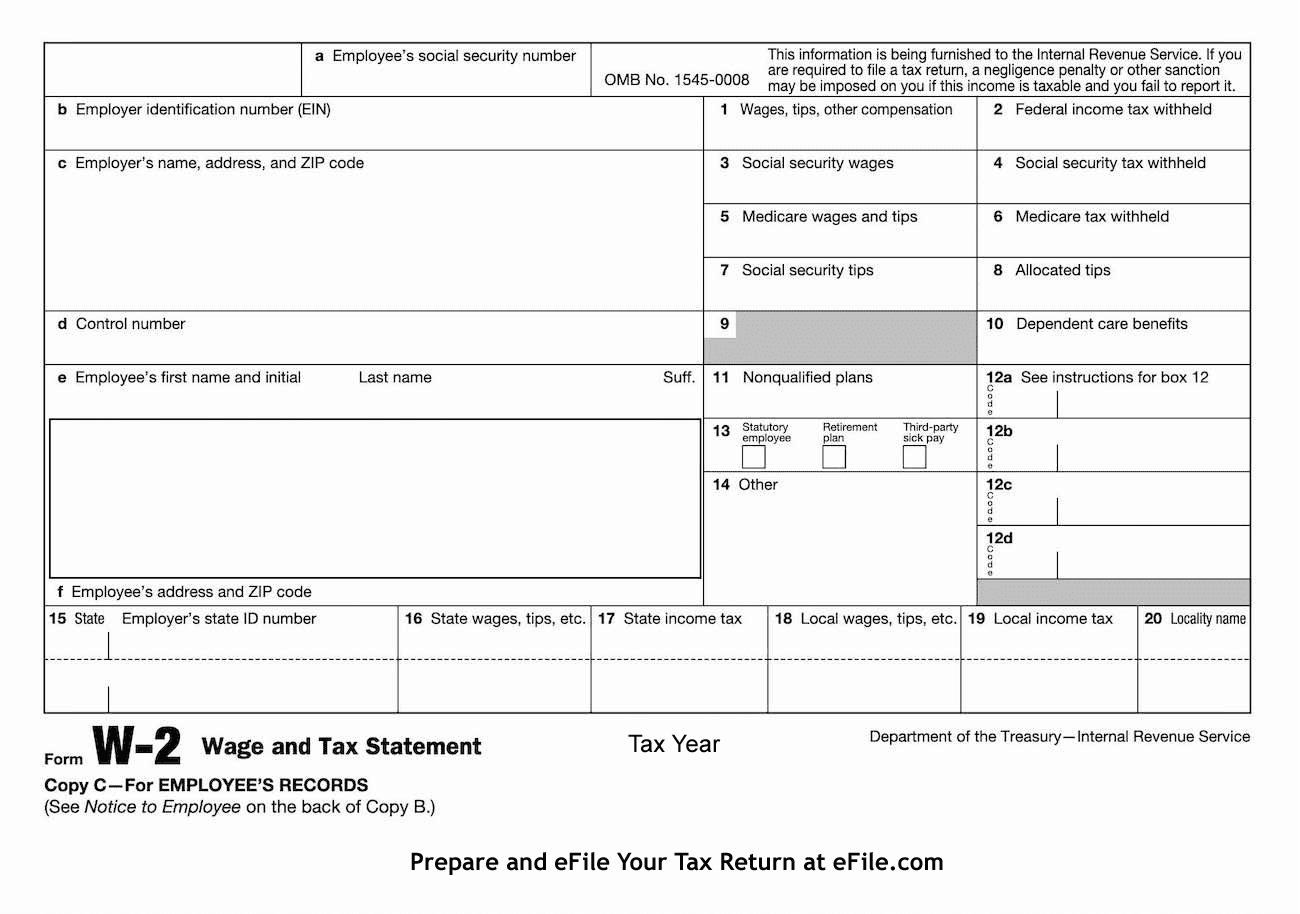

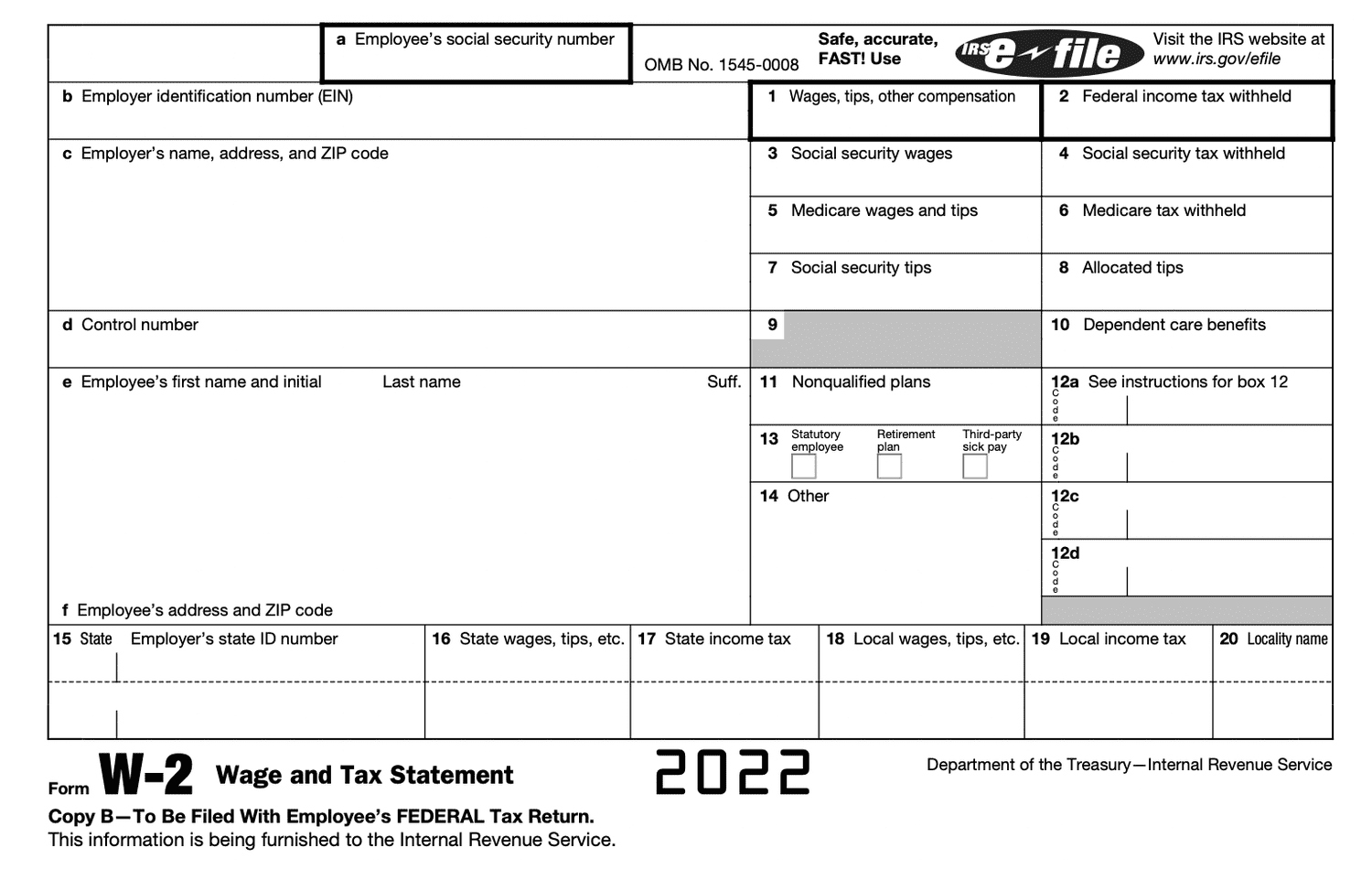

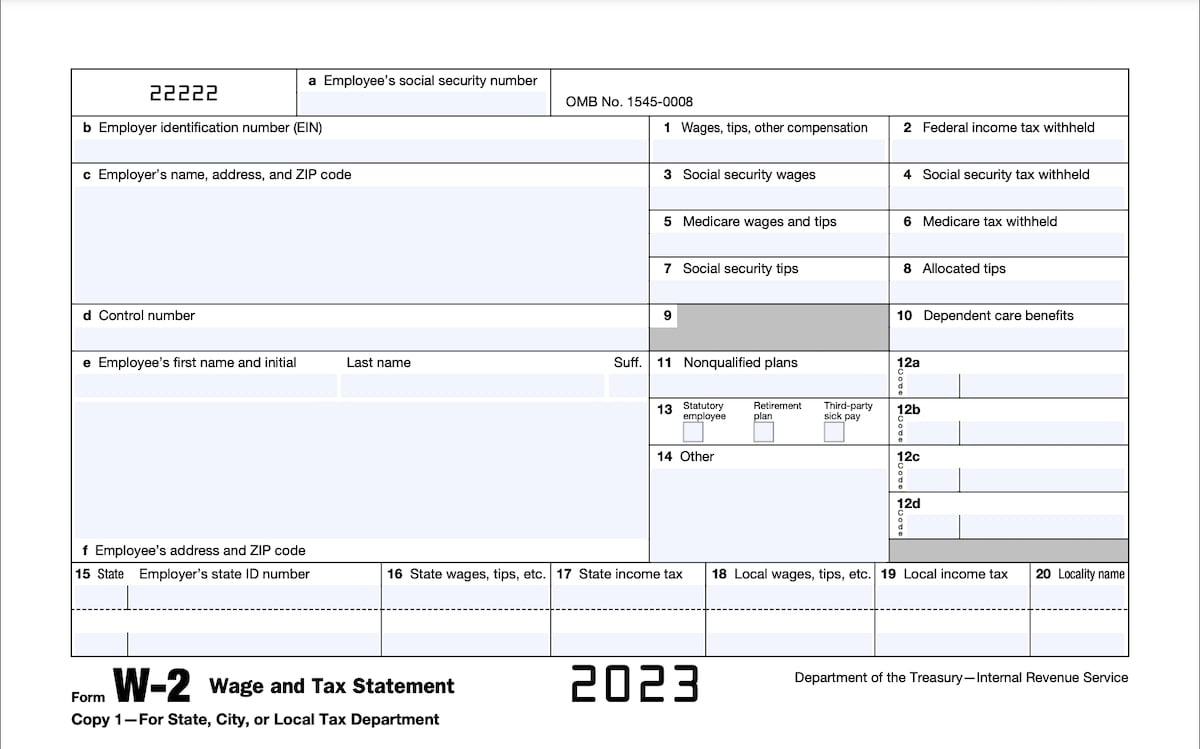

W2 Form Vs 1040 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

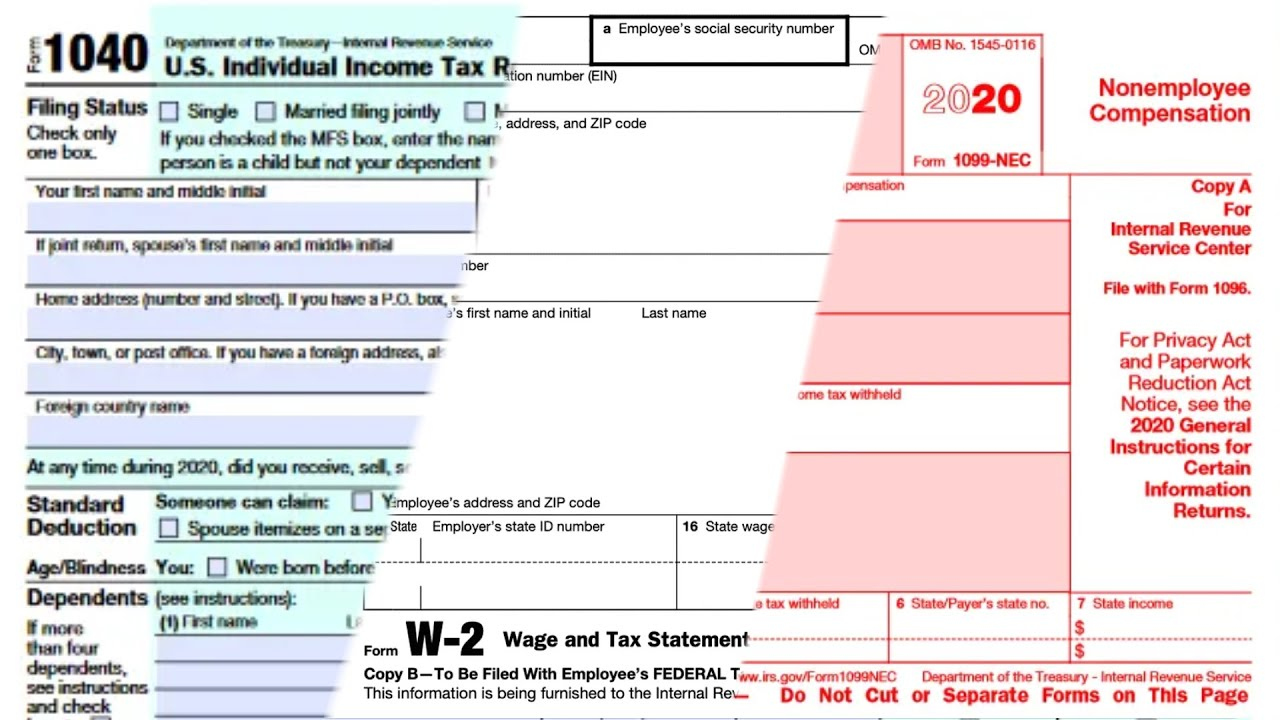

W2 Form vs 1040: The Ultimate Tax Season Showdown!

As tax season rolls around, the battle of the tax documents begins – W2 Form vs 1040! The W2 Form, also known as the Wage and Tax Statement, is the document that your employer provides you with detailing your earnings and taxes withheld throughout the year. On the other hand, the 1040 form is what you use to file your federal income tax return and declare any deductions or credits you may be eligible for. Both documents play a crucial role in the tax-filing process, but which one will come out on top in this epic showdown?

