W2 Form With Instructions – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

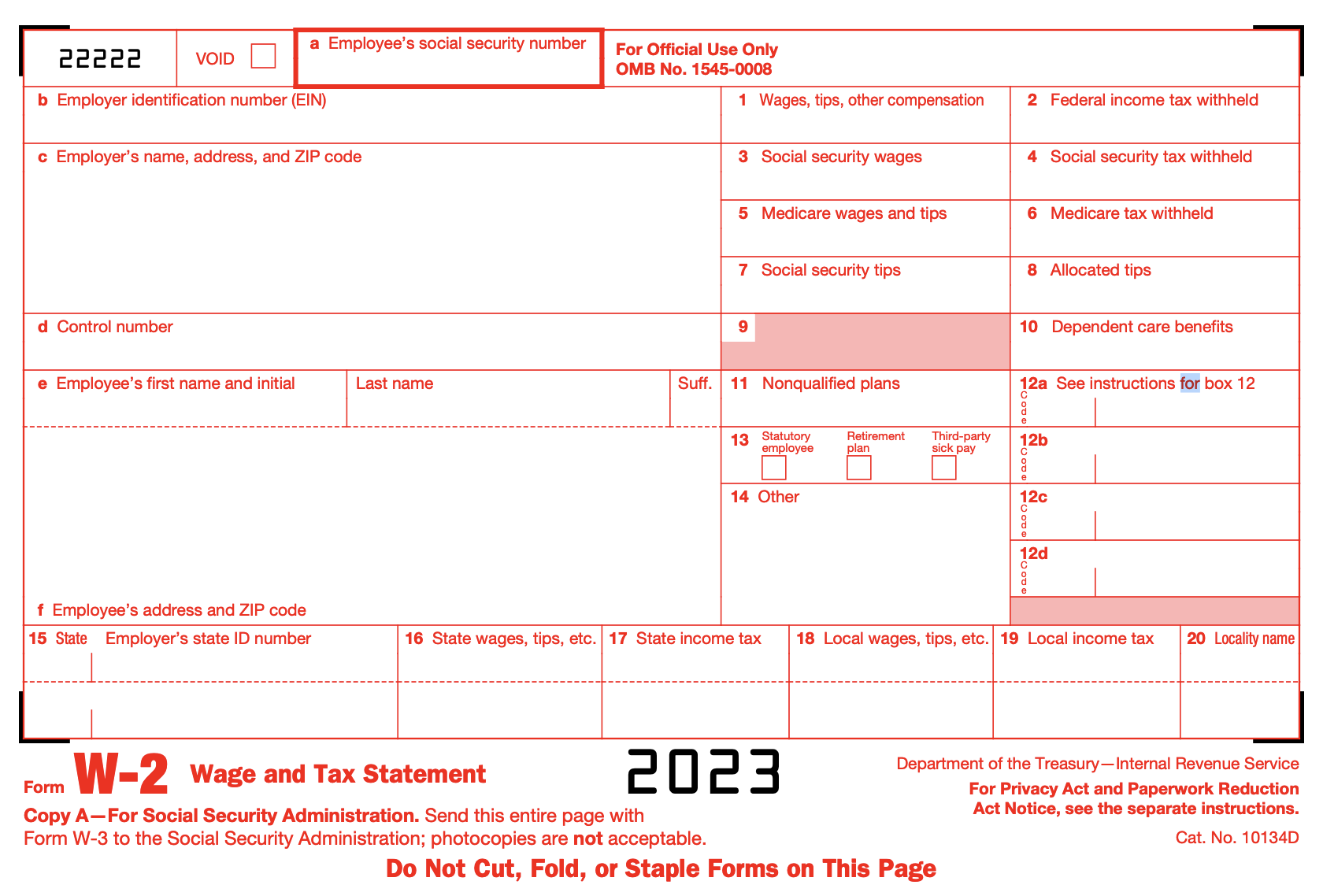

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unravel the Mystery of Your Taxes!

