W2 Form What Is – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

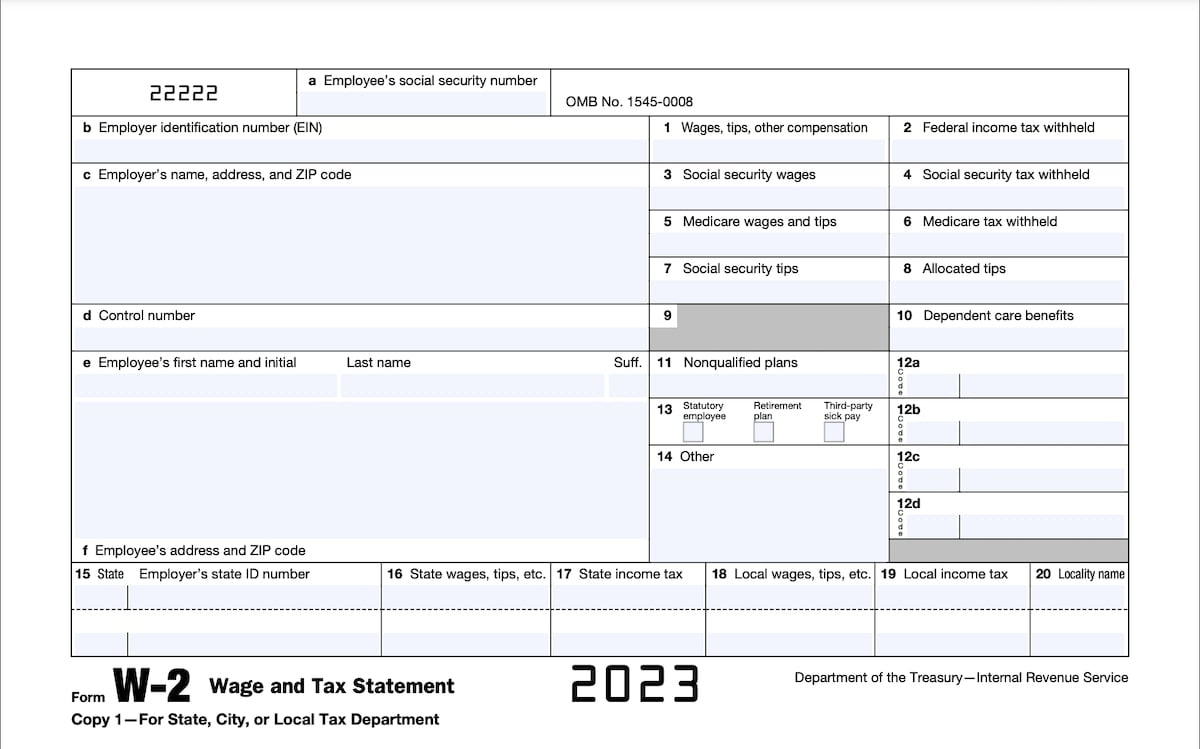

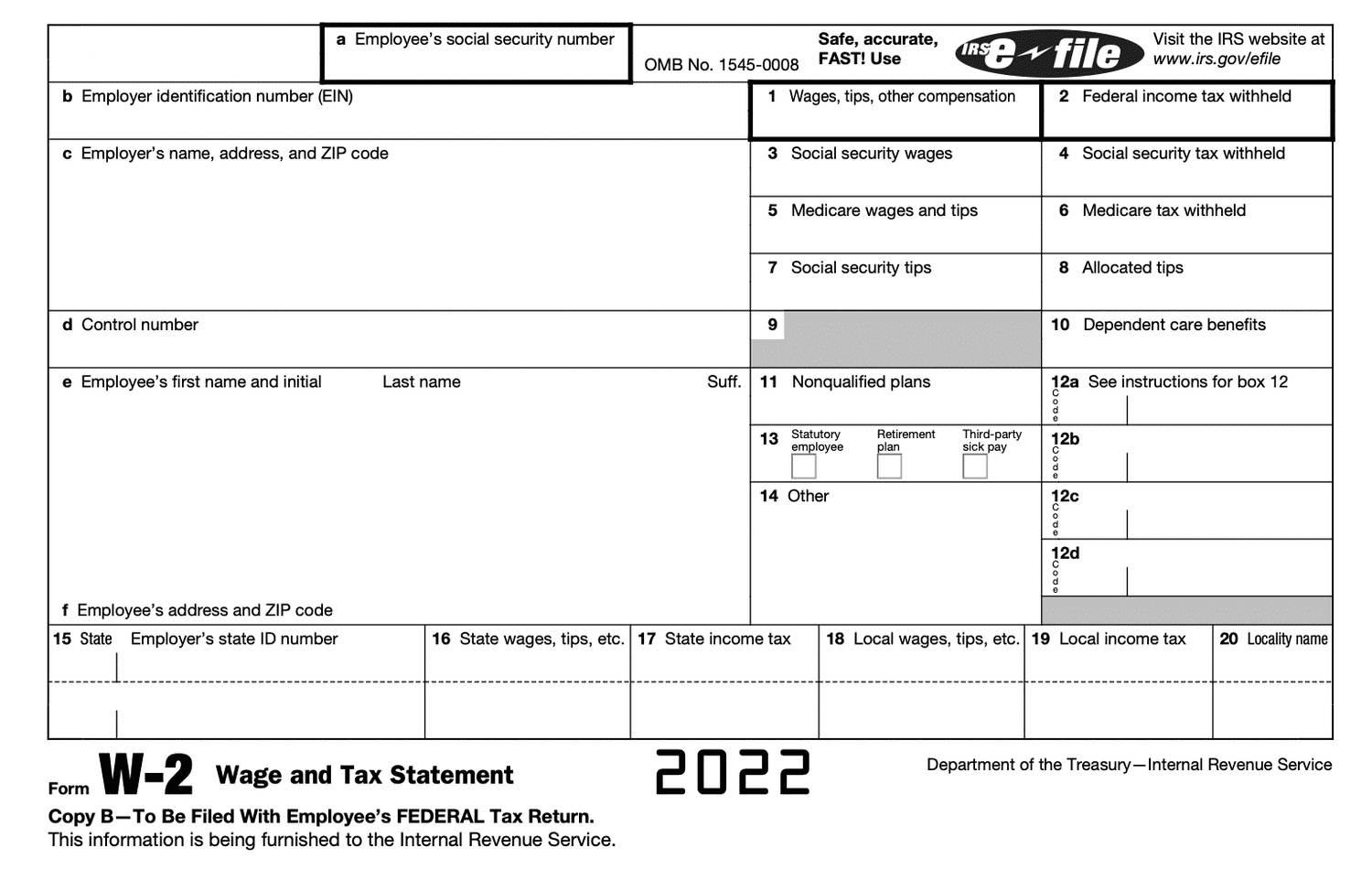

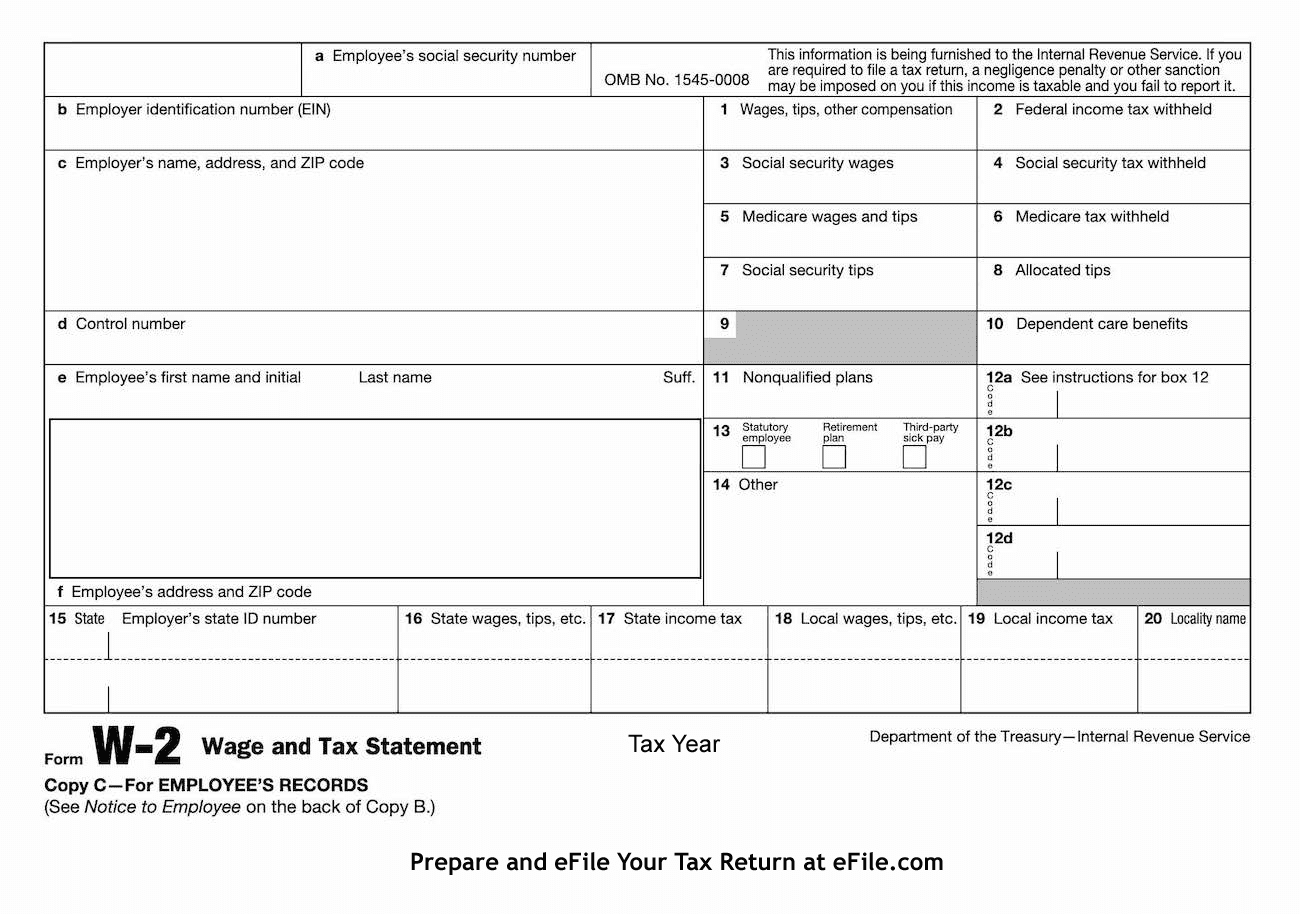

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Wonders of the W2 Form: Your Essential Guide!

Are you feeling mystified by the enigmatic W2 form that arrives in your mailbox each year? Fear not! In this essential guide, we will decode the mysteries of the W2 form and help you uncover the hidden treasures it holds. From understanding your tax obligations to maximizing your tax refunds, the W2 form is your key to financial success. So grab your magnifying glass and let’s embark on an exciting journey of unlocking the wonders of the W2 form!

Decoding the Mysterious W2 Form: A Beginner’s Guide!

The W2 form may seem like a puzzle at first glance, but fear not – we’re here to guide you through it! This essential document, provided by your employer, summarizes your annual earnings and the taxes withheld from your paycheck. It also includes important information such as your Social Security number, employer details, and any additional income you may have received. By familiarizing yourself with the different boxes on the W2 form, you can gain a clearer understanding of your tax situation and ensure that you’re properly reporting your income to the IRS.