When it comes to simplicity and ease of use, the W2 Form takes the lead. With all of your important tax information neatly laid out for you, filling out your tax return becomes a breeze. However, don’t count the 1040 form out just yet! While it may require a bit more effort and attention to detail, it also offers more opportunities for tax savings through deductions and credits. It’s a tough call between convenience and potential savings – which document will you choose to champion this tax season?

Battle of the Tax Documents: Which Will Come Out on Top?

In the showdown between the W2 Form and the 1040 form, there is no clear winner – it all depends on your individual tax situation. If you’re looking for a straightforward and simple way to file your taxes, the W2 Form may be the way to go. However, if you’re willing to put in a little extra work to potentially save more money, the 1040 form might be worth the effort. Whichever document you choose, just remember that the ultimate goal is to accurately report your income and maximize your tax refund or minimize your tax liability.

As you gear up for tax season, take some time to familiarize yourself with both the W2 Form and the 1040 form. Understanding the differences between the two documents and how they impact your tax return can help you make informed decisions and ensure that you’re getting the most out of your tax-filing experience. So, whether you’re Team W2 or Team 1040, may the best tax document win in this season’s epic showdown!

In conclusion, the battle between the W2 Form and the 1040 form is not just a fight for supremacy – it’s an opportunity for taxpayers to take control of their finances and make the most of their tax returns. So, gather your documents, sharpen your pencils, and get ready to face off in the ultimate tax season showdown!

Below are some images related to W2 Form Vs 1040

is w2 same as 1040, w2 form vs 1040, w2 vs 1099 vs 1040, what is w2 and 1040, what’s the difference between a w2 and 1040, , W2 Form Vs 1040.

is w2 same as 1040, w2 form vs 1040, w2 vs 1099 vs 1040, what is w2 and 1040, what’s the difference between a w2 and 1040, , W2 Form Vs 1040.