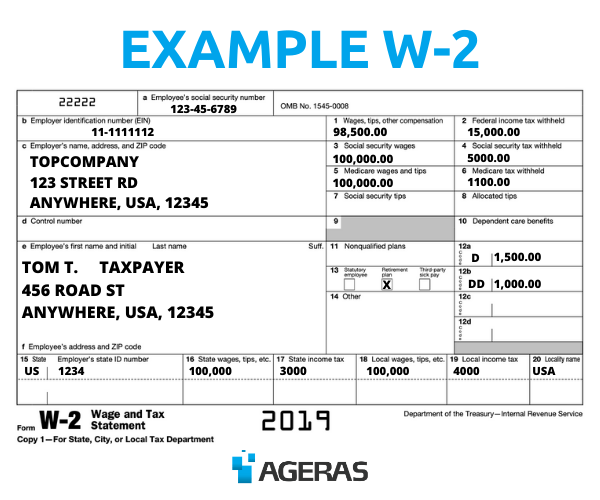

W2 Tax Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2s: Your Guide to Tax Form Happiness

Are you ready to dive into the enchanting world of W2s and unlock the secrets to tax form happiness? Look no further! Your trusty guide is here to show you the way to a stress-free tax season. With a little bit of magic and a sprinkle of knowledge, you’ll be on your way to filing your taxes with confidence and ease.

Unleash the Magic of W2s!

Ah, the elusive W2 form – a crucial piece of the tax puzzle that can sometimes feel like a daunting task to tackle. But fear not, for this magical document holds the key to unlocking your tax refund dreams. Your W2 contains all the important information about your earnings and taxes withheld throughout the year, making it essential for filing your taxes accurately. So grab your wand (or pen) and let’s dive into the world of W2s!

Your Pathway to Tax Form Bliss

Once you’ve received your W2 form from your employer, it’s time to start the journey to tax form bliss. Take a moment to review the information on your W2, making sure all the numbers match up with your records. If you spot any discrepancies, don’t hesitate to reach out to your employer for clarification. Next, gather any additional tax documents you may need, such as 1099 forms or receipts for deductions. With all your paperwork in hand, you’ll be well on your way to a smooth and stress-free tax filing experience.

Embrace the Magic of Organization

Organization is key when it comes to navigating the world of tax forms, and your W2 is no exception. Create a folder or digital file to store all your tax documents in one place, making it easy to access them when it’s time to file. Keep track of important deadlines and make a checklist to ensure you’ve gathered all the necessary documents before sitting down to do your taxes. With a little bit of organization and a touch of magic, you’ll breeze through tax season feeling confident and prepared.

In conclusion, unlocking the magic of W2s is the key to a successful and stress-free tax season. By familiarizing yourself with your W2 form, staying organized, and gathering all the necessary documents, you’ll be well on your way to tax form happiness. So embrace the magic, stay positive, and remember that with a little bit of effort and know-how, you can conquer tax season like a pro. Happy filing!

