W2 Form Box D – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

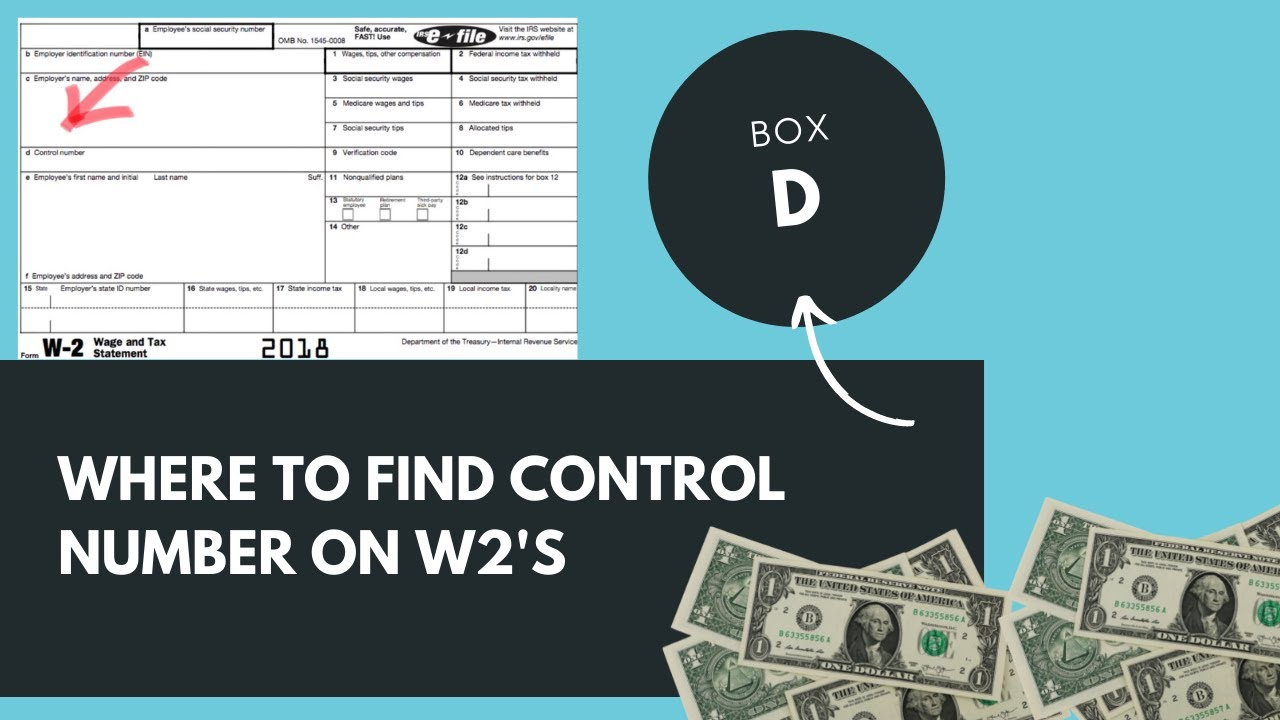

Unveiling the Enigma of Box D on Your W2 Form!

Have you ever wondered about the mysterious Box D on your W2 form? Many people overlook this seemingly insignificant box, but little do they know, it holds the key to unlocking a world of hidden treasures and secrets! In this article, we will delve into the magic of Box D and discover the wonders it has in store for you.

Discover the Hidden Treasures of Box D on Your W2 Form!

Box D on your W2 form contains valuable information about the amount of pre-tax dollars you have contributed to your employer-sponsored retirement plan throughout the year. This number represents the money you have set aside for your future, allowing you to save for retirement while reducing your taxable income. By unraveling the contents of Box D, you can gain a better understanding of your financial health and plan for a secure future.

Furthermore, the information in Box D can have a significant impact on your tax liability and refund amount. By contributing to a retirement plan, you not only save for the future but also lower your taxable income for the current year. This can lead to a lower tax bill or a higher tax refund, making Box D a valuable tool for maximizing your tax savings. So, next time you receive your W2 form, be sure to take a closer look at Box D and unleash its magic!

Unlock the Secrets and Unleash the Magic of Box D!