One of the most important sections of the W2 form is Box 1, which shows your total taxable wages for the year. This amount is used to calculate your federal income tax liability, so it’s crucial to double-check this figure for accuracy. Additionally, Boxes 3 and 5 show the total amount of Social Security and Medicare taxes withheld from your pay, which are essential for determining your eligibility for benefits in the future. By understanding the significance of each box on the W2 form, you can take control of your finances and make informed decisions about your tax planning.

Discover the Hidden Treasures of Your W2 Form!

While the W2 form may seem like a daunting document, it actually holds a wealth of valuable information that can benefit you in more ways than one. For starters, your W2 form provides a snapshot of your annual income, which is essential for filing your tax return accurately. By comparing the information on your W2 form to your own records, you can ensure that you’re reporting all your income and deductions correctly to maximize your tax refunds.

Furthermore, the W2 form can also be a helpful tool for tracking your financial progress over time. By saving your W2 forms from previous years, you can monitor any changes in your income, taxes withheld, and benefits received. This historical data can be useful for setting financial goals, budgeting effectively, and planning for future expenses. So don’t overlook the hidden treasures of your W2 form – embrace it as a valuable resource for your financial well-being!

In conclusion, the W2 form may seem like a mysterious document at first, but with the right guidance, you can unlock its wonders and harness its power to improve your financial future. By understanding the different sections of the W2 form, you can gain insight into your tax obligations, track your income over time, and make informed decisions about your financial planning. So embrace the W2 form as a valuable tool in your financial toolkit and embark on a journey of financial empowerment today!

Below are some images related to W2 Form What Is

on a w2 form what is box 12, on w2 form what is box 1, on w2 form what is box 14, w2 form is used for, w2 form what is box 12a, , W2 Form What Is.

on a w2 form what is box 12, on w2 form what is box 1, on w2 form what is box 14, w2 form is used for, w2 form what is box 12a, , W2 Form What Is.