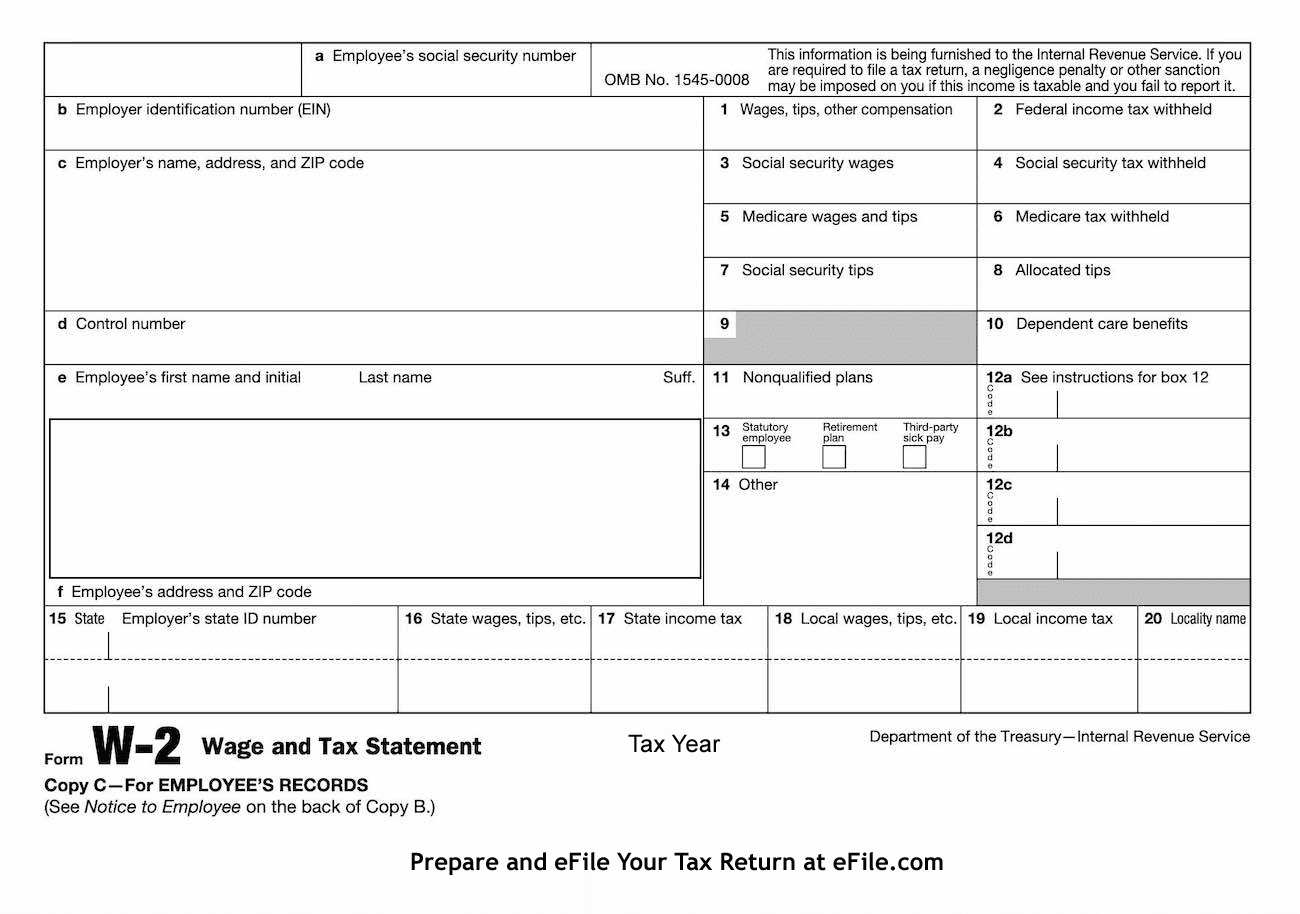

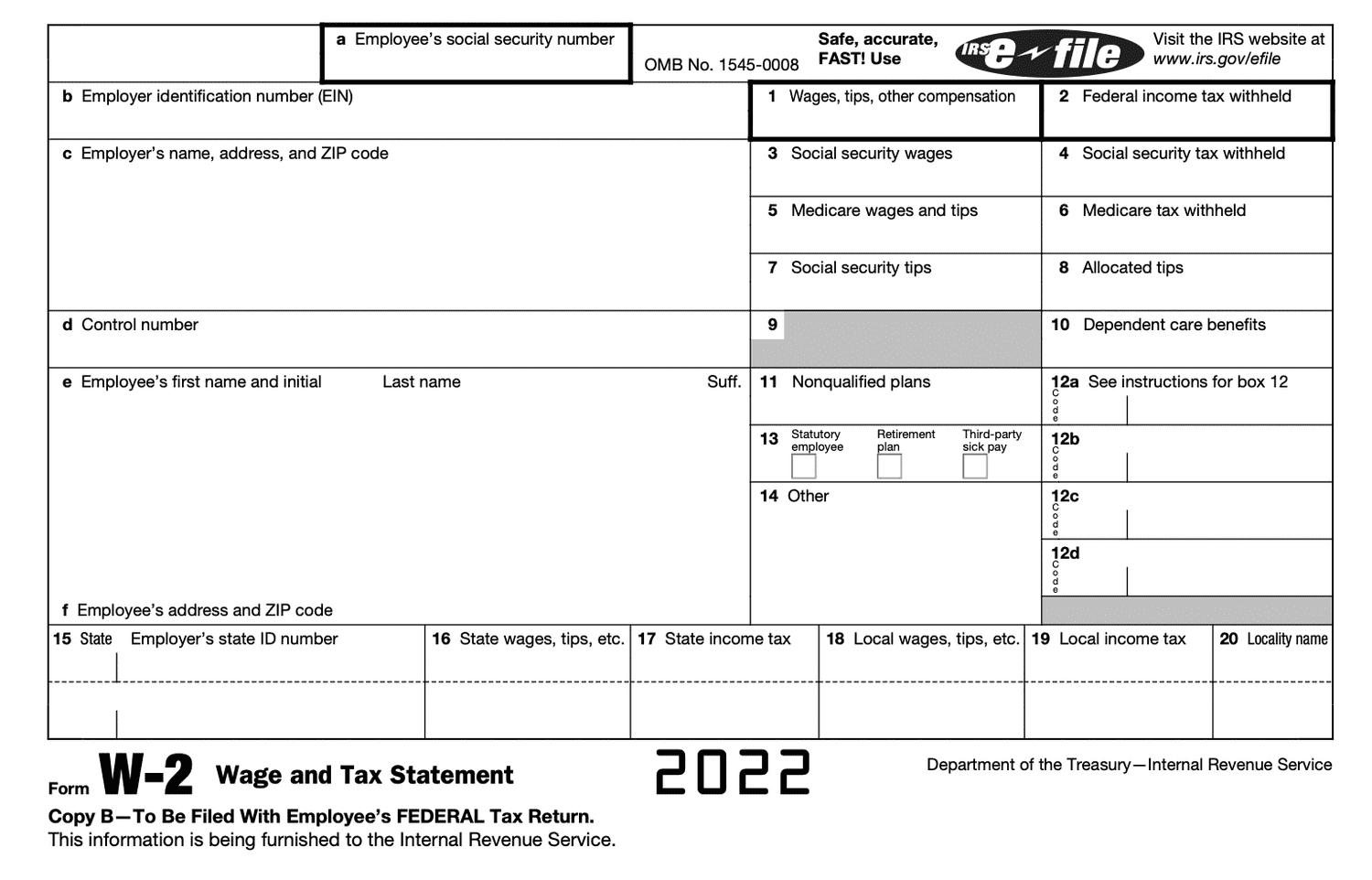

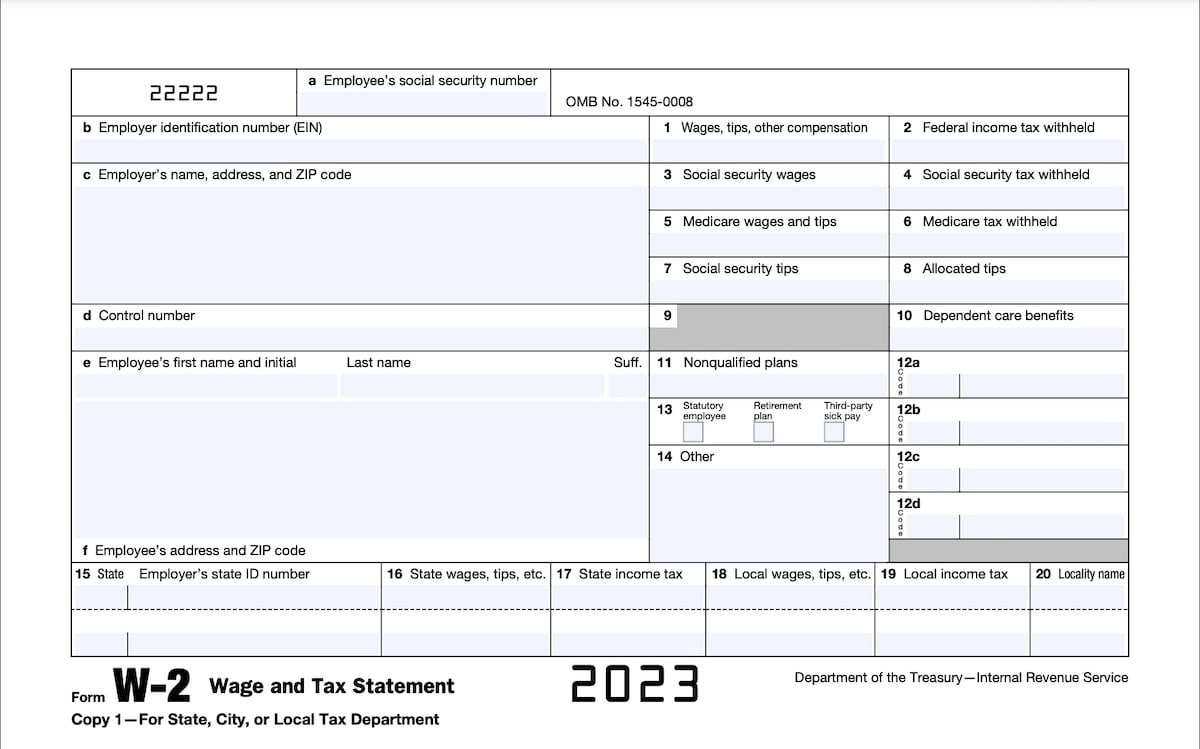

Below are some images related to W2 Tax Forms

w2 tax form box 12, w2 tax form canada, w2 tax form example, w2 tax form explained, w2 tax form meaning, , W2 Tax Forms.

w2 tax form box 12, w2 tax form canada, w2 tax form example, w2 tax form explained, w2 tax form meaning, , W2 Tax Forms.