In conclusion, Box D on your W2 form is not just a random box filled with numbers – it is a treasure trove of information that can help you secure your financial future and maximize your tax savings. By understanding the significance of Box D and the impact of your contributions to a retirement plan, you can make informed decisions about your finances and plan for a brighter tomorrow. So, don’t let Box D remain a mystery any longer – unwrap its magic and take control of your financial destiny!

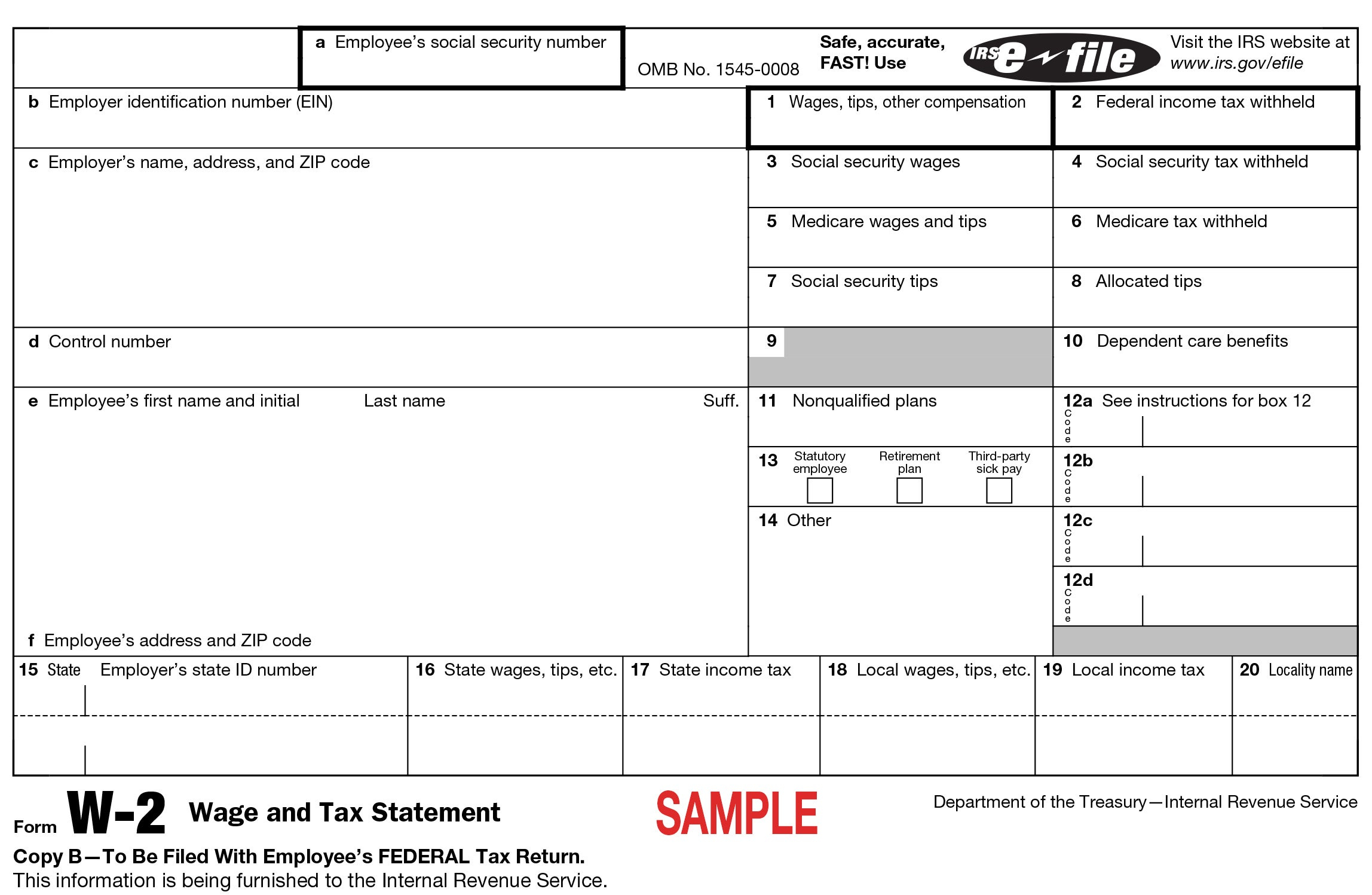

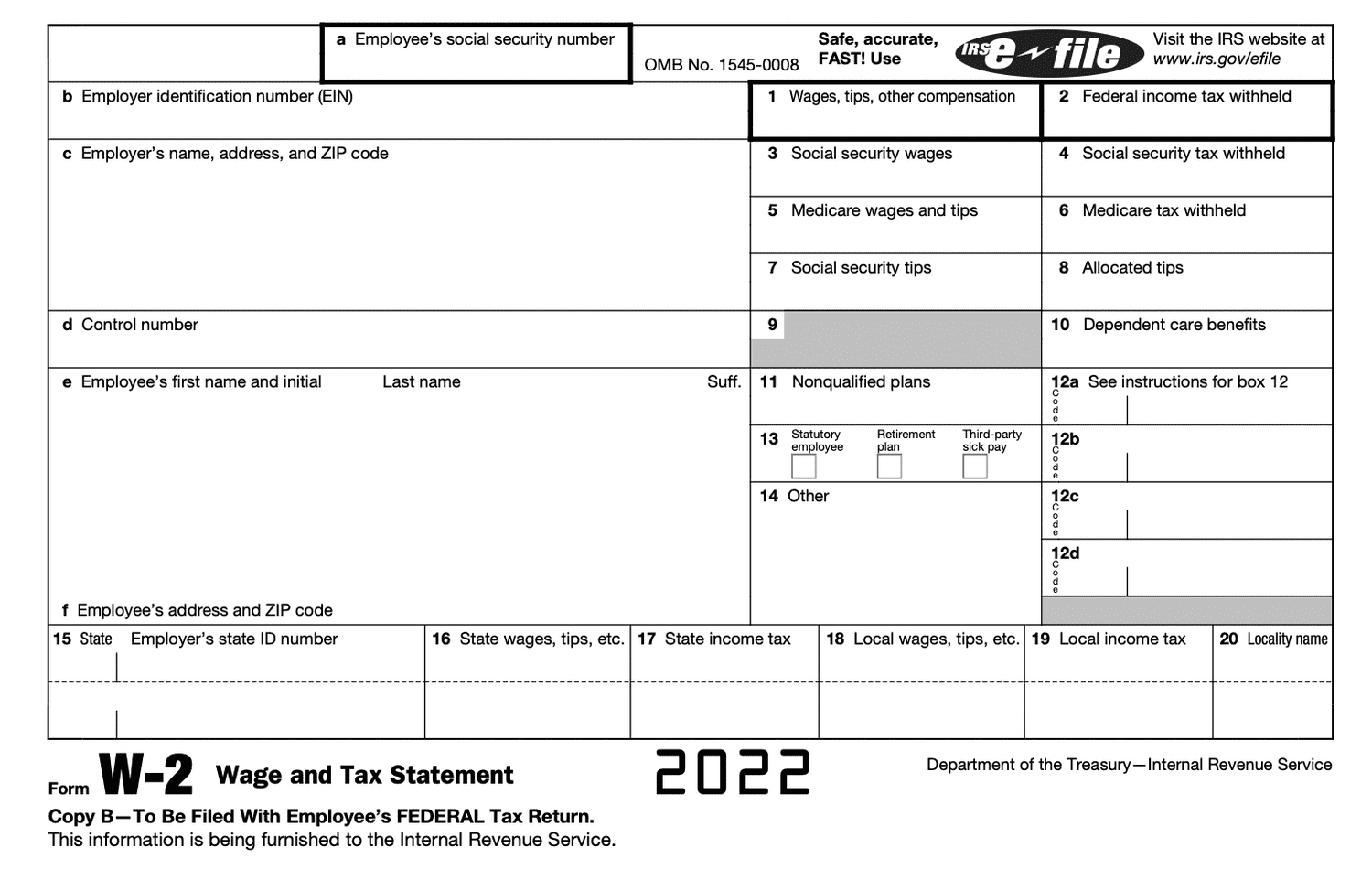

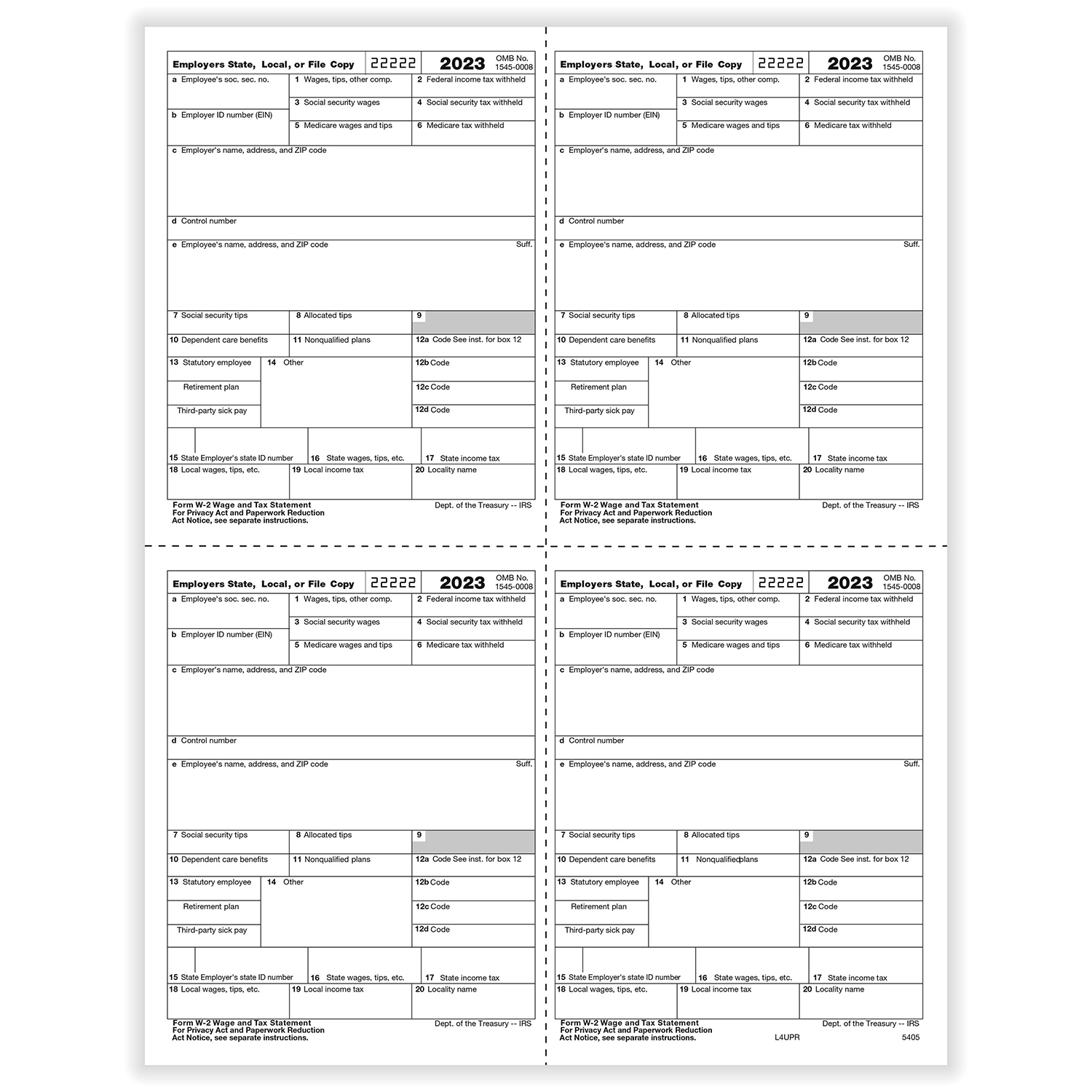

Below are some images related to W2 Form Box D

w-2 form box 12b dd, w-2 form definition box 12, w2 form box 12 d, w2 form box 12a d, w2 form box 12a dd, , W2 Form Box D.

w-2 form box 12b dd, w-2 form definition box 12, w2 form box 12 d, w2 form box 12a d, w2 form box 12a dd, , W2 Form Box D.