Are you feeling overwhelmed by the thought of tackling your taxes this year? Do you break out in a cold sweat at the mention of W2 forms and deductions? Fear not, for we are here to demystify the process and make it as easy as pie! With a little bit of knowledge and some simple tips, you’ll be well on your way to mastering your taxes like a pro.

Master Your W2 Form with These Simple Tips!

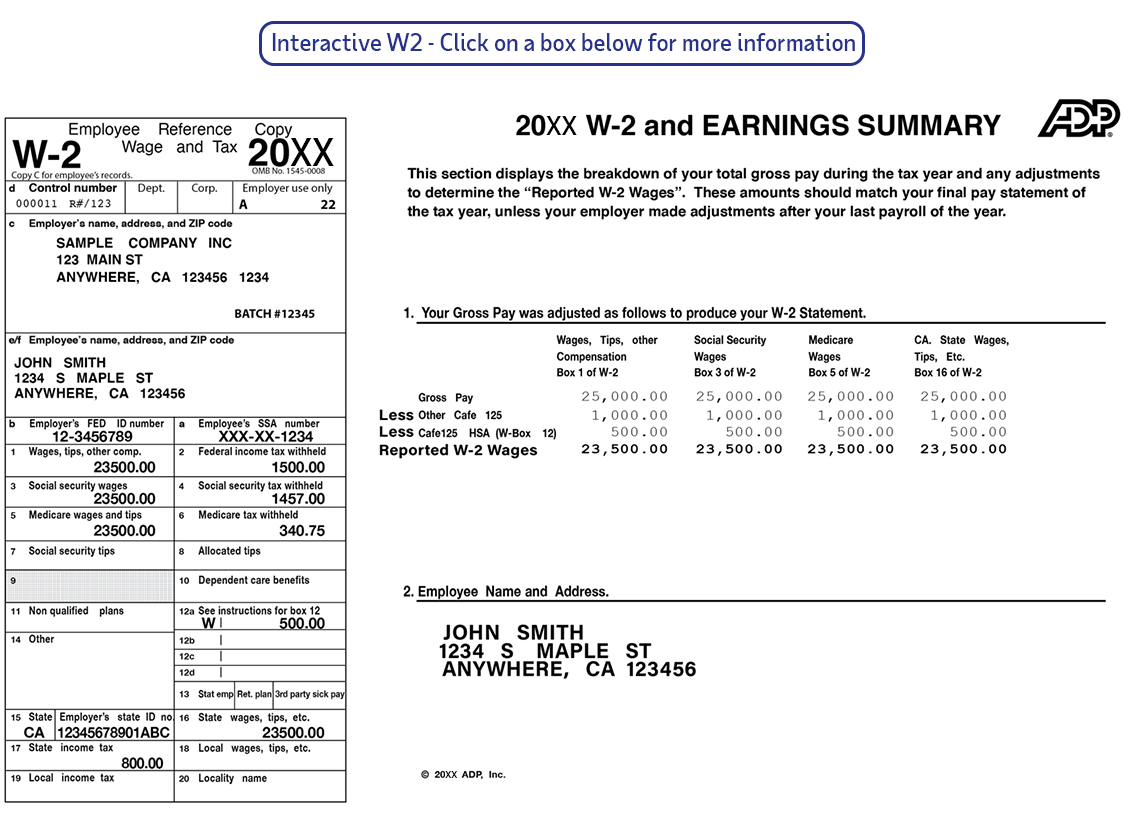

The dreaded W2 form is a key piece of the tax puzzle, but it doesn’t have to be a source of confusion. First things first, make sure you have all your W2 forms from each of your employers handy. Take a close look at Box 1, which shows your total taxable wages for the year. This is the starting point for calculating your tax liability. Next, check out Box 2, which displays the federal income tax that has already been withheld from your paycheck. This amount will be used to determine if you owe additional taxes or if you’ll be receiving a refund.

