in a pile of papers, or forgotten by your employer, the important thing is to stay calm and take action to rectify the situation.

Oops! Where Did My W2 Go?

First things first, double-check all of the usual places where important documents tend to hide. Look through your mail pile, desk drawers, and any other places where you may have stashed papers. If you still can’t find it, reach out to your employer and request a copy of your missing W2. They are required to provide you with a duplicate, so don’t hesitate to ask for their assistance.

If you’ve moved recently, it’s possible that your W2 was sent to an old address. Contact the postal service to see if they can forward any mail that was sent to your previous residence. Additionally, make sure to update your address with your employer to prevent any future issues with receiving important documents.

Don’t Panic – Here’s What to Do Next!

Once you have a copy of your missing W2 in hand, you can proceed with filing your taxes as usual. If you’re running short on time before the tax deadline, consider filing for an extension to give yourself some breathing room. It’s important to make sure that all of your tax information is accurate and up-to-date before submitting your return.

If you’re still unable to locate your missing W2, you can also request a copy from the IRS. They have a program called Get Transcript that allows you to access your tax information online. While it may take some extra time and effort to retrieve your W2 this way, it’s a helpful option if all else fails.

In the future, make sure to keep all of your important tax documents organized and in a secure location. This will help you avoid the stress of losing a W2 again and ensure that you’re prepared for tax season each year. Remember, mistakes happen, but with a little patience and persistence, you can overcome any obstacles that come your way.

Conclusion

Losing a W2 form can be a frustrating experience, but it’s important not to panic. By taking proactive steps to locate your missing document and reaching out for assistance when needed, you can ensure that your tax filing process goes smoothly. Remember to stay organized and keep track of your important documents to avoid similar mishaps in the future. With a positive attitude and a willingness to problem-solve, you’ll be back on track in no time.