Once you’ve familiarized yourself with the basics of your W2 form, it’s time to dig a little deeper. Pay attention to other boxes on the form that may apply to your situation, such as Box 12, which lists any additional compensation or benefits you may have received. Keep an eye out for any discrepancies or errors on your W2, as these could lead to trouble down the line. By taking the time to understand your W2 form and double-checking for accuracy, you’ll be able to file your taxes with confidence and ease.

As you navigate the world of taxes and W2 forms, remember that you’re not alone. There are plenty of resources available to help you along the way, from online guides to tax professionals who can offer expert advice. By demystifying the process and breaking it down into manageable steps, you’ll be well on your way to mastering your taxes and taking control of your financial future. So don’t let the fear of taxes hold you back – with a little bit of knowledge and a positive attitude, you can conquer your taxes like a champ!

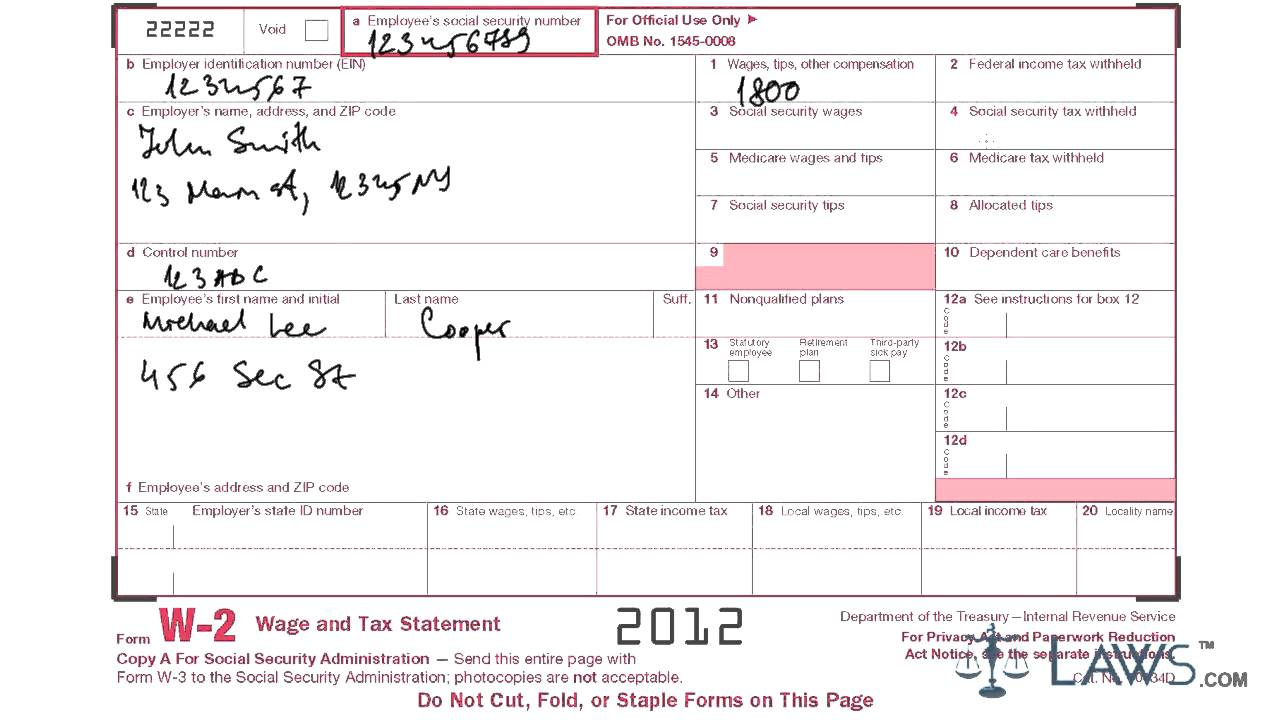

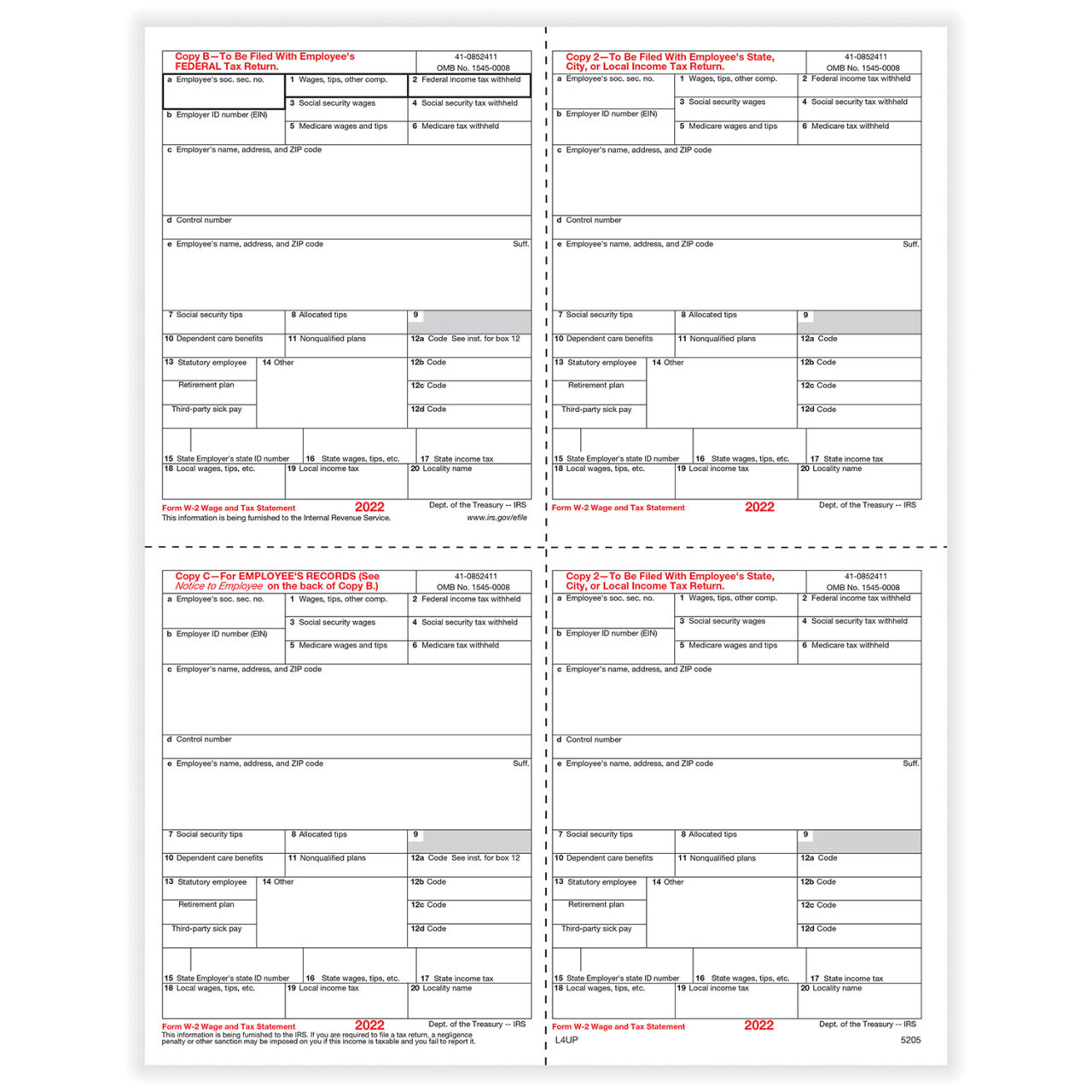

Below are some images related to W2 Form With Instructions

form w2 instructions 2022 pdf, w-2 form employee instructions, w-2 form instructions box 1, w-2 form instructions box 13, w2 form 2023 instructions pdf, , W2 Form With Instructions.

form w2 instructions 2022 pdf, w-2 form employee instructions, w-2 form instructions box 1, w-2 form instructions box 13, w2 form 2023 instructions pdf, , W2 Form With Instructions.