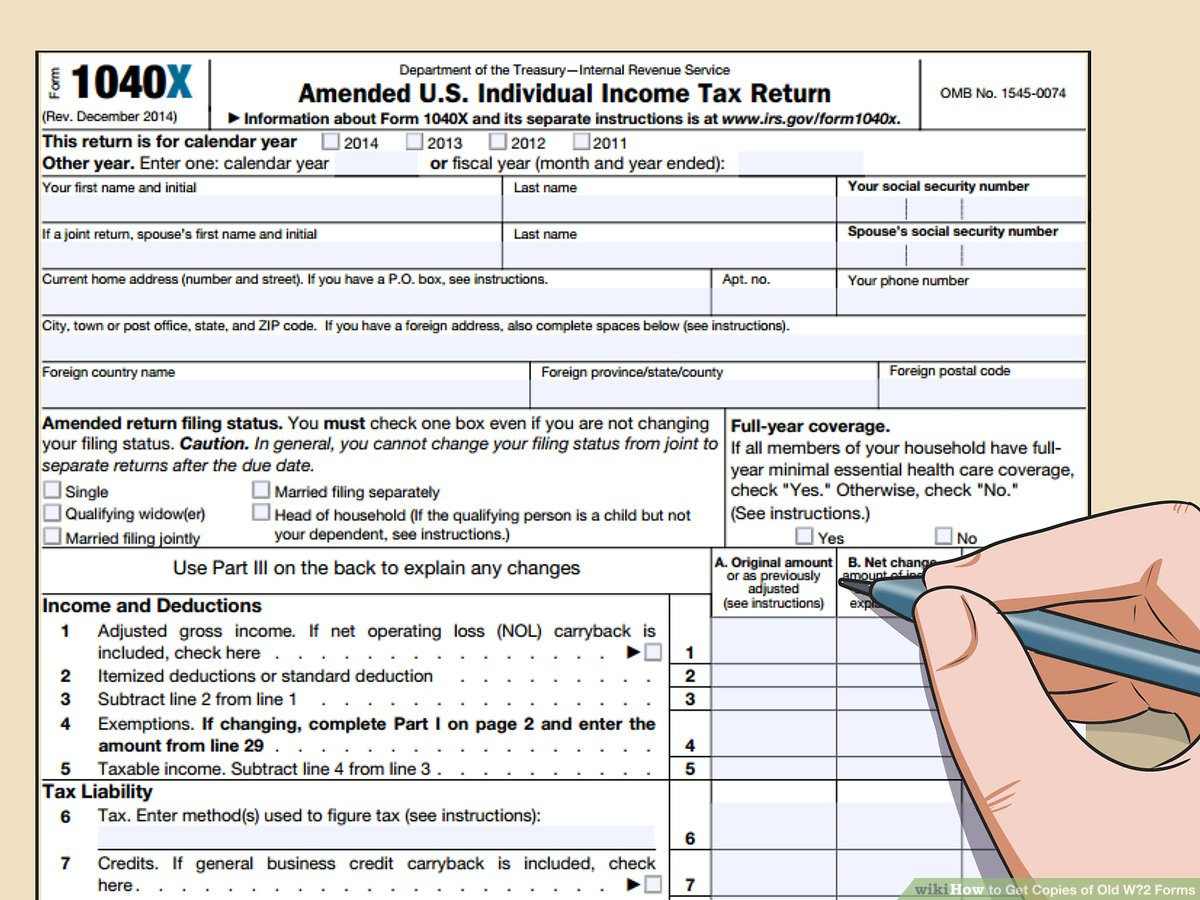

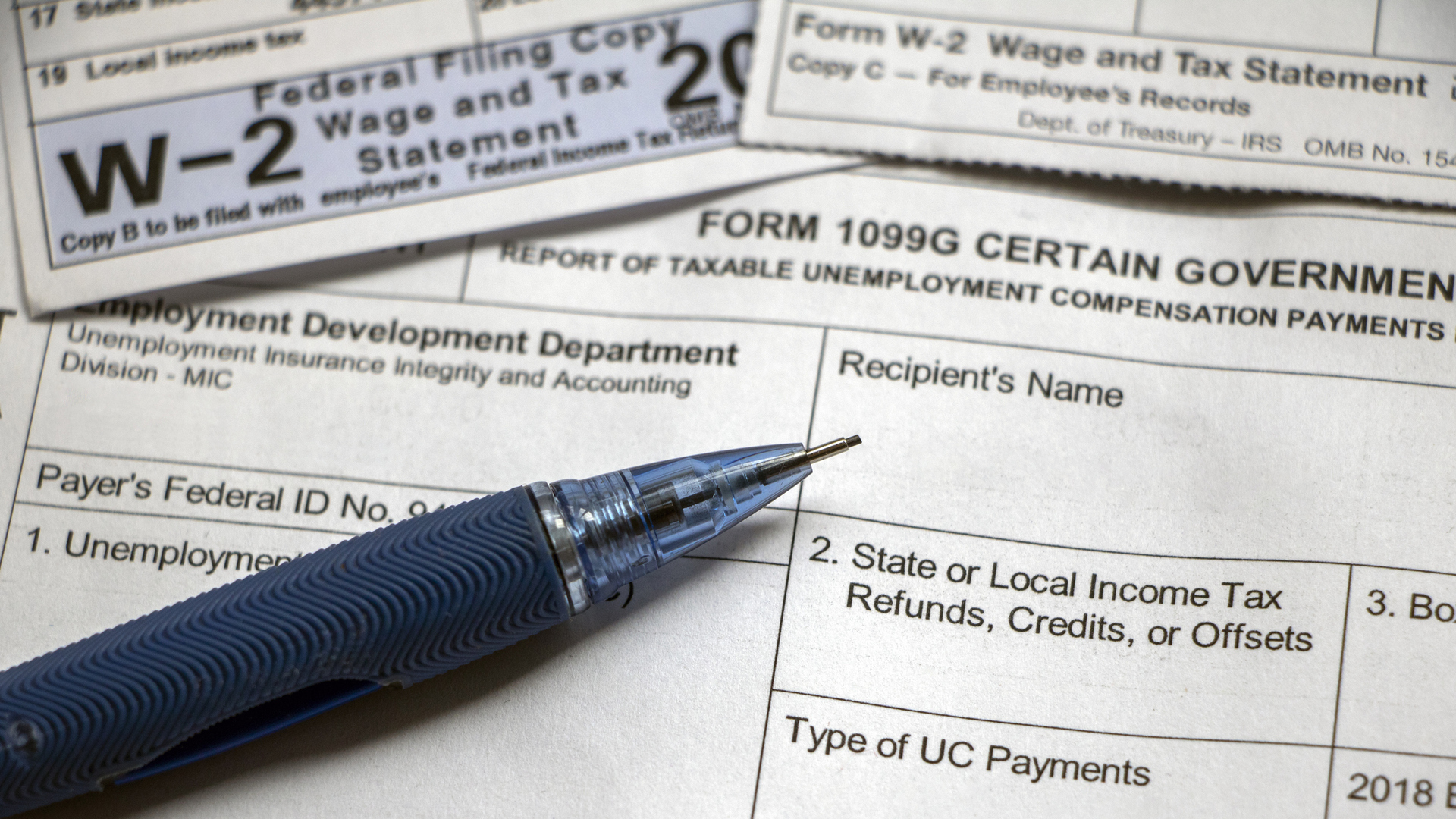

Below are some images related to I Forgot To File One Of My W2 Forms

i forgot to file one of my w2 forms, what happens if i forgot to file one of my w2s, what if i forgot to file one of my w2 forms, what to do if you forgot to file a w2, what to do if you forgot to file one of your w2s, , I Forgot To File One Of My W2 Forms.

i forgot to file one of my w2 forms, what happens if i forgot to file one of my w2s, what if i forgot to file one of my w2 forms, what to do if you forgot to file a w2, what to do if you forgot to file one of your w2s, , I Forgot To File One Of My W2 Forms.